How Far Will Services for Point Program Members Evolve?

Whenever we pay for things at convenience stores, supermarkets, restaurants, and other places, we inevitably rack up points. These point services are becoming more and more taken for granted, but they are also becoming more complicated.

Total number of points issued to exceed one trillion in 2020

When we shop, points can be used toward discounts on goods and services or exchanged for them, or they can be converted into e-money, for example. From the stamp cards we use at restaurants and eateries to the common points we receive at multiple stores in different lines of business, we come into contact with all kinds of point services on a daily basis.

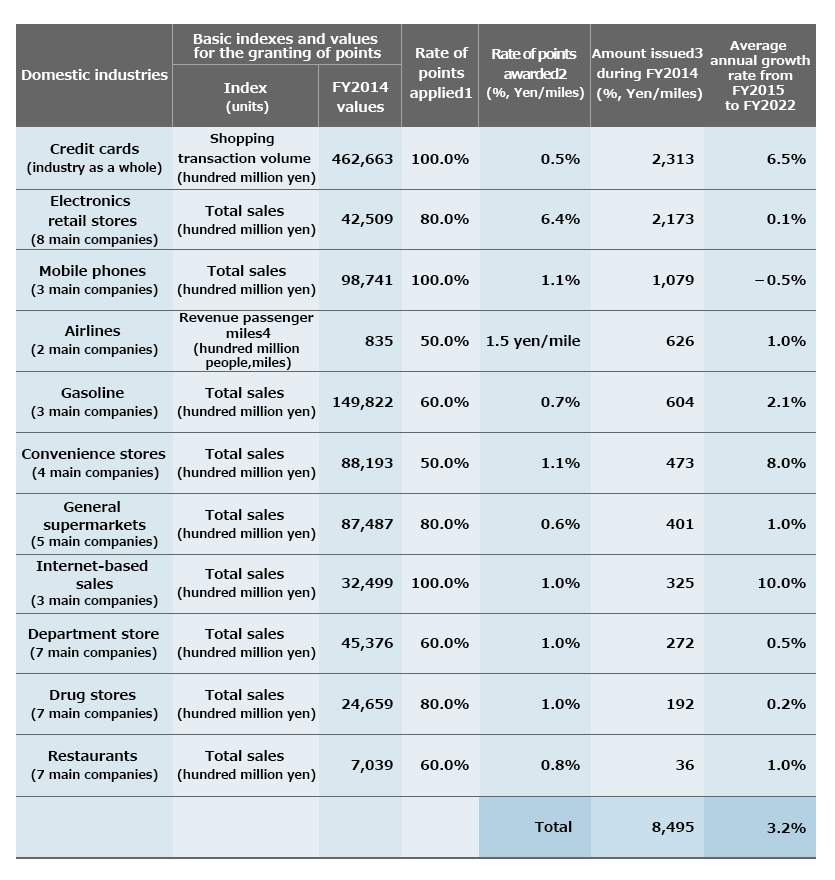

According to an NRI survey, the minimum total number of points issued by major companies on an annual basis amounted to 849.5 billion yen in FY2014. In FY2017 that number is expected to be 939.9 billion yen, and in FY2020 it could reach approximately one trillion yen. Looking at the total number of issued points by industry, it was the credit card industry that issued the most points, followed by electronics retail stores and mobile phone companies. By FY2020 the total number of issued points involving credit cards, internet-based sales, and convenience store sales is expected to rise significantly.

Table: Minimum Annual Points/Miles Issued by Eleven Domestic Industries in FY2014

It all started with membership services designed to “customer retension”

NRI’s Hiromichi Yasuoka, who has studied corporate point services for many years, says that “Point services started out as membership services that enabled businesses to win and keep customers. These services have come a long way.” According to Yasuoka, the original purpose behind introducing point services involved four phases from the businesses’ point of view: (1) customer retension, (2) building a preferred customer base (promoting consumer demand), (3) acquiring new customers, and (4) reciprocal customer referrals.

“With the advent of common points systems, as exemplified by T-Points, the phase involving reciprocal customer referrals has already been achieved. Points have already become a service that’s taken for granted. We’ve entered an era in which point services, which had been introduced and provided separately by individual business operators, now tend to be provided in alliance with common points partners, such as with T-Points, Ponta, and Rakuten Points.”

From point services to payment and financial services

Going forward, businesses that participate in common points systems will be looking to use them not only for their marketing base, but to break into the financial business domain as well, says Yasuoka.

“First of all, this means payment services. For instance, we have already seen T-Money cards for T-Points, Osaifu Ponta cards issued for the Ponta system, and Rakuten Edy being issued after Rakuten acquired the e-money platform Edy. LINE has also begun providing its LINE Pay service. These are all services that come packaged together with a payment system. By retaining customer information that’s linked to a bank account, for example, these services make it easier for customers to use their money. What we’ve already seen emerge are loans and other financial services which get people to spend more of their money. Just as Rakuten acquired an e-bank and launched Rakuten Bank, I think other companies are also going to be developing finance-related services.”

These point-based businesses are obtaining not just their customers’ personal information, but also their purchasing histories, movement histories, asset information, and other types of information. Yasuoka believes these activities will not be limited to marketing-related services, but will eventually expand to include authentication services such as identity verification agent services.

Providing incentives to customers and obtaining customer information

The goal nowadays for point service providers is to hold onto their customers’ information and, little by little, to enter the realm of finance. That’s why Yasuoka believes we now live in an era where common points partners are in a complex struggle for supremacy to expand their individual “point-based economic zones”. At a time when points are taken for granted, and the major common points partners are bringing these economic zones increasingly under their control, how should individual business operators approach point services?

“Although point services have grown more complex and harder to grasp, the essence of point services lies in membership services. Their purpose is to capture and hold onto customers, and to obtain their information, and the important thing is to conceptually differentiate between points, which provide incentives to customers, and the obtaining of IDs, which can identify customers and serve as a source of information. We already have key identifiers, and authentication media ranging from credit cards to biometrics, and with the matching of acquired information and other types of information as well as advancements in AI technology, it will be possible to use IDs in a variety of applications going forward.”

Is it necessary for your company’s customer strategy to involve providing membership services? What do you want to obtain by providing them? In reality, Yasuoka says, a surprising number of companies give little thought to these matters, partnering with leading common points businesses and entrusting everything to them, which means that the customer information which they should be gathering in the first place ends up in the hands of their common points partners. That arrangement might well suffice for businesses whose goal in granting points is to attract many customers. However, a business looking to retain its preferred customers or to launch promotions or develop products to gain new customers, for example, would gain little from providing a point service by simply outsourcing the entire process.

So far, we have looked at point services from the perspective of businesses. Finally, what are the smartest ways to use point services from the viewpoint of the consumer who gets the points?

“Consolidate the stores and services you use within the area your daily activities take place. Visit a certain convenience store because it’s near work, or go to a particular drug store that’s close to home—in other words, have a narrow range of stores that you frequent and stick to them. That’s the easiest way to accrue points, and it’s how you come to be regarded as preferred customers both in the real world and in terms of the data.”

Profile

-

Hiromichi Yasuoka

* Organization names and job titles may differ from the current version.