An overseas joint venture strategy that considers future separation

Launching a joint venture with a local company is said to be an effective method to enable Japanese companies to enter overseas markets. However, differences can arise between the two parties as business continues. When considering the development of both companies, separation can be an option. However, Japanese companies are not good at making such decisions. We asked Sung-Yun Kim, who provides assistance for joint venture dissolution at the India office of NRI, about the current status of Japanese companies in India and joint venture strategy.

A good relationship does not last forever

――How do Japanese companies enter the Indian market?

My impression is that many Japanese companies come to make a presence in India. They enter the market to gain business experience. An effective method for doing so is to launch a joint venture with a local company. I believe that Japanese companies have a strong impression that entry into the Indian market requires a joint venture.

――Why does the topic of joint venture dissolution come up?

When management starts to get on track after launching a joint venture, the financing Japanese company and the local company start to have different visions for the venture. For example, a Japanese manufacturer might position their joint venture in India as a regional headquarters and want to strengthen exports to the Near East and Africa from India. On the other hand, the Indian company might want to aim for the top market share in India rather than focus on global business expansion. These different visions soon lead to management confusion and delays, and the joint venture becomes difficult to sustain.

NRI has heard several opinions from Japanese companies, such as "Local management is too opaque and we do not receive detailed reports," "Even though we increased funding, our business does not develop due to the circumstances of the local partner," and "Our local partner only makes decisions based on whether they will make money or not." In some cases, the existence of the joint venture itself hinders growth in the Indian market and the Japanese company brings up the topic of joint venture dissolution. However, it is rare that the dissolution actually happens.

Six steps for smooth dissolution

――Why do companies not work towards dissolution?

There are several reasons. First of all, since local brands are strong in India, it is difficult to separate from a local company and expand business with one's own brand. If dissolution is determined and the Japanese company decides to sell its stock or buy the stock of the local company, the Japanese company is at a big disadvantage because local companies are protected by Indian law. For example, when a Japanese company leaves the Indian market and sells its stock, an Indian company will not buy foreign owned stock higher than the market price. If the stock price was 100 yen, an Indian company would not buy it for 150 yen.

It goes without saying thata contract that supposes various scenarios must be created when forming a joint venture, including whether the relationship will continue in the future. However, an ambiguous contract is often created when forming a joint venture, possibly because the companies want to start off on a good foot. Particular care needs to be taken when dealing with the allocation of stock, as differences in understanding may cause prolonged legal battles when the joint venture is dissolved.

Another common reason that action is not taken is because the Japanese head office leaves everything up to local management. From the head office's point of view, they do not want to go to the trouble of dissolving the company after all the work put into discussions, negotiations, and launch of the joint venture.

――What kind of actions are required for successful dissolution?

I believe that it is important to think about how the company will handle things that they had relied on their local partner for. For example, the local sales network, permission and authorization such as licensing, and factory sites, etc. To enable the company to conduct management by itself in the future, it is also important to decide things such as whether to invest in finding new business partners or work with the previous partner in advance.

――What concrete methods do you have for joint venture dissolution?

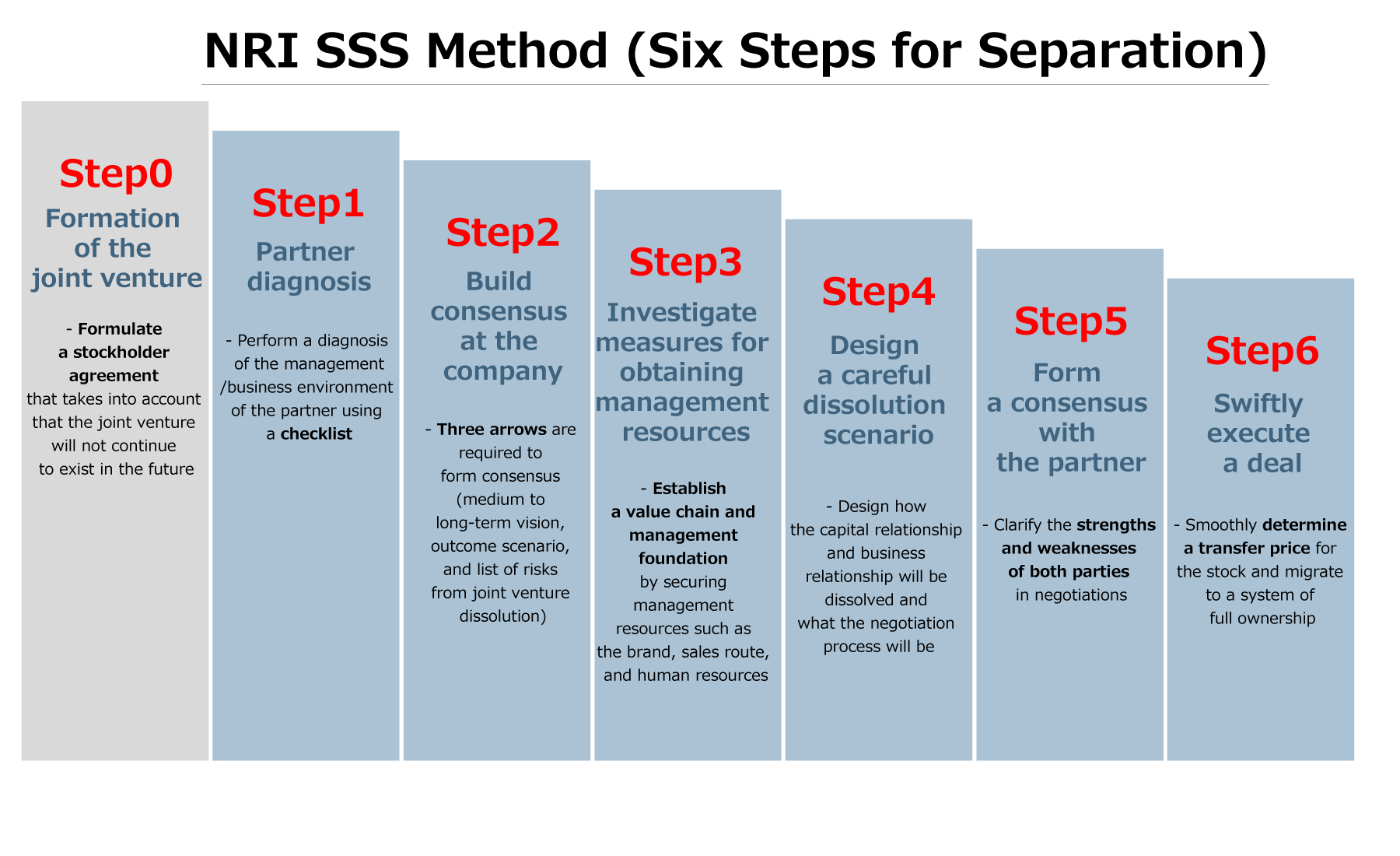

At NRI, we provide proposals for smoothly dissolving joint features that follow a six-step program. We also recognize the importance of quickly restarting business operations.

Profile

-

Sung-Yun Kim

* Organization names and job titles may differ from the current version.