Takahide Kiuchi's View - Insight into World Economic Trends :

The Potential of Virtual Currencies as Investment Vehicles

In the wake of a sudden drop in the prices of virtual currencies between the end of 2017 and the beginning of 2018, a growing number of institutional investors are beginning to reassess the value of such currencies as investments.

Market Capitalization of Virtual Currencies Remains Small

At the end of last year, virtual currency prices suddenly went through a major adjustment phase. However, it was only after their prices had shot up dramatically that this downturn occurred. The price of Bitcoin, one of the most well-known virtual currencies, saw a nearly 60-fold rise in a one-year period before hitting its peak late last year. The pace of its ascent even eclipsed historical precedents for stock price jumps set during famous “bubble” eras. During the Mississippi Bubble that occurred in 18th-century France, stock prices experienced around a 30-fold increase in one year before peaking, whereas during the South Sea Bubble that arose in 18th-century England, stock prices failed to achieve even a 10-fold increase. With that being said, we can call last year’s spike in virtual currency prices unprecedented.

Despite of this meteoric rise in prices, the market capitalization of virtual currencies is still rather small compared to the scales of other financial assets. For example, as of March this year virtual currencies accounted for less than three percent of the assets held by the world’s four major central banks (the Bank of Japan, the U.S. Federal Reserve, the European Central Bank, and the Bank of England). These figures tell us that virtual currencies have a long way to go before they can threaten the dominance of legal currencies.

A Balance Between Volatility and Expected Returns

Meanwhile, as opposed to traditional financial assets such as stocks, bonds, and Forex, or to commodities such as oil and gold, what largely characterizes virtual currencies as investment vehicles is their degree of volatility*1. This feature significantly impedes the utility of virtual currencies as methods of payment, and excessive volatility has likely discouraged many institutional investors from adding virtual currencies to their traditional asset classes.

Nevertheless, given the extremely low volatility of so many financial instruments and the available opportunities for investors to profit from rising prices, the fact is that institutional investors are gradually shifting their focus to highly-volatile commodities. In addition, it’s common for actual investment decisions to be made in terms of the balance between expected risk—which is measured by volatility—and expected returns.

Let’s compare what’s called the Sharpe Ratio—which indicates the size of your return relative to the investment risk, i.e. your expected return after adjusting for the risk—for virtual currencies against that of several other asset classes. The Sharpe Ratio for virtual currencies is 1.5 for previous one-year period and 2.5 for the previous two-year period. This is roughly on par with the average share price of the four flagship U.S. IT companies (FANG*2 stocks), which have seen remarkable price spikes. Yet it’s much higher than the ratio for U.S. real estate, U.S. stock prices and bonds, gold, oil, and emerging market currencies. This surely means that virtual currencies also possess a certain appeal as investment vehicles.

Low Correlations with Other Financial Instruments

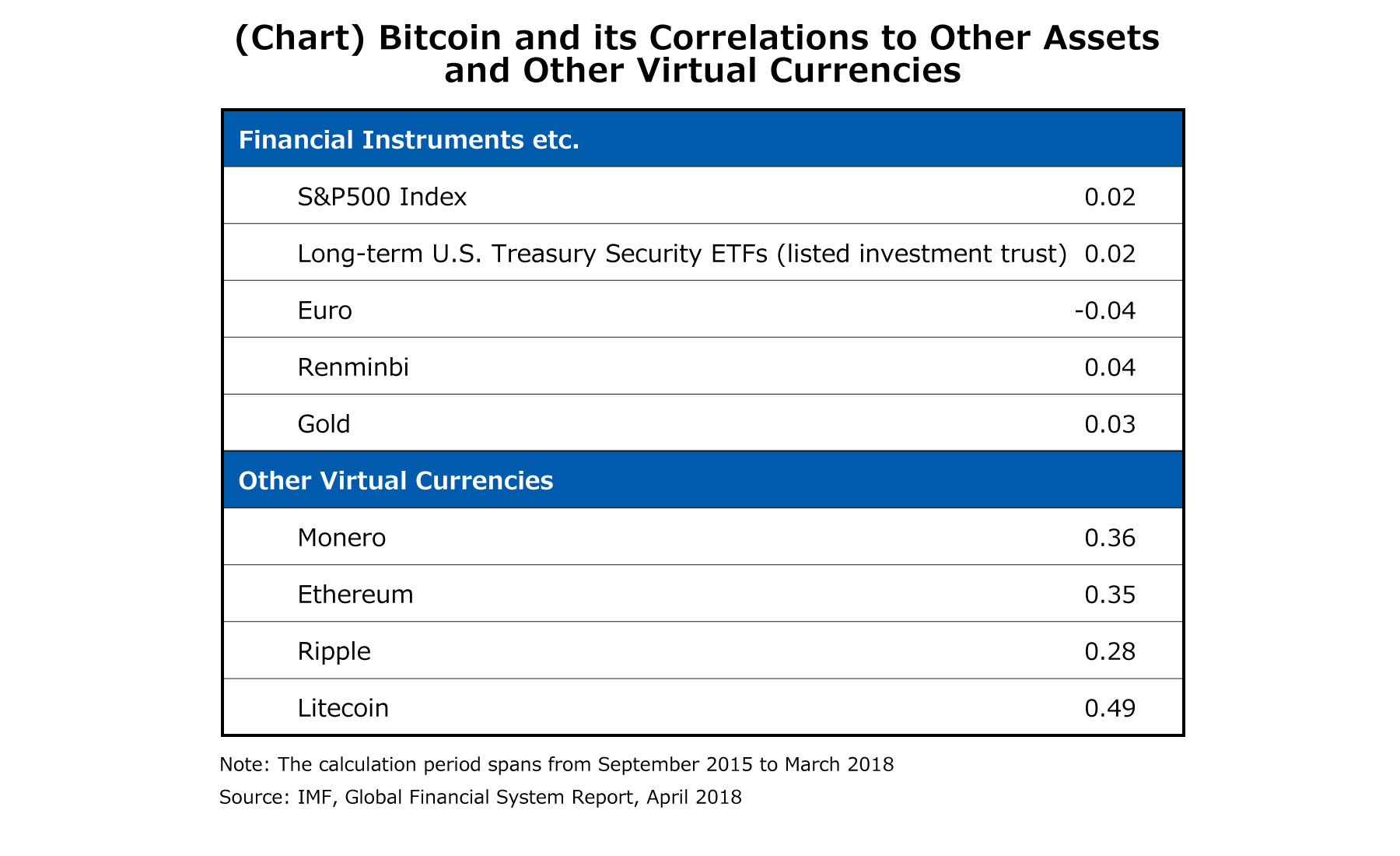

In addition, from the viewpoint of making diversified investments, an extremely important thing for institutional investors to consider when deciding whether to invest in virtual currencies is the price correlations between virtual currencies and other investment vehicles. When they have a strong positive correlation, virtual currencies are less ideal as investment vehicles from the viewpoint of diversifying one’s investments so as to reduce the overall price fluctuation risk. Conversely, when they have a negative or minimal correlation, investors are more apt to consider including virtual currencies in their diversified investment portfolios.

Now, if you were to calculate the price correlations between Bitcoin and U.S. stocks, long-term U.S. Treasury bonds, the Euro, the Renminbi, and gold, you would see that in every case the correlation is quite small (see chart). Even during the recent downturn in virtual currency prices, this correlation hasn’t changed significantly. In light of the Sharpe Ratio and these correlations as indicators, virtual currencies arguably have a growing potential as investment vehicles.

A Note Regarding Changes in Future Correlations

However, we should note that these low correlations are also a sign that investors—particularly institutional investors—do not yet widely regard virtual currencies to be sufficient as investment vehicles, that few transactions are conducted between virtual currencies and other types of assets, and that price differences haven’t been arbitraged away. Supposing that forward-looking investors were to expand their virtual currency holdings as part of their diversified investments, it could very well end up increasing the positive price correlation and thereby reducing the appeal of virtual currency investments, which would be an ironic outcome.

When it comes to accurately measuring the correlations between virtual currencies and other financial assets, there’s also the fact that virtual currencies have only been around a short while, and so we don’t yet have an abundance of information available about them. The same is true for the Sharpe Ratio mentioned earlier as well.

While the price spike brought a great deal of attention to virtual currencies, the price drop that began late last year is leading professional institutional investors to exercise caution in evaluating the investment potential of virtual currencies.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.