With Serious Worker Shortages, Construction Sites Need Drastic Improvement in Productivity

#DX

Aug. 13, 2018

Every year, NRI publishes an outlook of Japan’s domestic housing market through 2030, beyond the years after the number of households peaks out. The declining population and the falling number of households result in a decrease in demand in the form of housing starts, while also reducing supply in the form of the number of carpenters. NRI, which has long analyzed the housing market, explains what the market will look like in 2030 from the perspectives of both demand and supply.

Declines in the population and the number of households to hit housing market directly

Today, Japan is facing a somewhat unusual situation where the population is on the decline while the number of households still continues to increase. Yet the number of households is projected to peak in 2023 (National Institute of Population and Social Security Research), and Japan is set to soon become the first industrialized nation with declines in both the population and the number of households. The twin decreases in the population and households will affect a wide range of markets greatly in the country, with the housing market expected to be affected particularly significantly. Houses have the longest life cycle of all consumer durable goods, and the average Japanese person is said to purchase fewer than two houses in his/her lifetime. Given that the number of total houses in Japan excluding the number of vacant houses roughly matches the number of households, the decline in the number of households is expected to have a direct impact on this market.

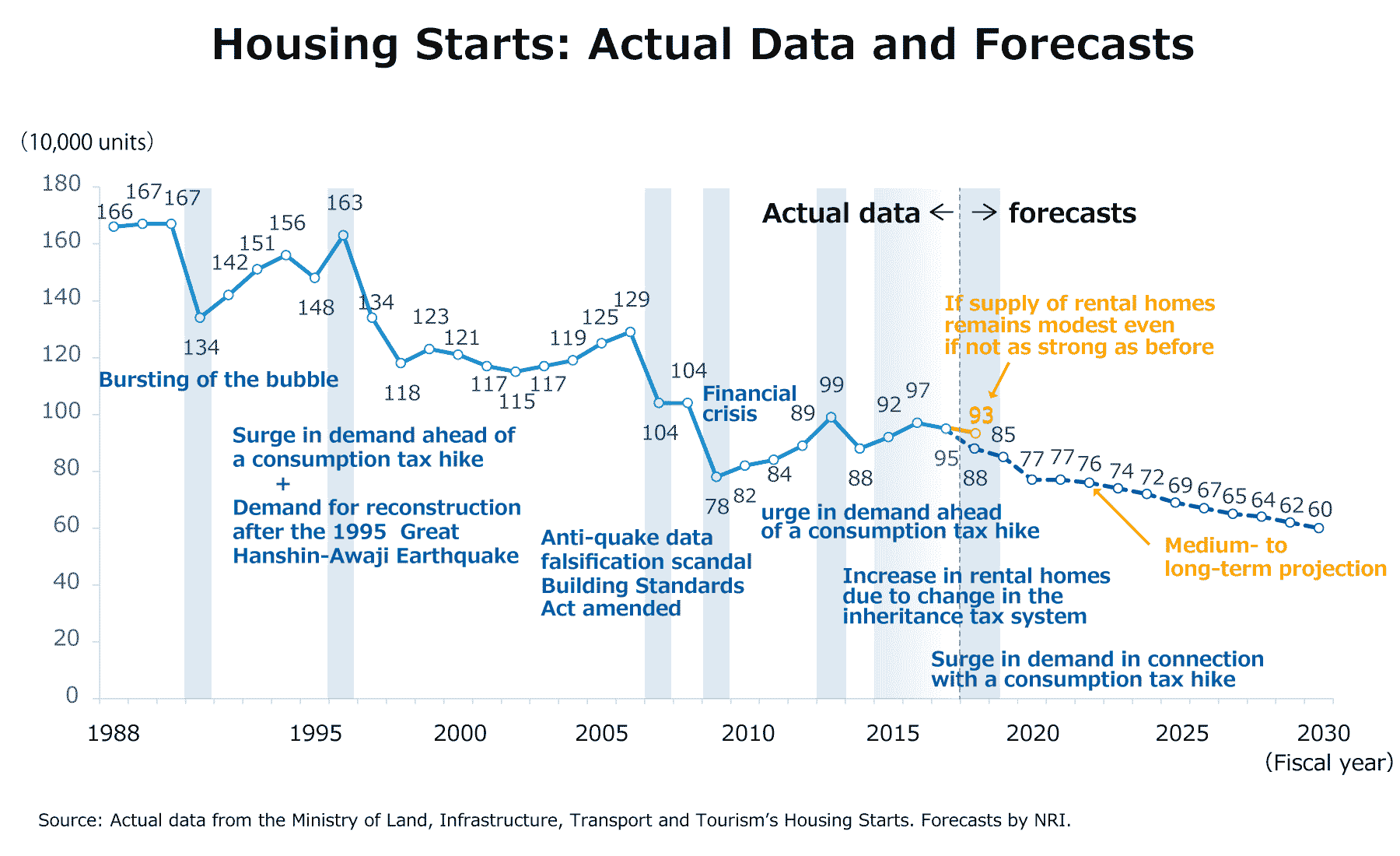

Fiscal 2030 housing starts projected to fall to 600,000

NRI forecasted in June 2018 that housing starts will decrease from 950,000 units in fiscal 2017 to 770,000 in fiscal 2020; 690,000 in fiscal 2025; and 600,000 in fiscal 2030. The figure for fiscal 2030 is expected to comprise 200,000 units to be owned; 140,000 units built for sale; and 260,000 rental units (including company housing).

With strong influence of the country's climate, natural features and culture, Japan's housing market has remained dependent on new construction. The forecast of 600,000 units would be less than 40% of the post-bubble peak of roughly 1.63 million in fiscal 1996. The housing industry, which has relied on new construction, will need fundamental structural reform.

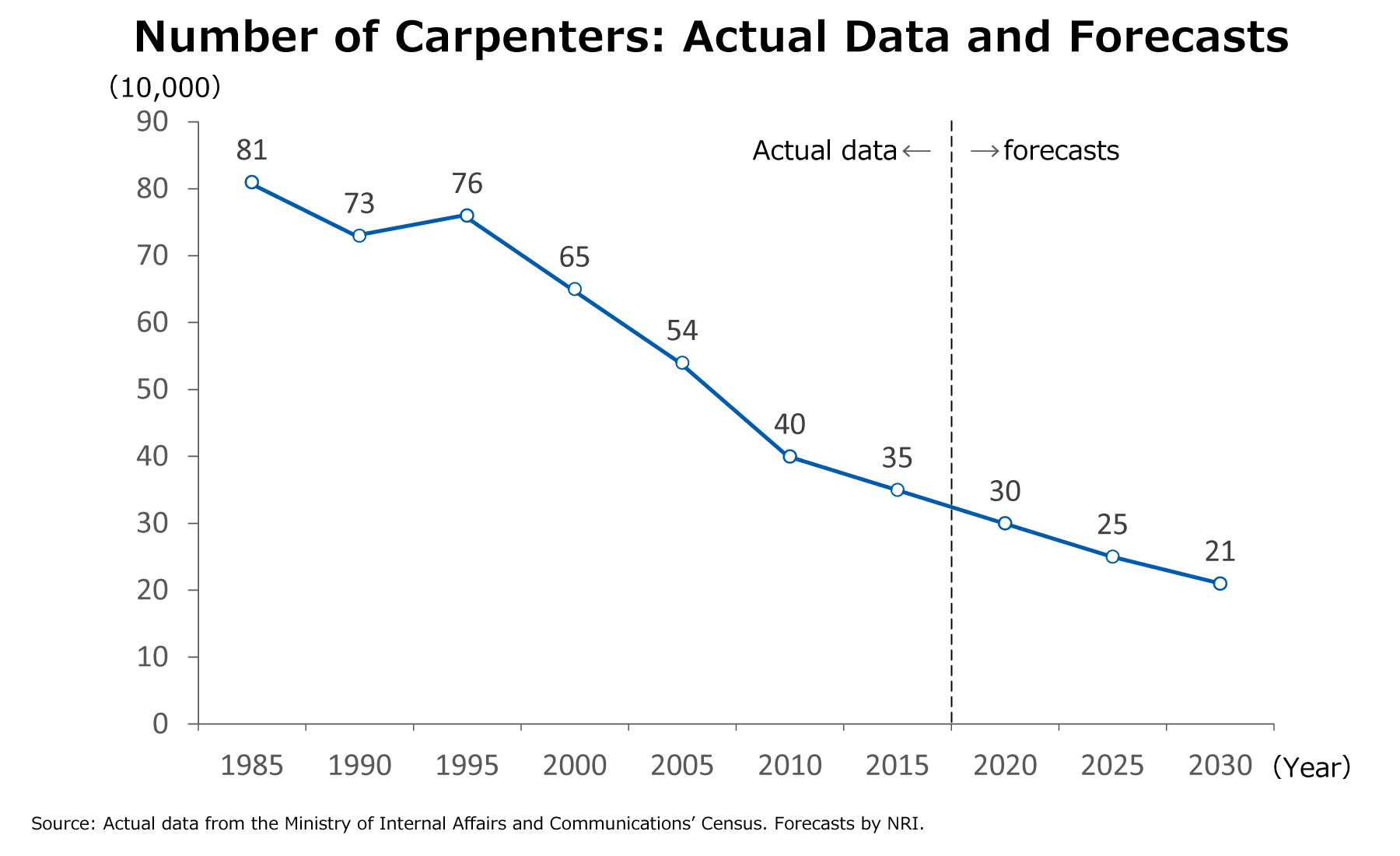

With the number of artisans decreasing while they age, the number of carpenters seen falling to 210,000 by 2030

Meanwhile, the number of carpenters in Japan has been on the long-term decrease. They totaled approximately 810,000 in 1985, but three decades later, in 2015, there were just about 350,000, or less than half of the 1985 level. What’s more, those aged 60 and older account for about 40% of that total. In today’s carpentry industry, the number of artisans is decreasing and aging at the same time.

A close look at the changes in the number of carpenters shows that the pace of decrease slowed down somewhat between 2010 and 2015. By age group, the pace of decline slowed in particular for those 60 and older. The surge in demand for reconstruction work after the 2011 earthquake and tsunami and rapidly growing demand for construction amid economic expansion likely stopped carpenters 60 and older from retiring. However, given that a wave of carpenters 60 and older is expected to retire ahead of 2030 and the grim prospect of winning workers over other industries, the number of carpenters is certain to decline in the long run. NRI forecasts that the number of carpenters, which stood at 350,000 in 2015, will fall to 210,000 by 2030.

Digital transformation (DX) at construction sites urgently needed

We have projected that, by 2030—when the population and the number of households are expected to show full-fledged declines—housing starts will fall to approximately 600,000 (down 27% from fiscal 2010) while the number of carpenters will decline to approximately 210,000 (down 49% from 2010); this indicates that carpenters will experience a steeper decline.

In Japan, the number of housing starts per carpenter a year remained around approximately 2 units for many years. Going forward, the scale of decline in supply (number of carpenters) will surpass the scale of decline in demand (housing starts), and therefore it is likely that supply would not be able to meet even a demand of approximately 600,000 units unless productivity at construction sites is increased by about 40%.

If productivity at construction sites is not improved, and if the number of carpenters becomes a factor that hinders supply, housing starts could fall to roughly 420,000 (= 210,000 carpenters building 2 units per person). To ensure that a worker shortage does not hinder supply, construction sites will need dramatic improvement in productivity.

In the past, prefabricated homes played a major role in Japan in addressing housing and construction engineer shortages. Going forward, measures addressing worker shortages will be necessary, such as innovations contributing to reducing the number of man-hours at construction sites and those in construction materials and facilities that will not rely on the skills of veteran carpenters.

We hope to see industry-wide efforts on digital transformation that uses AI, IoT and robots to achieve drastic improvement in both productivity and added value.