How Should Companies Face the Growth of ESG Investments? — The Required ESG Approach and Information Disclosures to Investors

More than one year has passed since the Government Pension Investment Fund (GPIF) announced in July 2017 that it was allocating one trillion-yen worth of funds to invest using ESG (Environment, Social, and Governance) indexes. Interest in ESG has been growing since then among Japanese companies and institutional investors. As this trend unfolds, how should companies engage in ESG-related practices? We spoke with NRI members Eiko Ibuki and Kotaro Fukai, who have been involved in sustainability projects and ESG investments, about the key points of ESG.

The True State of ESG Investments and Scores in Japan

――Compared to the investors in the West, Japanese investors would seem to have relatively little interest in ESG.

Fukai: A survey done by the Global Sustainable Investment Alliance in 2016 showed that ESG investments in Europe accounted for over 50% of all investment, whereas in Japan they made up a mere 3% of total investment. But now that the institutional investors entrusted with managing GPIF’s funds are accountable for their decisions to GPIF when it comes to choosing investments, I get the impression that the attitude of many investors towards ESG has changed.

Ibuki: It’s said that companies can’t change if investors don’t, but ever since institutional investors first took a strong interest in ESG, even companies that had previously placed little emphasis on sustainability management began to do so. More and more companies are starting to have their corporate planning, IR, CSR, and other relevant departments work together to consider what they must do to boost their ESG scores and get included as constituents in the ESG indexes.

――Why are there so many varieties of ESG-related indexes?

Fukai: It’s because there’s no definitive means or method for rating a company’s ESG performance, meaning that each ratings agency performs its assessments in its own particular way. Of the three ESG indexes that were designated by GPIF, even if we compare the FTSE Blossom Japan Index (FTSE) and the MSCI Japan ESG Select Leaders Index (MSCI), which are provided by internationally renowned index agencies, the ratings criteria they use are different. The FTSE index involves a broad-based assessment that applies around 10 out of its 14 evaluation items to each company. By contrast, the MSCI index has some 37 evaluation items, but its four governance-related items are applied to all companies, while the remaining items are narrowed down to around four items to be applied depending on a company’s industry type, so there’s a clear-cut process that’s followed in assigning ratings. For this reason, in some cases a company will earn a high FTSE score while receiving a low score from MSCI.

Are Information Disclosures by Japanese Companies Appropriate for Getting ESG Ratings?

――For companies with low scores, is it ultimately because they don’t make enough effort in the first place, or is it a communication problem?

Ibuki: While some companies need to make improvements on both fronts, there are many Japanese companies that earn more accurate scores globally by making their information disclosures more robust.

Fukai: Companies doing business principally in Japan tend to be focused on initiatives that are in demand in Japanese society, such as workstyle reforms or promoting female advancement in the workforce. But because ratings agencies employ globally uniform criteria, a sort of mismatch arises in ESG scores. Japanese companies are even required to disclose information in connection with things like prohibitions against forced labor or child labor—that is, with types of activities that they believe no one could possibly suspect them of conducting. Companies looking to raise their scores would probably do well to verify the items that the ratings agencies require to be disclosed, and to think again about what constitutes appropriate disclosures of information.

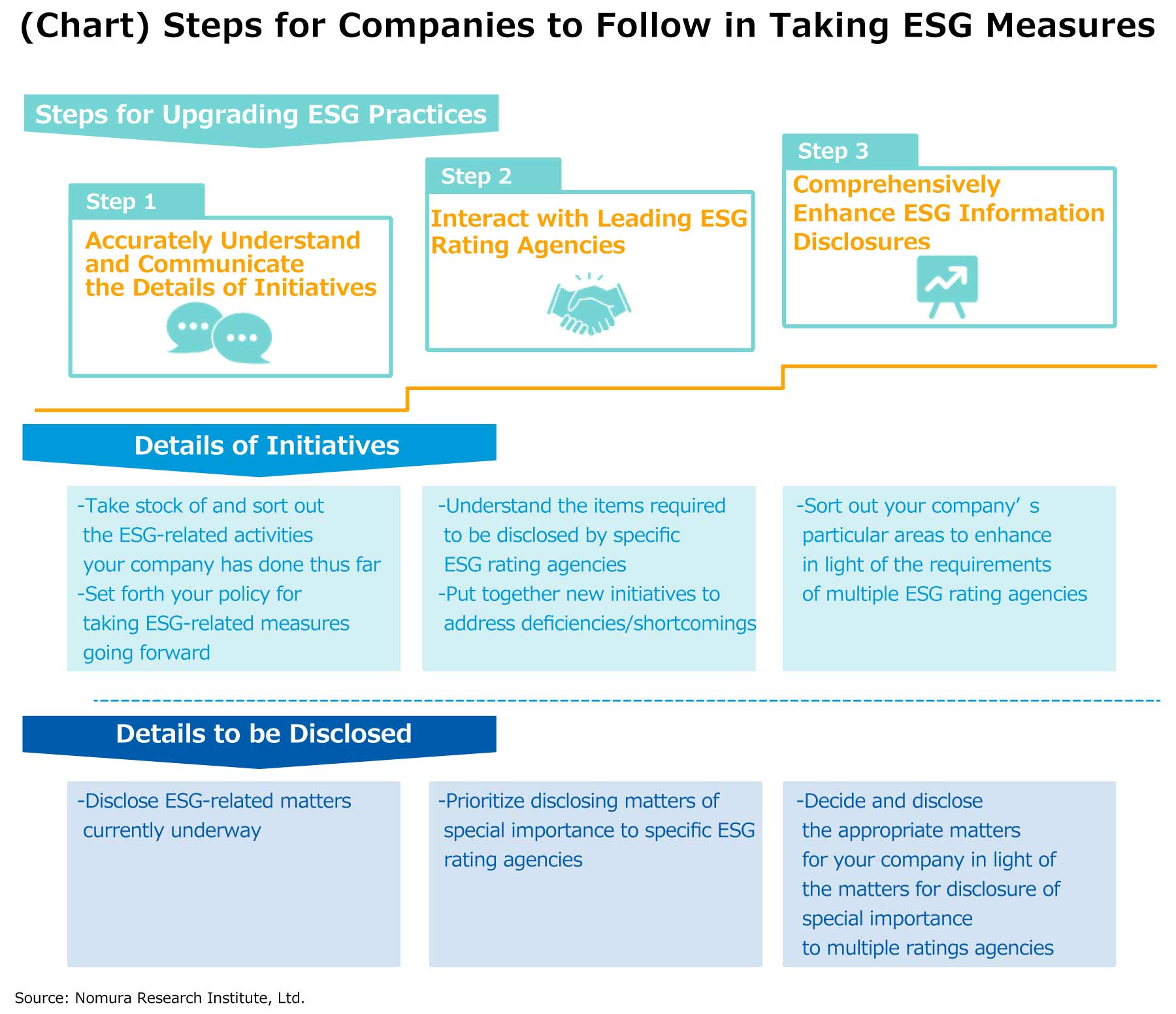

Enhancing Your Efforts in Three Steps

――What should companies that are looking to enhance their ESG efforts do?

Fukai: I think broadly speaking it’s a good idea to break the process down into three steps. Step one is to understand the situation. This means looking at the state of your company’s efforts and the current score you’ve been assigned by ratings agencies, and really taking stock of where things stand. Step two entails identifying one these indexes as a target area and then working to upgrade your efforts in that area. Finally, step three is when you should look at multiple indexes, think about the ones in which you want to focus your energies, and decide the right stance for your company. The more advanced companies are concentrating on laying the groundwork for further enhancing their credibility and embarking on new initiatives in partnership with other stakeholders such as regional or international organizations.

――Are you able to know how individual companies are currently being evaluated by the ratings agencies?3

Fukai: NRI has obtained licenses to use ratings agency databases, and when we receive a customer request, we can access the evaluation items being examined by the ratings agencies, and the rating methods they use, as well as the breakdown of different companies’ scores. Plus, because we also see the current scores of industry competitors and benchmark companies, we can provide this information to our customers. Not only that, we can also advise them on what efforts they should make and how far to take them, as well as what kind of information disclosures would be most effective.

Ibuki: To further develop your sustainability management initiatives and information disclosures, you have to get a variety of departments involved. At such time, if you can demonstrate the grounds for your efforts using data-driven analysis results and scores, as we’ve noted, it will help facilitate your in-house discussions.

Considering the Essential Significance of Undertaking ESG Activities

――Finally, do you have any advice on what ESG measures companies ought to take?

Ibuki: For companies, getting themselves included in indexes or rankings is the first step, but that isn’t the goal. What investors evaluate is a company’s efforts to strengthen its management foundation in order to achieve sustainable growth. Therefore, it’s vital for a company to identify its priority issues and to engage in them with a goal. We at NRI are ready to give Japanese companies that extra push through our consulting activities, to help ensure that they are accurately rated globally and can achieve growth.

Fukai: Until now, companies, institutional investors, and asset owners providing capital had been isolated from one another. Conducting dialogue using ESG information will afford these groups opportunities to deepen their level of mutual understanding and engagement. To that end, it is crucial for companies to go beyond simply disclosing enough information to get a certain score, and to think about what’s the essential significance of engaging in ESG practices for them.

Profile

-

Eiko Ibuki

-

Kotaro Fukai

* Organization names and job titles may differ from the current version.