Competitive advantage of digitization: Suggestions obtained from financial cases

Against the backdrop of various social, economic, and technological changes brought about by digitization, such as "Society 5.0," "Sharing Economy," and "Singularity" * , the financial world is also changing. What should financial institutions focus on in the context of digitization trends? We spoke with Yasuki Okai, an Executive Fellow at Nomura Research Institute (NRI).

Three competition axes produced by digitization

At present, financial institutions in Europe and the United States are in an intense digitization competition. Three new competition axes emerge from here.

1. Competition to access customers’ daily life

Digital measures by major U.S. financial institutions targeted at individuals have led to the development of applications that slightly overshoot the categories of financial services, such as “household account apps” and “small change management apps”. This is because it is necessary to draw in customers with apps for savings and asset management in order to understand their sudden financial needs. The more the information, the less time the customer spends on one piece of information, and the harder it is to draw his attention. It is therefore important to secure the customer's attention to the company.

2. Competition among ecosystems

In this competition axis, we should focus on competition among free services. The business models of free services are diversifying, including “tie-ups”, “third-party relationships” with other companies, and “freemiums” to induce people to purchase paid apps. Competition has arisen between ecosystems, where for instance, online brokers cannot compete if asset management firms make stock trading commissions cheaper, and large banks are disadvantaged if tech platformers such as Google and Amazon provide free or cheap loans. For this reason, it is becoming increasingly important to provide high value through collaboration across finance and industries, and to enhance the autonomy and predominance of price strategies.

3. Importance of People X Machines

The third axis is how to add value by combining people and machines. A good example is Morgan Stanley's “Cyborg Salesmen”. Using data analysis and artificial intelligence (AI), the bank has developed a mechanism that allows the system to follow up on everything from identifying customers and recommended services to focus on, drafting of customer e-mails, to checking the customer response status. The salesmen are now able to use the time saved in administrative work to focus on advising existing customers, which has led to higher sales.

Machine-centric services may also involve human intervention, such as asset management advice services provided by robo-advisors. Initially, they were completely unmanned, but recently, hybrid services involving horizontal human support have grown to meet the detailed requests of customers. There is room for innovation in combining people and machines, which may lead to greater market expansion than taking the approach of people or machines alone.

Competition structure called "Platformer takeover"

The three axes of competition are not independent. One company alone cannot provide access to customers, and it is necessary to create an ecosystem by partnering with someone. In order to achieve a strong ecosystem, it is necessary to access the customers’ daily life and gain an edge in the competition for the customer's attention. Thus, “competition to access customers’ daily life” and “competition among ecosystems” mutually reinforce each other.

After these competitions run their course comes the “platformer takeover”, where only platformers survive. Providing a variety of business knowledge to start-ups on the platform disrupts the existing superiority of major financial institutions and creates antagonistic competitive relationships. Alternatively, if an "agent" appears on the platform and begins to select and recommend appropriate services to the customer based on his data, the service provider may lose contact with the customer and be pushed into a difficult situation. Platforms of tech giants (such as GAFA) have the ability to change the financial business as a whole.

Aiming for value addition through "People × Machines"

We can compete with this "platformer takeover" by pursuing added value through "People x Machines". After ascertaining the value that only human beings can add, we think about the optimal combination of the strengths of people and machines.

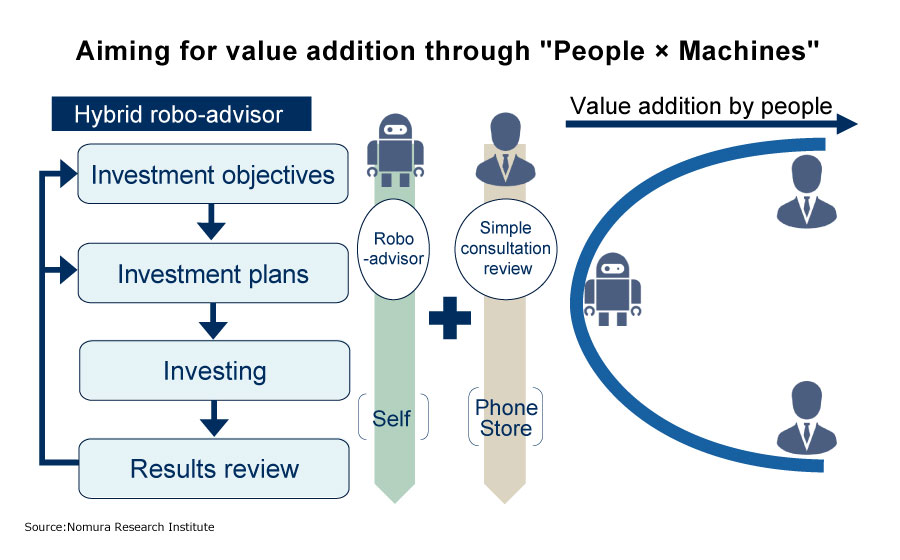

One example is a hybrid asset management service that integrates robo-advisors and people. Asset management follows the process of setting investment objectives, creating investment plans, investing, and reviewing the results. However, the phases of drawing out investment objectives in line with customers' lifestyles or of reviewing the results to reassure customers, are areas that robots cannot handle and where people can easily add value. On the other hand, robots can sufficiently cope with the creation of investment plans and the execution of investments.

These methods of optimizing the combination of people and machines have a variety of possibilities, and they lead to a unique value addition in each company. As digitization progresses, I believe it will be important to review the value of people in each company's services.

*Society 5.0: A human-centered social view advocated by Japan that combines economic development and the resolution of social issues through a highly integrated system of cyberspace (virtual space) and physical space (real space)

Sharing Economy: A system for sharing and exchanging various goods and services

Singularity: The concept that artificial intelligence (AI) develops to an extent surpassing human intelligence, resulting in major changes in human life

Profile

-

Yasuki Okai

* Organization names and job titles may differ from the current version.