New Value Addition with Operating Company Finance 3.0

In recent years, many new financial services utilizing digital technology have emerged. As a result, an increasing number of operating companies that were not involved in financial services previously are now expanding into this area. We spoke to Junji Hatoya and Makoto Nakagawa of the Nomura Research Institute (NRI), who have been long involved in projects related to financial services offered by operating companies. According to them, business reforms have enabled operating companies to transcend the mere provision of goods and strive for business development, which could have a major impact on the financial sector. They also talked about what operating companies should keep in mind while handling financial services.

Building up core business through new financial services

How did operating companies handle financial services until now?

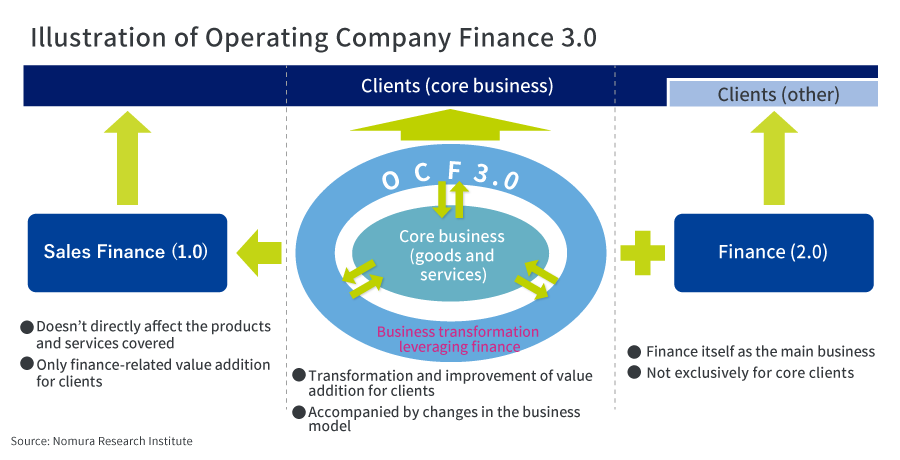

Hatoya: Operating Company Finance (OCF) refers to the operations of financial services by companies whose core business is not providing financial services, such as those in the manufacturing and distribution sectors. Examples include “OCF version 1.0”, in which operating companies provide financial services to clients to facilitate their sales of products and services; “OCF version 2.0”, in which finance business is undertaken to generate additional profit alongside the company’s core business; and the currently booming “OCF version 3.0”, which aims to transform the company’s core business by leveraging finance.

Specifically, what services do they provide?

Hatoya: The oldest case of version 1.0 in Japan was probably the financial support provided for installment sales of sewing machines, which began in the early 1900s. Sales finance emerged as a means of supporting the purchase of high-end products at that time. After that, when financial regulations were relaxed around the year 2000, major manufacturers began credit card and insurance businesses and the distribution industry expanded into the narrow banking business (banks specializing in ATMs and asset management). This comes under version 2.0. There are also methods of generating profit without establishing a financial enterprise, such as an electronic store offering repair-guarantee packages along with the purchase of televisions.

Nakagawa: In recent years, social networking sites and e-commerce businesses have begun selling insurance and securities. Existing financial institutions have struggled to shift their approach from savings to investments. However, new companies that have entered the market have overcome this psychological resistance and made complicated procedures easier through systems such as point programs. These new services of version 2.0 are expanding in parallel with version 3.0.

Incentive-type financial services that encourage good behavior

Can you give us some examples of Operating Company Finance 3.0?

Hatoya: A typical example of OCF 3.0 is providing subscription *¹ -type services to the clients while maintaining continuous communication with them. This not only changes the billing system, but also involves changes in all operations, such as product improvement, client management, and sales and distribution processes.

In particular, we are focusing on services that leverage financial functions as well as incentive-type financial services that enhance their value. An example of this is a vehicle insurance service that charges a lower insurance premium to drivers who drive safely and don’t cause any accidents. This means that rather than considering vehicles as mere goods, the company considers them to be a means used by people to commute safely, and accordingly provides services that promote safe driving. So far, the accident rate of the vehicles covered under this insurance service seems low.

Nakagawa: China's Zhima credit (Sesame credit) is a system that assigns credit scores by tracking users’ behavior, such as whether the books borrowed from a library have been returned by the due date or not. This score is used not only for credit screening but also for a variety of other services, such as eliminating the need for deposits when renting cars. According to the local citizens, such services have made people behave better and society as a whole has improved, as a result.

Financial services that increase the fundamental value of a company’s products

What should companies pay attention to when designing services for Operating Company Finance 3.0?

Hatoya: It is important to actively consider the kind of value the company’s products and services provide. In other words, an automobile company should reflect on its fundamental value, as not just a company that sells vehicles as goods, but one that provides a means for clients to commute quickly and safely.

Furthermore, it is important to consider the kind of information the company utilizes. Data that is useful for measuring safety performance, such as methods and frequency of applying brakes, is captured and analyzed for linking to financial services. It requires knowledge of both business and finance to design this part. At NRI, experts in the field of finance, industrial and IT solutions use their respective expertise and work together to support clients with the services of OCF version 3.0.

Nakagawa: I think there are two major challenges in the case of OCF version 3.0. One challenge is to consider the financial mechanisms that will realize the ambitious goals of the company, including global goals and goals concerning their clients. Another challenge is to consider the people who are not covered under OCF version 3.0, such as reckless drivers who may not be able to access good services. We must think about solutions to such challenges together. I believe that NRI will always continue to support its clients while aiming for a better future society.

- *¹subscription: paying a predetermined price to use a service for a set period

NRI Principals hold a high level of expertise in specific industries and solutions. They have also played major roles in the transformation of society and clients as leading consultants. NRI Principals create new businesses, ensure an unwavering commitment to projects, and are responsible for resolving clients’ issues.

Profile

-

Junji Hatoya (Head) and Makoto Nakagawa (Principal) of the Finance Consulting Department

* Organization names and job titles may differ from the current version.