Formulating Strategies Incorporating the Risks and Opportunities of Climate Change -- Long-term Visions Described by Scenario Analysis

In recent years, the frequency and the scale of abnormal weather hazards have been on the rise. Amid a growing awareness of climate change around the world, in 2017 the Task Force on Climate-related Financial Disclosures (TCFD) issued its final report, in which it made a proposal soliciting companies to disclose their climate-related financial information. In response to this, there has been a growing movement among Japanese companies endorsing this activity. What kinds of responses must companies make to climate change these days, and what sort of challenges are they now facing? We posed these questions to NRI’s Eiko Ibuki and Yutaro Niimi, who are well versed in areas including sustainability and ESG (environment/society/governance) investments.

Envisioning multiple scenarios, conceiving of survival strategies

--- Tell us about the background to the TCFD’s proposal.

Niimi: When the Lehman Brothers failure occurred in 2008, and the state of conventional finance got called into question, more attention began to be paid to ESG investments, which involve investing activities that take the environment and society into consideration. Subsequently, there was a growing sense of danger concerning the impact that climate change would have on the financial markets, and amid these circumstances, the Financial Stability Board (FSD) launched the TCFD in 2015 at the request of the G20. Then in June 2017, the TCFD’s final report was presented, asking companies to disclose the information they have on the risks and the opportunities associated with climate change.

--- What kinds of information disclosures were solicited?

Niimi: The report indicates 11 recommended disclosures from the standpoint of four themes — “governance”, “strategy”, “risk management”, and “metrics and targets”. Given the high level of uncertainty about the future, such as the range of temperature rises and the policy and technological innovations that go with that, companies were asked to envision multiple scenarios, clarify the risks and opportunities for themselves in each scenario, and describe the resilience of their strategies for combating climate changes.

Ibuki: If you look at the content, some of it does overlap with the items that companies have discussed regarding efforts to cut CO2 emissions, but conventional CO2 reduction measures have tended to be responses on a relatively short- and medium-term time basis. Meanwhile, TCFD deals with risks and opportunities from a long-term perspective up to 2030 or 2050. So, it makes it easy for companies to consider making forward-thinking, bold investments, for instance like using renewable energy for all of their electricity, or transforming their businesses in keeping with technological innovations.

Depicting a long-term vision, and applying it to business strategies

--- Are Japanese companies making progress with TCFD measures?

Niimi: Companies began showing more interest when the TCFD Summit was held in Japan in October 2019. Ministry of Economy, Trade and Industry and other organizations have also worked to promote these efforts, and Japan now has the most companies on board with the TCFD proposal in the world. Another characteristic to mention here is that it’s not just financial institutions, but also a lot of manufacturers, food producers, trading companies, and other kinds of non-financial sector companies that are involved. However, the initiative itself has only just gotten started, so all of these companies are still feeling things out. I also think that in particular, out of the 11 recommendations, there are a lot of companies that are doing “analysis using multiple scenarios” for the first time. The challenge going forward will be not simply to disclose information, but to depict a long-term vision, and to connect it smoothly to your business strategies.

--- In scenario analysis, what kinds of considerations are made?

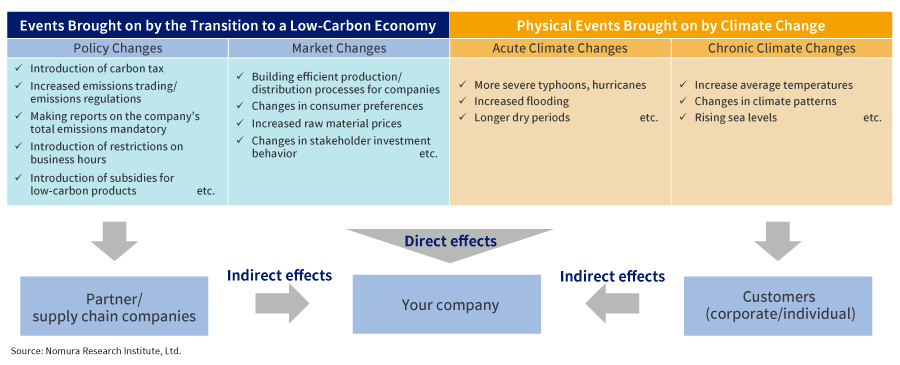

Niimi: The number of operations for supporting Japanese companies with their TCFD measures has increased, but what we often use on these occasions is scenario creation, where we envision what will happen if global temperatures rise by less than two degrees, and what will happen if they rise by four degrees, by the end of this century. For example, in the less-than-two degrees scenario, a carbon tax could perhaps be rolled out as a way of curbing climate change. We evaluate the risks and opportunities involved in this scenario, looking for instance at how much electricity costs will go up if a carbon tax is imposed at such and such rate, or conversely, how the procurement of electric power will change if the price of renewable energy drops this or that much. For the most serious risks and opportunities, the financial impact is quantitively measured, then response measures for alleviating or adjusting to climate change are considered and incorporated into a company’s business strategy.

Ibuki: These past few years, I’ve often been in charge of projects that combine climate change and sustainability, but I feel that when we adopt a climate change-centric approach, it’s easier to have more substantive discussions than it was with previous sustainability-related projects. For instance, it allows everyone from the top management down to the business segment level to conceive of things like the impact from rising sea levels on their company’s site, or the impact from abnormal weather on their supply chain, as something that concerns them personally. I also feel that by using climate change as a point of entry for these discussions, people have an easier time thinking about big topics like sustainability and social value. I think that trying out scenario creation or analysis also helps to build a shared understanding throughout the company, too.

A chance to promote and deepen sustainable management

--- Is there any advice you give for when pursuing TCFD measures?

Niimi: In the world of finance, people are deeply concerned about “green swan” events—that is, situations where climate change leads to catastrophic shocks to the financial markets which central banks or financial supervisory authorities won’t be able to handle by themselves. In this context, investors are now giving more attention to how the companies in which they invest are grappling with climate change and what kinds of response measures they’re working on. As for operating companies, we’re now in an age where if they don’t map out a long-term management vision that factors in climate change, they could be eliminated from the market. In terms of TCFD response measures, the important thing is not to make superficial information disclosures, but instead to use scenario analysis and depict a concrete image of the future involving a long-term vision, and then to thoroughly incorporate that into your business strategies. We also look forward to assisting with these efforts in any way we can.

Ibuki: Thinking about the risks and opportunities involved with climate change gives you a chance to reconsider your company’s materiality (key issues concerning sustainability). When it comes to this critical topic of climate change, top management would do well to engage in proactive discussions. I also think it would be good for management to involve those on the operations side in the discussions, to create opportunities for promoting and deepening their sustainability management straight away.

NRI boasts its Principals holding high level of expertise in specific markets or solutions. NRI Principals, also as leading consultants, have played roles to lead innovations for society and clients to success. NRI Principals create new businesses, ensure unwavering commitment to projects and have responsibilities to solve the client's issues.

Profile

-

Eiko Ibuki

-

Yutaro Niimi

* Organization names and job titles may differ from the current version.