Takahide Kiuchi's View - Insight into World Economic Trends : Supply-Side Economic Policies are Vital

Following the outbreak of Covid-19, the Japanese economy has taken a dramatic turn for the worse. According to GDP statistics for the period from April to June 2020 (secondary preliminary report), real GDP showed an annualized contraction of 28.1% from the previous period, the most substantial drop in Japan’s postwar history. There are concerns that this decline will not be merely a temporary one, and that Japan’s economic potential could be dissipated even further.

The decline of Japan’s economic potential cannot be stopped

Over the 71-month period lasting from November 2012—immediately prior to the inauguration of the Abe administration—until its peak in October 2018 (provisional), the Japanese economy enjoyed the second-longest recovery in its postwar history. The long-term rebound of the global economy is thought to have provided a powerful impetus for this recovery.

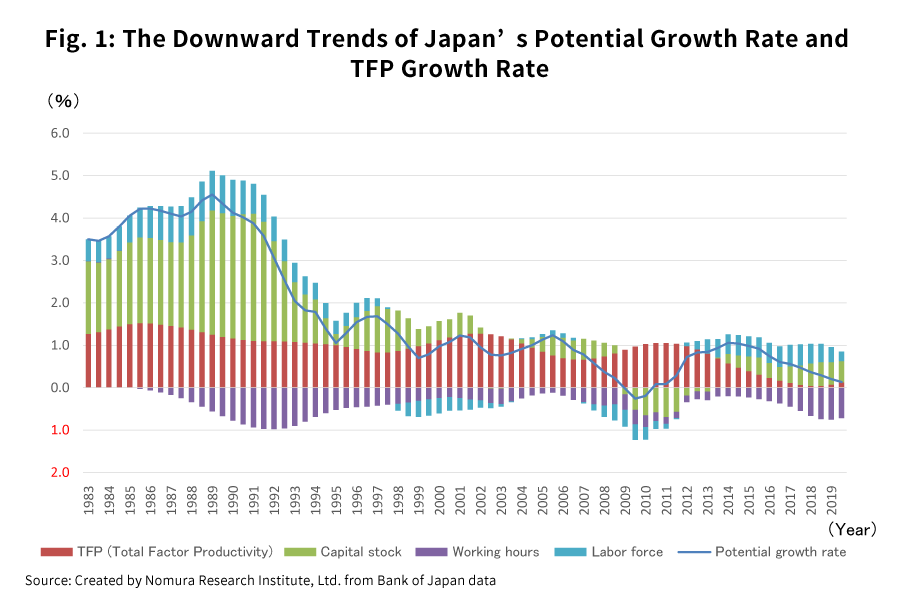

However, during this period, Japan’s economic potential followed a downward trajectory. According to the Bank of Japan’s statistics, the growth rate of total factor productivity (TFP)—which indicates the productivity growth rate based for instance on technological progress—peaked in 2010-11 and has been on a downward slope ever since, with its contribution to the potential growth rate recently having fallen to around an annualized 0.1%. That is why the potential growth rate itself has also dropped recently to an annualized 0.1% or so (fig. 1).

As the potential growth rate follows this path of decline, the Japanese people will likely be unable to maintain a rosy view of Japan’s economic future. And with the labor productivity growth rate also on a downward trend, the people will likewise be unable to see any bright prospects for their own future livelihoods. This is because the labor productivity growth rate has a major impact on real wage growth, which determines an individual’s purchasing power.

If the government were to try overcoming deflation by stimulating demand, and thereby expand fiscal spending financed by the issuing of national bonds, it could perhaps cause the Japanese economy’s potential to fall even further. This is because the issuing of more national bonds borrows demand from the future, creating a greater burden on the next generation, and thus companies will lower their expectations of medium- and long-term growth, and become wary of making more capital investments, hiring more workers, and raising wages.

Measures for raising productivity are of paramount importance

Given the above points, policies for raising the potential growth rate and improving the productivity growth rate would seem to be the highest-priority economic measures in Japan. An increase in the productivity growth rate will mean a higher rate of growth in real wages, and broadly speaking, it will likely incline the population to have a brighter outlook for their own future lives.

As with the aftermath of the global financial crisis, there is an undeniable possibility that the current Covid crisis could trigger another downturn in economic potential. However, might it also be possible for us to turn the adversity of this Covid crisis to our advantage, so to speak, so that we can make our economy more efficient and further enrich people’s lives? Below, I would like to give two examples of measures to achieve those ends.

The first is taking advantage of this opportunity to move forward with digitalization, which is an area where Japan has lagged significantly behind other countries.

Under the Japanese government’s “Basic Policies for Economic and Fiscal Policy Management and Structural Reform 2020 (Basic Policies 2020)”, which was approved by a cabinet decision on July 17, the digitalization of administrative procedures and the construction of a “digital government” is considered a signature top-priority issue. e-Government is a field involving the use of online services, and alongside cloud services and e-Learning, it is an area where Japan has most seriously fallen behind. According to a report published in 2017 by the OECD (Organisation for Economic Co-operation and Development), of the 36 OECD member nations, Japan ranked 35th in the use of e-Government. Advances in the digitalization of administrative procedures can be expected to have the effect of promoting digitalization in the private sector as well.

The Covid-19 problem has also unexpectedly created opportunities to advance Japan’s transformation into a cashless society and digitalization in the field of payment services, which are two other areas where Japan lags far behind countries overseas. Japanese consumers have lately become much more aware of hygiene-related issues concerning cash payments. According to an estimate by a research team at Tufts University, the annual cost involved in the use of cash in the US, amounts to as much as 1.2% of nominal GDP. Going cashless could conceivably have a profound effect in raising economic efficiency.

The Basic Policies included a plan to consider a Central Bank Digital Currency (CBDC) which could be issued by the Central Bank of Japan. The issuance of a CBDC—which would have a higher creditworthiness than digital currencies used for smartphone-based payments etc. provided by the private sector—could potentially expand the use of smartphone-based settlements and help society go cashless, and if so, the issuance of such a currency would surely merit consideration.

I believe that if progress toward a cashless reality opens the door to a broader popular acceptance of a digital society, the effects obtained from greater economic efficiency could be tremendous.

On improving productivity in the service industry

The second measure entails raising the productivity of the service industry. The service industry including the retail, restaurant, and hotel businesses, which have taken the most severe hits from the Covid-19 pandemic, is a representative industry type that, as has long been observed, suffers from remarkably low productivity in Japan versus overseas countries. According to the Japan Productivity Center’s “International Comparison of Labor Productivity Levels by Industry (2017)”, the labor productivity level of Japan’s hotel and restaurant businesses in 2017 was just 36.3 compared to the US’s 100, while the level for its wholesale and retail sectors came out to 32.3.

As precautions against the risk of infection become more prolonged, consumers will likely reduce their levels of consumption in these areas more than ever before. At present, it would seem that the correct policy measure is to rescue companies and support employment in those areas that have been severely struck through government subsidies and such. However, assuming that sales do not recover to their original levels, then starting next year, there may need to be a major shift towards policies that encourage companies in these industries to change their businesses and workers to change jobs, as a way of staying ahead of changes in industrial structures in response to variations in consumer activity.

If these government initiatives and corporate self-help efforts somehow managed to shrink the gap between Japan’s productivity levels in the hotel, restaurant, wholesale, and retail industries and the much higher corresponding levels in the US by one-quarter, a simple calculation reveals that Japan’s overall productivity would rise by as much as 8.3% in a flash.

Pursing these two productivity enhancement measures is by no means an easy feat, but I think the fact that the major impact of the Covid crisis is still lingering just might make it possible to achieve such huge results.

Perhaps the new administration, after fully examining the effects and side effects of the previous administration’s economic policies, should then decisively steer us away from demand creation policies designed to overcome deflation, and instead towards supply-side policies that will raise the Japanese economy’s productivity.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.