Impact of Covid-19 on the Japanese Economy and Measures to Avoid Bottoming Out

Covid-19 is having a large impact on the Japanese economy. Going forward, as we enter the era of “After Corona” (post-Covid-19) or “With Corona” (coexistence with Covid-19), what needs to be done to avoid the economy bottoming out? We talked to Shinichiro Umeya of Nomura Research Institute (NRI), who has twice now made urgent proposals regarding Covid-19, and asked what kind of impact Covid-19 is having on the Japanese economy and what kind of response is required.

Reduction of interpersonal contact adversely affects sales in the “four interpersonal industries impacted by Covid-19”

Despite the unprecedented difficulty of the Covid-19 pandemic, the number of corporate bankruptcies is about the same as in the same period last year, and the unemployment rate has deteriorated by less than 1%. It can be said that this was due to the success of emergency evacuation-like policies such as cash flow measures and sustainability benefits for companies, and employment adjustment subsidies and special fixed-amount benefits for employment. The current situation is that companies and employment have managed to persevere even in a difficult environment because of the total mobilization of these policies.

However, when we look at the current economic indicators, in the “four interpersonal industries impacted by Covid-19” (hospitality industry, food service industry, life-related service industry, and entertainment industry), which are premised on work involving interpersonal contact, activities such as going out are still sluggish, and for this reason the decline in sales has not stopped. For these industries, the policy of “70-80% reduction in contact” adopted when Covid-19 began to spread can be considered to mean an “interpersonal economy at 30%”. In fact, when we look at the data on the flow of people at terminal stations and the like, going out and other interpersonal contact is still far below last year’s level, and there is a possibility that the “interpersonal economy at 30%” will continue going forward depending on status of infections.

The “four interpersonal industries impacted by Covid-19” are facing the problem of excessive debt due to accumulated loans

The government has implemented cash flow measures to support the four interpersonal industries impacted by Covid-19, which are suffering from declining sales. Specifically, there are loans from government-affiliated financial institutions and loans with credit guarantees (100% guarantee) from private financial institutions, and it can be said that this system is a special and powerful form of financing because it essentially does not require repayment of interest and principal for three years. According to a report by the Nihon Keizai Shimbun dated September 10, 2020, the total amount of special Covid-19 loans has exceeded 40 trillion yen in the public and private sectors.

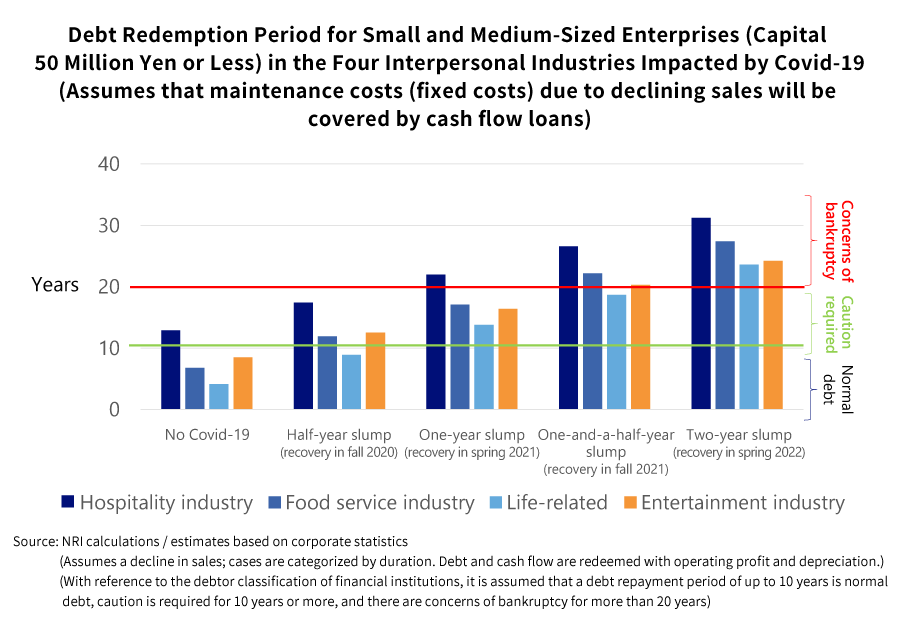

Meanwhile, this means that loans will accumulate in terms of cash flow. If the “interpersonal economy at 30%” continues, there is a risk that debt repayments for the “four interpersonal industries impacted by Covid-19” will reach difficult levels within two years.

Moreover, the “four interpersonal industries impacted by Covid-19” are based on local production and local consumption, and since most of the supply purchases and outsourcing are done within the same municipality or prefecture, the impact on other local industries cannot be denied. From this, it is expected that the slumping business of business operators in the “four interpersonal industries impacted by Covid-19” will affect the business of transaction counterparties in the same regions. Therefore, the impact on the 6.95 million small and medium-sized enterprise employees involved in retail and wholesale in those regions cannot be denied.

It will still take a considerable amount of time until Covid-19 is “completely contained”. If we further encourage self-restraint in economic activities and reduce interpersonal contact by 70 to 80% whenever infections are rising, there is a risk that the “interpersonal economy at 30%” will become entrenched for the “four interpersonal industries impacted by Covid-19”. In that case, many businesses in the “four interpersonal industries impacted by Covid-19” may reach a risk level that makes it difficult to repay debts and face a “cliff of corporate sustainability”, which may lead to the risk of the overall Japanese economy bottoming out. To avoid this, it is necessary to recover quickly to an “interpersonal economy at 70%” where contact is limited by about 30%.

Seeking a narrow path for policies that avoid both short-term and long-term turmoil

As I said earlier, neglecting the excessive debt accumulation of the “four interpersonal industries impacted by Covid-19” presents the risk of a “corporate sustainability crisis” and could bring out long-term economic stagnation. Meanwhile, “promoting corporate survival of the fittest based on liquidationism” amid sluggish economic activity could lead to “sudden death for companies” and the “chain reactions” which that entails, which could cause a policy-triggered depression.

Since the “four interpersonal industries impacted by Covid-19” and related industries have many employees, short-term and long-term turmoil would lead directly to employment insecurity, and would likely have a large impact on society as a whole. The government needs to seek a “narrow policy path” to avoid any of these outcomes.

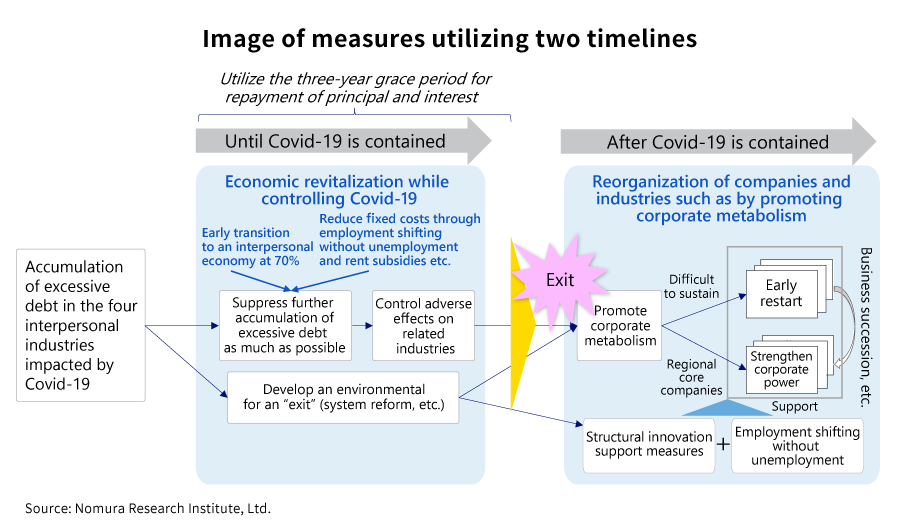

To that end, “timeline-based policies” such as “immediate support for economic activity and companies” and “medium- to long-term corporate reorganization and employment shifting promotion” are necessary, and the key is how to make effective use of the three-year grace period for special Covid-19 loans. In other words, until Covid-19 is completely contained, it would be best to develop an environment geared toward an “exit” while suppressing drastic changes by revitalizing the economy and continuing corporate and employment support measures, and once Covid-19 has been completely contained, to aim for corporate reorganization, industrial reorganization, and improved productivity by promoting corporate metabolism and re-employment without unemployment.

In the spring of 2021, the average debt redemption period for the hospitality industry could exceed the 20-year danger level. Before such a situation occurs, we should move to the phase of “revitalizing the economy while dealing with Covid-19”, which will support the economy and lay preparations for an exit.

The time limit for transition to the new phase is spring 2021

To prevent the Japanese economy from bottoming out, it is essential to move to a new phase by next spring. Therefore, the essence of our proposal is that the government should consider clearly declaring “a transition to a phase of revitalizing the economy while controlling Covid-19” to avoid falling off the “cliff of corporate sustainability” by recovering to an “interpersonal economy at 70%” while ensuring safety and security, and develop an environment for an “exit” after Covid-19 is “completely contained”.

The digitalization of life and society what will provide a breakthrough for this. In addition to preventing the spread of infections beyond the “new lifestyle” announced by the government in May 2020, digitalization will create a “new lifestyle 2.0 through digital transformation” “balancing offense and defense” that improves the welfare of the people and generates new opportunities.

That would be a life where people can live their lives with peace of mind since they are provided with appropriate information and support, a life that is convenient and exciting through the provision of new conveniences and services, and a society where people are provided with venues to realize their ideas and want to try new things. I believe that developing digital social capital that makes this possible will lead to the construction of a framework that enables economic activities while ensuring safety and security.