Takahide Kiuchi's View - Insight into World Economic Trends :

Will There Be a Virtuous Cycle in Prices and Wages?

The spring wage talks for 2023 are finally in full swing. This year, expectations for significant wage increases are higher than in typical years. In fact, wage growth is likely to be considerably higher. Meanwhile, consumer prices (excluding fresh food) rose 4.0% year-on-year in December last year, reaching the 4% level for the first time in 41 years. Will this result in a virtuous cycle in which prices and wages rise synergistically in Japan?

Wage growth this year is the highest since 1997

RENGO, the central organization of labor unions, has set a target for this year’s spring wage talks of about a 3% base pay increase in wages, which would come out to about a 5% raise if regular salary increases are also included. These are 1% higher than the previous targets.

Meanwhile, the business association Keidanren has strongly called on its members to raise wages, pointing out that aggressive wage increases are a “social responsibility of companies” considering the historically high prices for goods. Keidanren Chairman Masakazu Tokura also stated that “Unless we can create a virtuous cycle in which wages and prices rise appropriately, the revival of the Japanese economy will become even more difficult.”

In last year’s spring wage talks, wages increased by 2.2% including regular salary increases, with a base pay increase in the mid-0% range. This year, the wage increase is expected to be a little more than a 1% increase in base pay, and a little less than 3% including regular salary increases. The rate of wage growth is expected to be the highest since 1997.

In addition, this year’s spring wage talks are taking place at a time when expectations of policy revisions by the Bank of Japan (BOJ) are growing stronger. These developments are also attracting a great deal of attention from the perspective of predicting the BOJ’s monetary policy after the new governor takes office in April.

The upward swing in the price of goods since last year, combined with the uptick in the rate of wage growth in the spring wage talks, has raised expectations among some that a virtuous cycle between wages and prices will emerge, creating an environment in which the BOJ’s 2% price target can be achieved in a stable manner.

The upswing in price and wage growth is temporary

In reality, however, a virtuous cycle between wages and prices is unlikely. Certainly, wages are expected to swing upward considerably in this year’s spring wage talks, but this will be very transitory, as the high rate of price increases from last year will be passed on.

Consumer inflation (excluding fresh food) peaked in January of this year at slightly more than 4% year-over-year, and after remaining high for a while, is expected to follow a downtrend from the second half of 2023. The trend of soaring energy prices in overseas markets and a weakening yen, which brought about temporarily higher prices, has already changed, and now import prices have already started trending down given the effects of falling energy prices and a strengthening yen. The impact of falling prices in upstream markets is likely to bring about a marked decline in the rate of consumer price inflation in the second half of the year and beyond.

By the time of next year’s spring wage talks, the rate of consumer inflation is expected to have declined to the low 1% range compared to the previous year. Even if the rate of wage growth swings up in this year’s spring wage talks, it will be for one year only, mirroring the upswing in the rate of inflation, and it is expected that during next year’s spring wage talks, the rate of wage increase including regular salary increases will fall to the 2% range, with the base pay increase once again in the 0% range.

Sustained real wage growth requires an increase in economic potential

The BOJ has stated that the rate of wage increase consistent with the 2% inflation target remaining stable is about a 3% base pay increase. This is 1% higher than the inflation rate. Even if this year’s spring wage talks raise base pay wages, it wouldn’t be more than a little above 1%, and this is still far short of the level required to achieve the 2% inflation target.

Even if the rate of wage growth temporarily swings higher in response to the high inflation rate, if it doesn’t exceed the inflation rate, the rate of real wage growth (nominal rate of wage growth rate – rate of inflation) will be negative, making people’s lives more difficult. Furthermore, if real wages don’t increase sustainably, it is unlikely that prices and wages will rise synergistically and sustainably.

If there is no change in the distribution between companies and workers, the rate of real wage growth will coincide with the rate of labor productivity growth. From this point of view, the rate of real wage growth would increase only when there is an increase in economic potential, i.e., higher labor productivity growth, thus creating a virtuous cycle between prices and wages.

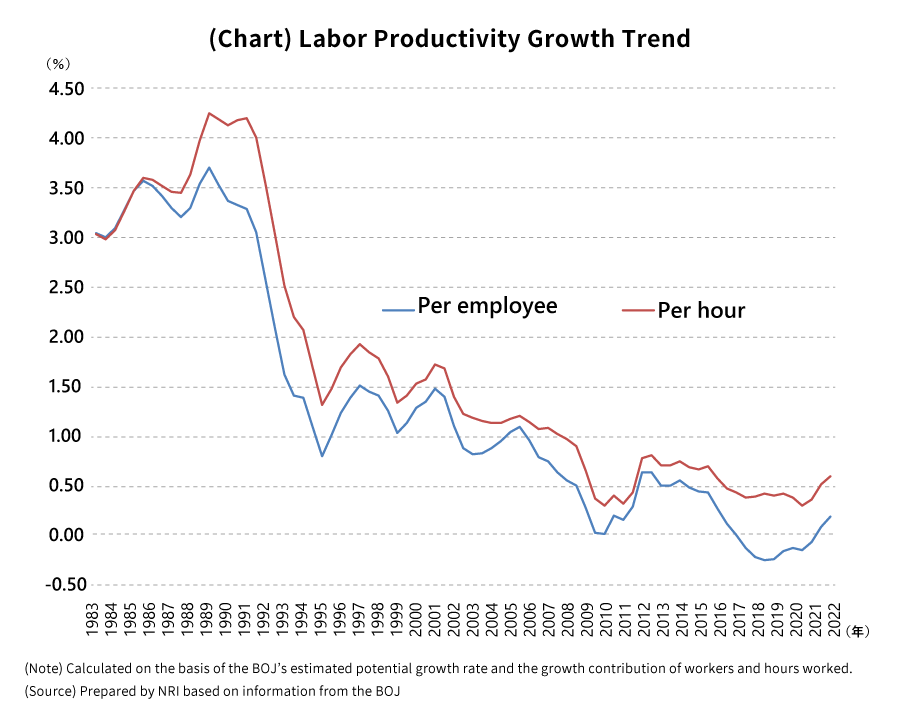

However, the current trend in labor productivity growth is about 0.2% year-on-year when calculated per employee and 0.6% year-on-year when calculated for total employee hours worked, and thus it hasn’t reached the 1% real wage growth rate (i.e., labor productivity growth rate) suggested by the BOJ (see chart).

If we consider the labor productivity growth rate in the early 1990s, when the inflation rate trend was above 2%, it would seem that it would actually be difficult to achieve the 2% inflation target in a stable manner unless the rate of labor productivity growth exceeds 3%.

Under the new administration starting in April, the BOJ is expected to revise its 2% inflation target to a medium- to long-term target and proceed cautiously with the normalization of monetary policy , rather than seizing on the current transitory rates of price and wage growth as a sign that the achievement of the 2% inflation target is now within sight and taking bold steps toward normalization.

Expectations for labor market reforms by the Kishida administration

In his policy speech in January 2023, Prime Minister Kishida proposed a three-pronged labor market reform to achieve structural wage increases by supporting skill development through reskilling, establishing a Japanese-style job-based wage system, and promoting smooth labor mobility towards growth sectors.

Prime Minister Kishida also called for higher wages in his policy speech a year ago, but at the time he was aiming to raise wages directly through the expansion of the tax system to promote higher wages and through requests to companies to raise their wages. However, it’s difficult to imagine that companies, acting in accordance with economic rationality, will raise base salaries substantially and sustainably in the absence of changes in economic structure, such as labor productivity improvements.

This time around, however, Prime Minister Kishida has set forth a structural wage increase that aims to create an economic environment in which wages will rise sustainably, which I believe is appropriate.

In order to achieve structural wage increases, it would be effective to improve skills and productivity through reskilling and other measures, and then change the seniority-based pay system to a performance-based one so that this will lead to higher wages for employees. Furthermore, in order to link the improvement of individual skills to increased productivity in the economy as a whole, it’s also necessary to increase the liquidity of the labor market. To this end, it’s important that objective market value be reflected in salaries through a performance-based pay system. This is what job-based pay is all about.

Traditional employment practices such as hiring new graduates all at once, seniority-based salary systems, and lifetime employment have supported Japan’s high growth in the past. Today, however, these practices are hindering labor productivity improvements and, as a result, are preventing wages from rising.

The improvement of skills and productivity through reskilling, and the establishment of a Japanese-style salary system, are labor market reforms that will lead to improved labor productivity and increase the potential of the Japanese economy, and are necessary for economic revival in Japan. Although it will take some time for these reforms to take root and have an economic effect, I hope that the Kishida administration will set a firm course to achieve this goal.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.