Takahide Kiuchi’s View - Insight into Economic Trends: Ten Years of “Another Dimension” of Easing, and Policy Prospects Under the Bank of Japan’s New Administration

It will soon have been 10 years since the Bank of Japan (BOJ) began its unprecedented monetary easing, which has been termed “another dimension” of easing measures. Opinions are varied as to the pros and cons of this policy. However, when one considers that the two-percent price stability target –which the BOJ had initially aimed to achieve in the short term—still hasn’t been achieved even after 10 years, this other dimension of easing arguably has failed. Further, while economic and price conditions may have improved somewhat compared to 10 years ago, when the effects of the Lehman Brothers collapse were still strong, it’s by no means clear to what extent this improvement is the result of the BOJ’s monetary easing.

Raising economic potential, growth potential through monetary easing is difficult

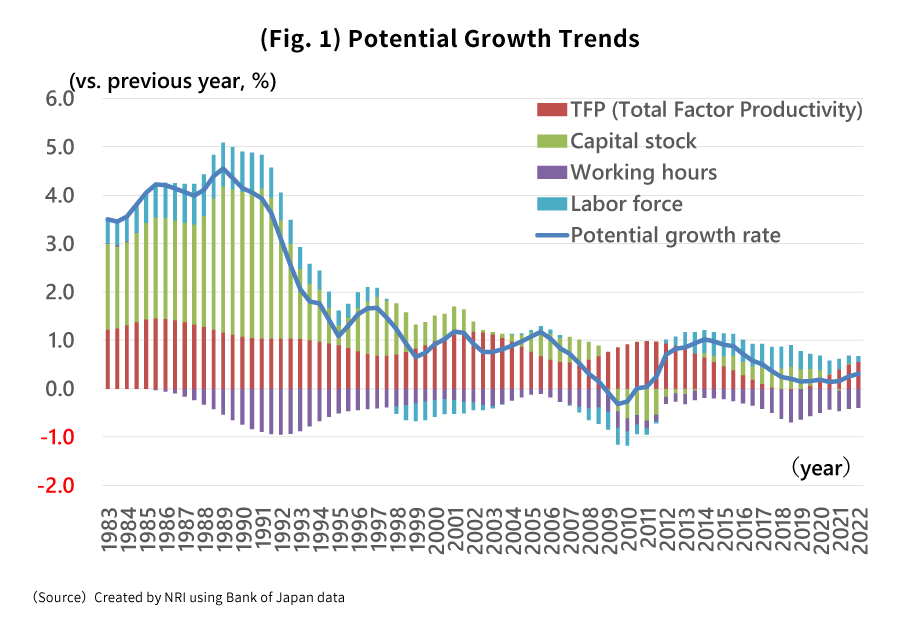

I believe that many of the various economic problems Japan is facing, including the long-standing stagnation of wages and prices, have to do with the fact that the country’s productivity growth rate, potential growth rate, and other aspects of its economic potential and growth potential have been on a downward trend. That is largely a problem that should be overcome through measures such as government structural reforms and growth strategies, private sector innovation, and raising workers’ skill levels. Meanwhile, although monetary easing can bring future demand forward into the present through lower interest rates, it would seem unable to directly affect economic structures like the productivity growth rate or the potential growth rate.

Since the BOJ implemented its extraordinary monetary easing program 10 years ago, the productivity growth rate has remained on the decline (Fig. 1). It would appear that this unprecedented monetary easing lacked the power to alter that trend.

If demand could be raised through monetary easing, then the economic environment could be improved at least in the short term. However, this extraordinary monetary easing—which was launched under conditions in which there was already limited room for interest rates to drop—failed to accomplish this as well.

In fact, during this 10-year period, the extent of the decline in interest rates has been limited. Short-term interest rates have only fallen from the +0.1% rate 10 years ago to today’s level of -0.1%, a drop of merely 0.2%. The yields on 10-year JGBs did briefly become slightly negative from around 0.8%, but currently they’re at around +0.5%, and so the decline has been limited in its scope. For this reason, it would appear that the stimulation given to demand has also had a limited effect.

The potential side effects will mount

On the other hand, this unprecedented monetary easing seems to have already given rise to a variety of side effects. Although the rapid depreciation of the yen and bond market turmoil that began last year have played some part, there are other factors involved, including the decline in market fluidity and other weaking of market functions, the downward pressure on financial institutions, and the deterioration of the BOJ’s balance sheet.

In addition, likely as a consequence of the high hopes that were placed on the effects of this extraordinary monetary easing, the government’s growth strategies, structural reforms, and other economic policies essential for restarting the Japanese economy have accordingly failed to make much headway. What’s more, it seems that this unprecedented monetary easing has in some sense even degraded the government’s fiscal discipline. As a result, the ballooning of the government’s debts over these past 10 years has probably sapped the potential of the Japanese economy, by worsening its future demand outlook.

The way that monetary policy is supposed to work is by being pursued after weighing the effects and the side effects it will have. From the viewpoint of economic stability, the current monetary easing framework, which has little effect but promises to have serious side effects into the future, surely needs to be reassessed and normalized. Furthermore, I believe it’s also important for Japan ultimately to gradually revert to its traditional monetary methods—namely, flexibly fine-tuning short-term interest rates and appropriately adjusting the provision of liquidity to banks—for which a wealth of knowledge has been accumulated over many years when it comes to their effects and side effects.

The forced large-scale purchasing of government bonds has been a major problem

Mr. Kazuo Ueda, a former member of the Policy Board of the BOJ and a professor emeritus at The University of Tokyo, is set to take office as the new BOJ Governor in April. Once Mr. Ueda becomes Governor, his first order of business would conceivably be to reassess the bank’s current monetary easing framework, and then to soften and normalize its rigid monetary policy, which has been tied to its rather impracticable two-percent price stability target.

In actuality, that course of action would be in line with the BOJ Secretariat, and the expectation is that Mr. Ueda will proceed cautiously yet steadily forward. Even under the current Governor’s administration, which has been aggressive about monetary easing, the Secretariat—which has a major influence on policy decisions—has taken the lead in promoting revisions aimed at mitigating these side effects, pursuing a so-called “de-facto normalization policy”. Given this, there is a good chance that this trend will likely only proceed further under the new Governor.

However, under the new administration, the BOJ will likely take its time and proceed cautiously with revising its monetary easing, while giving due attention to how the affairs of financial institutions and the financial markets will be affected. This also is the BOJ’s traditional policy stance.

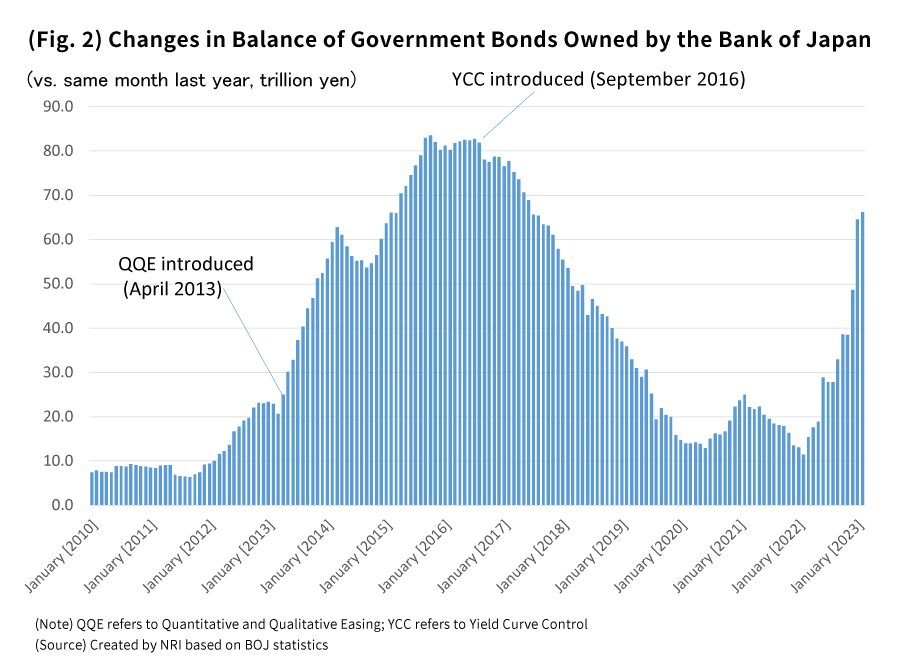

From the BOJ’s point of view, the greatest cause for concern right now is the fact that it’s being compelled to make massive government bond purchases to maintain its Yield Curve Control (YCC), which is a framework for controlling long-term government bond yields. This situation hampers the fluidity of the government bond market, while also bloating the BOJ’s balance sheet, and down the road it will even raise the risk for the BOJ’s finances. The balance of JGBs on the bank’s balance sheet was 66.2 trillion yen higher in February of this year compared to the same month the year prior, a dramatic increase from the rise of 11.5 trillion yen seen one year before (Fig. 2).

Having been introduced in September 2016, YCC is more than simply one part of the BOJ’s monetary easing framework—it is a measure that was adopted with the aim of drawing down the bank’s purchasing of government bonds. However, ever since last year, maintaining YCC has compelled the BOJ to purchase large quantities of government bonds. This is indeed an ironic outcome.

Will the BOJ embark first on YCC reform?

Furthermore, YCC would seem to have a structural problem. For example, in situations like the present in which the US economy is comparatively strong and inflation is ticking upward, and in which long-term yields in the US are rising, the firmness of the US economy and rising inflation will also influence Japan’s economy. Given as well how the growing yield differential between the US and Japan is exacerbating the yen’s depreciation, Japan’s inflation rate would also become prone to rising. That would mark a phase in which the BOJ would normally need to embark on a course of monetary tightening.

However, if the rise in US long-term government bond yields heightens the risk that Japan’s ten-year JGB yields could exceed their acceptable range of volatility, then the BOJ will be forced to expand its purchases of government bonds to curb the increase in yields. This would increase the money supply, and would only augment monetary easing, quite the reverse from monetary tightening. Depending on the environment, the BOJ would be compelled to take the entirely opposite sort of policy measures from what it originally intended—and that, one might say, is the grave structural problem facing YCC.

Considering this point, I believe that the BOJ’s first order of business under the new administration will be to dramatically overhaul YCC. Rather than a full-scale revamping of the monetary easing framework, we can expect the BOJ to undertake a substantive reform of YCC (its mechanism for controlling long-term government bond yields) at its April or June Monetary Policy Meeting, under the pretext of softening its current monetary easing framework. The options for doing this could conceivably include expanding yield volatility to 0.75% or even 1.0%, eliminating the volatility range altogether, or other such measures.

When that happens, it will likely lead the 10-year JGB yield to rise, and have certain effects on the financial market such as causing the yen to appreciate and stock prices to fall. However, given that this is already anticipated to some degree, we may suppose that the sort of major effects seen last December when the BOJ suddenly expanded yield volatility will not extend to financial markets.

Could we see a full-scale overhaul of the monetary easing framework from the second half of 2024?

It’s expected that after substantially revising YCC, the BOJ may choose to recast its two-percent price stability target as a medium-to-long-term goal, thereby laying the groundwork for normalization through a fully-fledged overhaul of its monetary easing framework and a reversion to a more flexible monetary policy. This would presumably be achieved through deliberations with the Japanese government, by amending the joint statement issued in January 2013 by the BOJ and the government (the Accord).

If the two-percent price stability target were softened into a medium-to-long-term objective, then the BOJ under the new administration could be expected to go through with revising its monetary easing framework in a way that is cognizant of various side effects.

However, with even some in the ruling party holding negative views about amending the two-percent price stability target, the debate has become bogged down, and it could take considerable time before the government and the BOJ reach an agreement about amending the joint statement to include softening that target. It could take until the latter half of this year, or perhaps even until near the end of the year.

It’s also expected that around that time the global economy will experience a growing sense of slowdown, with speculations mounting in the financial market of monetary easing by the FRB (US Federal Reserve Board). If that happens, then measures such as the elimination of negative interest rates—which could elevate the risk of a rapid appreciation of the yen—would presumably be postponed rather than being implemented straight away.

A full-scale revision of the monetary easing framework could be expected to follow the reframing of the two-percent price stability target, proceeding from the elimination of negative interest rates, the abolition of YCC, a drawing down of the BOJ’s outstanding JGB balance, and finally an off-balancing whereby the BOJ would take the ETFs (exchange-traded funds) it has purchased off of its balance sheet. However, the termination of negative interest rates is expected to be put off until the second half of next year or later. We can further suppose that successive framework revisions will be carried out gradually between 2024 and 2026.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.