Hydrogen Energy Utilization Business Accelerates Worldwide – Three Approaches to Market Entry

Hydrogen energy is one of the methods of achieving decarbonization that has come under discussion recently. Full-scale movements for the utilization of this energy source have seen rapid acceleration in both the public and private sectors, centered on the three poles of Europe, the United States, and China. How can Japan foster hydrogen energy-related businesses to avoid getting left behind in this global trend? NRI’s Tomoki Hamano, Teruo Matsubara, and Seiya Kawai sat down to discuss opportunities for entry into the hydrogen energy market.

The hydrogen shift is accelerating worldwide

The global trend toward hydrogen energy utilization has seen a major uptick in activity in the last few years. In Europe, the REPowerEU Plan for upward revision of hydrogen introduction targets was enacted in 2022, and the hydrogen shift is otherwise underway at a policy level, with the aim of overcoming dependence on Russian fossil fuels in response to the crisis in Ukraine. Likewise, in the United States, the Infrastructure Investment and Jobs Act was enacted in 2021, with a plan to invest 1.5 billion USD in green hydrogen as a new industry for job creation. In late 2022, the U.S. embarked on the formulation of a national hydrogen strategy and roadmap. Finally, in China, detailed facilitation measures are being worked out with a focus on major cities, under the national Hydrogen Industry Development Plan.

Tomoki Hamano echoes concerns about the Japanese situation. “In December 2017, Japan took the lead globally by formulating the Hydrogen Basic Strategy. But precisely because Japan was so far ahead of the curve, there was a limit to what we could do alone; specific areas of focus and balance with the rest of the world were never fully articulated, and so the efforts languished at the proof-of-concept level. Alongside these circumstances, domestic companies revealed a deep-rooted ambivalence in their tone about renewable energies, indicating a different level of enthusiasm than overseas. Japan’s approach to resource allocation and its sense of urgency undeniably lagged behind those of its peers.” For these very reasons, NRI has conducted a forecast study on the hydrogen market’s forthcoming prospects, with the aim reaffirming the current global reality of breakneck progress in the hydrogen shift.

Three approaches to market entry for green hydrogen

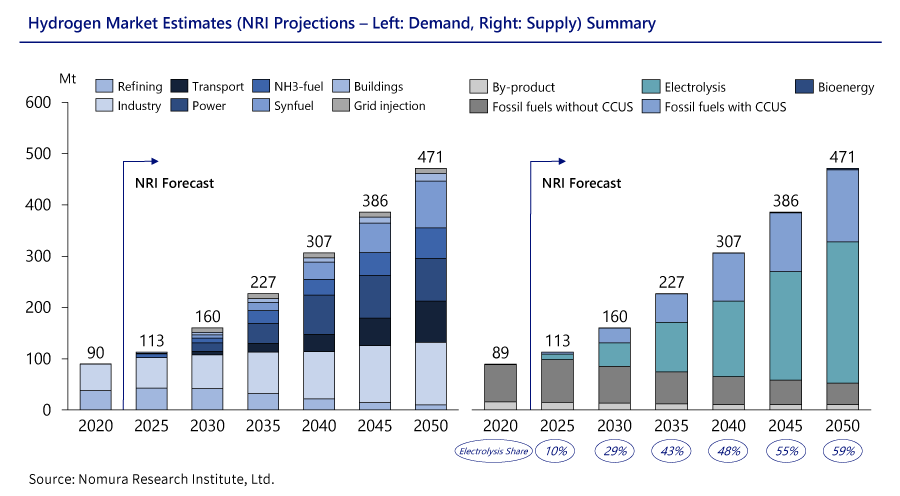

Teruo Matsubara explains, “While some institutions use a theoretical value basis to make market projections that show steep growth, our estimates prioritized accuracy while drawing on the most recent performance numbers and policy trends. In addition, we held discussions with European experts to increase our predictive accuracy. Thus, even though our approach may have been more conservative than other statistical methods, we nonetheless found that demand is rising rapidly, driven by industrial sectors such as steel and glass where hydrogen can be used in manufacturing processes, as well as in electric power fields, which have seen striking technical innovation in hydrogen-mixed combustion.”

A point warranting further emphasis is the different types of hydrogen available. There are three ways of making hydrogen: gray, where the hydrogen is extracted from fossil fuels; blue, where the CO2 given off in this process is captured and processed; and green, where water is electrolyzed using renewable energies. Of these, the supply of green hydrogen, which emits zero CO2, looks to make up around 10% of the total in 2025, but is expected to account for more than half by 2050.

As ways of seizing the opportunity on this growth in green hydrogen, three approaches to market entry appear worthy of consideration. The first relates to key components (parts, materials), and is an approach in which, instead of undertaking production in accordance with specifications, a “spec-in” method is adopted where joint efforts are made to resolve the concerns of leading companies, and any jointly developed solutions or new technologies are incorporated into the specifications. For example, the German catalyst maker Heraeus has engaged in joint development of catalysts, a key component in water splitting, with leading company Siemens Energy, which has initiatives underway for the mass production of electrolytic devices.

Latecomers can still disrupt newly emerging markets

The second approach is to partner with a startup and form an early initiative for next-generation technology. In newly emerging markets, novel technologies and methods sometimes create game-changers even when leading players are in place at the outset. What is important in this approach is not simply assessing what the next-generation technologies will be while diligently pursuing development within your own company but finding a startup with aptitude in those areas and bringing optimal technologies into your company. Seiya Kawai observes, “As can be seen in the example of EVs (electric vehicles), if we wait for the domestic market to mature, we will lag in the global marketplace and end up having to import cutting-edge technologies from overseas. The better approach is to step boldly into the new territory and start building business experience ahead of others.”

The third approach is to search for room for entry in the overall supply chain, ranging anywhere from the manufacture of hydrogen, to its transport, retention, and use. As an example, electrolytic device manufacturer Plug Power has executed an agreement to supply hydrogen energy to be used for shipping and operations with e-commerce leader Amazon, which hopes to achieve net-zero emissions by 2040. These endeavors have not been confined to device marketing, and they are venturing into operations, supply, and every other area. Since the circumstances around green hydrogen utilization differ from country to country, searching for new business while taking an expansive view of the supply chain will help facilitate the discovery of opportunities.

“What happened in the world in 2022 significantly increased the potential for hydrogen, and we absolutely must not miss out on this trend,” insist Hamano and his colleagues. “Our hope is that Japanese businesses will take our market forecasts and study results as an impetus for corporate strategy transformation and reinforcement, not just accept them as facts. Also, in addition to supporting corporations, we want to deepen the discussion with government leaders on the policy front, thereby revitalizing the debate on hydrogen utilization in Japan.”

Profile

-

Tomoki Hamano

-

Teruo MatsubaraPortraits of Teruo Matsubara

Business Co-Creating Consulting Department

-

Seiya Kawai

* Organization names and job titles may differ from the current version.