Takahide Kiuchi's View - Insight into World Economic Trends: Making Growing Inbound Demand the Engine for Japan’s Economic Revitalization

According to the Japan National Tourism Organization, the number of foreign tourists who visited Japan this March (number of international visitors) came out to 1,817,500 persons, which was 34.2% lower than in March 2019 (pre-COVID). This means that since quarantine policies were relaxed last October, tourist numbers have rapidly rebounded in just half a year up to around 66% of pre-pandemic figures. Another thing worth noting is that even though the number of visitors coming from China—which accounted for nearly 30% of all foreign tourists who came to Japan in 2019, the largest proportion by country—remains at low levels from the lingering effects of travel restrictions, the number of foreign visitors has nevertheless bounced back this much this quickly.

Foreign tourist numbers set to return to pre-COVID levels this summer

Restrictions on travel from China are already becoming increasingly relaxed. In April, Japan stopped requiring all entrants to the country coming from the Chinese mainland on direct flights to show proof of a negative COVID test taken within 72 hours of their departure. Then in May, it also eliminated the need for Chinese visitors to show proof of vaccination. The number of visitors from China is expected to rapidly increase going forward.

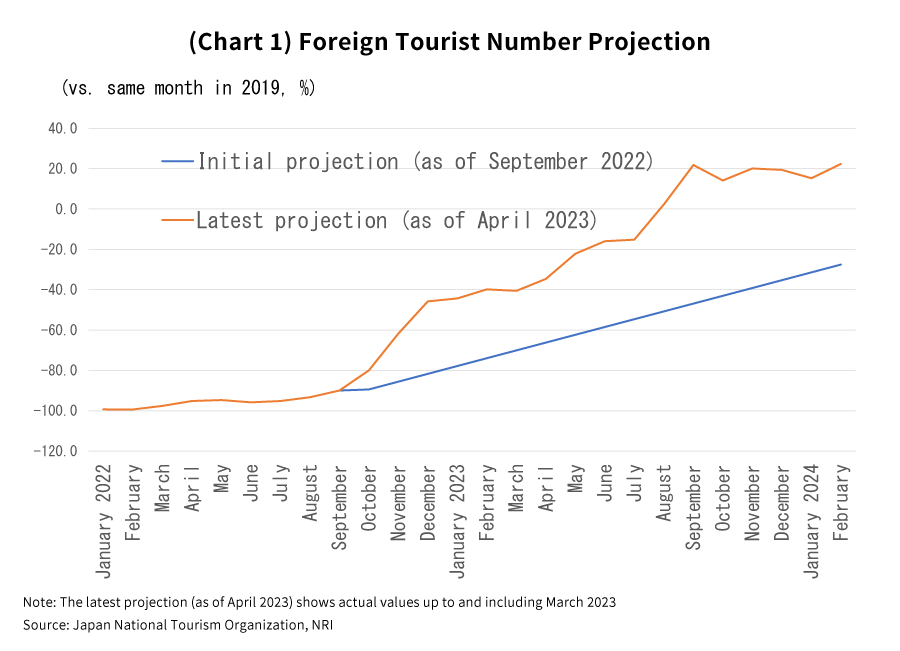

Last September before the quarantine policies were eased, I made an estimation of foreign tourist numbers, but at that time I calculated that those numbers would surpass their pre-COVID from the same month in 2019 in October 2024. In other words, I estimated that it would take about two years for those numbers to fully rebound. Now, having factored in the actual values up to and including this March as well as the effects of the eased entry restrictions on visitors from China, I’ve redone my estimate and found that the number of foreign tourists will surpass its pre-COVID level from the same month in 2019 in August 2023, significantly sooner than expected (Chart 1).

Moreover, inbound demand in 2023, as estimated on the basis of this predicted number of foreign tourists and per-person consumption by foreign tourists in the January to March 2023 period, worked out to 5,945.8 billion yen. This estimate would boost Japan’s 2023 GDP (nominal and real) by 1.07%. That should prove to be a great boon for the tourism and retail industries.

Government target for foreign tourist numbers to be achieved earlier than expected

The Japanese government reached a cabinet decision on March 31, 2023 in which it issued a “Fourth Basic Plan for the Promotion of Tourism”, with the aim of making Japan a tourism-oriented nation. In that plan, it set out to achieve the following foreign tourism goals by 2025: 1) to attract higher numbers of foreign travelers to Japan compared to pre-COVID 2019 levels; 2) to ensure that foreign visitors spend 200,000 yen each during their stay; and 3) to achieve 5 trillion yen in inbound demand. However, there is a strong chance that these targets can be reached sometime this year, without the need to wait for 2025.

According to the Consumption Trends of International Visitors to Japan Survey for the January-March quarter of 2023 that was published by the Japan Tourism Agency, the amount of money spent per person by foreign tourists while traveling in Japan came out to an average of 212,000 yen. The amount that foreigners spent per person pre-COVID back in 2019 was 159,000 yen. That means that the government’s 2025 stated target of having foreign visitors spend 200,000 yen each has likely already been achieved.

The prospect of traveling more cheaply in Japan because of the weak yen conceivably underlies this development. Not only that, it’s also possible that with the appeal of traveling in Japan on the rise, foreign visitors are becoming more inclined to spend more during their stay especially on lodging and accommodations—exhibiting a so-called “luxury mindset”. The additional “high added value” being sought by the Japanese government is being achieved faster than expected. Further, the goal of surpassing pre-COVID foreign traveler numbers from 2019 is expected to be achieved this August, as we have already seen. What’s more, with inbound demand in 2023 set to hit 5.9 trillion yen, it appears that the government’s target of 5 trillion yen will also be achieved by the end of the year.

Thus, it seems as though the targets set by the government for foreign tourism and inbound demand under the Basic Plan for the Promotion of Tourism will both be realized sometime this year earlier than expected.

Japan ranks 12th globally in terms of foreign visitor numbers

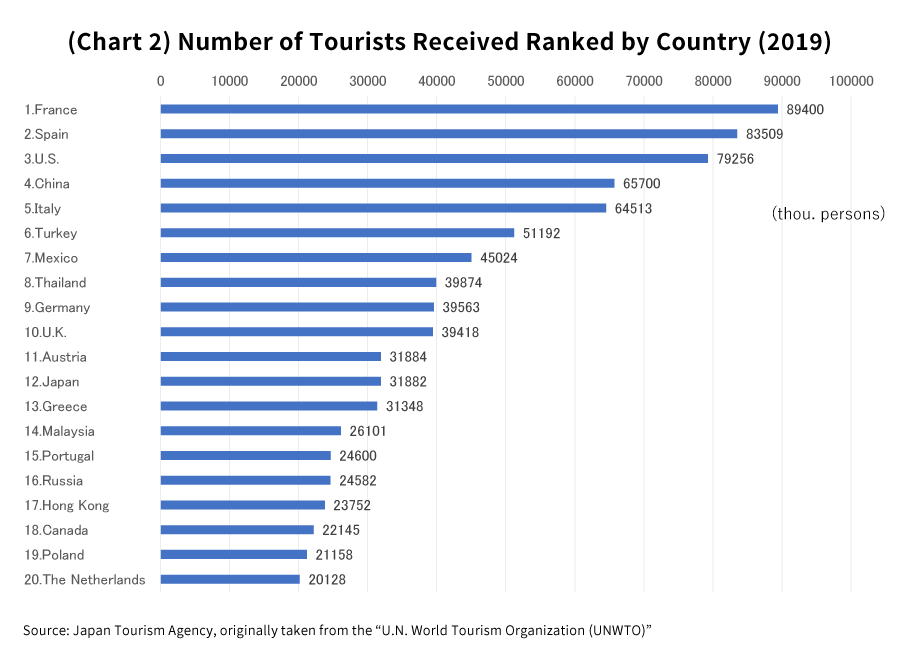

Japan had 3,188,200 foreign tourists visit back in 2019 pre-COVID. This is around one-third of the number of travelers who visited France (the top spot), and put Japan in 12th place globally (Chart 2). Looking at Asia, we see that Japan comes in third regionally behind China in fourth place and Thailand in eighth place. While Japan is third globally in terms of economic scale, it lags behind somewhat in 12th place when it comes to the number of foreign visitors, and at present it has yet to attain the status of a tourism-oriented nation.

That said, I believe Japan’s potential as a tourist destination is quite high. In the 2021 Travel & Tourism Development Index published in May 2022 by the World Economic Forum (WEF), also known as the Davos Conference, Japan claimed the top spot in a global ranking for the first time since the survey was first conducted in 2007. This index is also referred to as the “Tourism Attractiveness Ranking”.

More specifically, Japan received high marks for its convenient transportation infrastructure, its abundant natural, cultural, and other tourist attractions, its high level of public safety, and more, and thus it nabbed the number one spot in the rankings.

Foreign tourist numbers on par with France’s would boost GDP by 13.0 trillion yen; numbers on par with Thailand would raise GDP by 2.5 trillion yen

Now then, while this may be difficult to achieve in the near future, let’s imagine as a future goal some ten years hence a case in which the number of foreign tourists visiting Japan puts the country shoulder to shoulder with France for the top spot globally.

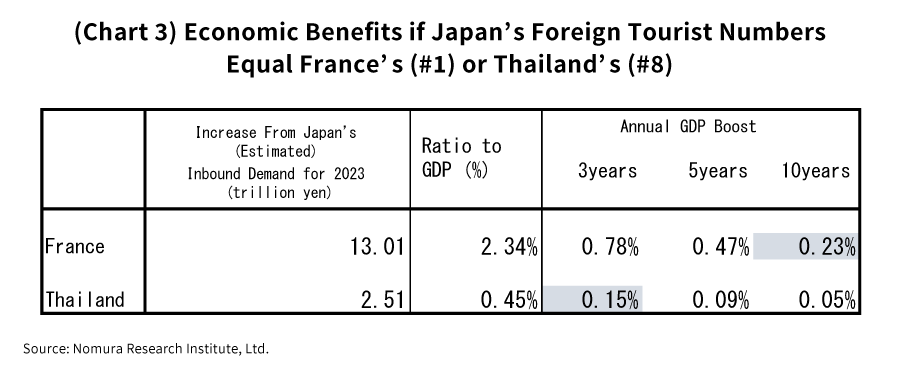

The increase in inbound demand in Japan in that scenario would work out to a total of 18.95 trillion yen. Given that inbound demand for 2023 is estimated to be 5.9 trillion yen, that would mean an increase of 13.01 trillion yen, equivalent to 2.34% of Japan’s GDP. Assuming that from 2024 onward, Japan’s foreign tourist numbers catch up to France’s over a period of 10 years, then the (nominal and real) GDP growth rate would receive an annual estimated boost of 0.23% (Chart 3).

On the other hand, catching up to France’s foreign tourist numbers would be no simple feat, and so let’s also consider a case where Japan catches up to Thailand, which is in second place in Asia right behind China. In that scenario, Japan’s inbound demand from 2024 onward would instead receive a boost of 2.51 trillion yen. If this were to be achieved in three years, then the annual GDP growth rate would receive a 0.15% boost. In both cases, the estimates show that Japan could be expected to see quite an economic stimulus effect.

Easing supply constraints an urgent problem

We can therefore see how the growth of inbound demand has significant potential to revitalize the long-slumping Japanese economy, and it should be regarded as one of the pillars of the country’s growth strategy.

However, even if Japan has major potential on the so-called demand side, in terms of a rise in the number of foreign tourists visiting from overseas, it’s possible that supply-side constraints in receiving those visitors will arise, thereby preventing inbound demand from eliciting the sort of substantial economic effects hoped for.

If the number of foreign tourist visitors grows at its current pace, then sooner or later the lack of adequate accommodations and other such problems will likely become severe. In addition, the domestic tourism industry as a whole might also face more troubling staffing shortages. Given these points, it behooves the industry, or alternatively the government, to quickly tackle the challenge of alleviating and eliminating these supply-side constraints. The three initiatives below are of particular importance in this regard.

The first of these is enhancing high-added value. If foreign tourists visiting Japan are induced to spend more per person, then even if supply-side constraints dull the pace at which these tourist numbers rise, the boost to Japan’s GDP can still be increased. That tendency is visibly apparent, as we have already seen. Business operators will be required to make proactive efforts to cement that trend, such as by providing foreign tourists with the kinds of services that appeal to them.

The second is to lead foreign tourists to stay in rural areas, which are considered to have much more lodging availability compared to large cities. While it has long been observed that the travel destinations of foreign tourists tend to be concentrated in Japan’s metropolitan areas, it’s important to introduce them to the tourist attractions found in rural spots, as well as to make tourism-related environmental improvements in these localities. Things like spreading information via SNS, making use of influencers, and enriching foreign language services would surely also be options.

If foreign tourists can be directed toward regional areas, this will also lead to the revitalization of Japan’s regional economies. And if, as a result, Japanese companies and individuals begin shifting from major cities to rural locales, making greater use of the relatively untapped infrastructure and human resources found there, then the Japanese economy as a whole would likely become more productive.

It's important to encourage greater tourism-related capital investment

It’s key to sustainably grow inbound demand by focusing both on “digging deep”, namely by creating higher added value for inbound demand, and on “geographical expansion” which entails inducing foreign tourists to visit the countryside. These two aspects are being emphasized by the government as well in its Fourth Basic Plan for the Promotion of Tourism.

The third initiative involves encouraging business operators to make more capital investments. More hotel construction would increase the country’s lodging capacity, and in turn would also enhance the potential of the Japanese economy. For that reason, it’s likely important to raise expectations among business operators that having more tourists visiting from abroad and increasing inbound demand will not only mean a temporary boom but will carry on into the future.

To achieve that, it will probably be necessary to attract a broad range of foreign tourists from various countries and regions. This is because letting foreign tourism be skewed to any specific country, as it was pre-COVID, creates the unavoidable risk that if relations between Japan and that other nation deteriorate, for example, overseas visitors and inbound demand could suddenly cool off. It’s necessary to diversify the risk, so to speak. To do that, it will likely also be essential for the national government, local authorities, and business operators to engage in widespread overseas promotion activities.

Given how the number of foreign tourists has been rising recently at an unexpected pace, we can foresee that the number of such visitors this summer will surpass pre-COVID 2019 levels. At that time, the supply constraint problem will probably become more severe. We can also imagine that with tourist areas getting crowded with foreign visitors, foreign guests making it hard for domestic travelers to reserve hotels and inns, and the like, there may be greater discontent among Japanese persons as well. This would amount to an “over-tourism” problem.

Before that happens, it’s important that we carefully pave the way to implementing a new post-COVID inbound strategy, as I’ve discussed, so that we can make growing inbound demand the engine for Japan’s economic revitalization.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.