Takahide Kiuchi's View - Insight into World Economic Trends :

The “Japanification” of the Chinese Economy and the “Chinafication” of the U.S. Economy

Even in the face of strong headwinds—historically high inflation in the wake of the COVID-19 pandemic and the war in Ukraine, the severe monetary tightening implemented by numerous countries—the global economy has escaped from its slowdown and continues to grow. The unexpected strength and steadiness of the U.S. economy would seem to be bolstering the global economy. Yet a downturn in the Chinese economy, which has avoided such high inflation and persisted with monetary easing, has recently come clearly into view.

China’s economy slips into “double deflation”

China’s real GDP for the quarter from April to June grew just 0.8% over the prior quarter, or slightly over 3% at an annualized rate, which means a considerable slowdown in growth. Achieving the government’s 2023 target growth rate of “around 5.0%” also is starting to seem out of reach. Among forecasting institutions, there’s been an increasing tendency to revise China’s economic growth rate outlook for 2023 downward to 5% or lower.

China’s growth rate last year fell below the government forecast of 3%, and there’s a chance that the figure could fall short of official forecasts for two years in a row, which would be an extraordinary occurrence. We’re even seeing projections that next year’s growth rate could also fall below 5%. In that case, for the first time since the days of Chairman Mao Zedong, China’s growth rate would fall short of 5% for three straight years.

According to the International Monetary Fund (IMF), every one percentage point decline in China’s growth rate would cause the global economic growth rate to slip by approximately 0.3%. Given that China’s share of global nominal GDP was 18.1% in 2022 (per the IMF), a simple calculation that takes only the direct effects into consideration would suggest that the global growth rate would be pushed down by around 0.18%. The fact that the IMF’s calculations show a far greater push-down effect suggests that China’s economic slowdown will have serious ripple effects on the economies of other countries through trade and so forth.

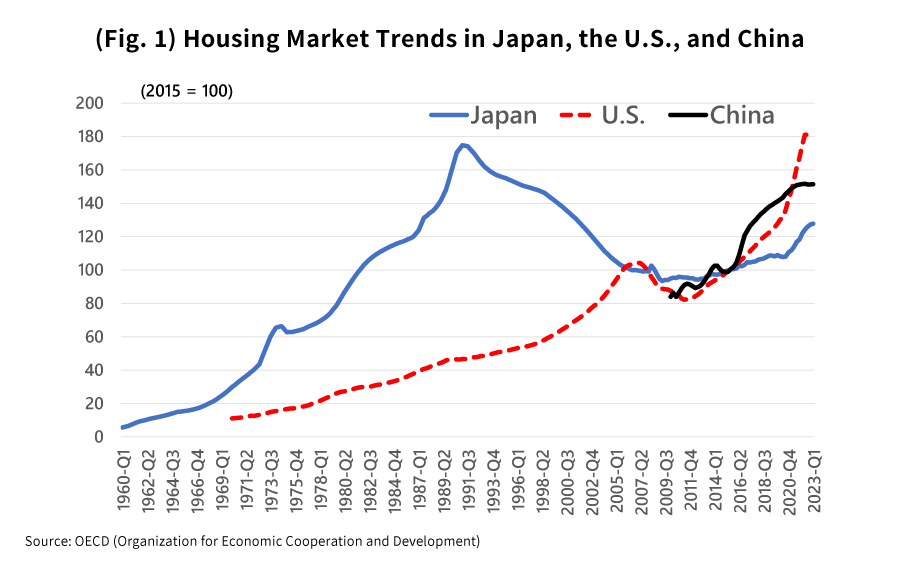

Amid these economic conditions, China’s consumer prices in July were 0.3% lower year-on-year, showing the first decline in two and a half years. Meanwhile, China’s housing prices, which had been rising at a faster pace since the mid-2010s, currently remain in a slump which began around 2020, when tighter real estate regulations were introduced (Fig. 1).

In 2021, problems surfaced for the major real estate developer Evergrande when it suffered a management crisis and defaulted on its debt, and the firm is still struggling with its ailing business operations and going through debt restructuring negotiations with its creditors. Recently, another major real estate developer called Country Garden has also posted large losses and is on the brink of default, and in this and other ways the crisis in China’s real estate sector has deepened once again.

These events indicate that the Chinese economy is beginning to show signs of “double deflation”, marked by falling prices on goods and services alongside a drop in real estate prices. Given these circumstances, there’s now an emerging view that much like what happened to Japan’s economy after the bursting of the bubble when similar characteristics were observed, China’s economy potentially could fall into a long-term slump.

Three commonalities between Japan’s economy around the bubble’s bursting and China’s economy today

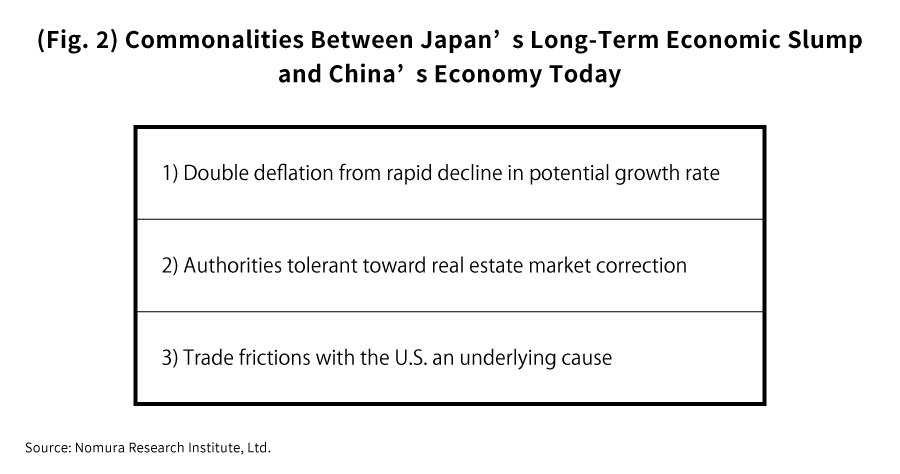

There are many apparent commonalities between Japan’s economy before and after the bursting of the bubble and China’s economy at present. Below are three such commonalities which I would like to observe (Fig. 2).

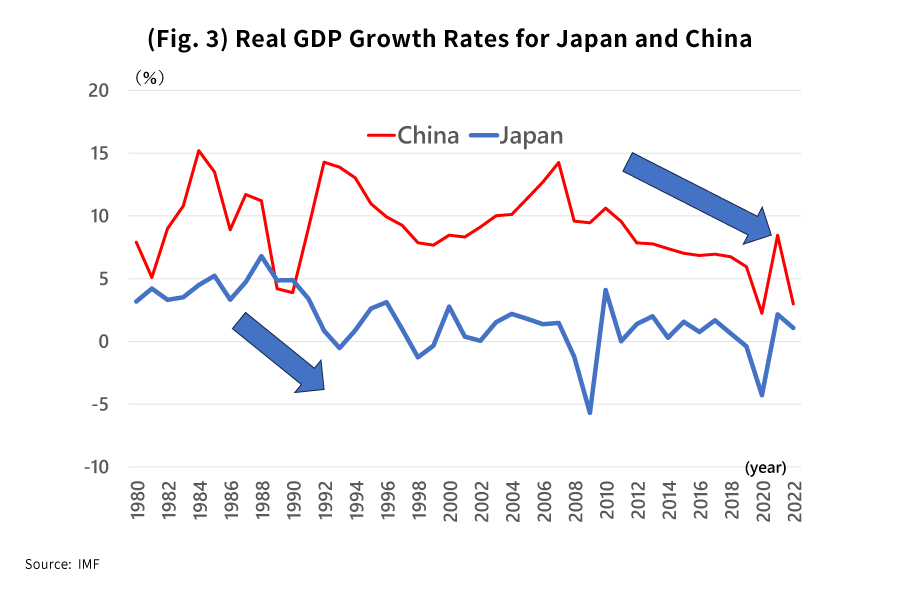

The first is that population changes and other factors have led the potential growth rate to fall significantly (Fig. 3). Japan’s population growth peaked in the mid-1970s at an annual rate of 1.4% and then followed a downward track, and since 2010 it has remained negative. China’s population likewise began contracting in 2022.

When a decline in the potential growth rate is still not fully appreciable to most people, a low interest rate environment leads to an excessive rise in asset prices followed by a significant drop, and this process can give rise to grave economic and financial problems.

Further, once the decline in the potential growth rate does become more perceptible, demand will be sharply curtailed, but the labor force and the facilities tasked with handling the supply won’t be able to scale back immediately, and thus the supply-demand balance will deteriorate and will exacerbate deflationary pressures.

Trade frictions with the U.S. also an underlying cause

The second is that the authorities are willing to tolerate, to some extent, a correction in the real estate market, regarding it as part of normalization. In Japan in the late 1980s, the authorities, which had blamed surges in housing prices for making home ownership a distant dream for ordinary citizens, initially welcomed the drop in real estate prices. The Ministry of Finance severely regulated any bank loans made to specific industries including real estate. These were what is called a “quantitative ceiling”. At the same time, the Bank of Japan went ahead with monetary tightening in a so-called effort to burst the bubble. The fact is that the authorities had failed to fully perceive the true danger of asset deflation. The decline in real estate prices would end up seriously shaking Japan’s banking system.

Similarly, the Chinese government, seeing how excessive development by real estate businesses that have reaped massive profits invited a surge in housing prices and made it difficult for individuals to buy homes, regards this as a problem in light of its “common prosperity” philosophy, which is designed to reduce disparities. For that reason, it would seem to still be cautious about giving full-scale assistance to the real estate industry.

The third is the trade frictions with the U.S. In Japan, these frictions with the U.S. were conceivably the underlying cause behind the drop in the country’s industrial competitiveness and the decline in its potential growth rate.

Furthermore, in the 1980s there was strong U.S. pressure to increase imports through domestic stimulus measures, and the excessive monetary easing introduced in response to this led to the formation of the bubble.

In China, the fierce trade conflicts with the U.S. seen in recent years have dealt a blow to the economy, particularly to cutting-edge fields. In addition, the stepped-up controls on private businesses in the context of this competition with the U.S. have in some sense probably discouraged economic activity.

Not the recurrence of the “Lehman Shock,” but rather Japanification

In China, the effects of a protracted real estate slump have led to a rise in the number of defaults for trust products and financial products (which are investment products), and the problem of “shadow banking” involving non-bank financial intermediaries is gaining attention. Concerns are also rising that the financial troubles in China could spread to the rest of the world, producing a Chinese version of the “Lehman Shock”, or the financial crisis triggered by the collapse of the investment bank.

Yet in fact, it is unlikely that China’s financial woes centered on shadow banking would spread significantly around the world, as was the case with Japan’s banking crisis during the 90s. From this perspective as well, I think that what will happen in China going forward will be something closer to “Japanification”, rather than the recurrence of the Lehman shock.

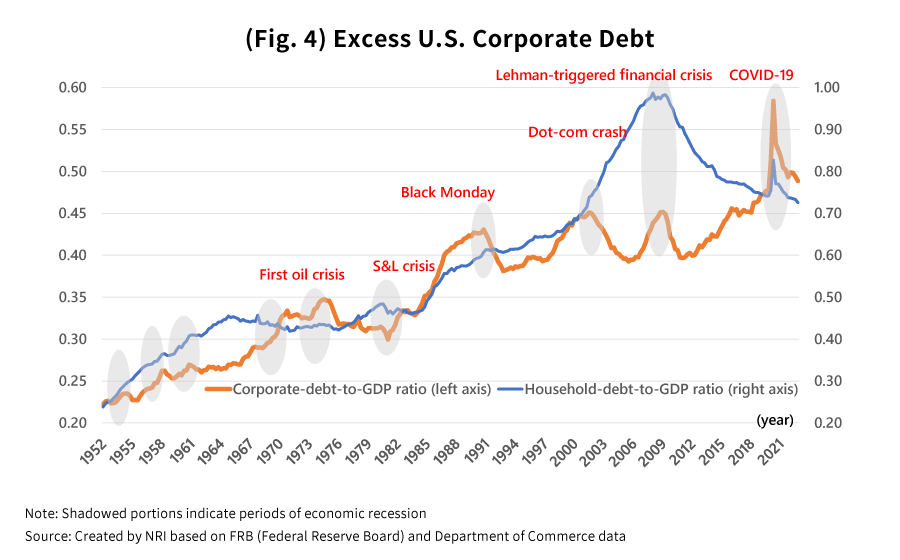

Incidentally, I believe it’s worth considering that the U.S. economy, which has remained unexpectedly robust, likely will show a marked tendency toward slowing down next year. The reason why aggressive monetary tightening has not yet dealt as much of a blow as expected to the economy might be because in the wake of the Lehman shock, households have made efforts to curb their debt, making household spending to become more resilient to interest rate hikes, especially in the areas of housing, automobiles, and other sectors that are sensitive to interest rate increases.

However, corporate debt by contrast has piled up significantly, and it would appear that corporate economic activity has grown more vulnerable to interest rate increases (Fig. 4). An upturn in interest rates could eventually deal a serious blow to corporate capital investments etc.

Furthermore, interest rate hikes could even bring about major corrections to the commercial real estate market as well. In that case, an increase in bad debt would lead to serious management concerns for SMEs and midsize banks, as well as a drop in the prices of real estate-related financial products. Any funds or other shadow banking (non-bank) institutions that hold a large number of such financial products might fail (

NRI Journal, “Excessive Corporate Debt as the Achilles’ Heel of the US Economic and Financial System”, Jun. 9, 2023

)。

Thus, it may be foreseen that an economic downturn, real estate market corrections, a deepening of financial problems, and other circumstances resembling those in China will also happen next year in the U.S., in somewhat delayed fashion. This could possibly even be regarded as the “Chinafication” of the U.S. economy.

If the U.S. and China—the world’s two largest economies—were to face severe economic and financial difficulties in succession, then it would mean that strong headwinds are unavoidable for the global economy.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.