Takahide Kiuchi's View - Insight into World Economic Trends:

Stock Prices Continue to Rise Amid Economic Slump

The Nikkei Stock Average Index reached a new all-time high on February 22, 2024, surpassing the previous high set over 34 years prior on December 29, 1989. Then on March 4, the closing price hit the 40,000-yen mark, and since then it has successively surpassed new milestones in a short period of time. Yet while it may have exceeded the stock price levels seen in the Bubble era, there are likely many who feel this is out of step with their everyday lives. In fact, recent economic conditions have remained in a slump, especially private consumption.

Stock prices continue to climb as economic activity stalls

Real GDP in the October to December 2023 quarter (first preliminary figure) showed a contraction of 0.4% on an annualized quarter-on-quarter basis, making for a second consecutive quarter of negative growth. Real private consumption was down 0.9% on an annualized quarter-on-quarter basis, while real capital investment was similarly down 0.3%, with both figures having fallen for a third straight quarter. It’s also conceivable that even since the start of 2024, the slump in private consumption stemming from high commodity prices has led this negative growth to continue. Furthermore, Japan’s nominal GDP in 2023 was overtaken by Germany’s in dollar terms, slipping to fourth place in global rankings. The International Monetary Fund (IMF) has predicted that India’s nominal GDP will surpass Japan’s in 2026, and there’s a growing possibility that in the near future, Japan’s nominal GDP will fall further in the global rankings to fifth place.

There’s a significant, tangible gap between the economic circumstances in which Japan now finds itself, and the stock market trends in which share prices are hitting new highs beyond the heights reached during the bubble years. These high stock prices truly seem unreal.

What’s more, the rising stock prices we’re seeing lately don’t really seem to be grounded in any clear improvement in so-called “real value”, i.e., improvements in Japanese economic or corporate growth potential, stronger international competitiveness, or higher standards of living resulting from higher labor productivity. What’s bolstering these high stock prices is attributable to “nominal value” in the form of high commodity prices, and from that perspective, one might even describe such high stock prices as bloated.

Additionally, the unprecedented monetary easing policies still in place amid these rising commodity prices are in some sense strongly driving stock prices higher, through both the decline in real interest rates (nominal interest rates – expected inflation rates) and the resulting ongoing depreciation of the yen. Thus, it’s likely that the high stock price phenomenon we’re seeing now is largely attributable to the bloating of nominal value and to stronger monetary easing.

Falling real wages and growing corporate earnings

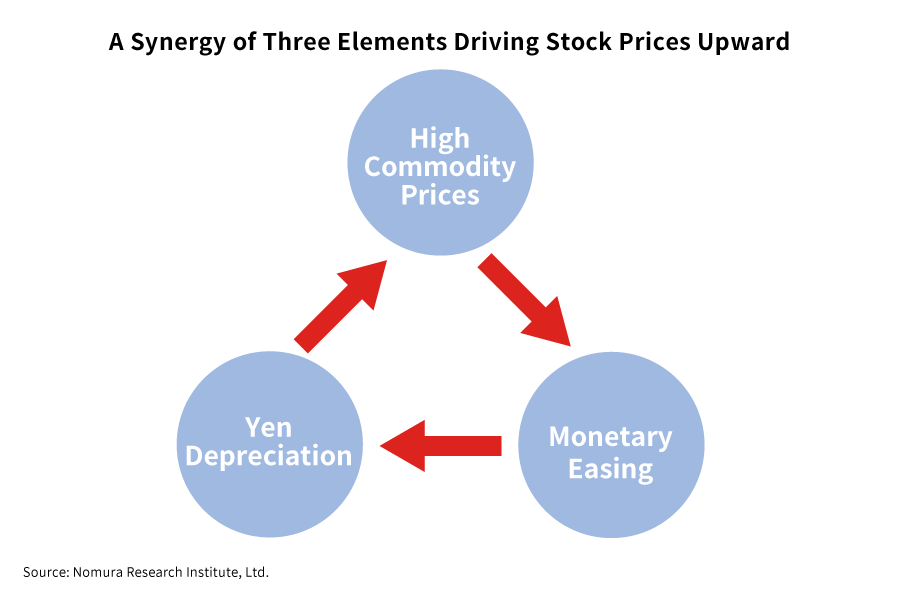

Given the points above, perhaps we can consider these recent dramatic stock price increases in some sense to be the product of a cycle of three elements, namely high commodity prices, monetary easing, and the yen’s depreciation, and even see a synergy among them (diagram).

Beginning in 2022, the year-on-year rate of increase in the Core CPI (consumer price index excluding fresh food) has stayed at around a 40-year high for the first time since the early 1980s immediately after the second oil crisis. That was very much driven by a rise in food and energy prices and by import inflation caused by a weak yen, but as companies passed on those higher imported material prices to their own product prices, the CPI inflation rate went up.

Prices are continuing to soar right now, yet on the other hand, wage growth rates are unable to keep pace with the price inflation rate. Real wages (preliminary report) in January 2024 as released by the Ministry of Health, Labour and Welfare were down 0.6% year-on-year, showing a continued decline, and even if the wage growth rate were to go up beyond expectations at this year’s spring labor-management wage negotiations, there is little chance that the real wage growth rate will turn positive before the end of the year.

A drop in real wages means that individuals’ living standards are deteriorating. However, this decline in real wages leads the distribution of income to favor the corporate side of things, with corporate earnings thereby growing instead. The result is that stock prices go up, which widens the gap with people’s everyday life experiences. This is the first component making up the high stock prices we’re seeing now.

On the other hand, even amid price surges, the Bank of Japan has maintained its extraordinary monetary easing policy stance. The Bank of Japan has not shown a strong determination to achieve price stability in the medium-to-long term, and this has led to rising medium-to-long-term inflation expectations among corporations, households, and the financial market. Consequently, real interest rates (nominal interest rates – inflation expectations) have fallen conspicuously, making the impact of monetary easing effectively even more pronounced.

Although it’s thought that a drop in real interest rates would normally provide economic stimulus, that effect hasn’t been clearly confirmed. Meanwhile, the real interest rate decline seems to be eliciting a major effect in boosting asset prices. This is the second component making up high stock prices.

Furthermore, the drop in real interest rates is strongly propelling the weak yen trend. The yen’s depreciation is driving up stock prices in an overall sense by increasing the revenues of export companies. In addition, a weaker yen makes Japanese stocks comparatively cheap for foreign investors, which spurs investment in Japanese stocks and leads stock prices to rise. This constitutes the third component making up high stock prices.

Soaring commodity prices augment the effects of monetary easing, and that furthers the yen’s depreciation. And the weak yen also leads to higher commodity prices. The three elements of high commodity prices, monetary easing, and the yen’s depreciation are thus proceeding in synergistic fashion, with each one now driving up stock prices considerably.

The elimination of the Bank of Japan’s negative interest rate policy would mean a stronger yen

Nevertheless, these three factors supporting high stock prices aren’t necessarily what one would call sustainable. The core CPI (consumer price index excluding fresh food) growth rate has followed a clear downward trend over the past year, and it’s predicted to land in the range of plus 1% year-on-year sometime in the latter half of this year. That will weaken expectations for corporate revenue growth, while also causing real interest rates to rise and softening the effects of monetary easing. Those developments will likely serve as a headwind for the stock market by correcting the yen’s depreciation.

Moreover, the Bank of Japan could conceivably move to eliminate its negative interest rate policy as soon as March. That potentially could lead real interest rates to rise, dampening the weak yen/high stock price trend.

The Bank of Japan has issued a forecast that even after it ends its negative interest rate policy, policy interest rates could remain at their current near-zero level for a time. However, if the Bank were to declare its 2% price stability target achieved and move to rescind that negative interest rate policy, then keeping policy interest rates at their current near-zero level would likely appear odd. That’s because the Bank would be maintaining its “ultra-easy” policy at the extremely low real interest rate (nominal interest rates – inflation expectations) level of around -2% even after the achievement of its target.

With this seeming contradiction in the Bank of Japan’s statements, speculations might emerge in some corners of the financial market that after eliminating its negative interest rate policy, the Bank of Japan will actually move relatively quickly to raise policy interest rates. That would likely give rise to a rapid reversal of the yen’s value, creating adverse conditions for the stock market.

Expectations for a soft landing by the U.S. economy potentially to be revised

The factors that have supported the yen’s depreciation and high stock prices thus far are also present in the U.S. With the U.S. inflation rate on a downward trend, there is strong speculation in the financial market that the Federal Reserve Board (FRB) will move to lower interest rates slightly sometime this year. That said, this would be a precautionary measure, and the prevailing view is that the U.S. economy will remain robust.

A situation in which policy interest rates fall as the economy continues to perform well would surely be the best-case scenario for U.S. stocks, and in some sense that is bolstering optimism in the global economy and the financial markets, strongly urging on the gamble of the depreciating yen and the high prices of Japanese stocks even further.

However, for the U.S. economy to remain stable going forward in the midst of historic price surges and the ensuing large interest rate hikes is also unlikely, given past experience. In the adjustments occurring in the commercial real estate market, we’ve already seen the impact of these major rate hikes, and that could upset the stability of the banking system and that of the economy.

Any growing signs of economic slowdown would lead to an adjustment for U.S. stocks, the effects of which would likely also spread to Japanese stocks. In addition, given speculations that the FRB will enact more substantial rate cuts, we may even see a strong yen/weak dollar scenario happen.

Efforts to bridge the gap between stock prices and the real economy

The cycle of high commodity prices, monetary easing, and the yen’s depreciation has powerfully propelled stock prices up to now, but once that trend begins to reverse, it would be exposed to strong headwinds from those stock prices.

There exists a gap between these recent high stock prices and the real economy. That being the case, the government likely ought to make efforts to bridge the gap between the two by improving the real economy. While companies of course have to continue striving to improve their capital efficiency and profitability, it’s also important for workers to refine their abilities through reskilling and so forth, in an effort to improve labor productivity.

Furthermore, the government needs to promote various growth strategies including labor market reforms, measures to fix the declining birth rate, the use of foreign labor, growing inbound tourism demand, and correcting the overconcentration of urban areas, so as to enhance the labor productivity growth rate and the potential growth rate.

Rather than getting carried away by this recent rise in stock prices, now is the time for companies, individuals, and the government to move in lockstep and make steady efforts toward this aim.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.