Takahide Kiuchi's View - Insight into World Economic Trends :

The Economic Power Balance Between the US and China is Changing

The slowing down of China’s economy has become particularly notable. China’s real GDP growth rate in 2023 was +5.2% (in reaction to a major slump the year before from the effects of its zero-Covid policy), thus achieving the government’s target of around 5% growth. However, in 2024, that rate could once again dip below +5%. Among the factors driving down China’s growth rate of late, besides the impact of its zero-Covid policy, is the blow from the ongoing real estate slump which began to get serious around 2022. In addition, things like the depletion of surplus labor in rural areas that began over a decade ago, and the accompanying rise in wages, constitute structural factors behind this recent drop in the country’s growth rate.

The “miraculously high growth” of China’s economy now a thing of the past

The stumbling of the Chinese economy isn’t just a result of the recent zero-Covid policy or the real estate downturn. China continued to enjoy a high average real GDP growth rate of around 10% for 30 years starting in the late 1970’s. This was their so-called “miraculously high growth”. Yet since around 2010, their growth rate trend flipped and started taking a downward track. This current downtick in the growth rate had already begun over 10 years ago.

One of the major factors behind this drop in the growth rate is the dearth of surplus labor in rural areas and the associated rise in wages. This development gradually made untenable China’s business model as the “world’s factory”, wherein high growth led by exports was achieved through foreign enterprises investing heavily in the coastal regions and expanding production using cheap labor.

Furthermore, since 2018 China’s trade conflict with the US has grown fiercer, with Chinese products gradually being locked out from the US and other advanced nations’ markets, and with the Chinese government consequently prioritizing security policies to counter the US over domestic economic policies; in a sense these kinds of changes likely have contributed to China’s economic stagnation.

According to the IMF’s (International Monetary Fund) latest forecast (April 2024), China’s real GDP growth rate in 2029 is projected to be +3.3%, dropping down to the growth rate of a mature economy rather than that of an emerging economy.

A change in the economic balance between the US and China

This slowdown in the Chinese economy is forcing a major correction to the forecasted balance between the US and China in a global economic context. In contrast to the increasingly pessimistic outlook for China’s economic prospects, the strength of the US economy now stands out more on the global stage.

The outlook that China’s nominal GDP (USD) would overtake that of the US by the end of the 2020s to become number one in the world was widely shared until relatively recently. However, given the Chinese economy’s downturn since last year, the prospect of China overtaking the US in terms of economic scale has receded substantially of late.

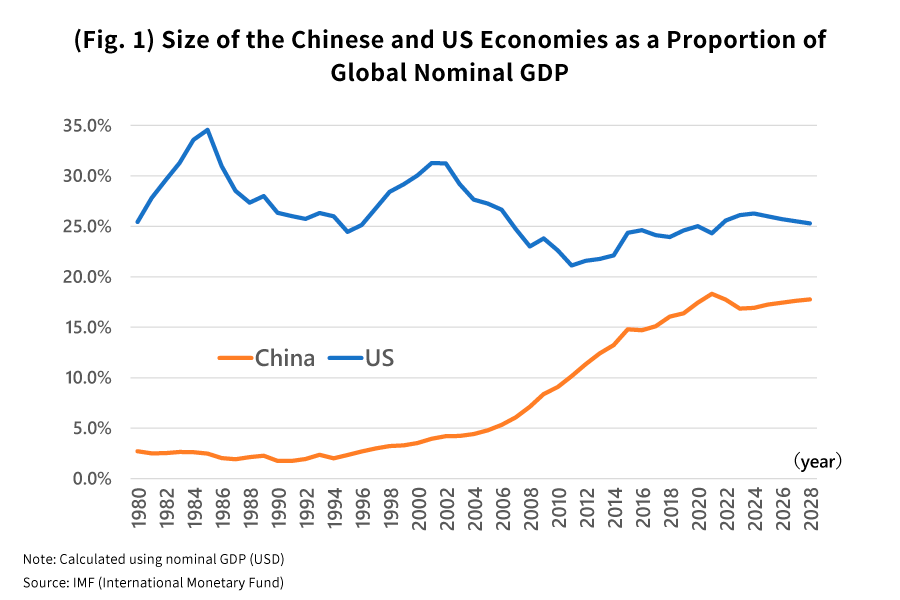

The proportion of global nominal GDP (USD) accounted for by China was 18.3% in 2021, having gotten to within six percentage points of the US (24.3%) (Fig. 1).

Yet subsequently the gap between the US and China has grown again, and based on the IMF’s latest forecast, the proportional difference between how much of global nominal GDP the US and China will respectively make up in 2029 comes out to 7.3%. Further, the US economy is projected to still account for one-quarter of the world’s economy at that time.

China’s shrinking population a headwind for growth

What’s darkening China’s medium-to-long-term growth outlook is the decline in its labor supply. Although China did away with its one child policy back in 2016, its birthrate has continued to fall even more quickly than expected in the years since then, and its population finally even started to shrink in 2022.

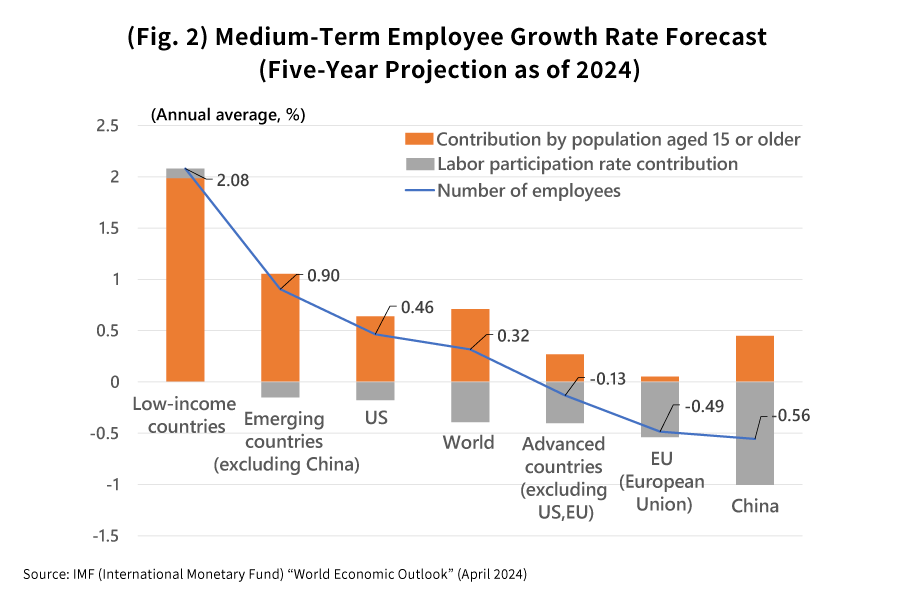

If we look at the IMF’s five-year-ahead employee growth forecast by country and region, we see that China comes in at an annual average of -0.56%, which is rather low compared to other countries and regions (Fig. 2). This reflects the impact not only of the decline in its population growth, but also a forecasted decline in the female labor participation rate (the ratio of the labor force population to the working-age population aged 15-64 years (workers + unemployed persons)).

According to the World Bank, the labor participation rate of women in China was 60.6% back in 2019, which was quite high compared to the global average of the higher 40% range. This is likely due in part to the fact that it’s a socialist country. The government has emphasized gender equity as ideologically important and has promoted equal employment opportunity and other related policies.

Yet the labor participation rate of women in China has fallen by around 10 percentage points in these last 20 years. This would seem to be the effect of developments like changes in employment patterns due to reforms enacted by state-owned enterprises, and the fact that the government abolished its system for determining where new university graduates got hired. With Chinese society becoming more like that of an advanced country, the female labor participation rate has also fallen to match that of other advanced countries.

In China, where there are restrictions on immigration and bringing in foreign workers, this kind of drop in the labor participation rate of women readily leads to a decline in the country’s potential growth rate.

Increased immigration bolsters US growth

As opposed to what we see with China, the US is forecasted to maintain a potential growth rate of over +2% going forward. Furthermore, since 2022, even though the FRB (US Federal Reserve Board) has gone forward with substantial hikes to the federal funds rate, the US economy has avoided stagnating, and has continued to be the dominant player in the global economy.

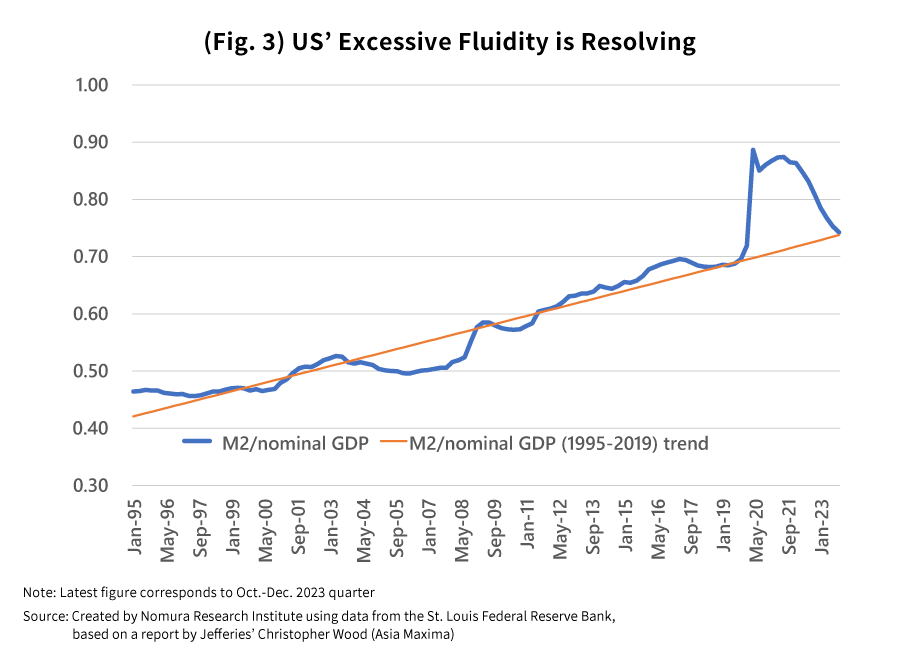

The fact that these rate hikes haven’t had as much of a restraining effect on economic activity as expected is an oddity, but one conceivable reason for this is that aggressive fiscal policies and monetary policies were implemented in response to the Covid-19 pandemic. Amid massive subsidies and a zero-interest rate environment, the money supply has ballooned relative to the country’s economic scale and has thus continued to provide an economic stimulus (Fig. 3).

With significant rate hikes being made after Covid measures ran their course, it’s conceivable that such so-called excessive fluidity was largely resolved around the end of last year.

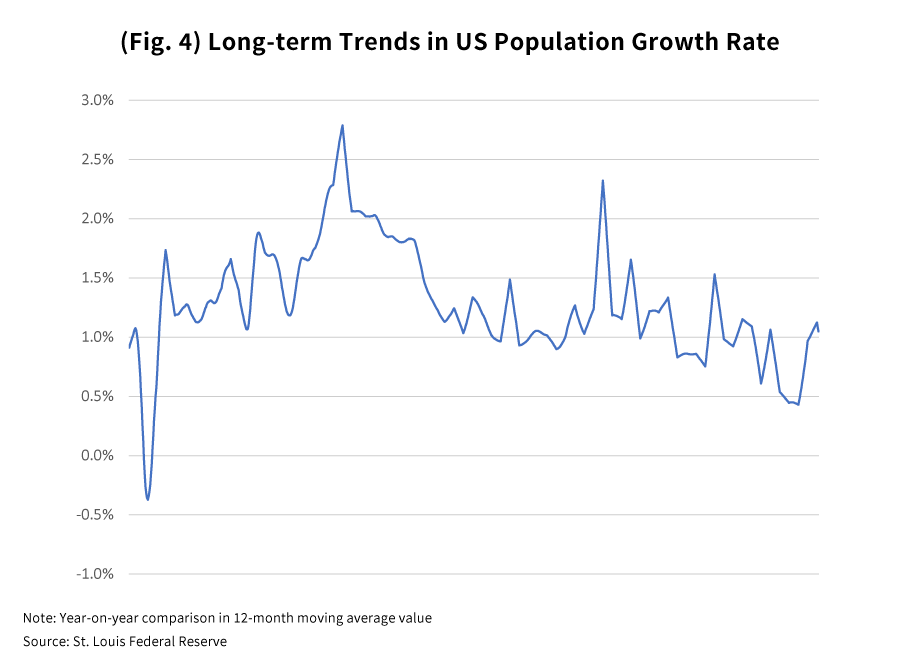

Even still, the US economy is holding strong. It’s a hotly debated topic right now that this can be attributed in part to the dramatic spike in immigration (Fig. 4). The Covid-19 pandemic temporarily caused a significant drop in the flow of immigration, but the drop in infection risk and the inauguration of the Biden Administration with its immigration-friendly policies led immigration rates once again to rise, and there’s a strong chance that this is supporting the current bout of economic growth in the US.

While the number of persons born in the US has fallen, immigrants have continued to enter the country, and this has led the overall population to continue climbing. The growth rate of the foreign population in 2023 reached +3.3% over the previous year, and calculations show this gave the real GDP growth rate in 2023 a direct boost of +0.33%.

The FRB also believes that this increase in immigration is serving to ease the pressure on the labor market, and that it’s making it possible both to achieve strong economic growth and lower the inflation rate.

Thus, when we look at the reality of what’s happening in the US, we can see that encouraging immigration and more actively accepting human resources from overseas is one means for a country to maintain strong economic growth amid a declining birthrate, an aging society, and population decline. I think perhaps Japan would also do well to take note of this point.

One of the factors that has been significantly reshaping the prospects for the US and China’s economic power balance lately is surely the disparity between the two countries’ labor supply outlooks—including when it comes to immigration.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.