How Do Consumers View FinTech-Related Services?

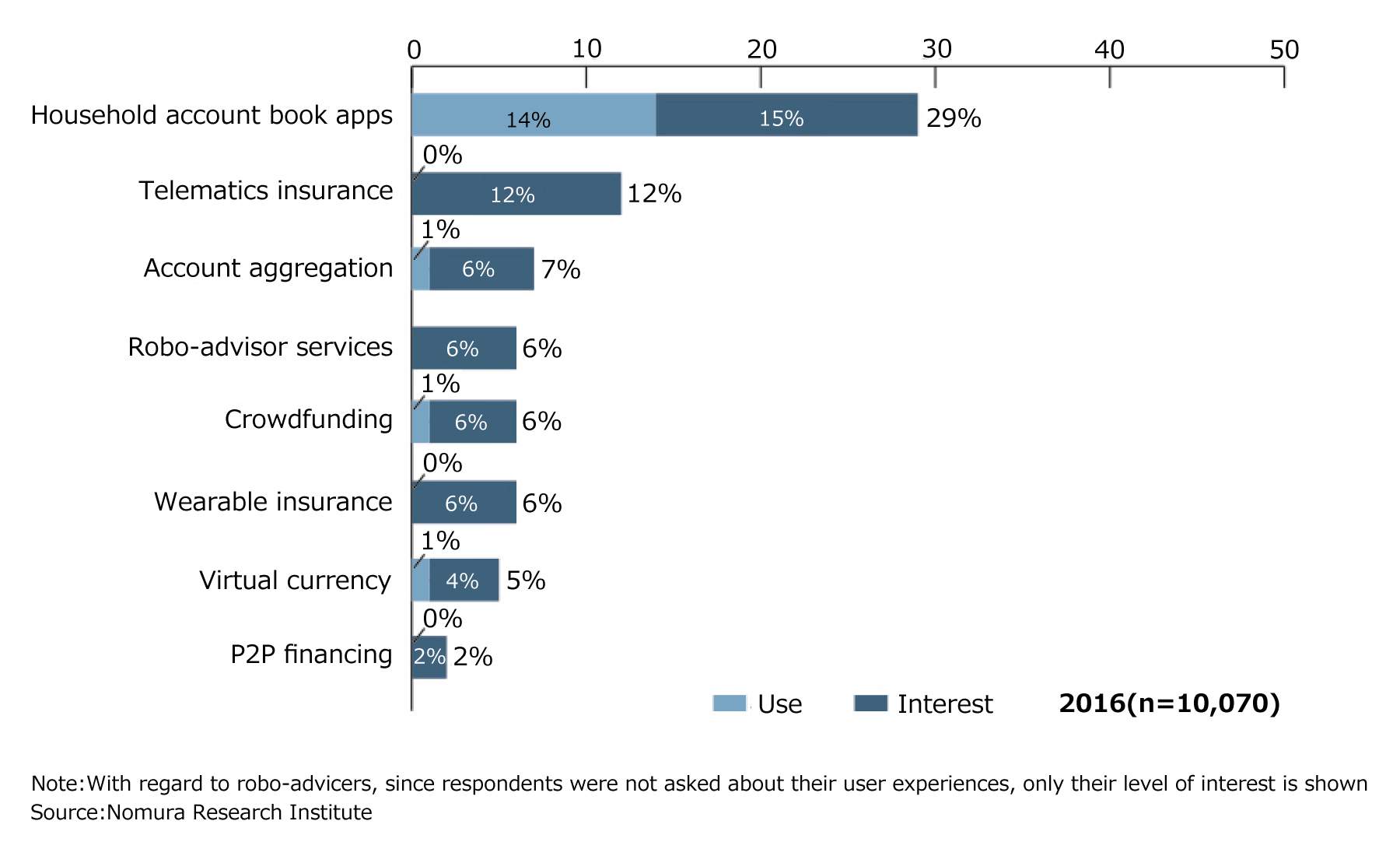

In 2016, NRI conducted a “Questionnaire Survey of 10,000 Consumers (Financial Edition)”. While Fintech has become a global topic of conversation, the survey results suggest that consumers haven’t quite managed to use FinTech-related services.

Consumers Still Not Familiar with Some FinTech-Related Services

NRI has conducted the “Questionnaire Survey of 10,000 Consumers (Financial Edition)” once every three years since 2010, to find out how Japanese people’s financial knowledge and behavior have changed over time. The 2016 survey focused on the progress of digitalization and trends in online services, while adding sections explaining how these kinds of services are being used. In this regard, what’s interesting is how people are using FinTech-related services, which have received plenty of buzz in the past year or two. Are consumers using FinTech more now? The survey dealt with the eight related services shown below, asking respondents about their user experiences and personal levels of interest.

Use of and Interest in FinTech-Related Services

8 FinTech-Related Services

| Household account book apps | Household account book apps or household budget management software for use with smartphones |

| Telematics insurance | Automobile insurance where premiums are set according to driving information obtained from on-board equipment |

| Account aggregation | A service that displays the balances in accounts with multiple financial institutions etc. |

| Robo-advisor services | A service which provides automated investment diagnoses and investment options by answering clients’ questions online, as opposed to asset management advice from a financial representative or consultant |

| Crowdfunding | The financing of persons or organizations by a large number of contributors via the internet etc. |

| Wearable insurance | Life insurance where the premiums are set based on the user’s health information collected from wearable terminals |

| Virtual currency | Payment methods such as BitCoin which do not require the intervention of a central bank and are not backed by tangible assets |

| P2P financing | An interpersonal loan intermediary service conducted through the internet etc |

“Most of the services still aren’t being used at this point,” says NRI’s Natsuki Abe, who was in charge of conducting the survey. “Even with household account book apps, which are seeing the most use, it looks like users are mostly just installing cashbook apps on their smartphones. Their level of interest in FinTech is low, and despite the fact that people around the world are talking about it, our sense is that consumer familiarity with the service isn’t really growing.”

Natsuki Abe, Financial Business Consulting Department

Meanwhile, companies in the financial world are looking to provide a broader range of FinTech-related services, and for that reason are exploring the possibilities of various kinds of services. It’s thought that in the future, FinTech will likely bring about major changes to financial services. Although little was being said about FinTech as recently as three years ago, nowadays we’re liable to hear about it just about anywhere. How this trend spreads among consumers going forward will be a focus of attention.

The key to popularize FinTech services is overcoming consumers’ anxieties and eliminating complicated operations

Some factors behind why the use of FinTech-related services by consumers hasn’t grown much are concerns about security and the inconvenience of having to type in passwords, says Abe. Still, there’s a conflict between making enhancements to security and getting rid of troublesome operations, and finding a simple solution to overcome this problem isn’t so easy.

There’s one other thing that could conceivably help in spreading FinTech-related services: improving consumers’ financial literacy.

“A trend we’re seeing is that the higher a person’s financial literacy is, the greater their levels of interest in and use of FinTech-related services will be. Raising people’s financial literacy helps them to better understand the actual services, and I think that’s because it also makes it easier for people to adopt not only FinTech but other new financial services, too.”

E-money services—which we’re all now intimately familiar with—also got their start in the early 2000s. Yet it seems that the more widespread, everyday use of FinTech-related services will take a little more time to become a reality.

Abe believes that for FinTech-related services to become more familiar and user-friendly for the public, it’s not enough merely for consumers’ financial literacy to increase, and financial institutions also need to do more than simply roll out more and more services—they must also find creative ways to explain these services to consumers and promote their understanding, and take steps to raise consumers’ financial literacy in the medium- and long-term.

Profile

-

Natsuki Abe

* Organization names and job titles may differ from the current version.