A Look at NRI’s CX Index and CX Management Methodology for Helping Japan’s Financial Institutions Promote and Establish “Customer-Centric” Business Operations

Nomura Research Institute (NRI), together with Professor Kazuo Ichijo of Hitotsubashi University, has developed and begun providing a CX (Customer Experience) index and CX management methodology (NRI CXMM: NRI CX Management Methodology) to Japanese financial institutions looking to engage in customer-centric business operations. To learn more about how these were developed and the advantages they can bring to financial institutions, we spoke with NRI’s Tatsuo Tanaka, who has surveyed the CX strategies of numerous enterprises.

CX Strategies That Prioritize How to Enhance Emotional Value for Customers

Prior to the development of the CX management methodology, the Financial Services Agency published new principles for conducting customer-oriented business operations in March 2017. Consequently, NRI gave a presentation on how the companies in the West that have had the greatest success are those that have been actively engaged in CX strategies, and how by incorporating the knowhow cultivated along the way into their business operations, these companies automatically become more customer-focused in running their businesses. NRI’s CX management methodology itself is rooted in this approach.

CX is meant to indicate “customer experience value”, and is a concept by which one pursues not only a product or service’s “rational value” in terms of its functionality or price, but also the “emotional value” experienced by the customer in the course of purchasing, using, and giving feedback for that product or service. Figuring out how to enhance this value is extremely important for CX strategies.

Financial Institutions Unable to Distinguish Themselves in Terms of Rational Value Metrics Such as Functionality, Performance, or Price

In recent years, it has grown more difficult for companies to significantly differentiate themselves from their rivals in terms of the rational value of their products or services—that is, in terms of functionality, performance, or price. In particular, financial institutions are unable to stand out from their competitors with just their product lineup (e.g. stocks, investment trusts), interest rates, or commissions. For this very reason, it is vital to find ways of adding a certain emotional value and thereby raise the overall value delivered to one’s customers.

According to leading U.S. marketing expert Philip Kotler, customer delivered value is defined as the total value for the customer minus the total cost for the customer. The total value for the customer includes the product value (e.g. functionality, design), service value (e.g. maintenance), personnel value (e.g. customer service), and image value (e.g. brand image). Meanwhile, the total cost for the customer includes more than simply monetary costs, encompassing labor costs and psychological costs as well.

From this standpoint, a CX strategy could be regarded as a philosophy focused on enhancing emotional value and discovering how to use that emotional value to reduce these cost elements.

One example of how to enhance the total value for the customer is a buffet experience at the Ambassador Hotel at Disney World Resort, called “Chef Mickey’s”. More than simply offering dining, it also provides experience-based value by letting customers interact and communicate with Disney characters, and for visiting families, parents can experience the joy of seeing the smiles on their children’s faces.

Japanese Financial Institutions Unable to Measure Customer Loyalty Index by NPS Alone

Companies leading the way in CX emphasize not only customer satisfaction but also their “customer loyalty index”. Customer loyalty means the emotional satisfaction or attachment that customers have towards a company. Companies that have the most advanced CX use a customer loyalty index, which is highly correlated with earnings, as a management index and as a way to evaluate executive/member performance. The purpose of this is to prevent personnel from only pursuing activities which raise immediate or near-term earnings, such as number of contracts signed or commission-based income, and to encourage workers to act in ways that enhance the customer loyalty index.

NPS

1

is a well-known example of an index for measuring customer loyalty, and has become the global de-facto standard, but for Japanese financial institutions its use tends to include a great deal of “noise”, as NRI’s survey revealed. Noise refers to people’s thought processes as a factor that impairs the measurement of customer loyalty, for reasons not directly related to customer loyalty. NPS attempts to measure customer loyalty by asking how likely a customer is to recommend a used service to others, but a respondent might think that financial institutions are not something that one would recommend to others—and this thought process is what is meant by noise.

In NRI’s survey, those who felt that “financial institutions aren’t something you recommend to others” accounted for nearly 80% of all respondents, revealing a large gap in NPS values between “all respondents” and “respondents except those whose thought processes create noise”.

Developing a CX Index and CX Management Methodology Suited to Japanese Financial Institutions Committed to CX Strategies

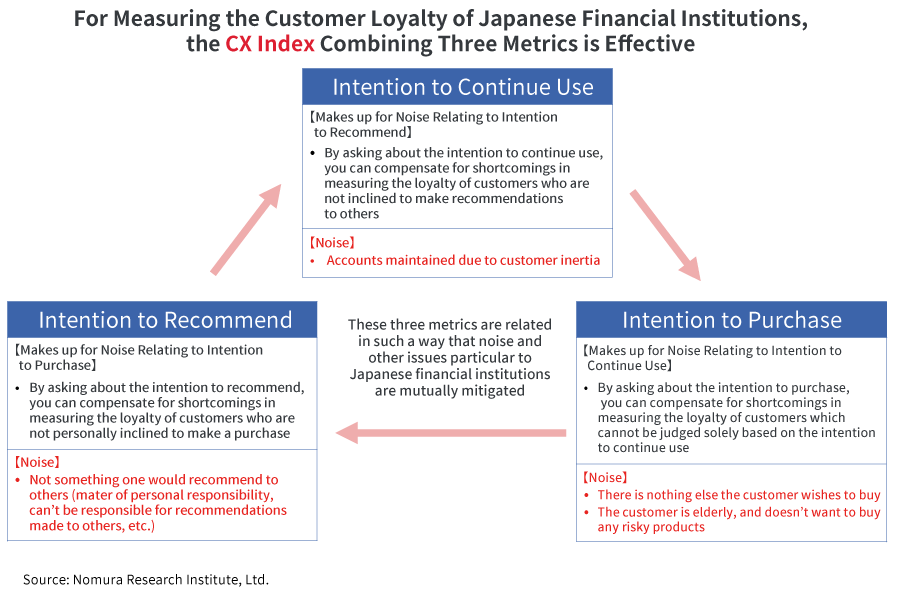

Professor Ichijo and NRI discovered that when they measured the loyalty metrics of Japanese financial institutions, if they combined the “intention to continue use ” and “intention to purchase”—which like NPS are classified as active loyalty metrics—with the “intention to recommend (=NPS)”, then noise and other issues particular to Japanese financial institutions would be mutually mitigated. They therefore coined a new term, “CX Index”, representing these three factors combined. As the CX Index shows a strong correlation with numerous business metrics, it is conceivable that financial institutions that take action toward enhancing their CX index will see increased customer loyalty, and consequently bring in higher earnings, making it possible to establish sound business operations.

Further, customer-centric business operations require both the continuous improvement of customer delivered value and higher earnings for the company. That is why NRI developed the “CX Management Methodology (CXMM)” to ensure that both these needs are met. Firstly, CXMM covers several metrics indicating emotional loyalty (a type of active loyalty) that affect the CX Index, specifically “reliability”, “convenience”, and “economic rationality”. Moreover, it incorporates methods for evaluating the current delivered value provided by financial institutions, which give rise to this emotional loyalty, using the Expectation-Disconfirmation Theory

2

.

Thus, it enables financial institutions to identify the key factors in how they can set themselves apart from their competitors and to pinpoint their own weaknesses, and also lets them identify the challenges they need to face with high priority, by analyzing numerical figures showing the gap between their expectations and evaluations as well as correlations with the CX Index.

By leveraging the CX Index and CXMM, Japanese financial institutions will be able to design questionnaires to measure customer loyalty in order to promote and establish customer-centric business operations, as well as to analyze the key points for enhancing the CX Index and for standing out from their competitors, and propose measures for improvement.

- 1 NPS (Net Promoter Score): a metric that quantifies “customer loyalty”, which was previously difficult to measure quantitatively, presented in 2003 by Frederick F. Reichheld of US consulting agency Bain & Company in the HBR (Harvard Business Review).

- 2 The Expectation-Disconfirmation Theory is a theory put forward by US economist Richard Oliver that measures and compares “Expectations” (prior expectations) and “Performance (results assessment/utility). By quantifying both expectations and performance, a financial institution can tell what customers expect of/from it and discern their assessment.

Profile

-

Tatsuo Tanaka

* Organization names and job titles may differ from the current version.