Takahide Kiuchi's View - Insight into World Economic Trends :

On the Advantages of a Cashless Payment

Japanese people tend to prefer to use cash when making small payments, but this preference is likely rooted in a lack of understanding of the major costs involved in using cash. Going cashless offers certain advantages that could boost the economic efficiency of Japanese society overall.

The Use of Cash in Japan is Conspicuously High

The monetary value of all cash in circulation in Japan accounts for some 20% of nominal GDP, which is a conspicuously high percentage among the world’s major powers. While debates occur for instance in the Nordic countries about the rapid decline in the use of cash, such discussions are nowhere to be heard in Japan. It would be no exaggeration to say that Japan is very much a cash society.

While there are conceivably many factors behind the popularity of using cash in Japan, some of the most representative ones are the following: (1) Japanese people tend to be sensitive about their personal information, and dislike having their transaction histories known to others, and thus they prefer paying in cash because their anonymity is safely ensured; (2)given Japan’s high level of public safety compared to other countries, there is relatively little anxiety about carrying cash; and (3) the Bank of Japan takes every manner of precaution concerning the nation’s cash supply, thus making it unlikely for cash shortages to occur in any region, as well as ensuring cleanliness of cash.

The Need to Acknowledge the Costs of Using Cash

Since most people in Japan lack any sense of the inconveniences attached to paying with cash, it is difficult to incentivize them to make more payments using other means, such as with their smartphones.

However, this ability to use cash in this way without feeling any of the inconveniences actually comes at a significant cost. For example, the direct costs include the cost to produce paper bills and hard money, along with the costs to store and transport them, plus the labor costs involved in the handling of cash and the manufacturing and maintenance costs for ATM machines that dispense cash and receive deposits. These costs are shouldered by the Bank of Japan as well as private banks, but ultimately they do by and large get passed on to cash users. For instance, the Bank of Japan’s cash-related expenditures result in a proportionate decline in its payments to the national treasury, which is a source of government revenue, and while these costs may be invisible to the public, the people do end up bearing them.

The Costs of Cash in the U.S. Estimated at Slightly Over 1% of Nominal GDP

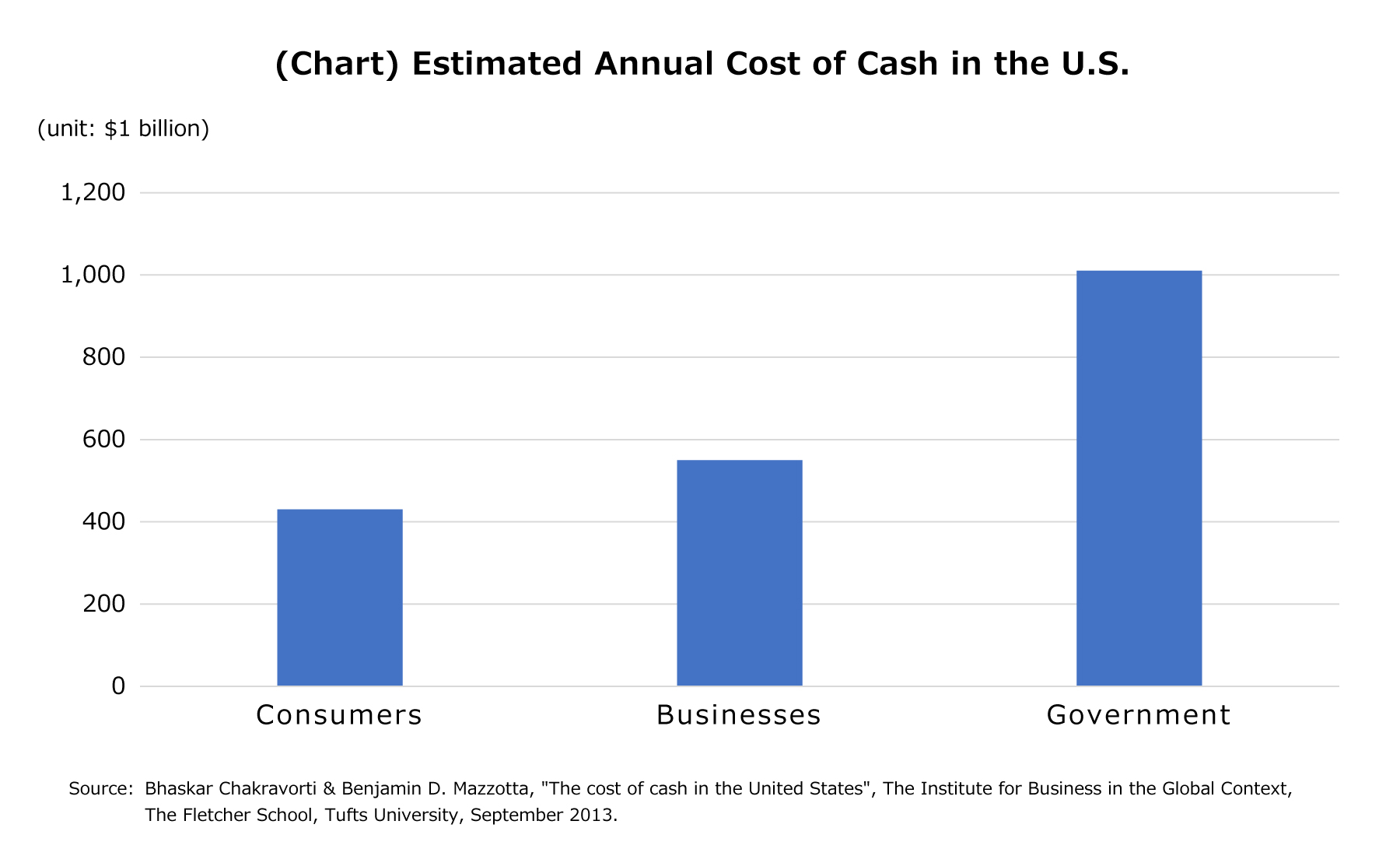

A study was done by a research team at Tufts University to estimate the true cost of cash. The study found that the cost of keeping cash in circulation in the U.S. amounts to more than $200 billion per year, which works out to 1.2% of nominal GDP.

The study breaks down the cost of cash into three segments, namely consumers, business, and government, and estimates the respective cost for each segment. Yet the government cost estimate stands at $101 billion, more than double the cost for individuals or the business world. This breakdown includes not only the costs of producing and manufacturing coins and paper bills, but also declines in tax revenues caused by tax evasion using cash, for example.

Cost of Cash in Japan Estimated at Over 16 Trillion Yen ($145 Billion), Amounting to 3% of GDP

Given that Japan has a cash-to-GDP ratio that’s 2.5 times higher than in the U.S., if we simply apply that ratio to the above calculation, the amount of cash in circulation corresponds to 3% of Japan’s GDP, meaning that a cost of 16.5 trillion yen ($145 billion) is racked up every year in Japan from the use of cash.

We must comprehend the cost of using cash on a broader conceptual level. In many countries, cash (in particular, large-denomination bills) is very often the type of currency involved in crimes. If we posit that postponing the transition to a cashless society in a sense encourages criminal activity and causes a deterioration in public safety, then this delay can be construed as a social cost. We can also observe that using cash involves a hygienic cost. There is the potential for infectious diseases to be spread through the use of paper bills and coins, as well as for terror attacks to be carried out using contaminated money, and these too can be counted among the costs of using cash in a broader sense.

If we consider the cost of cash in this sort of broader meaning, it could potentially balloon up to a huge scale. Conversely, by promoting the switch to a cashless world and reducing the use of cash, we can lower the costs borne by society overall, and boost our economic efficiency. The potential in going cashless could be quite significant indeed.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.