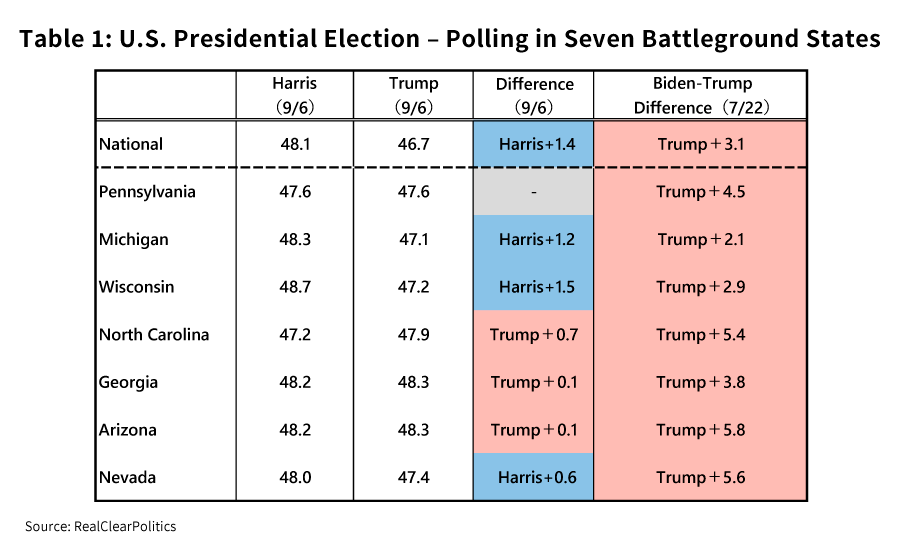

With Democratic President Joe Biden’s decision in July 2024 to withdraw from the election race, the U.S. presidential election, which had seemed to favor Republican candidate Donald Trump, has entered a strikingly new phase. President Biden’s hand-picked successor, Vice President Kamala Harris, has amassed unexpected levels of support and currently leads Trump in nationwide polling. The two candidates are hotly contesting the seven battleground states expected to decide the election’s outcome, with polls putting them neck and neck (Table 1). Financial markets, however, have shown little reaction to campaign developments, either when Trump’s victory seemed assured in the wake of the July assassination attempt, or after Harris’ dramatic emergence. It seems the markets are struggling to measure how the results of the election will affect the economy.

Harris’ strategy draws heavily on her background

On August 22, Harris delivered a speech to the Democratic National Convention

accepting her party’s presidential nomination. In that speech, she adopted a strategy that made a

strong appeal for her policies by drawing heavily on her personal background, including her youth, her

gender, her status as a child of immigrants, her middle-class upbringing, and her experience battling

major corporations as a public prosecutor.

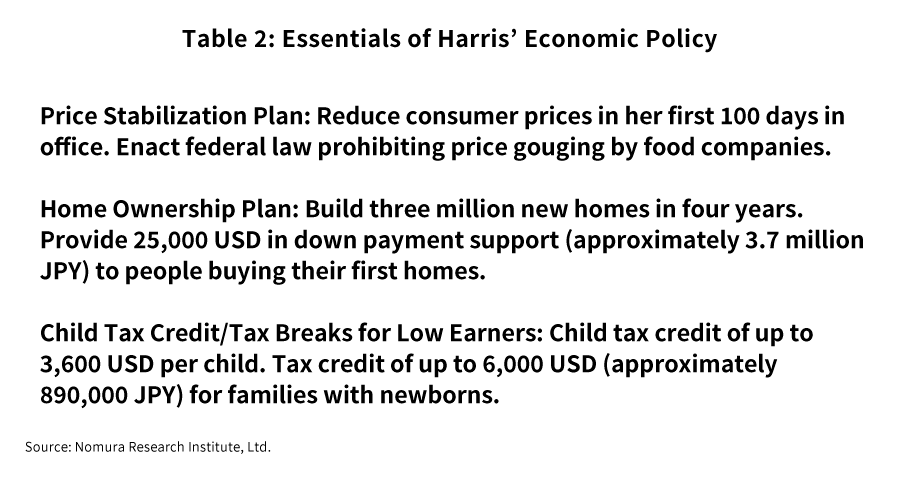

Harris also unveiled her economic plan on August 16 (Table 2), introducing a policy that rests on two

pillars: supporting the middle class and combating inflation. Her announcement, however, was narrowly

focused only on certain areas of economic policy, and made no mention, for example, of energy, tax, or

trade policies.

Looking ahead, Harris appears likely to adopt a strategy that will spotlight her differences from Trump

while focusing narrowly on the three issues of 1) inflation policy, 2) support for the middle class, and

3) abortion and other women’s rights issues. In her debate with Trump, Harris limited her remarks

to her areas of strength, sketching out vague pathways while saying nothing noteworthy in areas where

she is less adept. This posture could be an effective electoral strategy for Harris, whose experience is

especially lacking in the areas of foreign policy and national security.

Will Harris’ progressive economic policies become reality?

Harris’ economic plan, which seeks to crack down on big corporations

engaged in price gouging, is a progressive policy package that has aroused concern among corporations

and in the stock market. These proposals appear to be a response to the public belief that corporations

raise prices beyond the scale of their cost increases to grow their own profits, intensifying the burden

on consumers in a phenomenon known as “greedflation”.

In reality, however, it is quite hard to make a strict determination of whether a company’s prices

are legitimate or illegitimate. Also, Harris’ policies, which presuppose the enactment of new

laws, require approval in Congress and cannot be decided through presidential authority alone. The

Democratic Party will likely have a hard time passing such laws if it fails to win substantial

majorities in both the House and Senate in the congressional elections held alongside the presidential

race, and according to current polls, the House and Senate both favor Republicans by narrow margins.

Given all this, the progressive policies proposed by Harris do not seem especially feasible and could

end up as no more than campaign promises. Vice President Harris’ progressive positions may not

warrant the intense concern they have aroused in boardrooms and on trading floors.

Trump’s tariffs present immeasurable risks to the global economy

Donald Trump, on the other hand, has proposed a policy of protecting U.S.

domestic production by raising additional tariffs of 20% on imports from all countries and of more than

60% on imports from China. He also has proposed a weak-dollar policy, similarly aimed at protecting

domestic production. While the previous Trump administration also introduced tariffs and proposed

weak-dollar policies, these did not clearly undermine the U.S. or global economies or significantly

weaken the dollar. Financial markets remember this, which is why they do not seem especially alarmed

about Trump’s economic plans. You might say they are “Trump-proof”.

These new tariffs, however, differ markedly in scale from Trump’s previous ones. The tariffs

previously introduced by Trump have remained largely in place under the Biden administration, with the

result that average tariff rates are currently around 11% on imports from China and around 1% on imports

from other countries.

In contrast, Trump’s current proposal would impose additional tariffs not on imports in certain

sectors like his previous policy, but on all imports across the board. Implementing this policy could

raise average tariff rates to many times their current levels, causing major damage to global trade and

the economy.

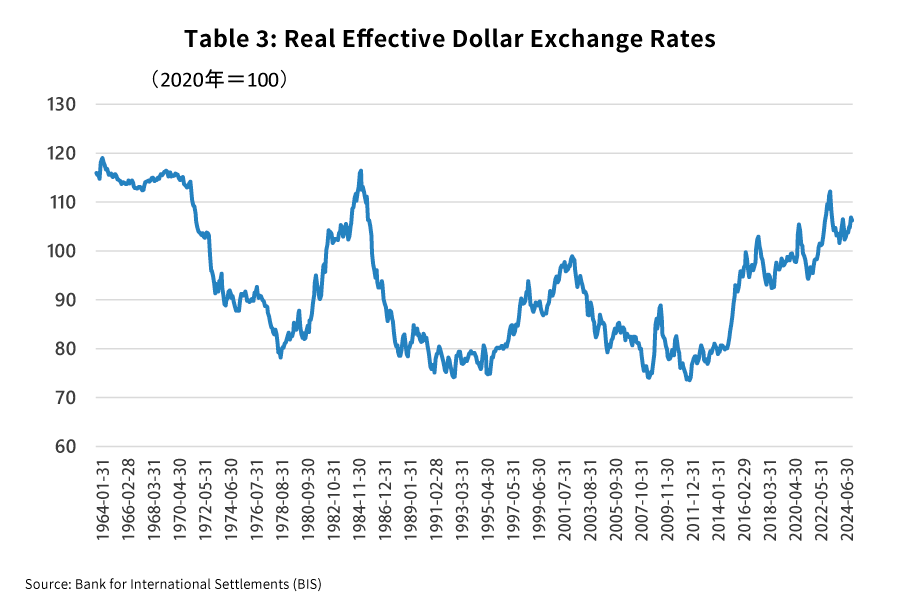

Also, the global economy and the financial market environment differ markedly from the conditions

instigated by the Trump administration eight years ago in another way that must not be forgotten:

China’s economy is currently at a standstill, and the global economy is more vulnerable than

previously. Likewise, the substantial rate increases by the Federal Reserve Board have had the effect of

significantly revaluing the dollar, which means that there is a far greater risk of a major drop in the

dollar over the next four years (Table 3).

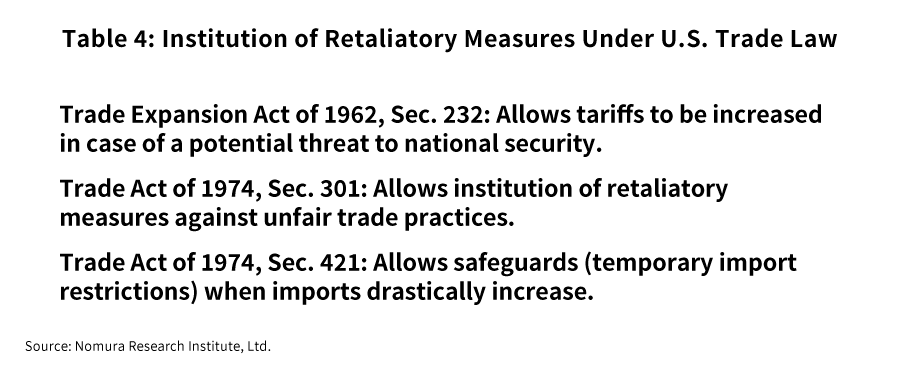

Finally, it is important to note that the introduction of additional tariffs can be accomplished through

presidential authority under U.S. trade law (Table 4). The tariffs Trump would impose after winning back

the presidency’s vast powers present such monumental risks to the global economy that their

potential impact is scarcely measurable.

Is the emergence of a Harris administration the better scenario for Japan?

Under a Harris administration, which fundamentally would continue the policies of

the Biden administration, Japan’s economy and financial environment would be unlikely to

experience major changes. In addition, inflation is steadily declining in the U.S., and a Harris

administration intent on lowering prices might help reinforce that trend. Under such conditions, the Fed

would gradually lower the policy interest rate, which could be expected to weaken the dollar and

strengthen the yen over time. A gradually rising yen would calm Japanese concerns about rising domestic

consumer prices and put wind in the sails of Japan’s lagging personal consumption.

In contrast, Trump’s reelection would increase the risk of additional tariffs undermining the U.S.

economy, while also heightening the risk of the dollar’s decline being accelerated by weak-dollar

policies. In such a case, the rapidly rising yen would have significant adverse effects on the Japanese

economy, accompanied by a drop in stock prices.

Given these differences, it seems clear that the emergence of a Harris administration, with its

attendant gradual rise in the yen, is the better scenario for Japan’s economy and its companies.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.