March 12 marked the Concentrated Response Day for the 2025 Shunto (spring labor-management wage negotiations), the day when most major companies respond to union requests for higher wages. In the automobile and electronics industries, for example, a series of companies have agreed to meet their unions’ requests in full. According to the third round of responses tallied by “Rengo”, the largest nationwide labor union federation in Japan, the average wage hike including periodic salary bumps was 5.42%, or a base pay hike of 3.82% if these regular wage hikes are excluded, with these results being higher than what was achieved in 2024 (+5.24% and +3.63%, respectively). Could this high wage increase serve to bolster the rebound in flagging consumer spending, and to ease major concerns over economic prospects which have risen sharply in response to the Trump Administration’s tariff policies?

The wage increase rate lacks momentum compared to last year

However, the wage increase rate among SMEs with fewer than 300 Rengo members (according to the third round response data) currently stands at 5.00%, which is lower than the average 5.44% wage hike agreed to by large firms employing 300 or more Rengo members, and this means that the wage level disparity between them is only expanding further.

That said, if wages were to be raised at these SMEs too drastically in an attempt to close that wage level gap with large firms all at once, that could harm those SME’s earnings environments, and potentially even lead to management difficulties and job cuts. Shrinking that gap probably needs to be done in a way that also entails improving productivity at these small and medium-sized businesses.

The average wage hikes to come at these SMEs—which will be agreed upon and decided in the near future—are expected to fall below the average level at large firms which have more or less already been decided, and therefore we can anticipate that as the responses continue to be tallied, the average value of these wage hikes will decline. We may foresee that the average rate of wage increase in 2025 (including periodic salary bumps) will ultimately come out to around 5.3%, and thus will end up being slightly higher than the 5.1% increase that we saw in 2024.

Given the results of the wage hikes from this year’s Shunto, some are taking the positive view that sharp wage hikes are becoming the norm in Japan. However, in actuality, it remains the case that these wage hikes are simply following the high rate of inflation, and so the reality seems to be that any improvement in real wages minus inflation is lagging behind.

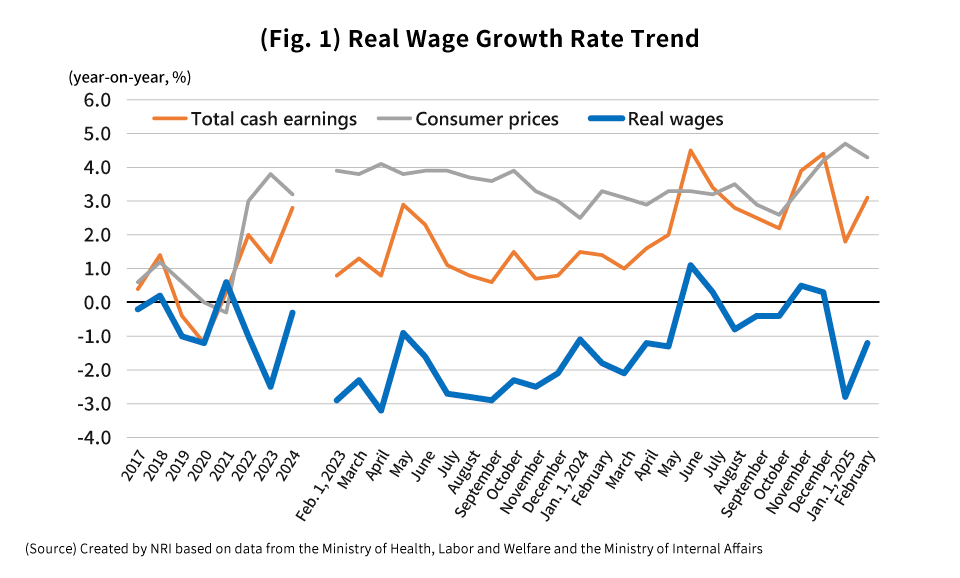

Last year, the rate of increase in nominal wages essentially kept up with the inflation rate, but it was the Shunto that provided the impetus for this. It is clear that while this year’s wage rate increase is highly likely to exceed last year’s level, that rise lacks momentum compared to last year. This is because in 2024, the average wage increase rate year-on-year jumped up from around 3.6% to around 5.1%, whereas this year, that rate is projected to exceed last year’s level only slightly. Hence, we cannot expect the wage increase rate to significantly surpass the inflation rate, or real wages to make a conspicuous rebound.

The real wage boosting effects are not very significant

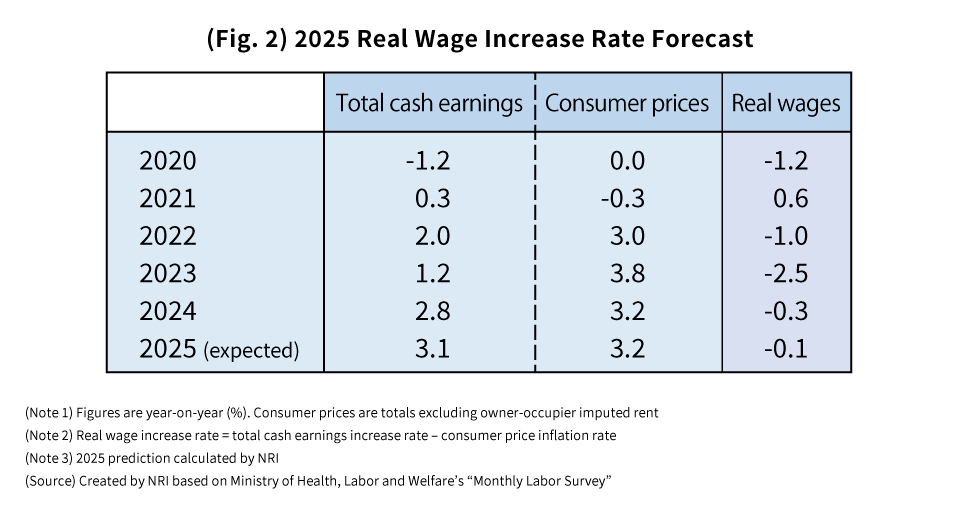

Looking at the results of this year’s Shunto up to now, we may expect that the rate of increase in average nominal wages (total cash earnings) for 2025, which roughly corresponds to the base pay increase excluding periodic salary bumps, will come out to approximately 3.1%. This is because although the rise in base pay as of the time that the third-round data was tallied for the Shunto was 3.82%, we can expect that SMEs and micro-enterprises will substantially bring down the average value of their final base salary hikes, which will be decided in the near future.

Given these circumstances, it is being forecasted that the rate of increase in real wages year-on-year will remain negative for some time, with positive growth taking hold only after the middle of the year and into the summer (Fig. 2).

The Shunto wage increase rate should be assessed in terms of the real wage level minus the inflation rate. From this standpoint, the wage rate increase in this spring’s Shunto –while ostensibly still at a high level—cannot possibly be considered high. This increase is quite evidently inadequate when it comes to gaining back the significant losses in real wages seen over the past few years.

Price stability is key to restoring consumer spending

The government’s aim is for the rate of wage growth to exceed the inflation rate, but it would seem quite difficult to boost the rate of wage increases any further in this kind of environment. In order to achieve a rebound in consumer spending, the key will be to aggressively clamp down on the inflation rate, which has been ticking up recently, in an effort to improve real wages. I believe the government would probably do well to enact policy measures that place a greater emphasis on restoring price stability.

The government’s first step should be to make efforts to quickly stabilize the skyrocketing price of rice. One may also hope that in conjunction with the Bank of Japan’s normalization of monetary policy, the government will try to correct the yen’s depreciation by making a currency intervention as needed, and thus seek to restore stability to import prices which have a major influence on food and energy prices.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.