At the Monetary Policy Meeting (MPM) held on June 17, 2025, the Bank of Japan decided to hold its policy interest rate at 0.5%. At the press conference following the previous meeting held on May 1, Governor Ueda had observed that the underlying rising trend in inflation toward 2% might come to a halt due to the effects of the Trump tariffs, and he had expressed an intention to effectively hold off on raising interest rates for a time. This was still the Bank’s thinking at the most recent MPM. That said, at the meeting there was discussion about the Bank’s plans to scale back its long-term JGB purchases.

Two Conflicting Objectives: Restoring the Functioning of the Government Bond Market and Ensuring Stability in the Government Bond Market

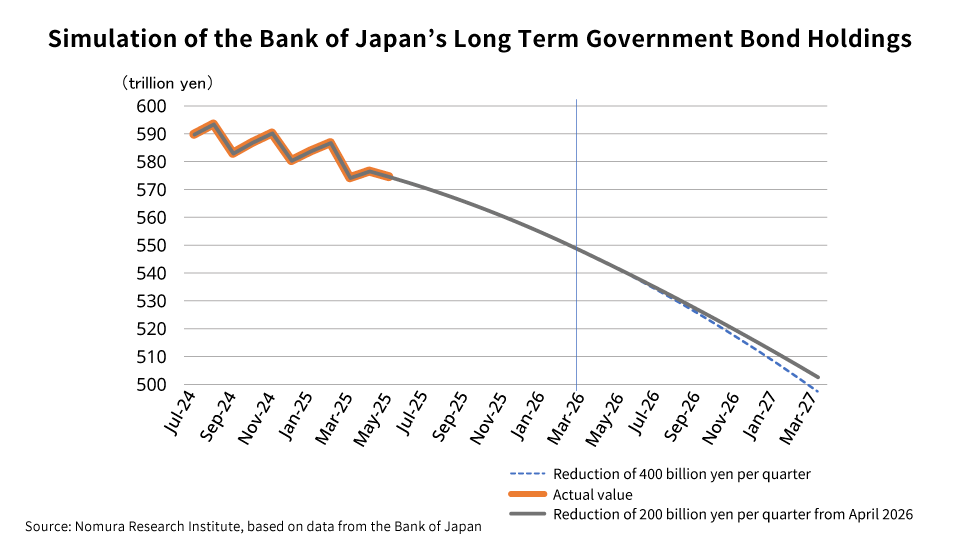

With no real prospects for any additional rate hikes at this last MPM, the financial market’s attention was focused on two things: the interim assessment given by the Bank at this last meeting regarding plans to draw down its long-term JGB purchases through January-March 2026; and the subsequent schedule for scaling those purchases back from April-June 2026 onward. The Bank opted to maintain its current policy of reducing its monthly purchases of JGBs by around 400 billion yen each quarter. By contrast, it decided that beginning in April-June 2026, it would halve the pace of these reductions to around 200 billion yen per quarter, thus maintaining a policy of scaling down its purchases.

This decision approximates the consensus expectation, and in some sense the Bank of Japan may have intentionally made its determination in line with the prevailing market expectation in order to prevent the volatility in long-term interest rates from rising, for instance.

Governor Ueda explained that while the fundamental philosophy is that interest rates should be formed in the markets, the current measures were decided on in order to balance the goal of improving market functioning by reducing the Bank of Japan’s JGB balance against the risk of destabilizing the market by scaling back its JGB purchases too rapidly.

In order to restore the functionality of the JGB market, and furthermore, to diminish the risks associated with essentially financing fiscal deficits, the Bank of Japan needs to continue scaling back its long-term JGB purchases for an extended period going forward.

However, the Bank of Japan had been aggressively purchasing long-term JGBs for quite some time, holding at least half of all outstanding government bonds. If it were to try normalizing this unique market environment all at once, it would risk throwing the market into turmoil, sending long-term and super-long-term interest rates upward, for example. The Bank of Japan thus finds itself having to simultaneously achieve two conflicting objectives — restoring the functioning of the JGB market, and ensuring that the market remains stable.

Scaling Back JGB Purchases at a Gradual Pace, Just as Originally Expected

As a result, the rate of reduction of the Bank’s JGB holdings between last July and this May was just 3.1% on an annualized basis. Meanwhile, the U.S. Federal Reserve Board (FRB), which began reducing the amount of government bonds on its balance sheet in June 2022, logged a holdings reduction rate of 10.4% in the first year and then ramped it up to 13.7% in the second year. Compared to this example, the Bank of Japan has chosen quite the cautious and measured approach to ithis scaling back, amounting to something of a slow start.

And yet under the present system for reducing its long-term JGB holdings, with the passage of time, the scale of these reductions in JGB purchases will rise, and the pace at which the Bank decreases the amount of JGBs on its balance sheet will rapidly increase. That could potentially elevate the risk of a rise in long-term and super-long-term interest rates out of concerns over a deterioration in the supply and demand balance of government bonds.

From this standpoint, the approach of gradually tweaking the pace of the reductions of JGB purchases is just what the Bank of Japan had envisioned at the outset, and so this move is not necessarily a response to the recent uptick in super-long-term interest rates.

The recent upswing in super-long-term interest rates likely is largely due to the effects of rising super-long-term interest rates in the U.S. stemming from concerns about fiscal deterioration, inflationary fears, and worries over a possible shift away from dollar assets, and presumably it had no serious influence on the Bank of Japan’s current program of reducing its long-term JGB purchases.

Will the Monthly JGB Purchase Amount Bottom Out at Around 2 Trillion Yen?

In the January-March 2027 quarter, when this new schedule for reducing long-term JGB purchases will be concluded, the Bank’s monthly long-term JGB purchase amount will fall to around 2 trillion yen. It is possible that at the next interim assessment, the Bank of Japan will lay out the criteria under which it will end its drawdown of long-term JGB purchases.

At present, let us assume that the monthly long-term JGB purchase amount will drop no further than around 2 trillion yen, or in other words, this level will be the lower limit for the time being. If the Bank of Japan lowers its long-term JGB purchase amount to 2 trillion yen per month and keeps it there, its balance of JGBs will decline at an annualized pace of around 11%. That is to say, if the Bank holds to a pace of purchasing 2 trillion in long-term JGBs each month, then all of the long-term JGBs on its balance sheet will be cleared off of it through redemption in approximately nine years’ time.

In actuality, however, the Bank of Japan will probably increase this monthly long-term JGB purchase amount beyond 2 trillion yen sooner or later, entering a period in which it continues to hold a certain amount of long-term JGBs.

Successive Guidance to Improve Market Predictability Regarding the Future Supply-Demand Balance for JGBs

Rather than any fluctuations in the pace of the drawdown in JGB purchases from April 2026 onward, market participants would appear to have been more interested in where the Bank would decide to draw the line to suspend these reductions.

Although the Bank of Japan did not clearly indicate any prospective lower limit for its monthly long-term JGB purchase amount, by setting the endpoint of its next schedule to be when that amount falls down to around 2 trillion yen, the Bank can be said to have implicitly suggested that 2 trillion yen will be that lower limit. At the interim assessment to be given next June, it may well provide a clearer picture of what the lower limit for its monthly long-term JGB purchase amount will be.

Furthermore, at some point in time, the Bank will have to give the market some hint as to just how far it intends to slash its long-term JGB holdings. By providing this sequential guidance, the Bank of Japan will aim to improve market predictability regarding the future supply-demand balance for JGBs, and to thereby ensure that the market remains stable.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.