Since last year’s presidential campaign, President Trump has been strongly advocating for greater support for the cryptocurrency industry, stating his intention to make the U.S. the world's cryptocurrency (virtual currency) capital. Amid that push, in July 2025 the U.S. passed the Guiding and Establishing National Innovation for U.S. Stablecoins Act (the GENIUS Act), the intention being to establish a regulatory environment for “stablecoins” with the aim of ensuring their sound development.

Issuance of stablecoins likely to also intensify competition between banks and non-bank institutions

Large-scale issuers with $10 billion or more in total issuance are subject to regulatory oversight by federal agencies, whereas those below that threshold are allowed to operate under the regulations of state authorities.

All issuers are required to make public the status of their reserve assets on a monthly basis. Any issuers with a market capitalization exceeding $50 billion must also submit an audited financial report once a year.

Any foreign stablecoin issuers looking to do business in the U.S. must be found by the U.S. Treasury Department to be subject to regulations in the countries where they operate that are equivalent to those in place in the U.S.

If the use of stablecoins spreads within the U.S., the advantages they offer, such as lower transaction fees when shopping compared to credit cards, will be delivered to consumers. In anticipation of the passing of the GENIUS Act, major U.S. retailers like Walmart and Amazon have been contemplating issuing their own stablecoins to be used for shopping.

If the use of stablecoins grows to the point where it takes the place of credit card payments, then banks involved in the credit card business could potentially see a drop in revenue from payment fees, which would squeeze their profits. As a countermeasure, large banks are also looking into jointly issuing their own stablecoins, and going forward, it’s even possible that competition between banks and non-banking institutions over stablecoins will become more intense.

The Trump Administration’s aim to maintain dollar hegemony through stablecoins, and the Libra plan

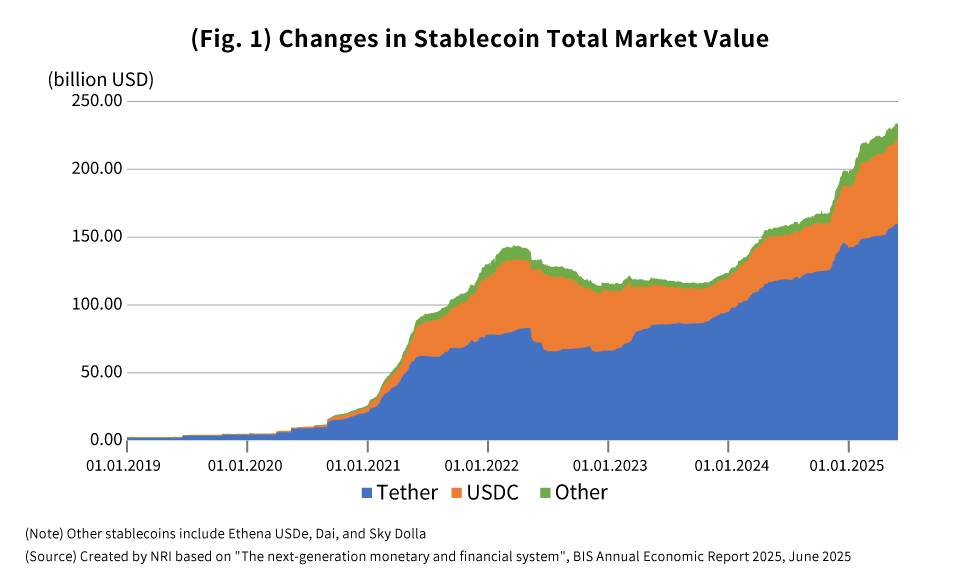

The total market value for stablecoins as of the end of this past May reached as high as $230 billion, but this is an oligopolistic market in which two stablecoins, Tether and USDC, account for the majority of the market value (Fig. 1). Both of these are issued in the U.S. and are fiat-collateralized stablecoins, having U.S. dollars or U.S Treasury securities bond as their reserve assets.

Thus, the global stablecoin market is currently being dominated by the U.S. dollar. The Trump Administration appears to be looking to capitalize on this dominance in order to make dollar-denominated stablecoins the global standard for stablecoin issuing and trading, thereby maintaining the dollar’s status as the world’s de-facto reserve currency.

However, we should note that this effort aimed at expanding the use of dollar-denominated stablecoins in international payments has much in common with the “Libra plan”, which was proposed in 2019 by Facebook (now Meta), with the aim of issuing a global stablecoin called Libra backed by major world currencies.

Financial authorities in the U.S. and across the world put pressure on Facebook (Meta), and ultimately that plan was withdrawn. This happened out of concerns that Libra would easily lend itself to money laundering or other crimes, could destabilize the international flow of capital and financial systems, and could diminish the efficacy of monetary policies, among other fears.

With global stablecoins issued by the private sector, previous attempts have been made seeking to address these various challenges and to provide a highly convenient digital settlement method. Following those attempts, debates got underway in major countries about issuing a Central Bank Digital Currency (CBDC), a digital form of a country’s national currency issued and backed by a central bank. Although it was envisioned that CBDCs would initially be used domestically within a given country in place of cash payments, there was much discussion about how they would subsequently come to be used for international payments as well.

Yet the Trump Administration has been dismissive toward the creation of CBDCs, looking instead to popularize the issuance of dollar-denominated stablecoins by the private sector. The U.S. Congress has even deliberated over a bill that would ban the Federal Reserve Board (FRB) from issuing its own CBDC. As a means for spreading the use of a digital currency that would be highly convenient for users, the Trump Administration has chosen stablecoins issued by the private sector, rather than a CBDC backed by the central bank as a fiat digital currency. This will inevitably have a major influence on discussions in Japan, Europe, and elsewhere over the issuance of CBDCs.

With regard to measures against money laundering and other such crimes, the GENIUS Act requires issuers to comply with the “Bank Secrecy Act”, which aims to prevent financial crimes, as well as to keep records of all transactions and to monitor and report any suspicious activities.

However, in the case of stablecoins issued by private-sector entities, it’s unclear whether or not the government and the financial authorities can provide adequate oversight beyond what’s done for bank payments and settlements in order to prevent money laundering or other such problems from arising.

A possible dollar depreciation policy

With FRB Chair Jerome Powell’s term of office set to expire in May 2026, if President Trump moves quickly to nominate someone more bullish about rate cuts to succeed him as FRB Chair, that will only make Powell seem like more of a lame duck, and will also mark the beginning of a dollar depreciation policy. If that person is appointed Chair next May, the Trump Administration’s dollar depreciation policy could go full-scale.

However, a move by the Trump Administration to politically intervene in the FRB’s affairs and the adoption of such a policy to weaken the dollar also carry the risk of significantly diminishing confidence in the dollar, and of throwing the U.S. financial market into disarray. That being the case, the Administration’s aim could perhaps be to bolster demand for the dollar by promoting the spread of dollar-denominated stablecoins around the world.

Given that issuers are legally required when issuing dollar-denominated stablecoins to have dollars or short-term government securities as reserve assets, that move may be expected to lead to growth in demand for the dollar and maintain the credibility of dollar-denominated assets.

Challenges remain in maintaining the dollar’s hegemony with dollar-denominated stablecoins

That issuer would then be forced to sell off the short-term U.S. government securities in its possession as the reserve assets for its stablecoin. That sell-off potentially could send short-term interest rates soaring and have an adverse effect on the economy. Further, it could even exacerbate unrealized losses on government bonds held by banks, leading business conditions to deteriorate.

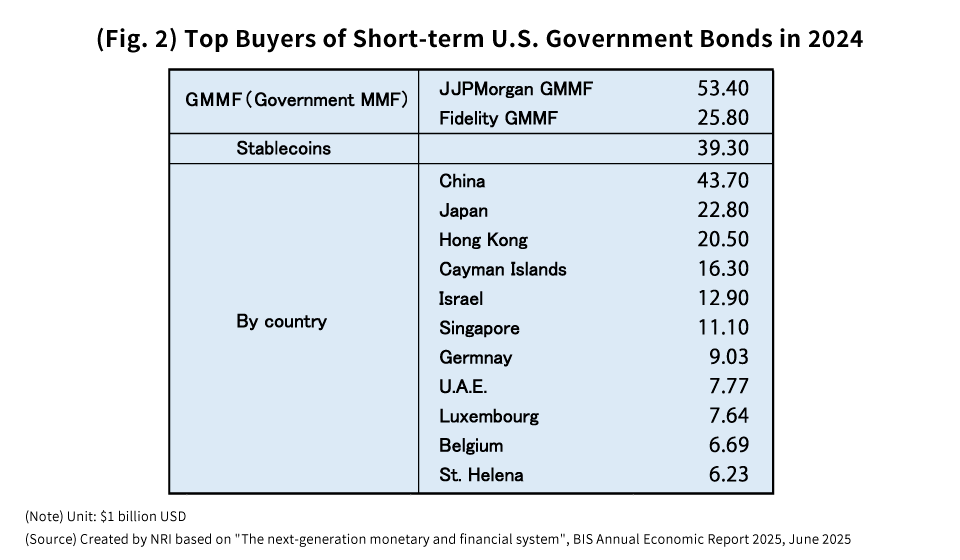

According to the Bank for International Settlements (BIS), stablecoins accounted for $39.3 billion worth of short-term U.S. government securities purchased in 2024, making them the third-largest buyer in U.S. Treasury markets last year, right behind the JPMorgan government money market fund (GMMF) at $53.4 billion and China at $43.7 billion (Fig. 2). Thus, the concern is that if stablecoins force the sale of short-term U.S. government securities, the U.S. economy and the banking system could be dealt a huge blow.

In addition, as we’ve already seen, if the use of stablecoins issued by private-sector entities expands beyond national borders, they could be used for money laundering or to aid and abet other financial crimes. That in turn would also severely damage the credibility of international payments made using stablecoins.

This all means that many challenges remain to be overcome before the use of dollar-dominated stablecoins catches on both within the U.S. and abroad, and it will likely take time to accommodate that shift. However, it seems that the Trump Administration, which is asserting that future growth in the use of dollar-denominated stablecoins will bolster faith in the dollar, could very well embark on a dollar-depreciation policy that involves having the FRB cut interest rates, while trying to minimize the risk of a loss of confidence in the dollar.

Yet given that such a policy would also disrupt the U.S. financial market, there’s probably a good chance that it can’t be maintained in the long run.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.