2026 could potentially be the year that the dollar’s status as the de-facto reserve currency begins to falter. The biggest reason is that President Donald Trump has been increasingly intervening politically in the affairs of the U.S. Federal Reserve Board (FRB), which could erode confidence in the dollar.

The potential weakening of the dollar through FRB rate cuts

Ever since his first administration, President Trump has repeatedly and blatantly called on Powell to cut interest rates, but last year, his political interventions in the FRB’s affairs have grown more intense in the form of personnel changes. This posture could erode confidence in the central bank as the guardian of currency value and prices, and it could seriously damage trust in the dollar.

The Trump Administration is expected going forward to gradually scale back its tariff policies in view of their negative effects on the U.S. economy and of public discontent. If the U.S. Supreme Court were to hand down a ruling early in the year that the reciprocal tariffs exceed presidential authority and are illegal, the administration will be compelled to significantly draw down its tariff policies. In that event, the inflation rate in the U.S. — which has been elevated by the tariffs — will come down, creating more room for the FRB to cut interest rates.

Meanwhile, the Trump Administration might look to shift its method of shrinking the nation’s trade deficits from tariff measures to aggressive rate cuts by the FRB to weaken the dollar. Under these circumstances, the dollar could perhaps begin to depreciate more than expected in 2026.

Could U.S. economic supremacy crumble?

The conditions that have often been cited for a particular country’s currency to become a reserve currency include a huge economic scale, a high-liquidity, large-scale financial market, a highly credible central bank, free movement of capital, and strong military capabilities, for example. Although confidence in the U.S. central bank has started to shake, in terms of economic scale, it does not seem that the supremacy of the dollar as the U.S.’s currency can be shaken so easily.

There were fears initially that the Trump Administration’s tariff policies would deal a major blow not just to trading partners but also to the U.S. economy. However, at present that risk has somewhat receded, with the U.S. economy having maintained a high growth rate.

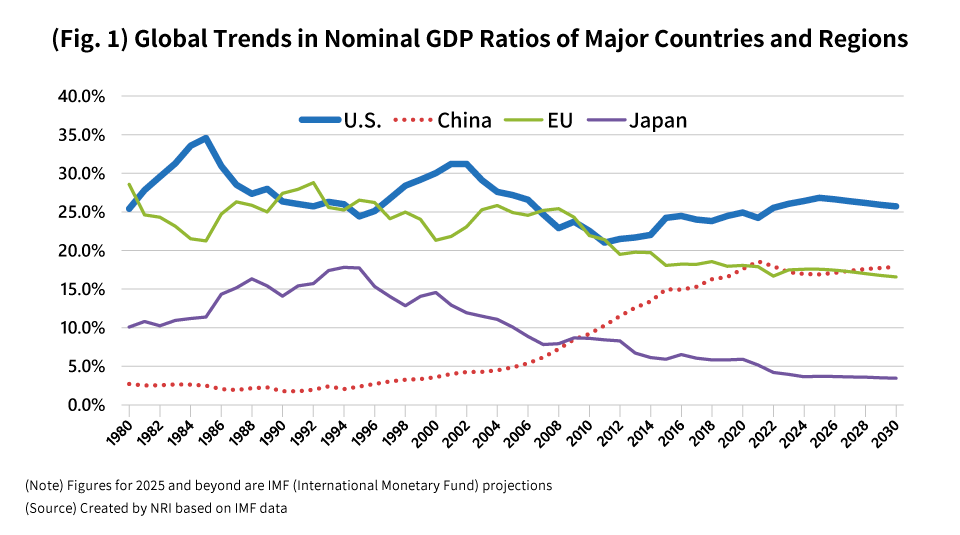

In addition, for a time it was supposed that U.S. GDP (dollarized) would eventually be overtaken by China’s, and some began to opine that this would threaten the dollar’s de-facto position as the world’s reserve currency. Yet the effects of a real estate slump and other factors have significantly hampered the growth rate of the Chinese economy, and thus the chance that U.S. GDP (dollarized) will be overtaken by China’s in the near future has fallen (fig. 1).

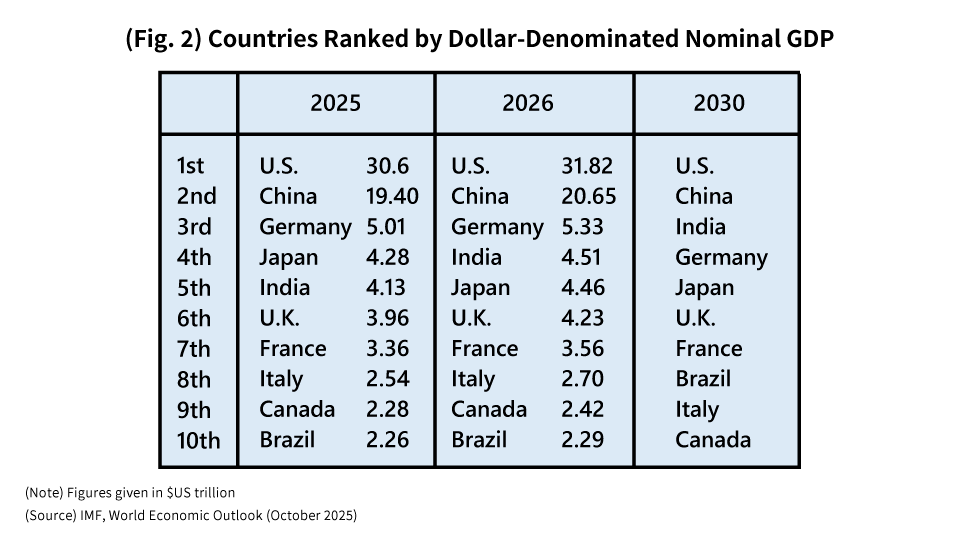

According to the International Monetary Fund (IMF), the scale of the U.S. economy even in 2030 is projected to remain in the top spot globally (fig. 2). It would appear that U.S. supremacy when viewed in terms of economic scale will continue to bolster the dollar’s de-facto status as the world’s reserve currency going forward.

The growth of emerging economies and the future of reserve currencies

The IMF uses the differences in price indices between the U.S. and other countries to calculate the equilibrium level of exchange rates, i.e., “purchasing power parity”, and then publishes data on individual countries’ economic scales based on those calculations.

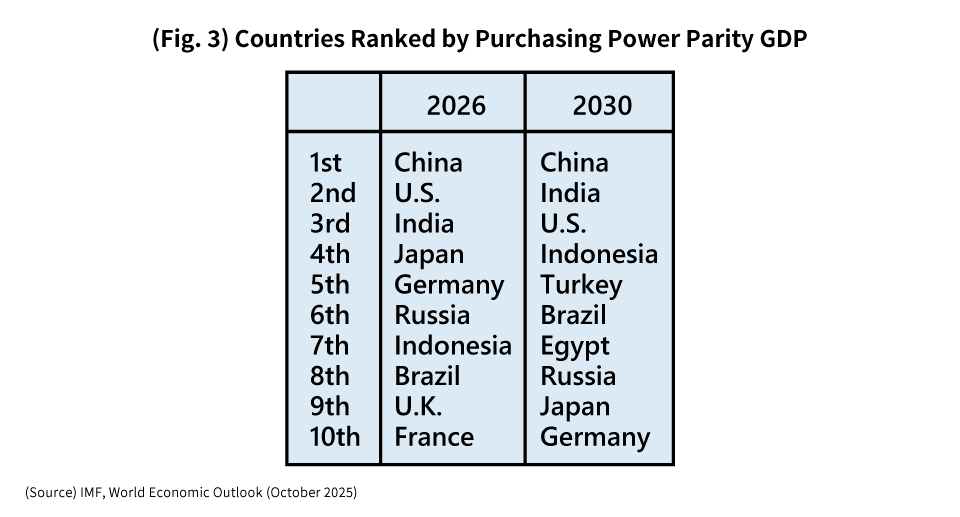

Viewed in terms of GDP (based on purchasing power parity), as of 2016, China had already overtaken the U.S. to claim the top spot globally. When considered in the sense of economic scale, the status of the dollar could potentially even be threatened in the future by China’s renminbi.

Moreover, if we look at projections for GDP (based on purchasing power parity) on a per-country basis in 2030, the U.S. is poised to be overtaken by India as well, falling to third place in terms of global economic scale. If we take the top ten countries, we see there are only three advanced economies in the list, namely the U.S. in third place, Japan in ninth place, and Germany in tenth place, with all the others being developing nations (fig. 3).

Based on this, the dollar’s ability to hold onto its status as the de-facto reserve currency into the future arguably will hinge largely on whether it will continue to be preferred among developing nations.

Currently, developing nations would seem to be increasingly moving away from the dollar. As part of the economic and financial sanctions put in place by advanced nations in response to the invasion of Ukraine, Russia’s central bank was removed from SWIFT (Society for Worldwide Interbank Financial Telecommunication), which has made it difficult for Russia to conduct trade settlements denominated in dollars. For this reason, Russia has been making more trade payments in renminbi, using China’s international interbank payment system.

Furthermore, more and more developing nations in rivalries with the U.S. have visibly begun, like Russia, to conduct settlements in non-dollar currencies such as the renminbi , fearing that they could be slapped with economic or financial sanctions by the U.S. down the road. Even the BRICS nations, as a bloc of major emerging economies, are starting to move away from the dollar.

With China, Russia, and other authoritarian countries looking to expand their spheres of political and economic influence to include emerging nations, we could see the renminbi come to be more widely used as a fiat currency in place of the dollar in the future.

Back when the title of reserve currency shifted from the English pound to the dollar, economic scale and other economic conditions were a major determining factor in that shift. Yet as global political structures and economies are now becoming increasingly fragmented, non-dollar currencies such as the renminbi could exert greater influence in developing nations against the backdrop of shifting political power, potentially threatening the dollar’s status as the world’s reserve currency.

Economic digitalization is inevitable

The U.S. signed the Genius Act into law in July 2025, and has sought to establish a regulatory framework around stablecoins — a cryptocurrency designed to remain stable in value relative to a fiat currency — and thereby promote their circulation. Going forward, dollar-denominated stablecoins are expected to replace credit card payments for shopping and other transactions within the U.S.

Moreover, the Trump Administration is aiming to popularize the use of dollar-backed stablecoins widely throughout the world. The goal of this is to protect the dollar’s status as the world’s reserve currency.

On the other hand, when it comes to the future of cross-border digital settlements, various countries are also planning to make use of central bank digital currencies, of CBDCs, which are statutory digital currencies issued by central banks.

The U.S. has not issued a CBDC of its own, seeking instead for privately issued dollar-denominated stablecoins to spread globally, whereas China is contemplating the use of a CBDC in the form of a digital renminbi for international settlements. And among developed nations as well, the Eurozone has been steadily laying the groundwork for issuing its own CBDC. Even Japan seems inclined to use a CBDC of its own.

Thus, the future of international digital settlements is shaping up to be a struggle for hegemony among stablecoins and CBDCs. In the near term, stablecoins might well have the upper hand.

Nevertheless, privately issued stablecoins come with a drawback, in that they do not adequately allow for users’ identities to be verified, which makes them susceptible to use for money laundering and other crimes. In addition, if more stablecoins are issued, that could also cause problems when it comes to the stability of monetary policy and the financial markets. If such concerns attract attention, stablecoins could perhaps lose credibility as a means of international settlement.

Problems such as these exist for the currency strategy of the Trump Administration, which aims to have dollar-backed stablecoins be widely used for international settlements. It is conceivable that the digital renminbi or other CBDCs will enjoy greater use in the future for international settlements than dollar-denominated stablecoins do.

This is why unlike in the past, global political conditions and digitalization will likely play a larger role in determining the status of the current reserve currency. These two elements could prove to be detrimental to the dollar’s stature as the world’s reserve currency.

In the near future, the dollar seems unlikely to lose its role as reserve currency in one fell swoop, but it is possible that emerging economies in particular will make greater use of the renminbi, which would lead to a gradual decline in the dollar’s status.

Further, if the Trump Administration does take measures in 2026 to weaken the dollar by way of political interventions in the FRB’s affairs, that might lead other countries around the world to reconsider using or holding onto the dollar. 2026 could well be the starting point that sees the dollar’s status slowly begin to waver.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.