Aiming to become a world-class economist with a strong reputation among investors, Takahide Kiuchi has weathered fierce competition and been active in areas including economic forecasts and monetary policy decisions for the Bank of Japan. In this feature, we look at how he has managed to cultivate the attitude and conviction to confidently advocate what he believes is right without being swayed by majority opinion.

Building a career as an economist, and even participating in national policymaking

Ever since I joined Nomura Research Institute (NRI) in 1987, I’ve basically focused on being an economist. After being assigned to a team that made analyses and projections for the Japanese economy, I got stationed in Germany in 1990 to cover the European economy, and subsequently moved to New York in 1996 and began covering the U.S. economy. In 2002 I came back to Japan, and then in 2004 I was transferred with my entire department to Nomura Securities. While there I served as Head of the Japanese Economic Research Section and Chief Economist in the Financial and Economic Research Center.

In 2012 I was nominated as a member of the Policy Board of the Bank of Japan. This is equivalent to being a member of a Board of Directors at a corporation, with outsiders being appointed. While I was doing the work of making economic forecasts for many years, I wanted to contribute not only to investors but to a much broader range of people, and that policy-related work was what would allow me to do that. So when they called on me, I accepted right away.

During my five years of service in the Bank of Japan, I was involved in decision-making for monetary policy and important business matters. Then in July 2017 I returned to NRI, and currently I’m engaged as an economist in the Financial Technology Solution Division.

Behind the monetary unification, there were historical beliefs that went beyond economic rationales

In my career, what’s had the greatest impact on my thinking as an economist are the events that occurred during my two overseas assignments. At my first post, I was tasked with observing up-close the steps toward the economic and monetary unification of East and West Germany in July 1990. The issues were, now that the economic wall between East and West had disappeared and their currencies were reunified, how would East Germany get back on its feet, and how would West Germany aid in the economic recovery? There were a great many challenges, and the citizens of West Germany were weighed down by higher taxes and other burdens. For a time East-West relations even deteriorated, but in the end I think it went rather smoothly.

In the latter part of my Germany assignment, England and Italy also went through currency-related crises. Europe’s monetary system was crumbling, leading to the emergence of a movement that sought to create a unified currency. When currencies get unified, every country involved sacrifices something. Germany in particular had to relinquish the well-trusted Mark and its decision-making authority in monetary policy matters. Even I was skeptical at first as to why it should move toward unification when it had so little to gain. But Germany was definitely to promote peace in the conviction that it would never again start a war, and it was grounded in the principle of achieving a unified Europe, and so it succeeded in the monetary unification. This had to do with beliefs that were rooted in Germany’s unique history, and the experience left a very deep impression on me.

Economic trends in the aftermath of a national emergency revealed the people’s character

During my next assignment in New York, I experienced the 9/11 terror attack in 2001. On the day of the attack, I was in a high-rise building near the World Trade Center, and I witnessed the planes flying into the buildings. Even at midday the area was pitch black from the dust, and I was confined in the building, and then got caught up in the chaos that followed. It was a truly harrowing experience.

When I went back to my regular duties, I started working on revisions to the economic forecast. When such a huge event occurs it’s important to consider how you should go about changing your outlook. That said, economists are flesh-and-blood people too, so our economic forecasts tend to be lower in response to a psychological impact. After thinking a lot, I predicted that the following year would see negative economic growth, but my prediction wasn’t too accurate.

At this time, I recalled the Great Hanshin Earthquake that happened in 1996. Nearly 6,500 people had perished then, so everyone was in mourning and a number of events were cancelled—and consumer confidence had dropped off not just in the Kansai region but also in the Tokyo area. Based on that experience, I figured that the same phenomina would happen in America as well. But Americans believed that if consumer activity were to weaken it would mean they’d surrendered to terrorism, and so they didn’t alter their consumer behavior. Although air traffic and hotel usage did decline sharply as you might expect, but airlines and hotels slashed their fares and rates, and Congress also straight away passed a bill to increase appropriations. These efforts succeeded, and from the fall of 2001 through the spring of 2002, the U.S. economy quickly rebounded.

Having macro and micro perspectives, and keeping a cool head

What I learned through my experiences in Germany and the U.S. was that you can’t operate by conceiving of anything as the same as Japan. Making economic analyses and forecasts requires you to consider the particular national character, disposition, and history of every country.

As an economist, when you formulate an economic forecast, it’s important not only to grasp things on a macro level using economic statistics, but also to combine the micro-level information obtained through experiences and interviews. For instance, when the Great East Japan Earthquake occurred, I made countless trips to the region, where I observed the progress of the recovery work and interviewed the local residents. Even when no such major event has occurred, I take care not to rely solely on the economic indicators, and instead to visit department stores and other shops, and make a more comprehensive economic analysis and forecast in light of real observations.

Conveying information assertively from a neutral position

At present, I’m doing analyses of monetary policies and various financial matters, giving lectures, writing reports, and doing interviews with clients and foreign investors based on those analyses. In addition to writing columns and contributing to magazines, I also get interviewed quite often by the media. Monetary policies are important so whenever you think the policies are biased, you need to say so distinctly. My intention is to continue conveying information assertively from a neutral standpoint.

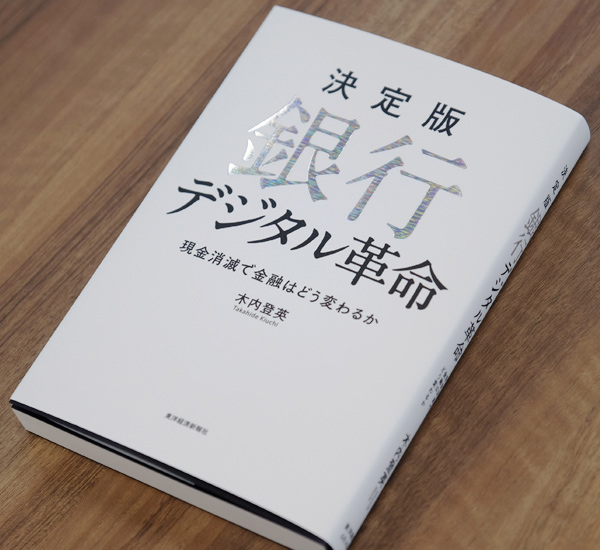

I had been thinking about writing books as something what convey my opinion so during the holidays I’m diligently engaged in book writing at a café near my home. The first two books that I wrote since returning to NRI are about monetary policy, and the third involved digital currencies. Blockchain mechanism is outside my field, but when it comes to currencies as a whole, I can apply my experience and knowledge. I would like to deepen my thought in broad areas including themes relevant to NRI’s businesses.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.