Mar. 31, 2020

Summary

- To ascertain the effects that the spread of Covid-19 is having on consumers’ daily lives, Nomura Research Institute (NRI) conducted an urgent internet survey of approximately 3,000 Japanese respondents in March 2020.

- Nearly 80% of respondents said they believed economic conditions or stock prices this year would deteriorate/decline, while close to 50% expected their household income to fall. These figures were significantly higher than in the survey done at the end of last year.

- Since the spread of Covid-19, respondents have been shopping in-store for daily necessities less frequently, yet they are stocking up whenever they do shop and making internet purchases more than before. This suggests that, at least in terms of daily necessities, short-term expenditures are likely on the rise.

- The government should periodically tabulate and publish cashless payment information in certain categories, e.g. by business type, by prefecture, etc. By using cashless payment information, it would be able to ascertain—almost in real time—which specific sectors and regions are seeing a downturn in consumer spending, and to what extent this is happening. Together with other data such as behavioral changes gleaned from questionnaire surveys, this would therefore serve as a useful information source for policymakers and corporate managers.

80% of People Expect Economic Conditions to Worsen Going Forward

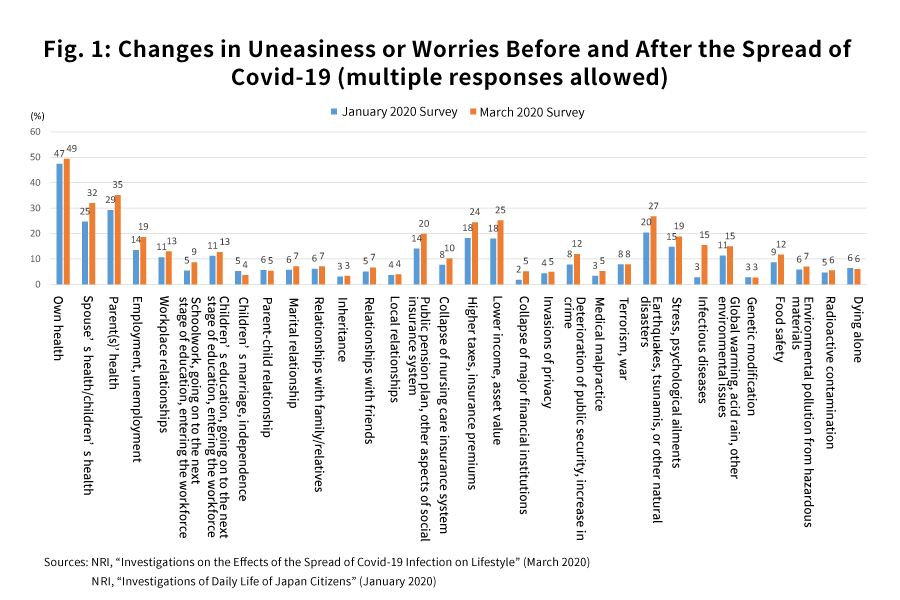

In order to ascertain the effects that the spread of Covid-19 is

having on consumer activity and psychology, Nomura Research Institute

(NRI) conducted an urgent internet survey of approximately 3,000

Japanese persons in March 2020. Compared with the internet survey that

NRI conducted in January on people’s daily activities, this urgent

survey revealed a definite rise in people’s uneasiness regarding their

own health and that of their spouses, children, parents, and other

family members, as well as a growing anxiety among the population

toward contagious diseases. A higher percentage of persons also said

they were anxious about declining incomes and asset values, rising

taxes and social insurance costs, and a breakdown of the social

security system, expressing greater unease about an uncertain road

ahead (Fig. 1).

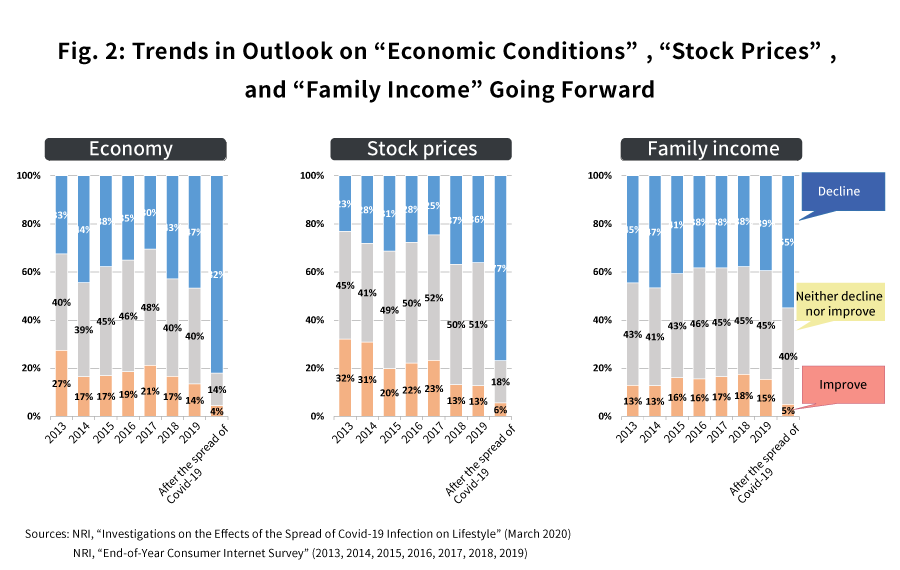

In addition, whereas 47% of respondents said at the end of 2019 that

they believed economic conditions would “worsen” going forward, this

number grew substantially to 82% in the current survey (March 2020).

And although 36% of respondents thought at the end of 2019 that stock

prices would fall, that number grew to 77% in March 2020. While the

percentage of those expecting their household incomes to fall exceeded

50%, this could suggest that the decline may not be as severe as the

deterioration of the economy and stock prices (Fig. 2).

People Going Out Shopping Less, Bulk Buying and Internet Shopping on the Rise

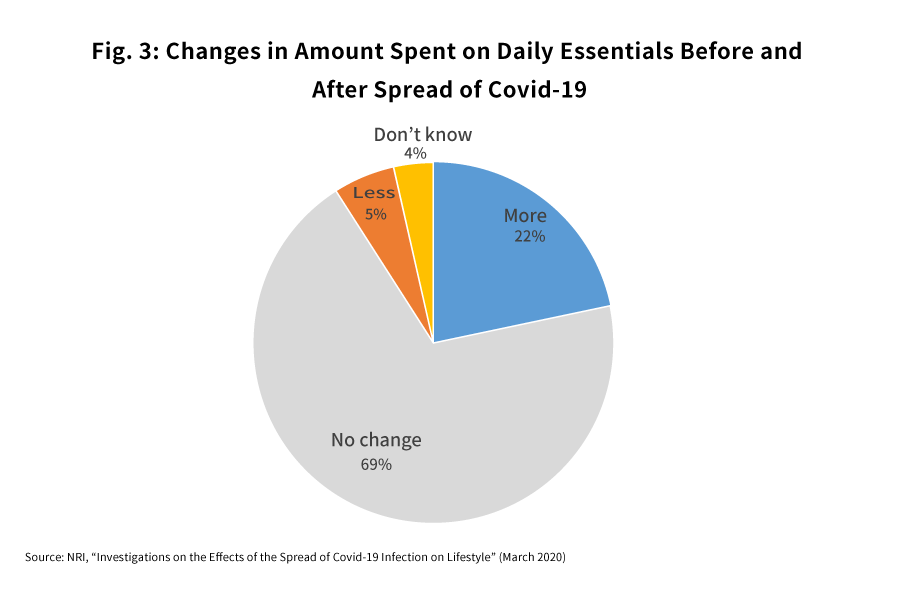

Following the spread of Covid-19, the call for people to abstain from

travel and other non-essential/non-urgent outings caused a slump in

related consumer activity. Yet it seems that spending on food,

everyday sundries, and other daily essentials has increased in the

wake of the spread of Covid-19 (Fig. 3).

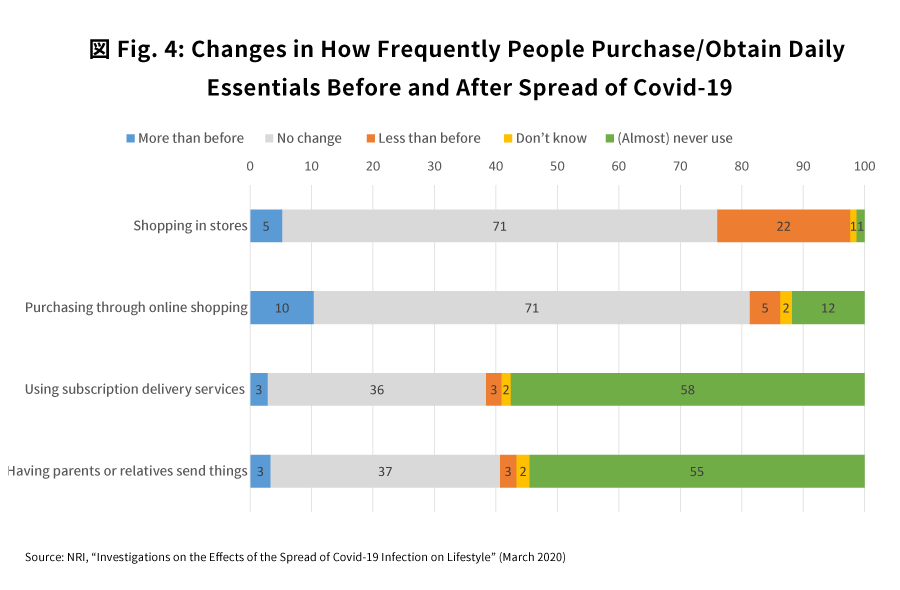

The percentage of respondents who said they were buying daily

essentials in stores “less than before” (22%) was significantly higher

than those who said “more than before” (5%), revealing that people are

going out less often and are tending to buy more in bulk per shopping

trip. Further, more respondents said they were purchasing everyday

essentials online “more than before” (10%) as opposed to “less than

before” (5%), revealing that people are refraining from going out and

instead taking advantage of online shopping opportunities more, if

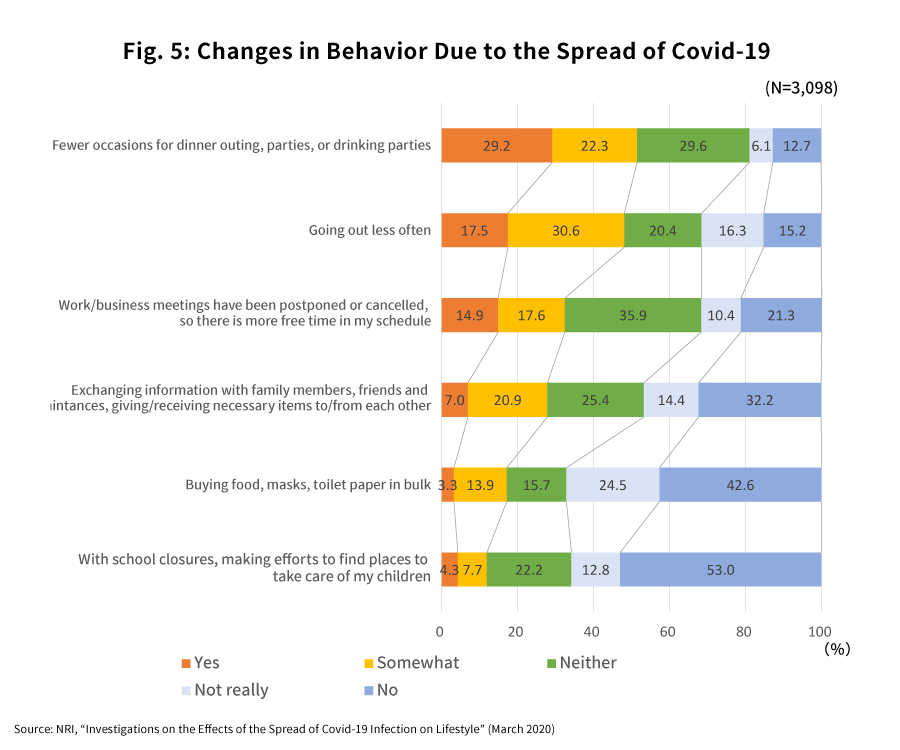

only slightly (Fig. 4). Looking at the answers to another survey

question, we see also that at the time this survey was conducted

(around March 20, 2020), the percentage of respondents who said they

“are going out less” stood at 48.1% overall, or nearly half of all

respondents (Fig. 5).

Two Trends in Lifestyle Preservation: Stocking Up on Daily Essentials and Curbing Overall Spending

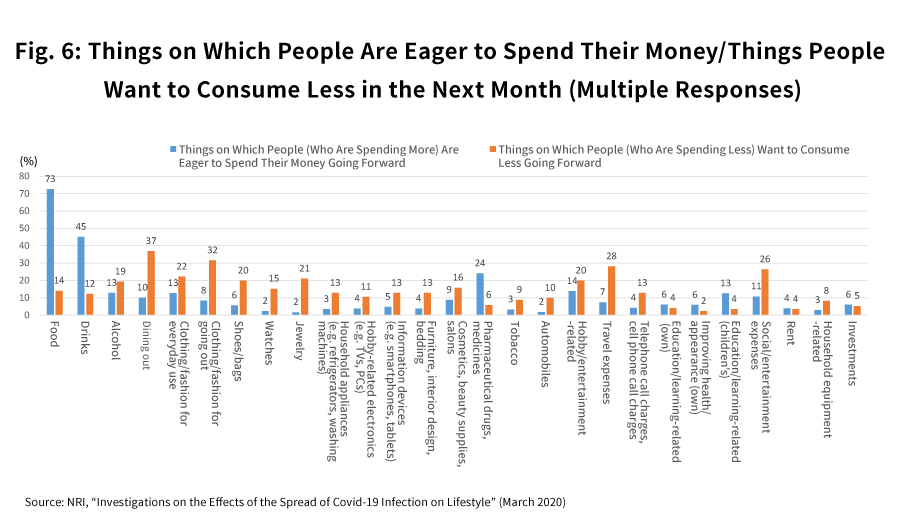

When it comes to things on which people actively wanted to spend their

money in the next month, and those on which they wanted to curb

spending, to a certain degree the results obtained were as expected.

Looking strictly at those whose spending on daily essentials had gone

up, we see that respondents cited “food” (73%), “drinks” (45%), and

“prescription drugs and medicines” (24%) as the top items on which

they eagerly wanted to spend money going forward, reflecting a desire

to safeguard their lifestyles by stocking up on everyday essentials

and drugs. Conversely, if we look only at those who were spending less

on these daily necessities, we see that “dining out” (37%),

“clothes/fashion for when going out” (32%), “travel expenses” (28%),

and “social/entertainment expenses” (26%) were the responses given

most often when it came to areas where people wanted to spend less

going forward. This revealed another tendency to protect one’s way of

living by cutting expenses not only on daily necessities but on

non-essentials as well (Fig. 6).

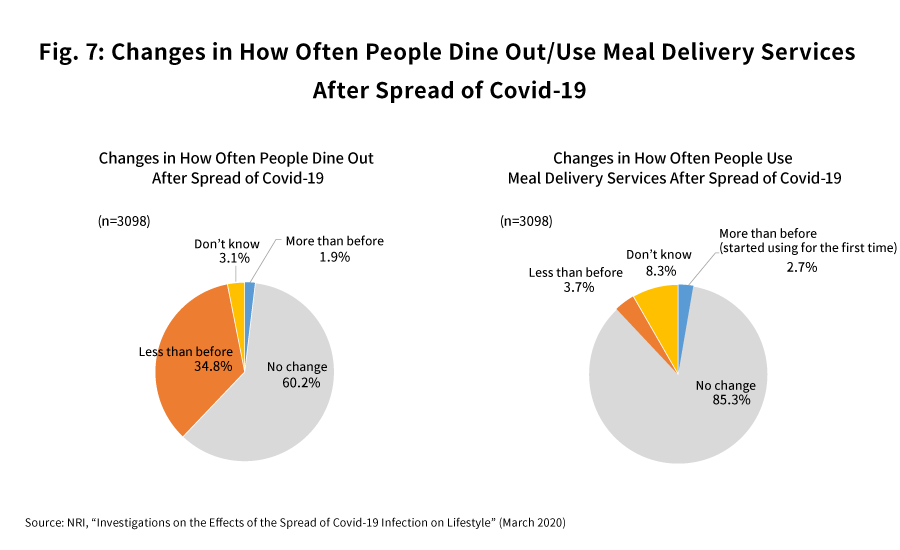

As for how often people are eating out, 35% of respondents said that

since the spread of Covid-19 they have been dining out “less than

before”, meaning that demand for restaurant dining has fallen, as

expected. However, the use of meal delivery services did not see a

conspicuous increase, at least as of the time of this survey. It can

be inferred that at present, the reduced frequency of dining out is

not so deeply tied to the use of such delivery services, and that more

people are cooking at home in conjunction with their bulk buying of

food (Fig. 7).

Consumers Turning Their Attention to Companies’ Stances in Wake of Spread of Covid-19

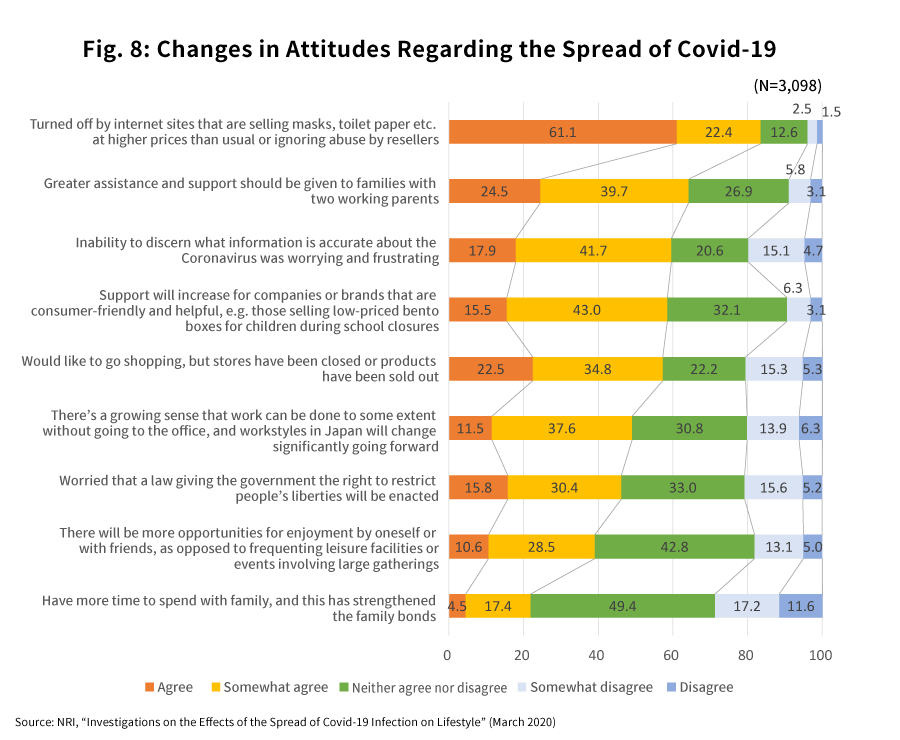

When asked about how their attitudes have changed in the wake of the

spread of Covid-19, 84% of persons affirmed (total percentage of

“agree” or “somewhat agree” responses) that they are “turned off by

internet sites that are selling masks, toilet paper etc. at higher

prices than usual or ignoring abuse by resellers” (Fig. 8). In

addition, some 59% of respondents agreed that “support will increase

for companies or brands that are consumer-friendly and helpful, e.g.

those selling low-priced bento boxes for children during school

closure.” These results show consumers are more interested in and

paying more attention to the stances that companies are taking in the

wake of the spread of Covid-19.

Furthermore, nearly half of respondents (49%) agreed that “there’s a

growing sense that work can be done to some extent without going to

the office, and workstyles in Japan will change significantly going

forward.” We can see that some people feel new workstyles including

teleworking will become more prevalent from here onward.

Utilize Cashless Payment Information to Accurately and Immediately Grasp Consumer Trends

Our questionnaire survey offers a glimpse at fluctuations in consumer

spending by sector, behavioral changes in shopping and shifts in

consumer psychology as measured before and after the spread of

Covid-19. That said, it does not allow us to grasp which specific

sectors and regions are actually seeing lower (or higher) consumer

spending, and to what extent this is happening. Given that the

government’s surveys of household finances are published about two

months after the fact, they too lack an immediacy.

In this survey, we also asked respondents whether they had seen or

heard any (seemingly) fake news regarding the spread of Covid-19, and

in fact over half of them answered that they had found what appeared

to be fake news. In addition to word that toilet paper would be sold

out, that heat would kill the virus, and other such information,

speculative and exaggerated accounts have also appeared online

regarding economic conditions. Fragmentary bits of information about

sales in specific industries (e.g. department stores), for instance,

are the only data publicly available that can be considered

reliable.

What we need is more comprehensive and immediate information on

consumer activity. The aspect we need to focus on in particular is

cashless payment information. As of February 2020, Japan had

approximately one million registered member stores offering cashless

payments or reward points, with these stores being compensated for the

reward points redeemed based on information about the value of

cashless payments made there. By employing this framework, we can

immediately obtain a general view of consumer spending information in

Japan. Furthermore, the more that Japanese people make use of cashless

methods, the more accurate our overall picture of consumer activity

will be. What the government needs to do is further promote cashless

payments, and collect and periodically publish such information by

business type and prefecture etc., not only in order to provide

accurate information to people, but also to utilize it as a vital

information source that will enable policymakers and corporate

managers to make decisions swiftly.

[Reference] Survey Overview

|

■Survey name |

Investigations on the Effects of the Spread of Covid-19 Infection on Lifestyle |

|

■Survey period |

March 2020 |

|

■Survey method |

Internet survey |

|

■Survey subjects |

Men and women aged 15-69 across the country |

|

■Number of valid responses |

3,098 people |

|

■Main survey items |

|

|

◇Information gathering behavior |

…Ways of gathering information, and any changes thereto |

|

◇Communication |

…Attitudes towards parent-child relationships, marital relationships, local relationships |

|

◇Workstyle |

…Work conditions, work attitude |

|

◇Consumer values |

…Attitudes toward consumption, areas where subjects are eager to spend their money going forward |

|

◇Actual consumer activity |

…Inclination to dine out, use meal delivery or online services etc., and any changes thereto |

|

◇Overall lifestyle, life planning |

…Economic/income prospects, any uneasiness or worries currently faced |

Authors

Takeshi Mori

Center for Strategic Management & Innovation

Nomura Research Institute

Hiroyuki Hayashi

Marketing Science Consulting Department

Nomura Research Institute

Hiroyuki Nitto

Consulting Division

Nomura Research Institute

Contact Us

Media Inquiries:

-

Corporate Communication Department

Nomura Research Institute, Ltd.

TEL: +81-3-5877-7100

Inquiries about the proposals:

-

Center for Strategic Management & Innovation

Nomura Research Institute, Ltd.