May 01, 2020

Summary

- During the SARS outbreak in 2003, Chinese retail and service companies could only sit and wait for the crisis to pass. Now, seventeen years later, Chinese companies that have actively promoted digital transformation are not just waiting amidst the crisis, but are actively working to integrate online and offline business (OMO), and have increased sales even while physical stores are unable to function.

- Fresh food e-commerce, live commerce, and food delivery services are typical examples of OMO strategies. Some companies posted sales of one million yuan per day, successfully overcoming a difficult situation.

- The rapid transformation of these business models was the result of insight into changes in the consumer experience due to advances in digital technology, and the digital transformation tackled in close coordination with tech companies.

- It is expected that contact control measures will continue in the future, with no prospect of the Covid-19 situation returning to normal. The retail and service industries that provide services involving human contact are undergoing major changes. Balancing infection control and economic activity requires a step forward in digital transformation.

Consumer behavior changing with “stay-at-home life”

In China, real economic activity was almost entirely suspended for

a period of time due to severe restrictions on going outside that

were introduced to cut off transmission routes. People have

disappeared from physical stores, with shopping done online and

food being delivered. Conversely, it can be said that the rapid

progress of digital social infrastructure in China in recent years

has prevented people from rushing to physical stores, and

consequently has reduced the transmission risk of the virus.

Chinese retailers accelerated digital transformation while it was

almost impossible to continue to operate physical stores other

than supermarkets. During the SARS outbreak in 2003, companies had

no choice but to wait for things to return to normal, but now,

seventeen years later, they have switched to offense to stop the

decline in sales by utilizing the digital infrastructure that they

have put in place.

Data-driven business transformation

Tencent-funded Chinese retail giant Yonghui Superstores has more than 1,000 supermarkets (stores), but just like Alibaba's “Hema Fresh,” it is focusing its efforts on e-commerce for fresh foods (online sales). It takes orders using its own app and completes delivery in a short time. For the week from January 24 to January 30 during the stay-at-home period, orders in the Fuzhou area, where the company is based, grew more than six-fold compared to the same period last year. On February 8th, Yonghui Superstores broke through 300,000 deliveries of fresh foods in one day, but because of the launch of Tencent’s cloud system, they were able to handle this volume without the system going down.

It would be an underestimation to simply think of this as what we

call an “internet supermarket” in Japan. With the demand for fast

delivery of fresh foods, Yonghui Superstores was able to respond

to such a rapid increase in orders because it had implemented

Tencent Cloud's smart retail solutions two years earlier.

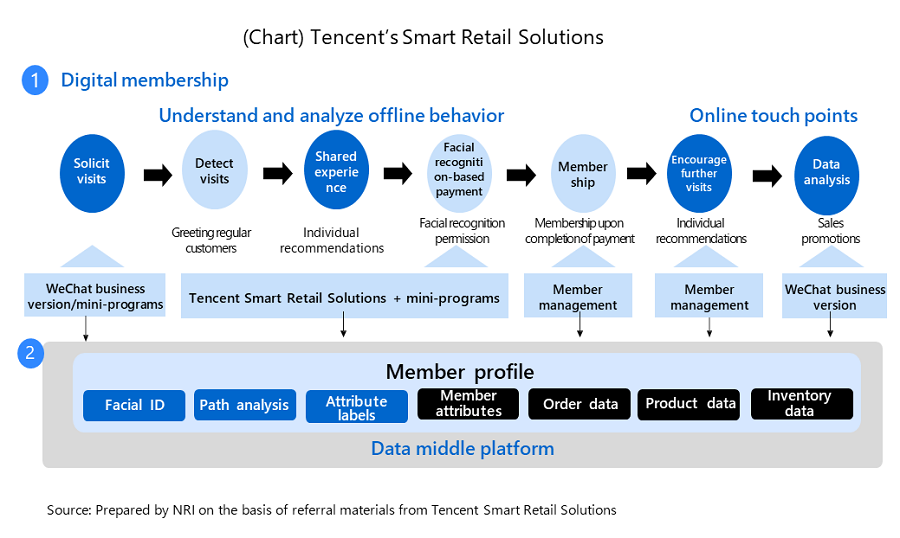

First, how can one get customers with them suddenly staying at

home? For the past few years, “Yonghui Superstores” has been

focusing on increasing online “interactions” with consumers by

utilizing Tencent's mini programs in store operations. As of the

end of August 2018, it had already gained 8.5 million digital

members.

The next question is, is it possible to understand customers and

somehow deliver products in a short time? Tencent's data analysis

and visualization tools enabled purchase forecasting, consumer

preference analysis, and consumer attribute analysis, among other

things, leading to increased consumer purchases. In addition, by

launching a cross-business data middle platform (Data Middle

Platform), Yonghui Superstores linked together member data,

product data, and inventory data, and achieved improved work

efficiency from order receipt to product pickup and delivery.

The data-driven business transformation that was being actively pursued since before the outbreak of Covid-19 has demonstrated its true power in this unexpected situation (Chart).

Retailers expanding into live commerce

“Live commerce” is a new type of sales method that lets customers purchase products while watching live video. The target products for live commerce are mainly daily necessities such as cosmetics, fashion, and foods, and many local specialty products such as dried foods and fruits are also sold. Its characteristics are very different from so-called YouTuber and TV mail orders. Through interactive communication with viewers during livestreams, live commerce lets viewers gain a deeper understanding of products as if they were actually there, which enhances the motivation to buy, and if there is a product that a customer wants, it can be ordered on the spot. This business model is a unique style created born out of China's digital economy, where livestreaming and other social media, e-commerce, and mobile payments are thriving.

During the stay-at-home period, stores other than those selling

daily necessities like fresh food were mostly closed. In order to

break the impasse, retail companies with physical stores have

expanded into live commerce one after the other. According to a

report from the Chinese research institute iiMedia Research, in

2017, the market size of live commerce in China was 19 billion

yuan (about 30.4 billion yen), but grew rapidly to 433.8 billion

yuan (about 6.9 trillion yen) in 2019. Riding on this wave, it is

expected to more than double by 2020 to exceed 961 billion

yuan.

Zhejiang Red Dragonfly Footwear Co., Ltd. (hereinafter referred to

as “Red Dragonfly”), a major shoe sales chain founded in 1995, is

one such company. The income of 4,000 physical stores nationwide

dropped to zero, and fixed costs such as monthly rent became a

heavy burden. On February 8th, Red Dragonfly CEO Qian Jinbo

quickly launched a project called the “Dragonfly Grand Strategy”

and set out a strategy to shift to online sales. Until then,

online sales of Red Dragonfly were less than 100,000 yuan per day,

and most were made at physical stores. On February 14, one week

after the shift to online sales, sales exceeded one million yuan

for the first time. In February, which was most affected by

stay-at-home orders, the company achieved great results, with

average daily sales exceeding two million yuan.

The success of Red Dragonfly is thanks to the digital

transformation it began in 2018 in close coordination with Alibaba

Cloud. Alibaba Cloud provides new retail solutions consisting of

five steps for companies seeking digital transformation, namely,

transitioning systems into the cloud, digitizing touch points with

customers, shifting to online operations, shifting operations to a

data-driven approach, and implementing smart strategy formulation.

The first step that Red Dragonfly has taken is to promote

multi-channel sales through a cross-business data middle platform.

Rather than an extension of an online supermarket that delivers

orders via online channels from store inventory to customers'

homes, by utilizing all data, from online to offline, artificial

intelligence and algorithms can be used to assist in tasks that

previously depended on experience and intuition, leading to

optimal solutions from product replenishment to recommendations

and product improvement.

In the response to Covid-19, two other initiatives discussed below

produced a great effect.

-

Dingtalk connects customers, salespeople and

companies

The first to be launched was Dingtalk, a business communication and collaboration platform developed by Alibaba Cloud. In the one week from February 8th to February 15th, the Red Dragonfly headquarters used Dingtalk to hold 434 video conferences with its member stores and distributors. The policy for shifting to online sales was immediately communicated to about 8,000 salespeople, which led to a prompt response.

Over the course of one week, salespeople created more than 500 chat groups with their own members, covering hundreds of thousands of members. This was achieved smoothly because of the CRM efforts that Red Dragonfly had made using Dingtalk prior to Covid-19. A customer can become a member of Red Dragonfly simply by scanning the Dingtalk barcode provided by the salesperson, and the customer's sales are recorded in the salesperson's performance. If the salesperson fills in the preferences of each customer, that information is linked to the system and reflected in the company database. With this method, more than one million members were acquired before the outbreak of the coronavirus. It can be said this mechanism is to thank for the company’s success in interacting with many customers even after the outbreak of the coronavirus. -

Focus on live commerce

In order to solve the problems of poor customer experience due to online sales, where one cannot try on shoes in a physical store, for example, CEO Qian decided to go into live commerce. 108 store managers were chosen and worked on live product promotion. CEO Qian himself appeared in a two-hour livestream from 10:00 to 12:00 one morning, which was watched by 435,300 people and achieved sales of over 500,000 yuan (about 8 million yen). Sales at its dedicated e-commerce store that day increased by 114%.

Success stories like Red Dragonfly are by no means isolated cases. In the travel industry, which was also seriously affected, founder James Liang of Ctrip, a major travel agency, flew to Hainan, an island which is said to be “the Hawaii of China,” and personally appeared in livestreams from there. The first broadcast on March 23 brought in hotel reservations of 10.25 million yuan. This filled three months of vacancies for hotels on Hainan. In addition, various industries have entered live commerce, including companies such as department store giant Yintai Commercial, apparel giant Septwolves, home appliance manufacturer Haier, and automobile manufacturers Tesla and FAW. These companies are leveraging live commerce as an important tool for their digital transformation, increasing online interaction with their customers and striving to survive the Corona crisis.

Implications for Japanese companies: Innovative corporate culture turns “crisis” into “opportunity”

The fight against Covid-19 is a challenge that no country,

including Japan, has ever experienced. Customers flooded into

stores that were still operating despite guidance to stay at home,

and the shortened business hours resulted in congestion, so Tokyo

made an unusual call to “reduce shopping to about once every three

days.” Because of differences in digital infrastructure, the

digital transformation case studies of Chinese companies that

faced the battle one step ahead cannot be said to be immediately

applicable in Japan. However, proactive efforts in digital

transformation to date have shown their worth, and the actions of

Chinese companies which, even in difficult times, were able to

take action and swiftly turn crisis into opportunity contain many

lessons that Japanese companies should learn post-Corona.

The examples of Chinese companies introduced in this paper have

made full use of the solutions provided by tech giants such as

Tencent and Alibaba. In science, innovative progress is sometimes

referred to as “standing on the shoulders of giants” (Newton), but

Japanese companies, which are said to have a tendency to do

everything in-house, should also consider dramatically expanding

their horizons by getting onboard with the services of innovative

companies. China, which has resumed social activities, is still

requiring companies to make efforts such as “contactless service”

to minimize contact with customers. Retail companies that have

resumed sales are also required to have data-driven management

that doesn’t just rely on the customer service of store employees,

but also highlights products that customers want at just the right

level and makes appropriate recommendations for individual

customers.

China’s development of “live commerce” unique to itself is also

illuminating. With the development of digital technologies such as

5G and AR/VR, it will be possible to make sales in the digital

realm as if you are there in a physical store. There are actual

cases of this new phenomenon where a famous influencer sells tens

of thousands of products in one go in just a few minutes. Existing

business models that depend solely on sales at physical stores may

one day face ruin at the hands of new players in the digital

age.

In an innovative and dynamic business environment, new business

models are born one after the other, and existing ones disappear.

Schumpeter called it “creative destruction.” In fact, even amid a

volatile and unpredictable situation like the Corona crisis, an

innovative corporate culture that boldly takes on the challenge of

digital transformation can turn “crisis” into “opportunity.”

Authors

Takeshi Mori

Center for Strategic Management & Innovation

Nomura Research Institute

Zhihui Li

Center for Strategic Management & Innovation

Nomura Research Institute

Contact Us

Media Inquiries:

-

Corporate Communication Department

Nomura Research Institute, Ltd.

TEL: +81-3-5877-7100

Inquiries about the proposals:

-

Center for Strategic Management & Innovation

Nomura Research Institute, Ltd.