August 16, 2021, Nomura Research Institute, Ltd. ("NRI") will begin providing an optional liquidity risk monitoring service (the "Service") on T-STAR/GX in response to the recent “Amendment to Risk Management Regulations of Publicly Offered Investment Trusts” set by Japan’s Investment Trust Association (“JITA”). NRI’s new service will enable clients to comply with the current regulations governing liquidity risk management of publicly offered investment trusts.

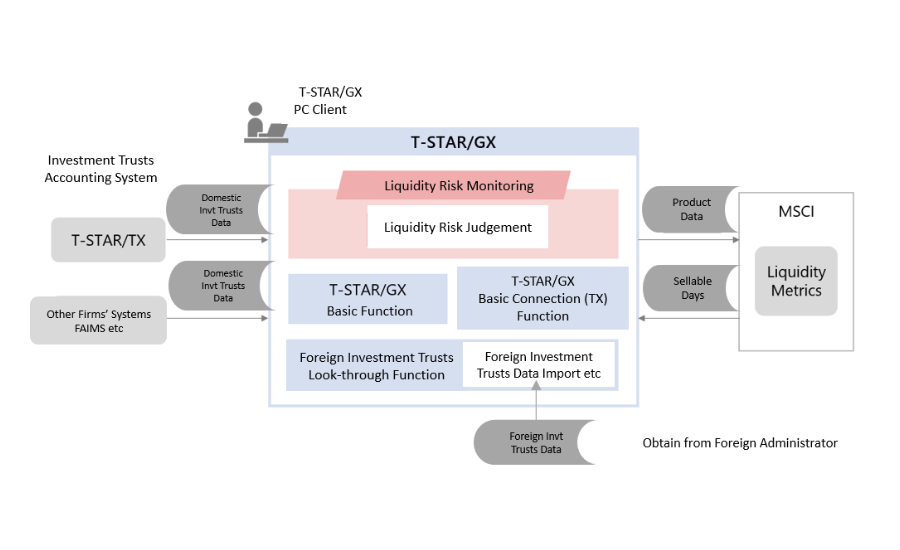

The Service is optional on NRI's T-STAR/GX multi-user service, already in use by a majority of Japanese asset managers, and leverages MSCI Inc. (NYSE: MSCI)’s LiquidityMetrics 1 liquidity risk calculation model, By utilizing NRI’s new service, asset managers using T-STAR/GX are able to calculate and assess liquidity risk efficiently while minimizing the additional cost for regulatory compliance.

Growing need for liquidity risk management in publicly offered investment trusts

Interest in liquidity risk management, now common in the United States and other countries on growing regulatory demand, has also increased recently among asset managers in Japan. On top of this, the Financial Services Agency and the JITA established the “Amendment to Risk Management Regulations of Publicly Offered Investment Trusts”, which are scheduled to go into effect from January 2022.

Services focused on reducing asset managers’ operational burdens

The strengthened regulatory environment naturally increases the burden on asset managers. NRI provides the Service with the dual aim of responding to new regulations while reducing asset managers’ operational burden to the extent possible.

Major features of the Service

(1)Significantly reduce the burden of data registration by using existing T-STAR/GX management data

As we use data on investment trusts and their holdings that are already managed in T-STAR/GX, in general, companies using the Service do not have to register new data on investment trusts and holdings for the purpose of managing liquidity risk, with the exception of some attribute information.

(2)Reducing operational burden through NRI's strong support

NRI verifies and sets up and maintains default values for various setting required by financial authorities, such as thresholds for the determination of liquidity risk and stress scenarios used in stress testing, thereby reducing operational management burden of clients using the Service.

(3)Leveraging MSCI’s wealth of experience in the risk-management field

The Service automatically links T-STAR/GX data to MSCI’s LiquidityMetrics to calculate fund liquidity risk such as that created by holding stocks and bonds in the portfolio.

NRI will continue to provide services to support efficient risk management and more sophisticated risk management in the asset management industry in the future.

-

1

MSCI is a leading provider of critical decision support tools and services for the global investment community. MSCI's LiquidityMetrics is used globally in the asset management industry and is licensed to over 4,000 funds.

About NRI

Founded in 1965, NRI is a leading global provider of system solutions and consulting services, including management consulting, system integration, and IT management and solutions for the financial, manufacturing, retail and service industries. Clients from all layers of these individual industries partner with NRI to tap NRI’s research expertise and innovative solutions across the organization to expand businesses, design corporate structures and create new business strategies. NRI has more than 13,000 employees in more than 50 offices globally including New York, London, Tokyo, Hong Kong, Singapore, and Australia. NRI reports annual sales above $4.8 billion. NRI is rated “A” by S&P Global Ratings Japan. For more information, visit https://www.nri.com/en

Contact Us

Media Inquiries:

Hale Sterling

Corporate Communications Department, Nomura Research Institute, Ltd.

TEL:+81-3-5877-7100

E-mail:

kouhou@nri.co.jp

Inquiries About the Service:

Asset Management Services Dept.

Kobayashi, Nomoto, Baba

TEL:03-5877-7583

E-mail:

risk-management-info@nri.co.jp