Tokyo, March 9, 2023 – Australian Investment Exchange Limited (“AUSIEX”), a group company of Nomura Research Institute, Ltd. (Headquarters: Tokyo, Japan; Chairman, President & CEO Shingo Konomoto, “NRI”) headquartered in Australia, began offering an “ESG Risk Rating Information Provision Service” (the “Service”) for Australian investors in October 2022.

The Service displays ESG risk ratings for Australian listed companies on the stock trading systems AUSIEX provides for investors. The ESG risk rating information provided by Sustainalytics

1

, a group company of Morningstar, is obtained by analyzing, evaluating, and scoring such factors as the state of ESG initiatives and the will to solve problems at each company, and the extent of the risks likely to affect that company’s businesses.

AUSIEX’s stock trading system, back office system and operational services such as call center operations are already used by investors in Australia. By adding the Service to those offerings, AUSIEX seeks to allow investors to utilize ESG-related indicators alongside corporate financial indicators, and in turn to enable companies to better facilitate their initiatives for ESG.

Background and Characteristics of the Service

Amidst rising Australian interest in ESG for the realization of a sustainable society, assessments of target company ESG initiatives are playing an ever-increasing role in the investment decisions. According to Responsible Investment Association Australasia (RIAA), an Australian ESG promotion organization, the scale of ESG investment in Australia (investment activity that incorporates ESG elements into the decision-making process) grew to AU$1.54 trillion by September 2022, with 43% of domestic investment trusts operated under ESG investment.

2

These facts make clear that ESG risk ratings are given serious weight when Australian investors make investment decisions.

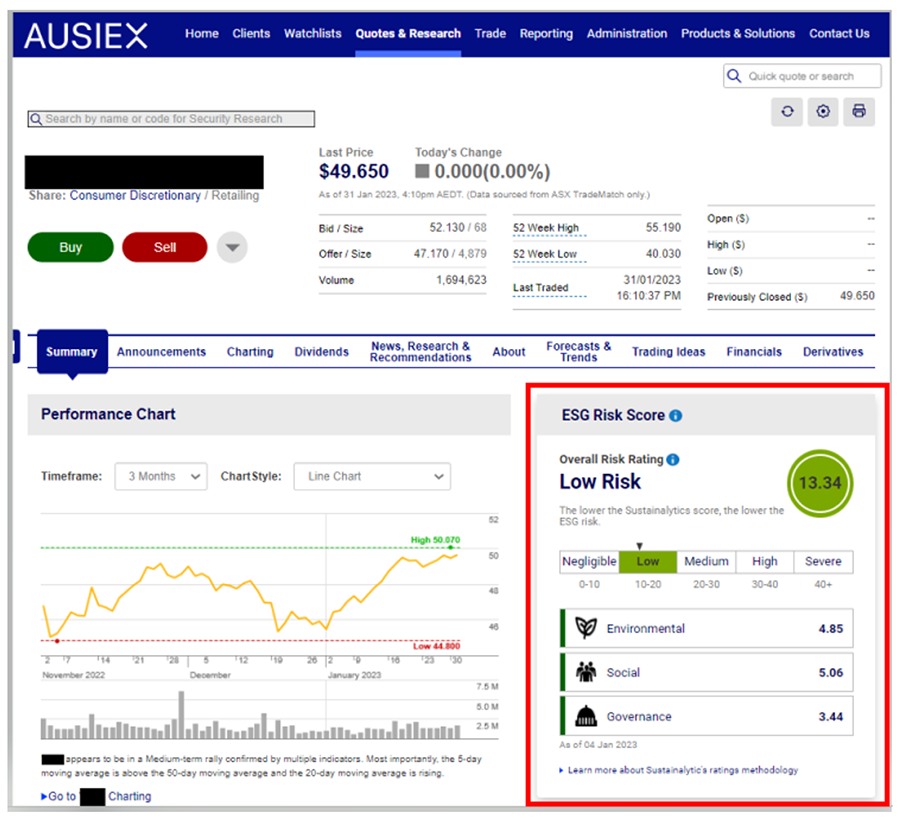

In response to the expansion of ESG investment, AUSIEX has begun displaying ESG risk ratings for each listed company on the stock trading systems investors use for their investment decisions. The overall ESG risk is shown as a score, and scores for “Environmental”, “Social”, and “Governance” are displayed below the overall score (see figure).

Figure: Example of Stock Trading System Company Information Display

(ESG risk rating in box at bottom-right)

The methods of calculating these scores are as described below. In all cases, lower numbers denote lower risk.

● Overall ESG Risk Score

For each of the major ESG issues faced by a company, regardless of the possibility of risk management through company initiatives, the extent of the ESG risk in an unmanaged state is assessed, and the scores are added together to obtain the total. The overall score is classified into one of five levels: Severe; High; Medium; Low; or Negligible.

● Scores by Item

Sustainability is assessed and scored on the basis of the performance of the company’s initiatives etc. for “Environmental”, “Social”, and “Governance” issues.

AUSIEX will build on the Service by spearheading development of educational content for investors etc. and offering new standards to be used as references for investment decisions. Through these business activities, AUSIEX and NRI Group aim to raise awareness of ESG and SDGs among stakeholders and society, and to contribute to the creation of a sustainable society into the future.

-

1

Sustainalytics is a leading company for the provision of ESG surveys, ratings, and data, and has supported the development and practical implementation of responsible investment strategies by worldwide investors for more than 25 years. For details, see the following website:

https://www.sustainalytics.com/ -

2

Source: Benchmark Report - Responsible Investment Association Australasia (RIAA),

https://responsibleinvestment.org/wp-content/uploads/2022/09/Responsible-Investment-Benchmark-Report-Australia-2022-1.pdf

For Reference

Details of AUSIEX’s Business and Services

AUSIEX holds a financial license and a seat on the Australian Securities Exchange, and provides Australia’s major financial institutions and IFAs (independent financial advisors that do not belong to major financial institutions etc.) with IT systems and operations services in back-office areas such as securities trading management and portfolio management. Through independently developed IT systems and standardized operations, AUSIEX provides high-added-value services to customers including major securities firms, wealth management companies, and IFAs serving more than 10,000 members.

NRI Group’s ESG Initiatives:

- Website Compiling Relevant Information: https://www.nri.com/en/sustainability

- Integrated Report: https://ir.nri.com/en/ir/library.html

- ESG Data Book: https://www.nri.com/en/sustainability/library/back_number

Contact Us

Inquiries about this news release:

Lawrence Hale Sterling, Kayano Umezawa

Corporate Communications Department

Nomura Research Institute, Ltd.

TEL:+81-3-5877-7100

E-mail:

kouhou@nri.co.jp