Tokyo, November 21, 2022 – Nomura Research Institute, Ltd. (Headquarters: Tokyo, Japan; Chairman, President & CEO Shingo Konomoto, “NRI”) conducted an online survey (the “Survey”) of 4,128 male and female car owners in Japan, the U.S., Germany, and China on automobile sales discussions and price negotiations between July 26 and August 17, 2022.

New ways to sell cars are emerging today, with consumers now able to purchase electric vehicles over the Internet instead of the conventional approach of visiting dealerships and negotiating prices in-person. The Survey was designed to study how consumers feel about these new methods of sales discussions and price negotiations. Considering the Survey’s findings, NRI believes that car sales discussions will take the hybrid format of online and in-person. The key findings of the study are set forth below.

Sales discussions

1. Over 80% in China embrace online sales discussions. But more than 60% in each of the four countries say in-person discussions are still necessary

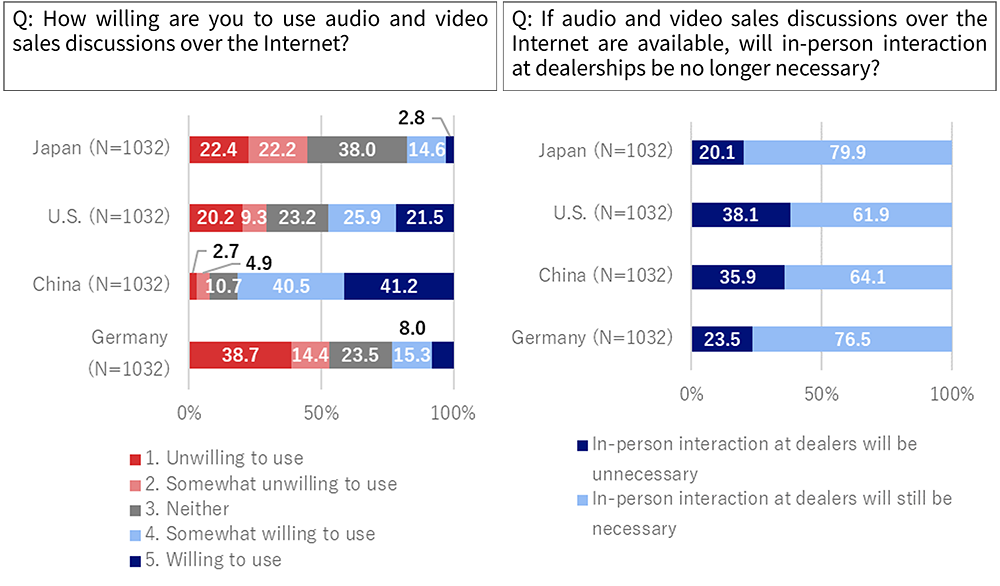

Chinese consumers were most eager to use online audio and video sales discussions (“online sales discussions”), with 81.7% saying they are “willing to use” or “somewhat willing to use” such sales discussions. In other countries, those eager to use came out to 47.4% in the U.S., 23.3% in Germany, and just 17.4% in Japan (Fig. 1).

Only less than 40% in each country, however, said that, “in-person interaction at dealerships will no longer be necessary” as long as online sales discussions are available. Even in China, where more consumers showed a strong eagerness to use online sales discussions, 64.1% said “in-person interaction at dealerships will still be necessary,” indicating that they feel online sales discussions will not entirely replace in-person discussions, but that consumers likely prefer a hybrid model in which both in-person and online methods supplement each other.

Fig. 1: How respondents feel about online sales discussions and in-person interaction

Source: NRI “Survey on Automobiles” 2022

Single answers/( ) indicate sample size

2. The top reason for wanting in-person discussions is to “inspect the actual vehicle” in all four countries. Expectations for VR test rides are the highest in China, followed by Japan, Germany, and the U.S.

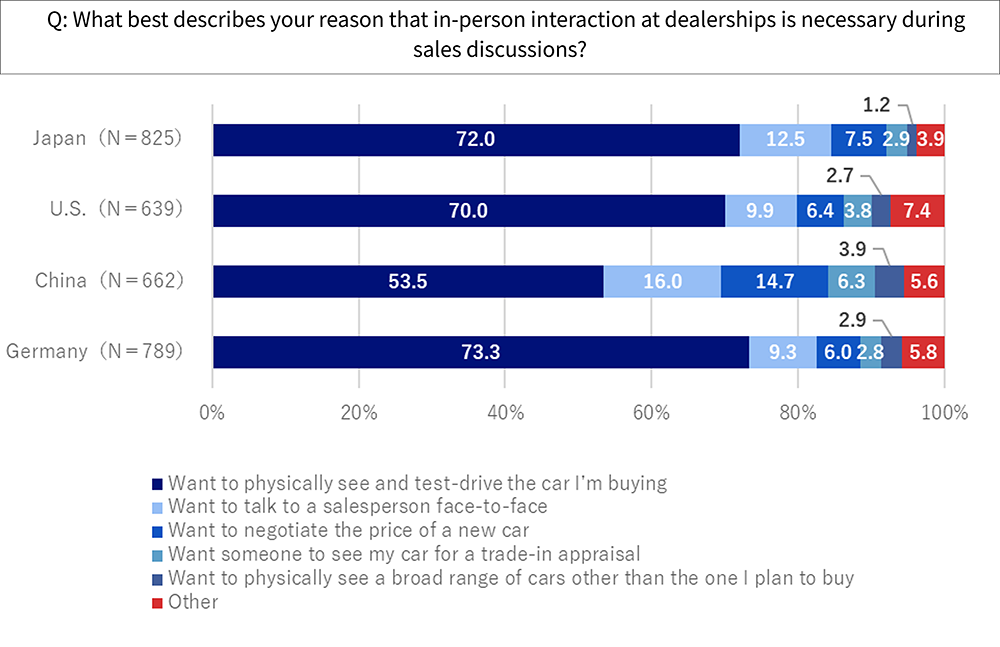

As for why consumers think in-person interaction at dealerships is still necessary for sales discussions, the most common answer was “to physically see and test-drive the vehicle I’m buying” in all four countries, with the percentage of respondents choosing this answer reaching 72.0% in Japan, 70.0% in the U.S., 53.5% in China, and 73.3% in Germany (Fig. 2).

When asked how they feel about using virtual reality test drives as an alternative way to inspect the vehicle, in all four countries, more people said “it will be helpful, but I also want to actually drive the car before making any decisions” than those who chose other answers, totaling 45.2% in Japan, 35.1% in the U.S., 61.4% in China, and 39.0% in Germany (Fig. 3). Sentiment was divided in the U.S. and Germany, with 30.8% and 34.9% of the respondents, respectively, saying VR test drives “will not help” their decision-making.

Fig. 2: Reasons for needing in-person interaction

Source: NRI “Survey on Automobiles”2022

Single answers/( ) indicate sample size

Fig. 3:Interest in test drives using virtual reality technology

Source: NRI “Survey on Automobiles”2022

Single answers/( ) indicate sample size

Price negotiations

1. Majority of respondents in all four countries feel negative about flat prices

In recent years, dealerships are adopting no-discount sales approaches, particularly for electric vehicle models. However, over 80% of the respondents in each of the four countries said they are attracted to “the brands that allow price negotiations at dealerships” (Japan: 85.1%, U.S.: 87.8%, China: 87.3%, Germany: 85.8%).

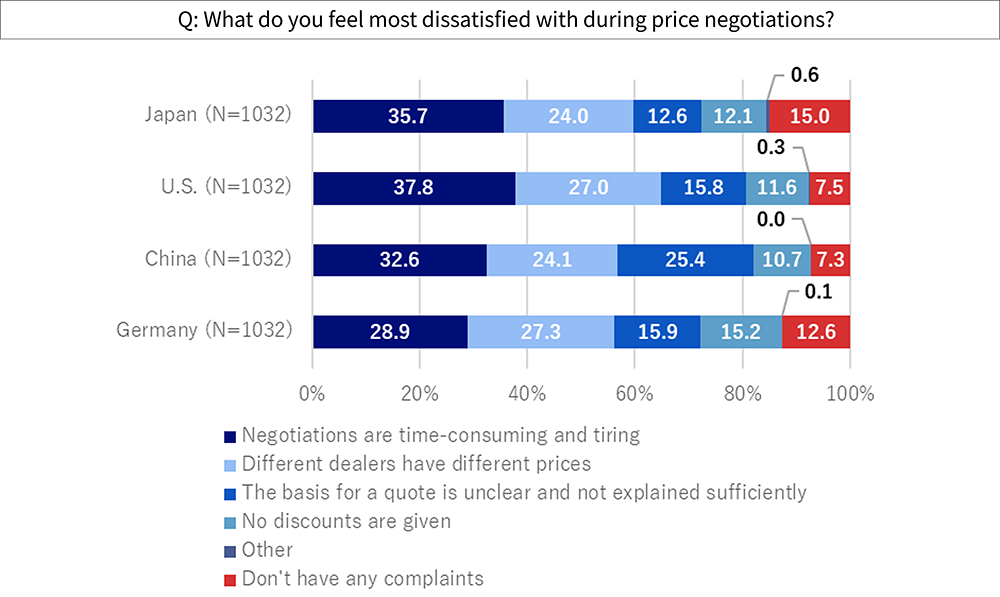

2. Over 80% of respondents in all four countries are not happy with price negotiations; quicker negotiations and pricing transparency are needed

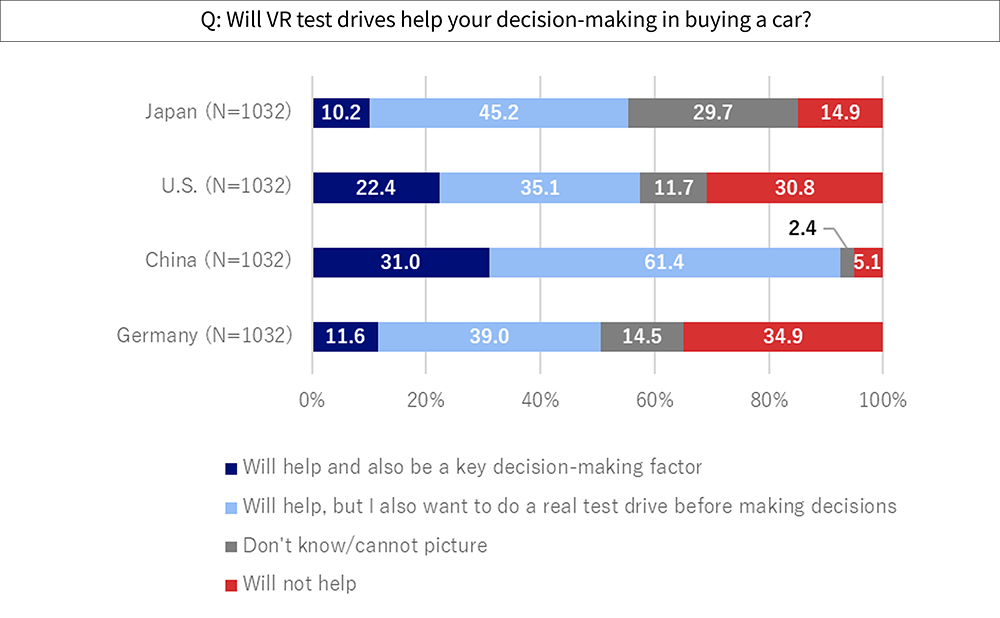

When respondents were asked why they are not satisfied with price negotiations, the most common answer was “negotiations are time-consuming and tiring” in all four countries (Japan: 35.7%, the U.S.: 37.8%, China: 32.6%, Germany: 28.9%). In Japan, the U.S., and Germany, this answer was followed by “different dealers have different prices” and “the basis for a quote is unclear and not explained sufficiently.” In China, the percentage of those who said, “the basis for a quote is unclear and not explained sufficiently” (25.4%) was roughly the same as those who chose “different dealers have different prices” (24.1%), showing higher dissatisfaction with pricing transparency, or the lack thereof, compared to the other countries (Fig. 4).

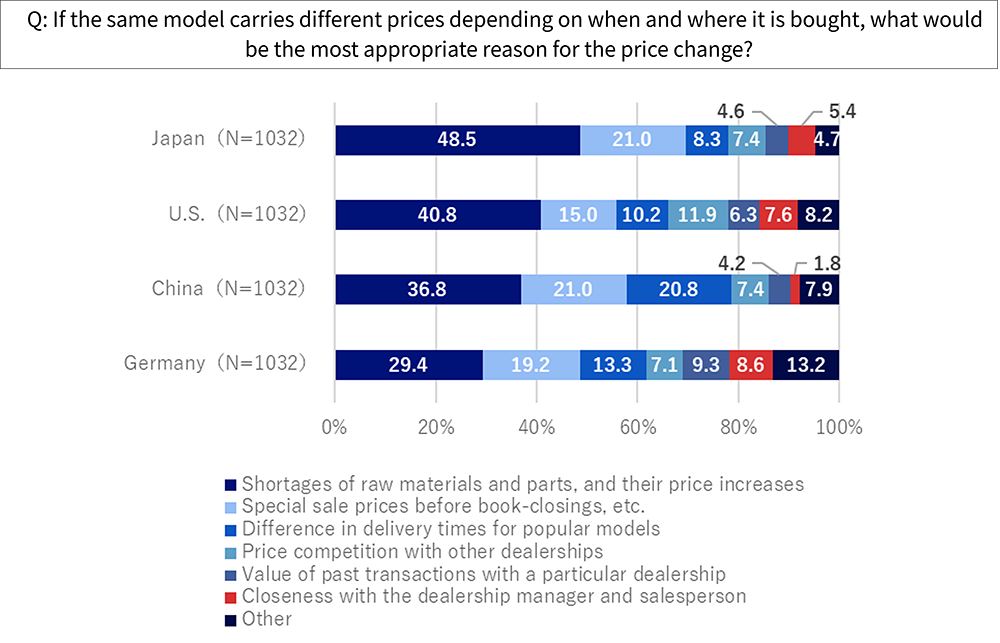

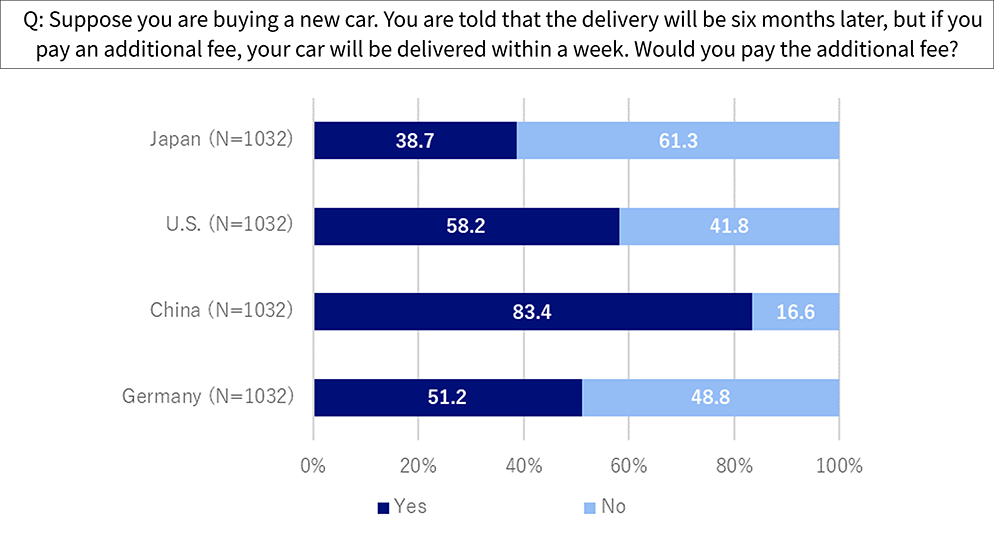

When respondents were asked to name an appropriate reason for a price change, the most popular answer in all four countries was “shortages of raw materials and parts and their price increases” (Japan: 48.5%, the U.S.: 40.5%, China: 36.8%, Germany: 29.4%), followed by “special prices before book-closings” (Fig. 5). When posed with a theoretical demand to pay more for a quicker delivery, over 80% of the respondents in China said they would accept the demand and pay more (83.4%), with more than half in the U.S. and Germany saying the same (58.2% and 51.2%, respectively), while the percentage totaled less than 40% in Japan (38.7%) (Fig. 6).

Fig. 4: Reason why respondents are not happy with price negotiations

Source: NRI “Survey on Automobiles”2022

Single answers/( ) indicate sample size

Fig. 5:Appropriate reason for a price change

Source: NRI “Survey on Automobiles”2022

Single answers/( ) indicate sample size

Fig. 6: How consumers feel about paying more for quicker delivery (%)

Source: NRI “Survey on Automobiles”2022

Single answers/( ) indicate sample size

Sales discussions will take the hybrid format of online and in-person, and prices will be determined based on conditions, not through negotiations

In light of the Survey’s findings, NRI believes that how cars are sold will change in the following ways.

- Online sales discussions will not completely replace those at dealerships; but virtual reality test rides, which will partially replace physical inspections, will be widely used and sales discussions will shift to the hybrid format of online and in-person experiences.

- Consumers have negative feelings toward no-discount prices, find price negotiations burdensome, and are dissatisfied with the lack of transparency in how quotes are based. For this reason, changes will take place so that prices will be determined not through personal negotiations at dealerships but based on raw material prices, changes in demand, and other conditions. Consumers in the U.S., China, and Germany are more willing to agree to dynamic pricing, an approach that adjusts the proposed prices depending on desired delivery dates. Pricing conditions include not only reasons attributable to the manufacturers but also special sale prices and other dealership-based reasons.

Reference

Overview of the Survey

| Survey | Survey on Automobiles |

|---|---|

| Survey dates | July 26-August 17, 2022 |

| Survey method | Internet |

| Surveyed |

Male and female car owners 20 and older in Japan, the U.S., Germany, and China (the numbers of respondents were allocated proportionally to the age-group-based makeup of car owners in the four countries (10-year intervals))

The Survey excluded persons in the mass media, research, marketing, and advertising industries. |

|

Respondents

with valid responses |

4,128 (a breakdown by age group provided in the attachment) |

| Main surveyed topics | Consumer behavior regarding sale discussions and price negotiations |

Attachment: Respondents with valid responses by age group

| Japan | U.S. | China | Germany | |

|---|---|---|---|---|

| 20-29 | 258 | 258 | 258 | 258 |

| 30-39 | 258 | 258 | 258 | 258 |

| 40-49 | 258 | 258 | 258 | 258 |

| 50-59 | 123 | 67 | 215 | 100 |

| 60-69 | 95 | 96 | 31 | 120 |

| 70 and older | 40 | 95 | 12 | 38 |

| Total | 1032 | 1032 | 1032 | 1032 |

Contact Us

Inquiries about this news release:

Yuri Takeo, Sangi Tamaoka

Corporate Communications Department

Nomura Research Institute, Ltd.

TEL:+81-3-5877-7100

E-mail:

kouhou@nri.co.jp

Inquiries about this Survey:

Toshiki Yamamoto, Yuya Kinoshita, Aoi Sasagawa

Systems Consulting Division

Nomura Research Institute, Ltd.

E-mail:

automotive-report-22@nri.co.jp