Our Responsibility as an "Industry Standard Platform"

With its origins in both think tank research and computing, NRI has cultivated a unique DNA that synergizes consulting capabilities and IT solutions to pioneer the future.

The Financial IT Solutions Division is a prime example of this DNA in action.

At NRI, our Financial IT Solutions go beyond merely addressing the challenges of financial institutions. We strive to deliver added value that drives best practices in the industry. This is made possible through the fusion of consulting expertise and IT solutions—the core of NRI’s DNA.

- Our consulting function brings together consultants and researchers who amass deep financial knowledge through extensive research and advisory engagements, covering everything from financial regulations in key global markets to investor behavior and market trends.

- Our IT solutions function is powered by IT infrastructure specialists, security experts, and system engineers, continuously refining their expertise in digital transformation (DX) and technological innovation.

Decades of accumulated expertise in these areas have earned NRI the trust of the financial industry, enabling us to provide industry-leading business platforms (ASP and SaaS-based solutions).

The financial sector is undergoing unprecedented transformation, driven by diverse investor needs, the entry of new players, and the demand for sustainable business models that balance both offensive and defensive strategies. In this evolving landscape, traditional business approaches are no longer sufficient.

At NRI, we work closely with regulatory authorities and key industry players to drive financial innovation. We recognize that finance is a fundamental pillar of society and are committed to shaping a stable, yet cutting-edge financial infrastructure that seamlessly integrates with advancing digital technologies.

By leveraging our strengths in consulting and IT solutions, we will continue to tackle societal challenges and redefine the future of financial services.

Our Responsibility as a "Financial Business Platform"

NRI provides IT solutions across various financial sectors, including securities, asset management, banking, and insurance. Our services range from contracted system development and operational outsourcing to our flagship Financial Business Platform (ASP/SaaS-based solutions).

Among these, the Financial Business Platform is a pioneering service model that anticipated the shift from system ownership to service-based IT utilization. Today, it serves as a standard industry infrastructure across multiple financial domains.

In fact, NRI’s application services power:

Over 50% of daily stock trading in Japan,

Over 30% of Japanese government bond transactions, and

Over 70% of mutual fund transactions.

These critical financial operations are all managed and run from NRI’s data centers, ensuring high reliability and security.

The financial industry is governed by strict regulations and evolving legal frameworks, aimed at maintaining market stability and investor protection. The accuracy and continuity of IT systems must meet exceptionally high standards to comply with these ever-changing regulations.

At NRI, we not only stay ahead of regulatory changes but also proactively contribute to best practices, integrating regulatory updates seamlessly into our solutions. This enables financial institutions using NRI’s platforms to quickly and smoothly adapt to new business requirements.

Since the implementation of the Financial Instruments and Exchange Act, Japan’s Financial Services Agency (FSA) has strengthened oversight on vendors serving financial institutions. To address this, NRI provides financial institutions with a highly secure, fully compliant service level agreement (SLA) that meets the strictest regulatory standards.

All NRI solutions are operated within our high-security data centers, ensuring robust disaster recovery (DR) and business continuity planning (BCP)—both critical in today’s fast-evolving financial landscape.

As a trusted Financial Business Platform provider, NRI remains dedicated to advancing and refining our solutions, continuously enhancing the infrastructure that powers financial institutions. We are committed to driving innovation, ensuring compliance, and delivering secure, scalable IT solutions that empower the future of finance.

Supporting Financial Institutions' Global Business and NRI's Global Expansion

Japan's financial market is seamlessly connected to global markets. Overseas financial regulations cannot be treated as mere external matters, as domestic markets are directly influenced by international financial policies and macroeconomic trends. Given these diverse and evolving dynamics, one of NRI's key missions is to provide solutions that support financial institutions in navigating and succeeding in this global environment.

NRI not only implements IT strategies aligned with financial institutions' business strategies on a global scale but also analyzes local challenges and emerging issues in various regions. This enables top management to make informed decisions regarding their IT strategies based on accurate and timely information.

NRI’s Financial IT Solutions Division operates in New York, London, Singapore, Hong Kong, Dalian, and India, continuously expanding its support for financial institutions engaged in global operations. As financial markets evolve, NRI remains committed to enhancing its solutions and expertise to meet the growing needs of the industry.

NRI Financial IT Solutions Rankings and Achievements

1954

The Beginning of Financial IT Solutions

NRI’s Financial IT Solutions division has over 50 years of history, beginning with system development for Nomura Securities.

- In 1954, Nomura Securities became the first company in Japan to introduce the UNIVAC 120, a U.S.-manufactured commercial computer.

- Throughout the 1980s, Nomura expanded its securities systems, developing three core platforms:

- A retail securities system supporting brokerage operations.

- An investment banking system catering to global financial markets.

- An investment information database at the heart of securities business.

In 1966, Nomura Securities’ IT division became an independent entity, Nomura Computer Systems, while in 1965, Nomura Research Institute (NRI) was established as Japan’s first think tank and consulting firm.

In 1988, Nomura Computer Systems and the former Nomura Research Institute merged to form the present-day Nomura Research Institute (NRI). This integration combined the strengths of a research and consulting firm with those of an IT solutions provider, enabling NRI to develop and deliver forward-looking infrastructure for the financial industry.

This vision has been realized through THE STAR, I-STAR, T-STAR, and BESTWAY—NRI’s flagship IT solutions that continue to support and drive innovation in the financial sector.

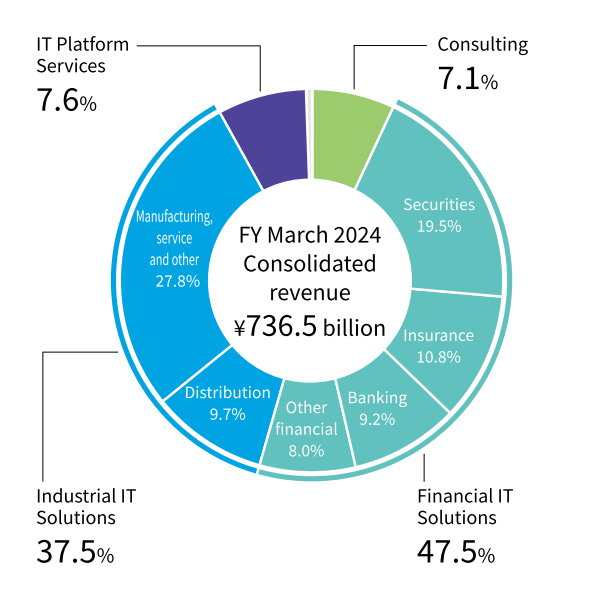

50% of NRI's total revenue

The Financial IT Solutions division is NRI's largest business segment, accounting for approximately 50% of its consolidated revenue.

Global top 50

Since 2010, NRI has been consistently recognized in the global financial IT services rankings. Due to changes in ranking criteria in 2023, along with the growth of NRI’s non-financial business revenue, the company was selected in a different category and ranked in the Enterprise TOP 50. This recognition underscores NRI’s status as a leading global financial IT services provider.

| 2024 | IDC FinTech Rankings Enterprise Top 50 (IDC Financial Insights) |

|---|---|

| 2023 | IDC FinTech Rankings Enterprise Top 25 (IDC Financial Insights) |

| 2021 | Ranked 10th in FinTech Rankings (IDC Financial Insights) |

| 2020 | Ranked 11th in FinTech Rankings (IDC Financial Insights) |

| 2019 | Ranked 10th in FinTech Rankings (IDC Financial Insights) |

| 2018 | Ranked 9th in FinTech Rankings (IDC Financial Insights) |

| 2017 | Ranked 10th in FinTech Rankings (IDC Financial Insights) |

| 2016 | Ranked 10th in FinTech Forward Rankings (American Banker) Ranked 9th in FinTech Rankings (IDC Financial Insights) |

| 2015 | Ranked 9th in FinTech Forward Rankings (American Banker) Ranked 10th in FinTech Rankings (IDC Financial Insights) |

| 2014 | Ranked 9th in FinTech Forward Rankings (American Banker) Ranked 9th in FinTech Rankings (IDC Financial Insights) |

| 2013 | Ranked 9th in FinTech 100 (American Banker, Bank Technology News, and IDC Financial Insights) |

| 2012 | Ranked 9th in FinTech 100 (American Banker, Bank Technology News, and IDC Financial Insights) |

| 2011 | Ranked 9th in FinTech 100 (American Banker, Bank Technology News, and IDC Financial Insights) |

| 2010 | Ranked 9th in FinTech 100 (American Banker, Bank Technology News, and IDC Financial Insights) |

50% to 80% across various segments

NRI’s financial IT solutions have achieved a market share of approximately 50% to 80% across various segments, becoming the established business platform for financial institutions.

| Number of Financial Institutions Using NRI Solutions (as of March 2024): | |

|---|---|

| THE STAR | Comprehensive Back-office System for Retail Securities: 86 firms |

| I-STAR | Back-office System for Wholesale Securities: 30 firms |

| T-STAR | Trust Asset Management System for Trust Fund Management Companies: 81 firms |

| BESTWAY | Account Management System for Over-the-Counter (OTC) Trust Fund Sales: 109 firms |

80% of the Mutual Fund Sales

NRI holds approximately 80% market share in mutual fund sales and back-office management through its industry-leading solutions:

BESTWAY – A comprehensive account management system for OTC mutual fund distributors, supporting everything from front-office sales operations to back-office account management and defined contribution pension account services.

T-STAR/TX – A back-office solution for asset management companies, primarily focused on NAV calculations and comprehensive mutual fund operations. FundWeb – A network solution connecting BESTWAY and T-STAR/TX, holding a similar market share.

With these solutions, NRI has become the de facto standard for mutual fund accounting and sales management in Japan, providing financial institutions with efficient, scalable, and compliant platforms.

50% of Tokyo Stock Exchange Trading Volume

Approximately 50% of the trading volume on the Tokyo Stock Exchange (TSE) is managed through NRI’s infrastructure solutions, THE STAR and I-STAR.

THE STAR – A comprehensive securities back-office system, supporting brokerage firms in various trading models, including face-to-face sales, internet trading, wholesale transactions, and brokerage services. It handles account opening, order processing, settlements, compliance, financial accounting, and reporting, serving as a core platform for securities firms.

I-STAR – A wholesale securities back-office solution, designed to support institutional and wholesale trading operations with efficient settlement and risk management.

Japan’s unique and complex financial practices and settlement systems require highly specialized solutions. THE STAR and I-STAR have earned industry trust by providing reliable, regulatory-compliant, and scalable infrastructure for Japan’s capital markets.

30% of Japanese Government Bond and Yen Transactions

More than 30% of JGB and JPY transactions are conducted through NRI's settlement management solution for the Bank of Japan (I-STAR/LC).

I-STAR/LC is Japan’s only ASP solution for Bank of Japan (BOJ) settlement operations, directly connected to BOJ-NET. It provides comprehensive support for the settlement of current accounts, government bonds, collateral management, and foreign exchange transactions. The system enhances fund and securities efficiency by enabling intraday overdrafts and Delivery Versus Payment (DVP) collateral settlements.

With real-time transaction monitoring and risk management, I-STAR/LC helps reduce settlement risks and ensures compliance with Japan’s financial regulations.

50% of Individual Securities Accounts

Approximately 50% of individual securities accounts in Japan are managed through NRI’s comprehensive back-office system, THE STAR.

THE STAR has become the de facto standard for retail securities operations, particularly among mid-sized and large brokerage firms.

NRI holds the de facto standard position in retail securities operations.