Global IBOR Solution for asset management firms

T-STAR/GV, a global IBOR (Investment Book of Record * ) solution

enables asset management firms to accelerate their global business

development by accurately providing IBOR to front office in real-time.

It integrates transaction data from multiple global locations and

creates balance data by operating 24/7 and seamlessly links data among

global operation hubs.

With T-STAR/GV, fund managers can make investment decision more

quickly and precisely using integrated data, regardless of the

location and the number of the office.

* IBOR: Data that provide fund managers with an accurate, real-time, and consolidated view of positions and cash.

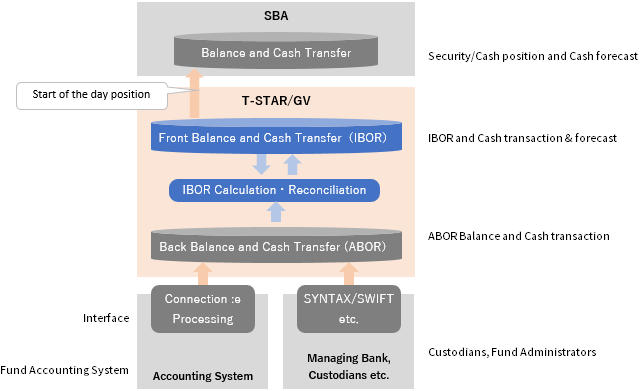

Overview

With T-STAR/GV, asset management firms can grasp an accurate, real-time and consolidated view of balance and accounting information across multiple locations around the world. It meets the needs of quantitative investing funds. In addition, the solution continually improves the overall efficiency of your back-office operations (post-trade, fund position control, cash control) across locations while maintaining a high quality of service and minimizing operational risk. .

Clients

Japanese and Non-Japanese asset managers, Asset owners

Features

1. Establishing a global operations platform by sharing up-to-date transaction and position data

T-STAR/GV centralizes transaction data from each location in real-time and, through a globally integrated portfolio and cash management process, providing the most up-to-date position/cash data from the operations section of each office to be utilized in investment decisions. As a result, the asset managers can increase their operational efficiency, report based of portfolio needs, centrally conduct risk management and compliance check. .

2. Improving overall efficiency through business process standardization

As IBOR provides balance data to front office, fund managers no longer have to manage it with EUC. During implementation, NRI designs and builds a comprehensive business process geared toward improving overall efficiency from a global perspective. The solution always provide accurate portfolio and cash data by connecting data from multiple back office and custodians and reconciling automatically. In addition, it enables firms to see consistently and efficiently improved business processes as the entire operations of all portfolio, assets and hubs can be visualized.

3. Global system management service

The NRI data center supports system operations management 24 hours a day, 365 days a year. The nationally appraised and ISO 20000-certified NRI systems operation service provides a secure business platform to meet client needs..

4. Global standard architecture

NRI adopts a three-tier system of databases, business logic, and web applications, to achieve growth through business expansion. We make use of globally standardized technology, including high-performance platforms and message processing to ensure a high level of independence among components..

How it works

- Aggregating information in one central database, which ensures that the most up-to-date information is used for all processes and that complex business matters can be managed with flexibility throughout every location. With T-STAR-GV's integrated management of references, transactions, and balances data, there is no need to conduct additional work to maintain data consistency between locations..

- T-STAR/GV efficiently and seamlessly coordinates with the T-STAR suite, NRI's total solution for asset management companies. Clients also have the option of a fully optimized service based on NRI's total solution.

Functions

* This solution is component based design and it is possible to provide not only specific functions but also as a total solution.

Attribution management

- Fund attribution, instrument attribution (including issuer and rating), access control, user management, data management

- Data such as index, benchmark, rate, exchange rate, market price, corporate action can be managed

- Cleansing function for attribute information from various data vendors

Trade management

- Stock and bond trading, foreign exchange, NDF, futures, as well as every type of transaction entry

- Automatic trade matching (Omgeo's Central Trade Manager and TradeSuite)

- Transaction record upload using Excel

Settlement management

- Sending instructions for spot, exchange, futures (SWIFT MT54x, MT304, 202, 210)

- Monitoring of transaction statuses (sending instructions/unsent instructions)

-

Capturing execution data in SWIFT format from outsourced firms and

custodians (MT54x, 304, 300)

Portfolio management

- IBOR balance management including real-time balance, valuation and all positions. NAV management and realized profit/loss are available.

- Unrealized gains and losses, forex forward valuation, futures valuation, calculation of accrued interest on bonds, etc.

- Sophisticated reconciliation function using SWIFT etc. (for custodians and accounting system etc.)

Cash management

- Cash forecast

- Cash in/out (past date, same date, future date) management

- Sophisticated reconciliation function using SWIFT. (for custodians and accounting system etc.)

Corporate Action

- Able to process many types of corporate action events (Stock split, merger, bonus issue, spin-offs, rights issue, cash dividends, coupon payment, redemption, etc.)

- Automatic re-generation of entitlement when there are balance changes or event changes

- Automatic matching of dividends (SWIFT MT566)

- Management of voluntary events (Rights Exercise, Dividend Re-investment Plan etc.)

Accounting processing

-

ABOR balance management *

*ABOR: Accounting Book of Record: Accounting data based on positions and projections at close of business or period. - NAV accounting (for front-office compliance)

- Fund accounting reports for clients (by monthly, by quarterly)

- Data interface to performance calculation system

Other

- Exception management

- Online generation completion of fixed-form reports

- Dashboard function (Functions for workflow, saving search criteria, automatically preparing reports)

- Customizable screen layout for each user. Various formats.

- Flexibly converting to different formats including SWIFT, Excel, XML, and text

-

Data warehouse for IBOR/ABOR transaction balance and attribute

information as well as API for publishing and extracting these data

Solution Image

*T-STAR/GV are registered trademarks of Nomura Research Institute,Ltd.

in Japan.

*Unauthorized reproduction or copying of any of the contents of these

documents is prohibited.

*The contents of this page are current as of April 2024. The

specifications and prices of products and services are subject to

change without notice. Offers and sales of these products and services

are subject to cancellation without notice.