Governance

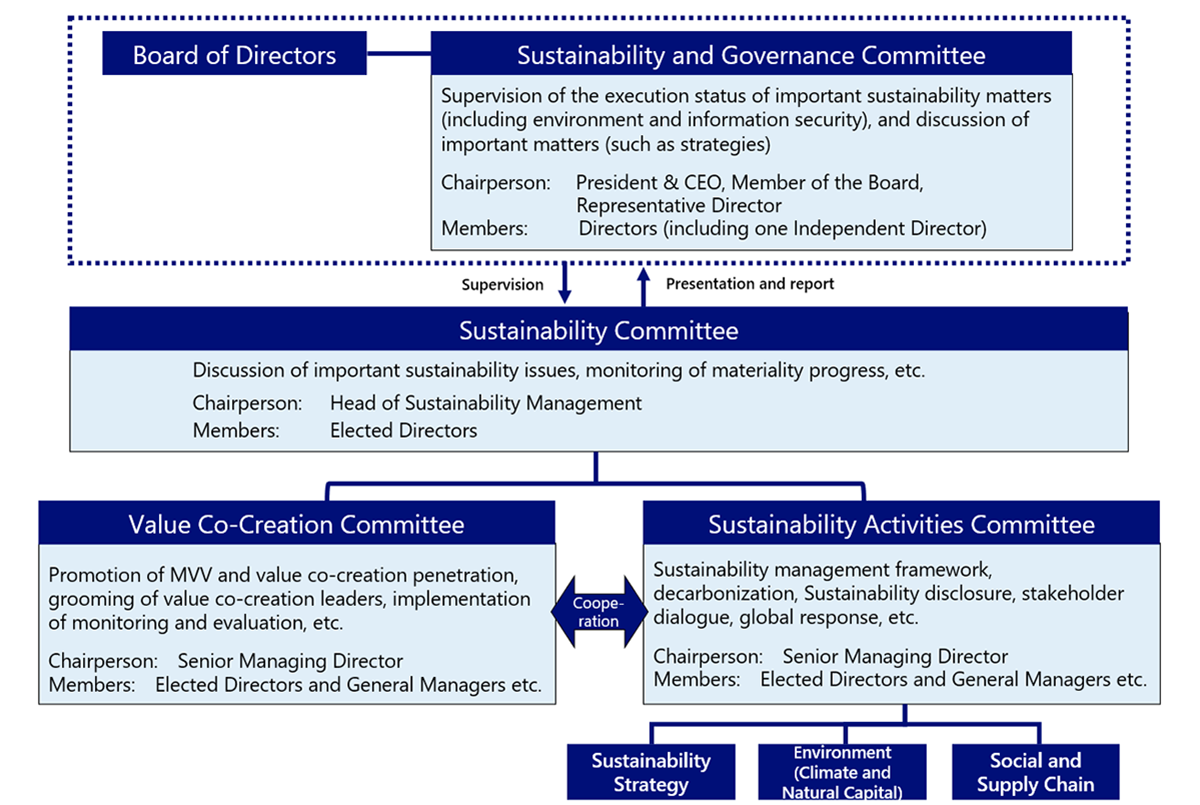

The NRI Group positions sustainability, including responses to climate change and biodiversity, as a critical management issue. The Board of Directors considers sustainability in its composition and oversight, and in addition to appointing outside directors who have insight regarding sustainability, the Board makes decisions on basic sustainability policies (including materiality) and other important matters. Sustainability Governance Committee has been established by the Board of Directors with only directors as members, and the Board of Directors and the Sustainability Governance Committee are responsible for overseeing the Company's efforts to address sustainability-related management issues.

In addition, under the supervision of the Board of Directors, a Sustainability Committee, chaired by a director in charge of promoting sustainability management, has been established. The Sustainability Committee deliberates on important sustainability-related issues (including related risks and opportunities), among others. There are subcommittees under this Committee, each chaired by a senior managing director. They are the Social Value Creation Promotion Committee and the Sustainability Promotion Committee, which promote group-wide sustainability and regularly report their progress to the Board of Directors.

Sustainability governance structure

Deliberations and reports on climate change and natural capital

The Sustainability Promotion Committee, chaired and vice-chaired by senior managing directors, and composed of employees with climate-related expertise, designates “environment” as one of its key themes. The Committee advances the consideration and implementation of climate-related measures, such as decarbonizing data centers and offices, reducing Scope 3 emissions, and procuring renewable energy. Is also considers issues related to the conservation of natural resources within this theme.

In addion, a system has been introduced that takes into account the NRI Group's efforts towards achieving sustainability indicators, including greenhouse gas emmisions reductions, when determining stock-related compensation for directors (excluding outside directors), senior managing directors, and other employees with officer status.

Strategy

The NRI Group conducts scenario analyses to identify risks and opportunities related to climate change and natural resources, as well as their financial impact on the NRI Group (TCFD scenario analysis, TNFD scenario analysis).

TCFD Scenario Analysis TNFD Scenario AnalysisRisk Management

In managing the overall risks of the NRI Group, including climate-related and nature-related risks, an officer responsible for risk management is appointed, and the Integrated Risk Management Office is established as the risk management department. The Integrated Risk Management Office is responsible for building and maintaining the risk management framework, and for identifying, evaluating, and monitoring risks, and for organizing the overall risk management structure. The Integrated Risk Management Committee, chaired by the officer responsible for risk management, meets twice a year to evaluate the PDCA cycle of risk management and deliberate on risk response measures, reporting the results to the Board of Directors.

Specifically, the risks that may arise in the execution of the NRI Group's business are classified into 13 categories, and risk items are set for each risk classification. The risk items are periodically evaluated by the department in charge of risk management, and the risk items, importance, and impact are reviewed. Of the 13 risk classifications, those recognized as particularly important each fiscal year are selected as "key themes for risk management" by the Integrated Risk Management Committee. One of the 13 risk classifications is "management strategy risk," which includes "sustainability management risks (including responses to climate change)."

In addition, particularly regarding the identification, evaluation, and response to climate-related risks and opportunities, since FY2018, the Sustainability Promotion Committee has considered and decided on measures for each climate-related risk, including business continuity risks due to the intensification of natural disasters, by taking into account the external environment, initiative status, and information from service provision departments.