Identification of Risks and Opportunities from Climate Change (TCFD Scenario Analysis)

Assumed scenarios

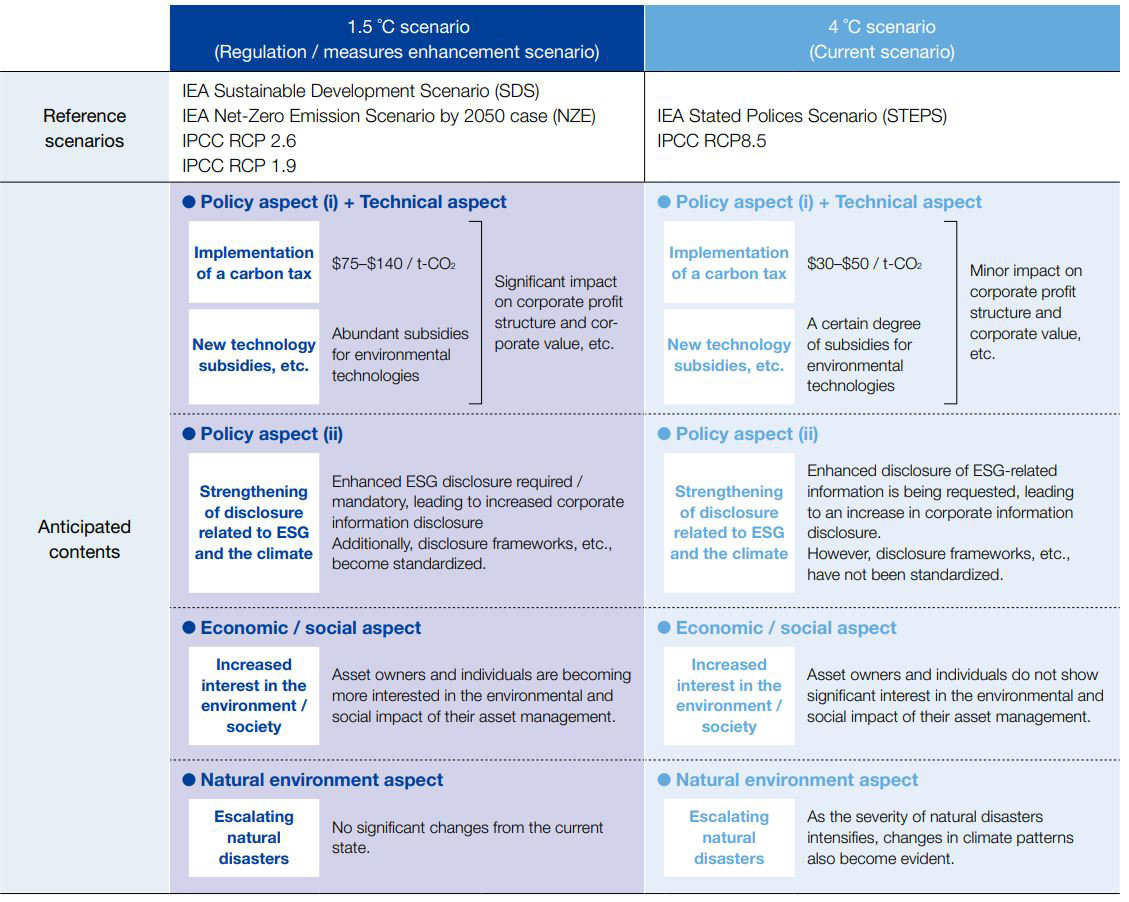

In the TCFD scenario analysis, two scenarios were assumed: the "1.5°C scenario" with strengthened regulations and measures, and the "4°C scenario" under the current scenario.

Reference Scenarios and Anticipated Contents

Scenario analyses conducted to date

From FY2019 to FY2021, scenario analyses were conducted for individual businesses.

Scenario analyses conducted to dateScenario analysis for all NRI Group businesses

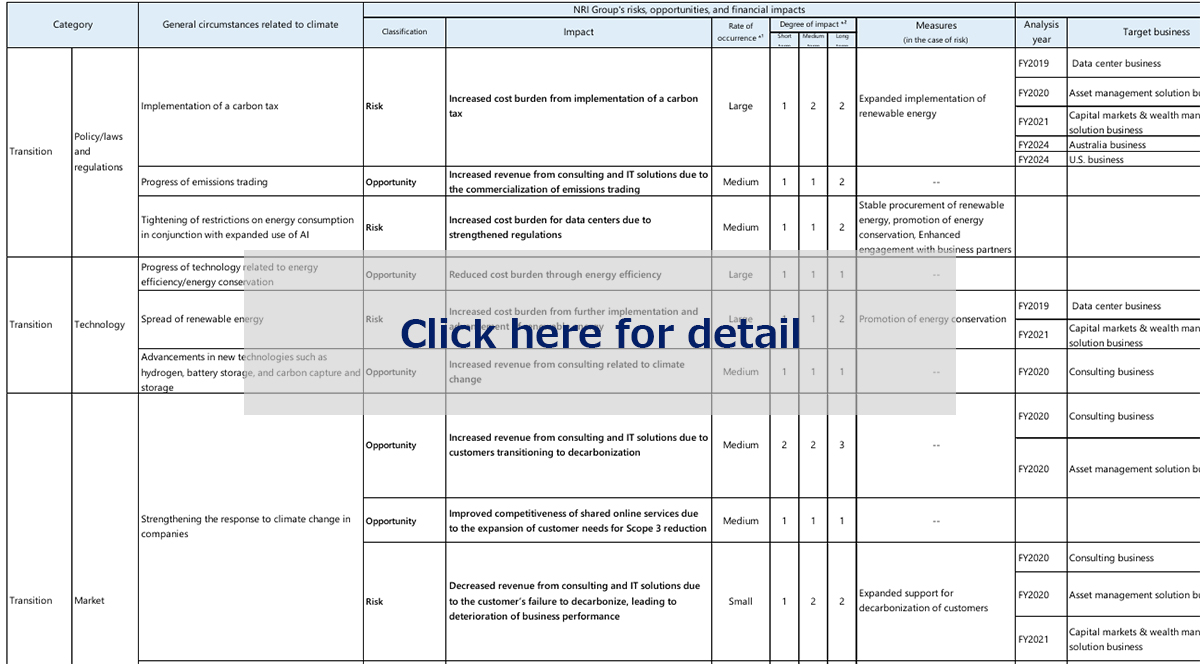

In FY2023, the risks, opportunities, and financial impact on the NRI Group's business overall were re-assessed, based on the results of these analyses. In the table's Category column, "transition" primarily refers to risks and opportunities under the "1.5°C scenario," while "physical" refers to those under the "4°C scenario."

Risks, opportunities, and financial impact of climate change on the NRI Group (311KB)

In addition, for some representative risks and opportunities, we have estimated the financial impact on the NRI Group's business overall as follows.

Estimated financial impact of individual risks and opportunities (assuming FY2030)

| Classification | Impact | Estimated value |

Assumptions of estimate, possibility of risk mitigation, etc. | |

|---|---|---|---|---|

| Transition | Risks | Increased cost burden from implementation of a carbon tax | Approx. 1 billion yen to 2 billion yen | The tax amount is calculated from the net greenhouse gas emissions assuming business expansion without changing the current renewable energy usage (carbon tax price is based on the IEA scenario). However, if the renewable energy usage rate reaches 100% by FY2030 according to the low-carbon transition plan, the tax amount can be almost zero. |

| Transition | Opportunities | Increased revenue from consulting and IT solutions due to customers transitioning to decarbonization | Approx. 6 billion yen to 7 billion yen | Assumes expansion of consulting themed on decarbonization in line with the growth of consolidated sales from current orders, recording the entire increase. Similarly, for the business platform business, it assumes expansion in line with the growth of consolidated sales, recording 10% of the increase as resulting from customer transition to decarbonization. |

| Physical | Risks | Interruption of business activities due to the company experiencing a disaster | Approx. 1 billion yen to 2 billion yen | The decrease in sales was calculated on the assumption that the business platform operation revenue of the NRI Group is not obtained for 2 days due to impact on the infrastructure (electricity, water, communication, etc.) around the Data Center from large-scale flooding, etc. However, the possibility of this risk materializing is considered extremely low due to various measures and training to prevent system stoppage, such as using Osaka Data Center II as a DR site if the Tokyo Data Center is not operational. |

| Physical | Risks | Disruption of the supply chain disruptions due to a business partner experiencing a disaster | Approx. 2 billion yen to 3 billion yen | Assumes a decrease in sales due to project delays, on the assumption that 10% (based on procurement amount) of business partners commissioned for system development by the NRI Group cannot operate for one month due to large-scale flooding. |