Scenario analysis for the capital markets & wealth management solution business [FY 2021]

In FY 2021, we conducted a scenario analysis for the capital markets & wealth management solution business, which is part of the Financial IT Solutions business.

【Business model analysis】

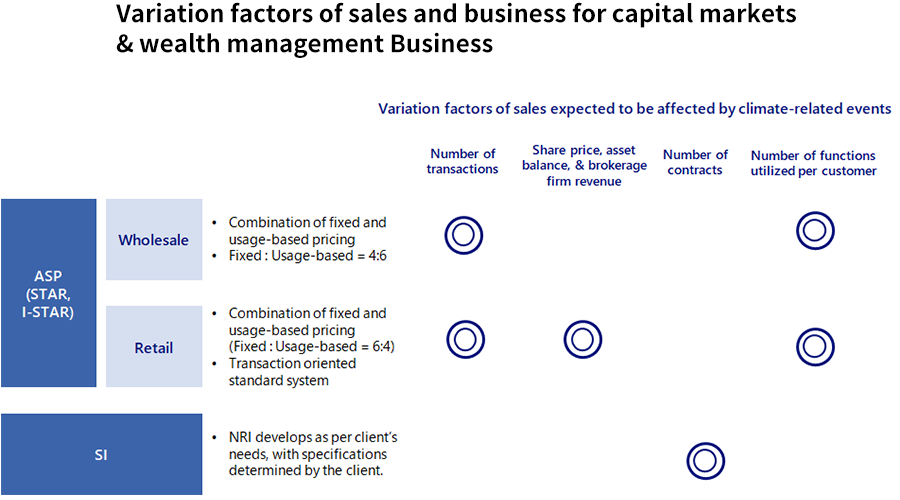

To identify risks and opportunities in the capital markets & wealth management solution business, we first conducted a business model analysis for the same. The services provided by the capital markets & wealth management solution business are broadly classified into ASP (Shared Online Services) and SI (System Integration). We surveyed the relationships between these services and the variation factors of sales, likely to be affected by climate change events. The below illustration demonstrates these relationships. Within ASP services, we identified that sales variation factors differ between wholesale and retail. We learned, that "number of transactions" and "number of functions used per client" hugely impact wholesale. While for retail, in addition to these, "share price, asset balance, and revenue from securities firms" are the most important factors. On the other hand, for SI services, "number of contracts" is the variable affecting sales.

【Risk and opportunity analysis】

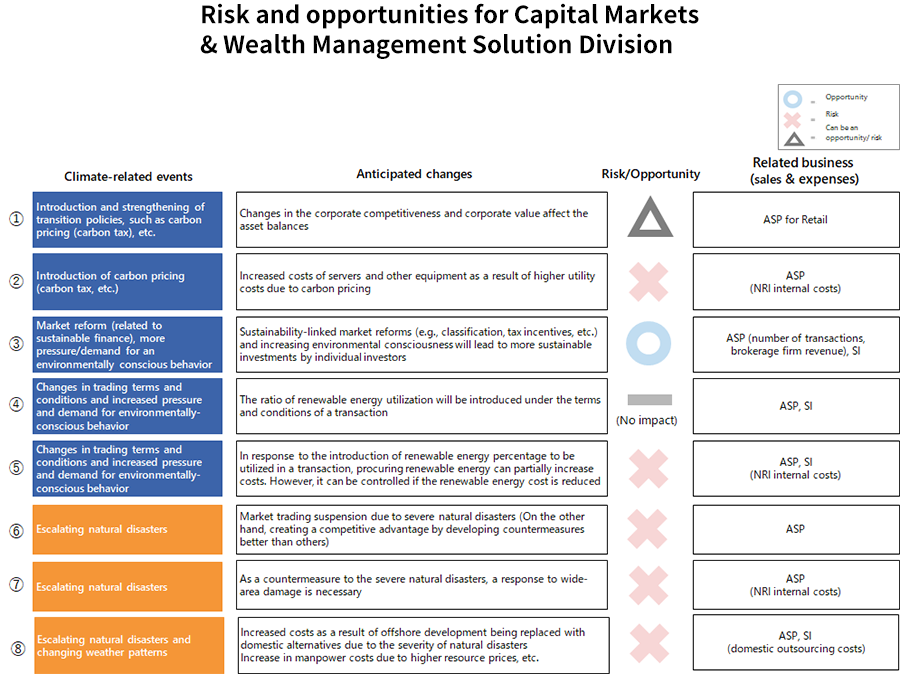

We then conducted a risk/opportunity analysis. We surveyed impacts on our services and potential changes in

the external environment in response to climate-related events, and analyzed whether these posed risks or

opportunities for NRI. The results are shown in the following illustration.

Within the climate-related events, blue represents "transition risk" which indicates the economic and social

transition due to climate change, while orange is for "physical risk" indicating the physical change caused

by climate change.

With regard to "transition risk,” we determined that a likely increase in utility and equipment (such

as servers) costs to sustain and manage the service due to the adoption of carbon pricing (including a

carbon tax) would pose a significant risk to NRI's ASP services.

On the other hand, we believe market reforms, such as sustainability bond market classification,

sustainability ranking of companies, and increased pressure/demand to be environmentally-conscious, will

create opportunities for NRI's securities services with more individual investors focusing on sustainable

investments.

With regard to "physical risk," we determined that the risk is high for society as a whole, including NRI,

because the entire macro economy will come to a halt or stagnate.

【Calculating financial impact】

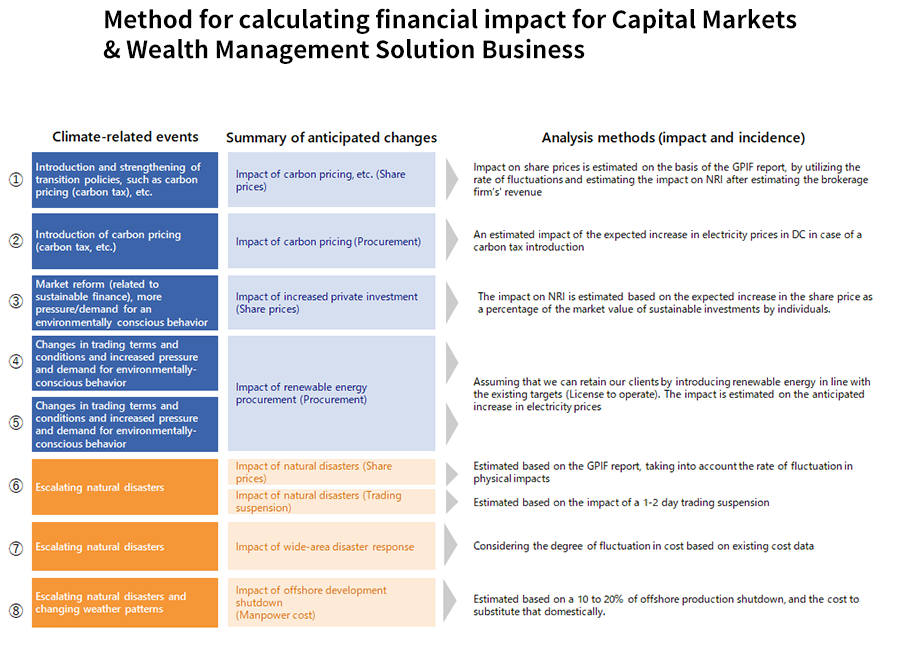

Next, we predicted how variation factors of profit would change based on the anticipated changes and calculated financial impacts for each climate-related event. The below illustration shows the calculation methods used. We predicted the anticipated changes from climate change events and derived a method for calculating the financial impact.

The adoption and strengthening of policies for transitioning to carbon price (carbon tax, etc.) were

estimated to have an impact on NRI through the profits of securities firms due to fluctuations in share

prices. (Above illustration ①) In addition, since it is expected that electricity prices will rise if a

carbon tax is adopted, we are looking at the impact in terms of cost increase for NRI due to the increase in

electricity prices. (Above illustration ②)

For market reform (sustainable finance-related) and increasing pressure and demand for

environmentally-conscious behavior, we believe that expanding sustainable investment to individual investors

will become an opportunity for NRI. We used the Fermi estimation to predict the increase in sustainable

investment and estimated the impact on NRI. (Above illustration ③)

Changes in trading terms and conditions and increased pressure and demand for environmentally-conscious

behavior anticipate that renewable energy will become more prevalent and that use of renewable energy will

be introduced into the trading terms and conditions with clients. Based on the assumption that NRI can

maintain business with clients by adopting renewable energy as targeted, we estimate the cost impact of

switching to renewable energy compared to existing electricity. (Above illustration ④ & ⑤))

Assuming that the market would be suspended due to a natural disaster, we estimated the decrease in sales,

etc. that would occur if trading were to be suspended for 1 or 2 days. (Above illustration ⑥)

The cost of responding to widespread damage caused by intensifying natural disasters is estimated with

reference to existing data. (Above illustration ⑦)

It is assumed that overseas development will be suspended due to intensifying natural disasters and that

development will be domestically substituted. We are looking at the cost impact of substituting in Japan if

overseas development were to cease operations by 10-20%. (Above illustration ⑧)

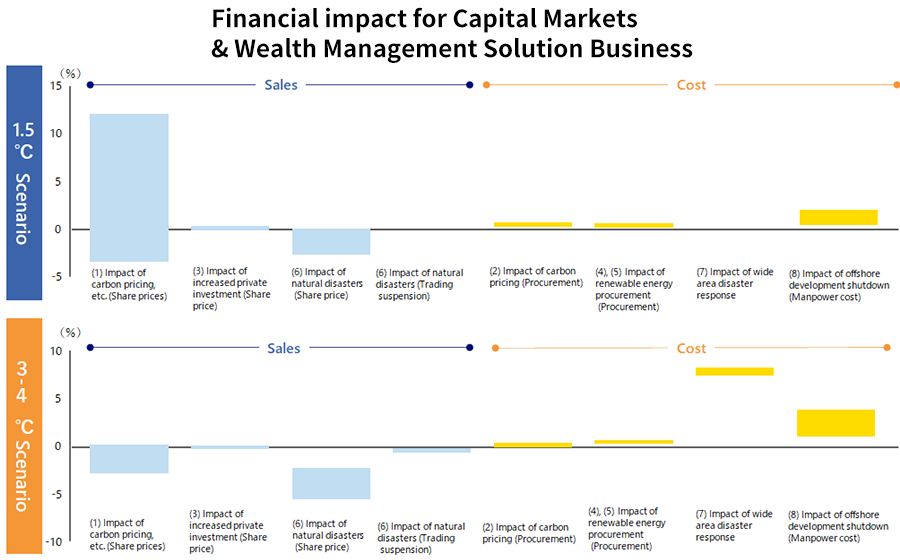

The above illustration shows the impact on sales and expenses due to anticipated changes ① through ⑧ in the

figure "Method for calculating financial impact for Capital Markets & Wealth Management Solution

Business" by range of effects in the 1.5 °C and 3 to 4 °C scenarios, respectively.

The blue graph on the left depicts the impact on sales. The impact of carbon price on share prices is

calculated by the GPIF in the form of value-at-risk, which is the impact of climate change on share prices.

According to this, in the 1.5°C value-at-risk case, opportunity is high and the share price is expected

to rise by about 25%, and NRI's sales increase rate is estimated to be high, through securities firms'

profits. The physical impact from natural disasters is limited, it is estimated that the 1.5°C scenario

and even the 3-4°C scenario could result in negative sales of about 3% and 5%, respectively.

The yellow graph on the right depicts the cost-related impact, and the positive portion represents a cost

increase for NRI. The impact on carbon price and renewable energy procurement is not expected to lead to

significant cost increases. The impact of natural disasters is expected to be greater than other expenses

such as the cost of repairing facilities, etc., in response to wide-area disasters, and higher labor costs

due to suspension of overseas development (offshore development) and the substitution of such development in

Japan.

Scenario analysis for the consulting business [FY 2020]

In FY2020, we conducted a scenario analysis for the consulting business.

【Risk and opportunity analysis】

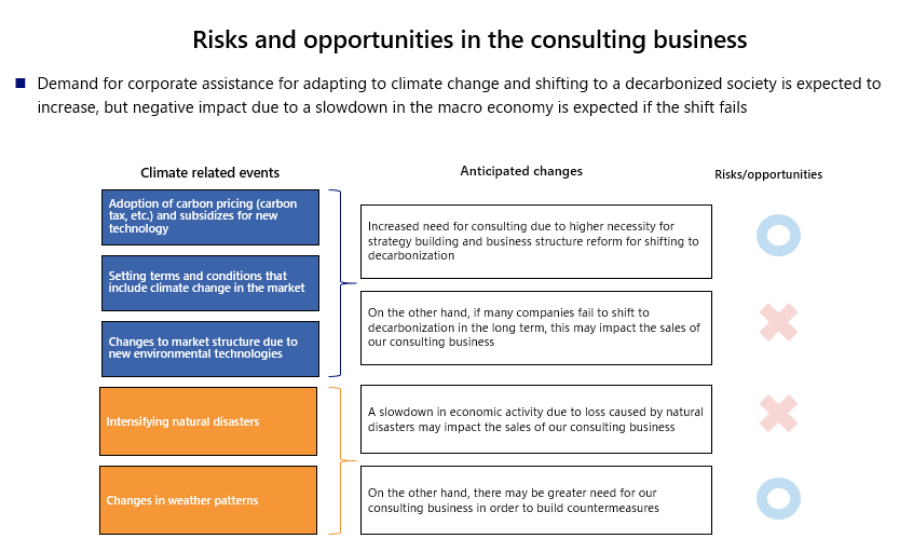

We conducted a risk and opportunity analysis for the consulting business. The results are shown in the illustration below.

We found that, while climate change results in increased needs for consulting business regarding sustainability, there is a high level of business risk if an economic slowdown occurs due to a failed shift to decarbonization and intensifying natural disasters.

【Opportunities in the consulting business】

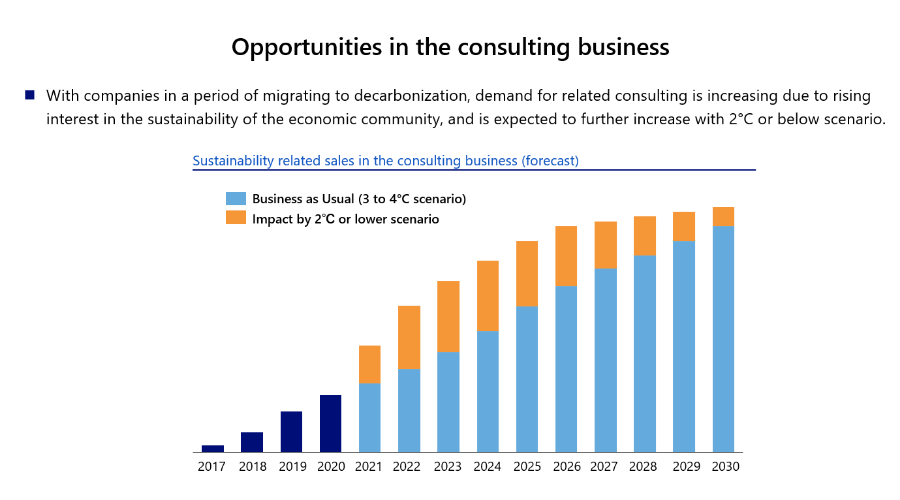

We anticipated future consulting opportunities based on our current track record for consulting work regarding sustainability. The results are shown in the illustration below.

We found that there would be greater consulting needs in the 2°C or lower scenario than in the 3 to 4°C scenario, and that sales would increase as well.

【Risk in the consulting business】

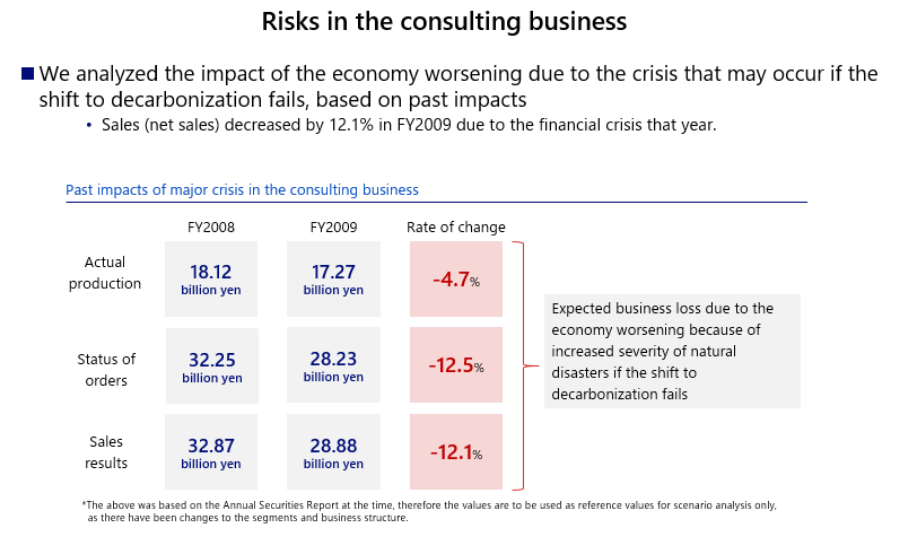

Regarding consulting risks, the economy will worsen if the global shift to decarbonation fails, causing natural disasters to intensify. Assuming that the impacts of a worsened economy would be similar to the financial crisis, we calculated that sales would decrease by 12.1%.

Scenario analysis for the asset management solution business [FY 2020]

In FY2020, we conducted a scenario analysis for the asset management solution business, which is part of the Financial IT Solutions business.

【Business model analysis】

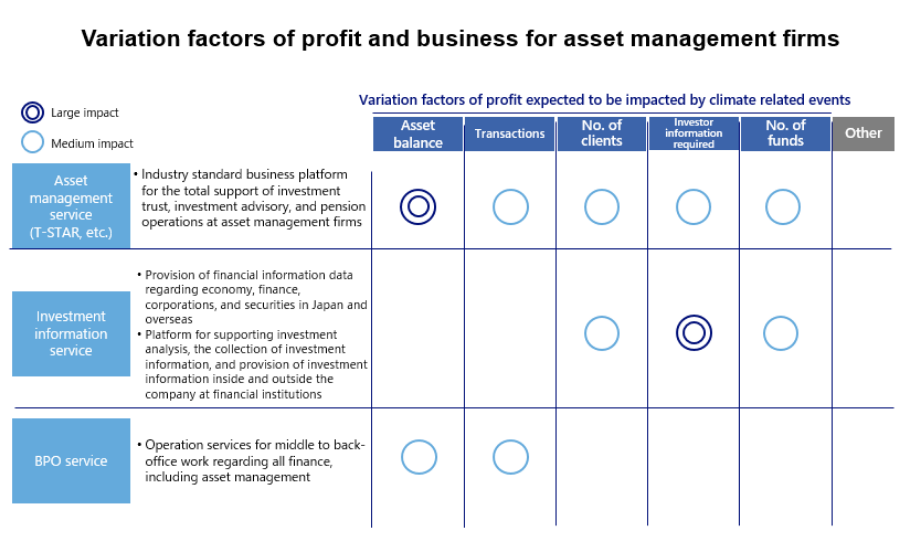

To identify risks and opportunities in the asset management solution business, we first conducted a business model analysis for the asset management solution business. The asset management solution business is broadly classified into the asset management service, investment information service, and BPO service. We surveyed the relationships between these three services and the variation factors of profit that are expected to be affected by climate change events. The below illustration demonstrates these relationships. In the asset management service, we learned that client companies’ asset balances had the largest impacts. In other words, in this business model, as client companies’ asset balances increase, NRI’s profit grows. As client companies’ asset balances decrease, NRI’s profit falls. In the investment information service, we found that the amount of information required by investors had the largest impacts.

【Risk and opportunity analysis】

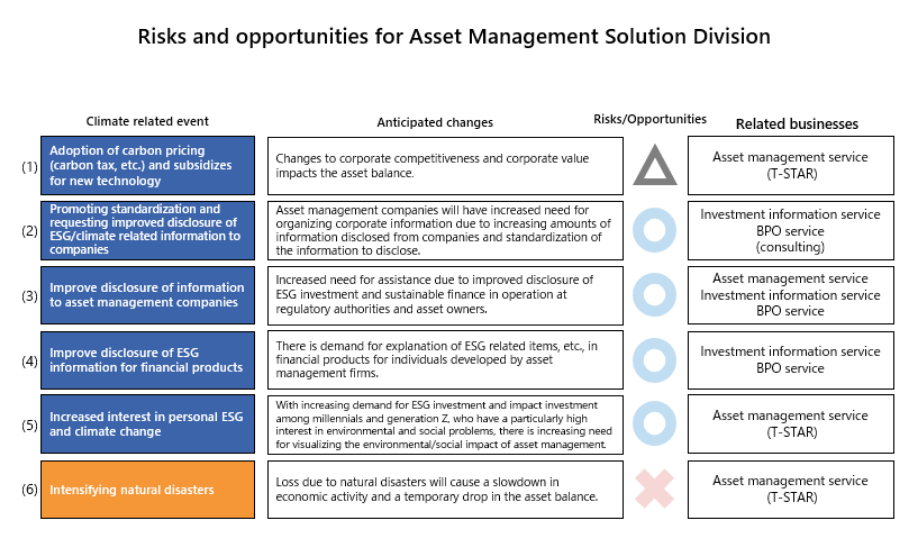

We then conducted a risk/opportunity analysis. We surveyed impacts on our services and changes anticipated at client companies regarding six climate-related events, and analyzed whether these posed risks or opportunities for NRI. The results are shown in the following illustration.

We assumed that there would be opportunities overall as ESG disclosure and other information advances. We have also conducted interviews with the management of client companies to corroborate the expected changes.

【Calculating financial impact】

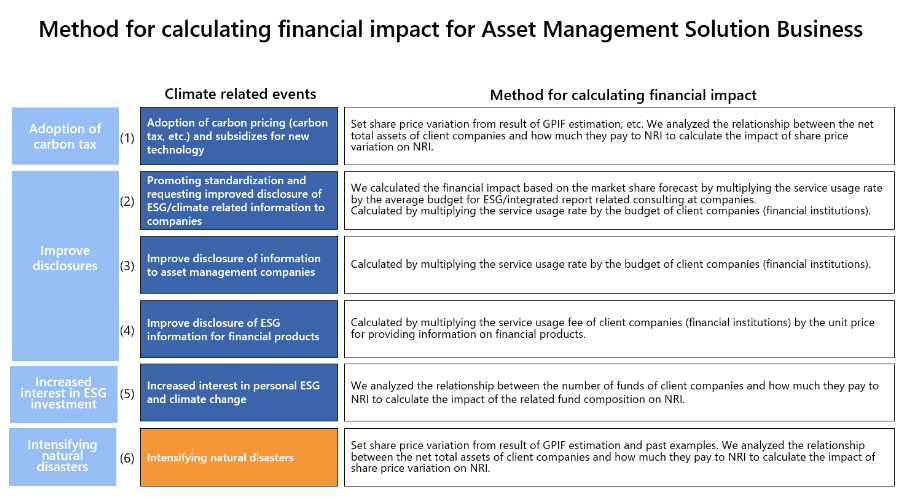

Next, we predicted how variation factors of profit will change based on the anticipated changes at client companies and calculated financial impacts for the six events. The below illustration shows the calculation methods used.

We derived calculation methods for and calculated financial impact for each of the events based on the

calculation methods in the above illustration and what we anticipated for each scenario.

For instance, regarding (1) Adoption of carbon pricing (carbon tax, etc.) and subsidies for new technology,

changes to corporate competitiveness and corporate value impact the asset balance. These impacts on the

asset balance also affect profit in the asset management service. Therefore, we conducted a regression

analysis to find the correlation coefficient for client companies’ asset balances and profit in

NRI’s asset management service. Assuming asset balance changes caused by the 2°C scenario and 3 to

4°C scenario, we can derive profit changes in the asset management service.

To predict stock asset balance changes in the 2°C scenario and 3 to 4°C scenario, we used the rate

of fluctuation, which indicates the impacts of climate on the corporate value of the entire portfolio, from

the GPIF’s ESG Report released in August 2020.

For events (2) to (6), we once again derived calculation methods and calculated financial impacts.

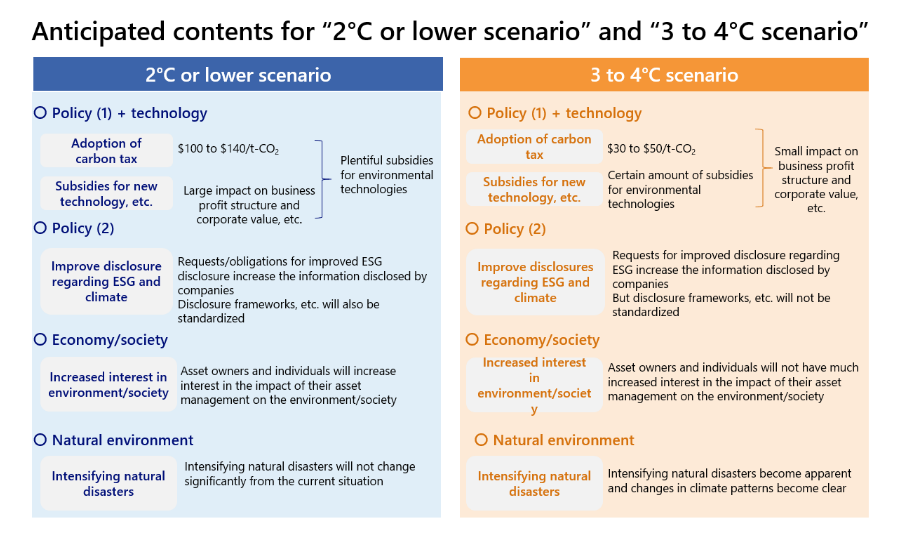

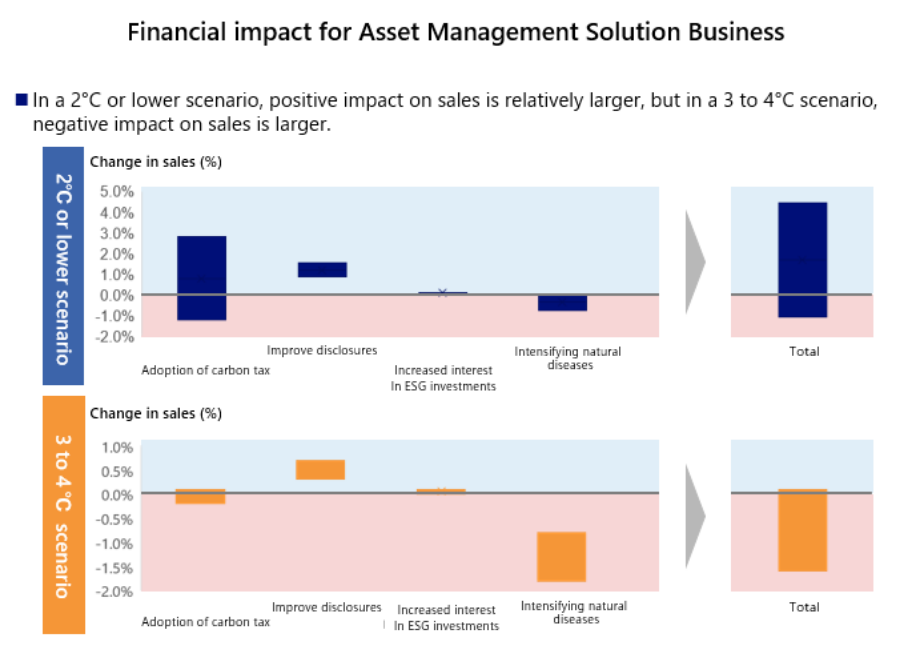

Financial impact was expressed as profit change. The following illustration shows the financial impacts in

terms of changes in earnings, summarized in four categories: adoption of a carbon tax, etc.; improved

disclosure; increased interest in ESG investing; and intensifying natural disasters.

According to the illustration above, the impact of increased sales is relatively larger in the 2°C or lower scenario, while the impact of decreased sales is larger in the 3 to 4°C scenario.

Scenario analysis for the data center business [FY 2019]

Among the risks and opportunities identified in FY2018, we conducted a scenario analysis for

the data center business—upon which climate change has the greatest impacts—in

FY2019.

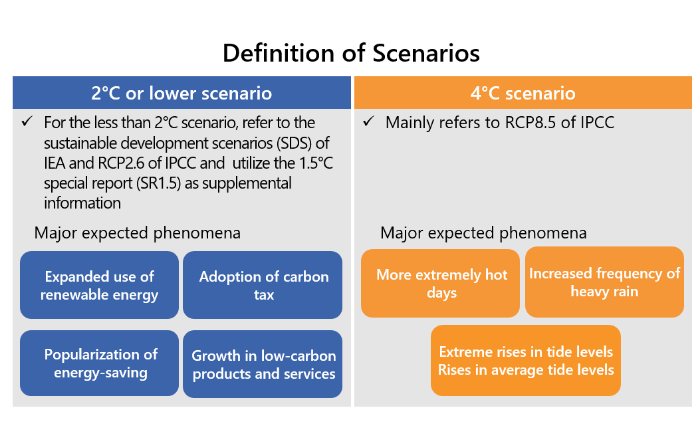

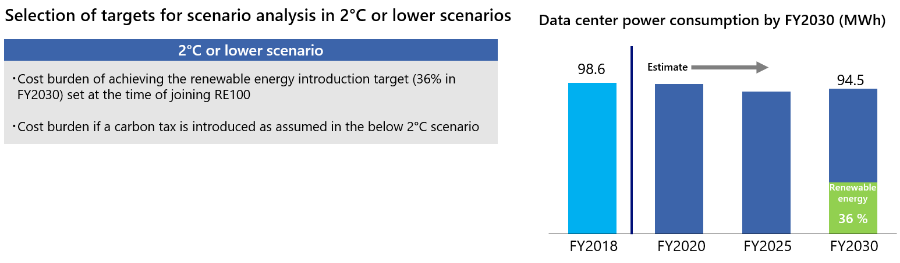

To define and identify scenarios, we established two scenarios for the mid-to-long term

(2030 on): the 2°C or lower scenario and the 4°C scenario. In selecting the subjects

of the scenario analysis, we chose scenario analysis subjects to evaluate business impacts

in the 2°C or lower scenario and in the 4°C scenario.

Finally, we evaluated impacts on the data center business in each scenario.

【Evaluating impacts in the 2°C or lower scenario】

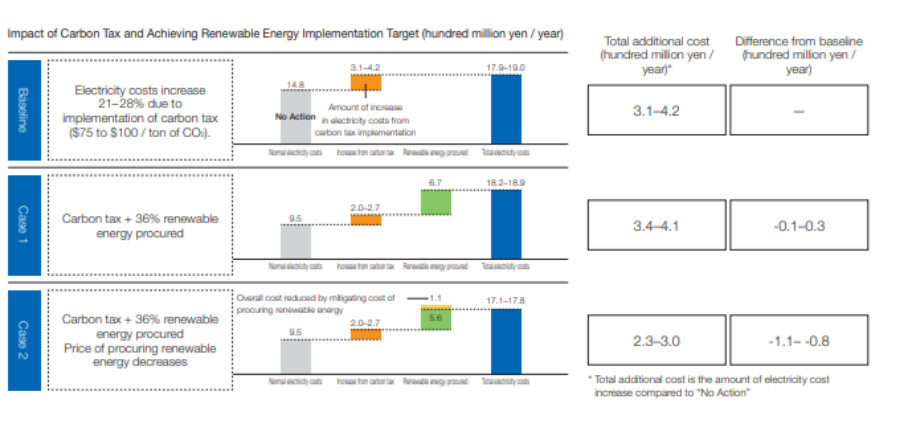

In the 2°C or lower scenario, to study the effects of adopting a carbon tax and renewable energy, we

anticipated a Baseline, Case 1, and Case 2, and evaluated the financial impacts for each. In the Baseline,

we anticipated that the adoption of a carbon tax ($75 – $100/t-CO2) caused electric utility expenses

to rise 21% to 28% compared to FY2018, and that NRI did not procure renewable energy. In contrast, in Case 1

we anticipated that NRI achieved a renewable energy procurement rate of 36% by FY2030, which is a

medium-term target. Case 2 had the same conditions as Case 1 while also assuming a world in which the

renewable energy procurement cost*4 had fallen.

As a result, it was found that under the 2°C or lower scenario, the impact of the introduction of a

carbon tax can be mitigated by achieving the renewable energy procurement target (see the differences

compared to the Baseline for Case 1 and Case 2 in the illustration below).

We are currently investigating the procurement of renewable energy, and are exploring methods for long-term,

stable procurement with an eye towards 2030 and 2050.

Assessment of impact in 2℃ or lower scenario

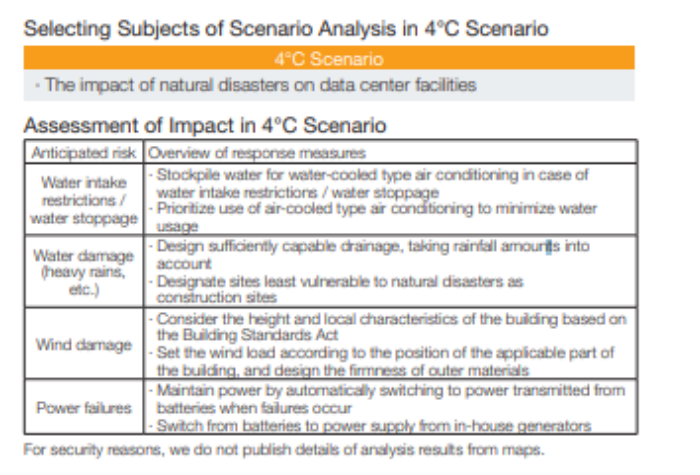

【Evaluating impacts in the 4°C scenario】

In the 4°C scenario, to research the impacts of natural disasters on data center facilities, we used hazard maps and other methods to analyze flood and landslide disaster risks near data centers. We evaluated these impacts as being small. However, data centers are taking measures against anticipated risks.