Enhancing Mechatronics for EVs through M&A “Integration of PMI strategy and governance”

When a component manufacturer conduct M&A for the enhancement of Mechatronics for EVs, advanced PMI is required that leads to business development.

Component manufactures need to strengthen the overall Mechatronics for electrification of cars

With electrification, cars would require 40% lesser components. This will have a devastating impact on especially component manufacturers that deal in mechanical parts of engine and driving system. If the workers do not have anything to do, they will be laid off by the reorganization or culling of corporate restructuring.

Component manufacturers are at a position where they cannot underestimate the flow of electrification, rather they need to strengthen their business in that direction. Further, electric cars require lesser components; hence, it is indispensable for the component manufacturers to expand their business domains from components to units and systems in order to maintain or expand their business scale.

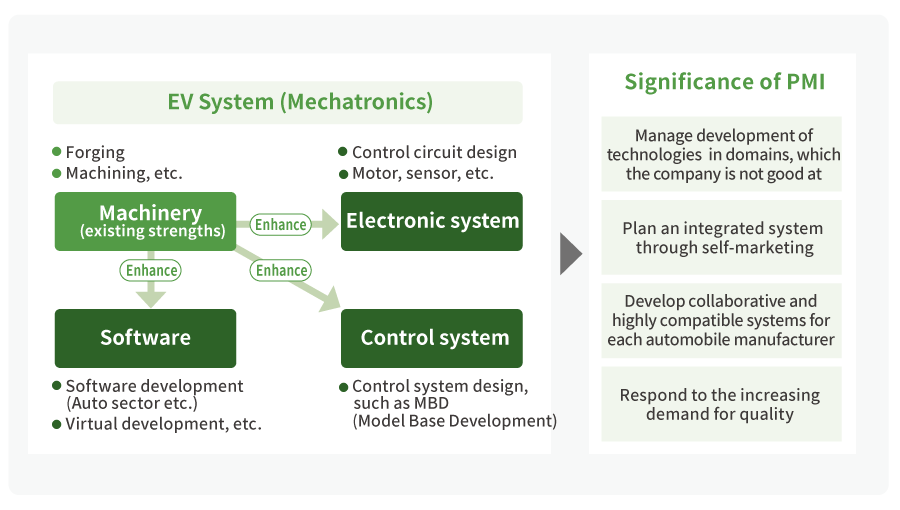

In order to develop the EV system, they are required to strengthen the control system, Mechatronic and the software domains, as well as improve the capabilities of the Mechatronics as a whole, in addition to the conventional strengths of molding and machining.

Advanced PMI is required for M&A concluded to enhance Mechatronics

Nowadays, companies that cannot cope up with the enhancement of EV system and enter into M&A are increasing. However, it is also true that there are many companies that did not enjoy the synergy effect from acquisition. In the worst case, they suffered impairment loss from the assets allocated at the time of acquisition.

Even if acquisition helps one in meeting the technical requirements for EV system, it is not enough. The companies are required to make a system that can be sold based on their own marketing, and have collaborative or compatible systems to meet the different needs of automobile manufacturers. In order to completely prevent the impairment risk, an advanced PMI (Post Merger Integration) is required to reinforce these business models.

■ Significance of PMI in M&A concluded to strengthen Mechatronics

NRI provides comprehensive support from strategic integration to designing governance structure for M&A that requires advanced calibration such as electrification.

Provides support for integrating strategies and governance aspects to achieve sustainable synergy

NRI analyzes that one of the factors for acquisitions failure is due to inadequate integration of strategic and governance aspects. Short-term measures such as cross-selling and joint procurement are not sufficient to achieve sustainable synergy. The long-term strategy of how to develop the system and how to sell it to the customers is strongly demanded. Also, in order to ensure the medium to long term strategy is promoted, it is important to design a governance system including management, evaluation, roles and responsibilities of the acquired company from own company.

NRI has a team specializing in automotive industry and organizational management that provides PMI support focused on strategies and governance.

Case: Support for consensus on the medium to long-term strategy for European acquired firms

A machine based automotive component manufacturer was acquired an overseas component manufacturer to expand its overseas customer base and strengthen the development of future EV systems.

Post-acquisition, at the first meeting of the two companies, NRI presented long-term prospects for the market and assisted in building a common understanding of the market environment as a prerequisite for strategic integration. Following this, NRI presented EV system’s promising domain based on industry expertise and support the two companies on the medium to long-term strategy agreement.

In the end, to ensure that the strategy is promoted, designed a 100 items initiative list (including activities and targets), set up KPI, and even designed the governance structure including the rights and responsibilities of the staff of acquired companies and reporting line to be followed in headquarters.

■ Features of NRI's PMI service

Developing solutions for materials business “M&A to expand value chain expansion”

The focus of material industry is also shifting from products to services. There is a need to provide solutions combining products and services to directly solve the issues faced by the customer.

Issues faced by customers are complex and diverse due to the destructive changes in the automotive industry

With the changes on regulations of the selling of gasoline vehicles in Europe, the automotive industry is moving towards rapid electrification and low fuel consumption. Further, with emergence of automotive operation technology and digitalization, use of automobile in transportation and living environment, as well as, the process of developing and designing them is undergoing a major change.

As a result, skills and know-how required by automobile and component manufacturers are also changing. Besides digitalization, businesses are required to review the component design, materials used and processing methods.

Moreover, it is not easy for the automobile and component manufacturers to resolve these issues with limited resources.

There is an urgent need to acquire skills to solve issues through material + α, using the resources of other companies

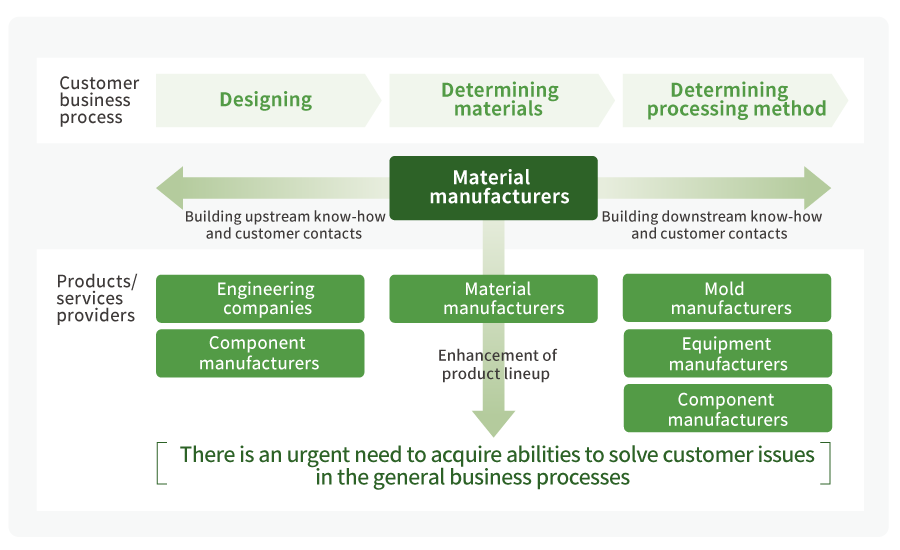

The material manufacturers are required to work more actively than ever and propose accurate solutions.

On the other hand, in addition to providing company’s material in response to RFQ received from customer, they need to propose the production, processing method, and usage at component level.

It is required to support for adding high value and for focusing on core operation according to the joint development with the end client (automobile manufacturer) and improving efficiency/alternative for the process of manufacturing and development.

However, in most of the cases, it is outside the scope of material manufacturers; hence, customer values must be improved rapidly using the resources of other companies as well.

■ Acquiring problem solving functions that utilizes functions not materials

NRI can support collaborations/M&A, from strategy building to execution and integration, for developing solutions for material manufacturers.

M&A support with a high strategic significance based on a deep understanding of the automotive industry

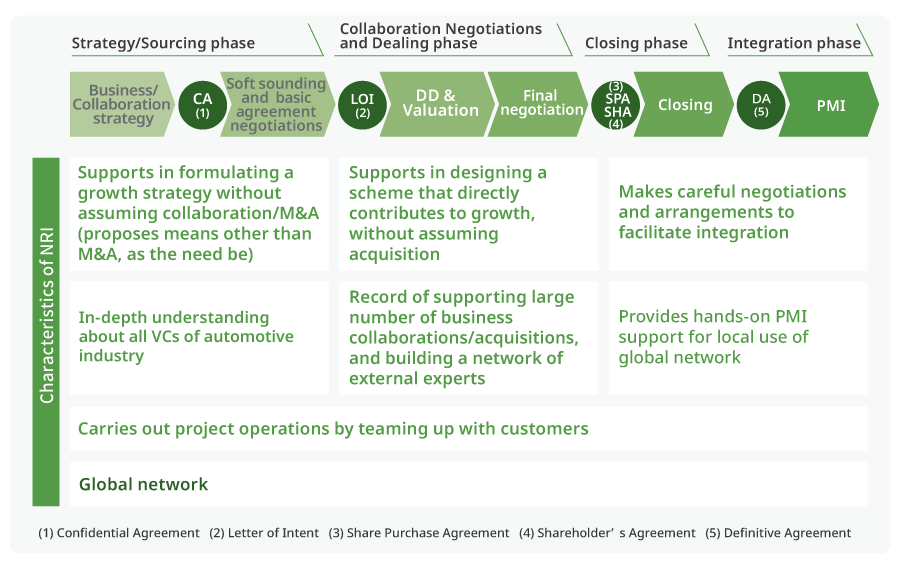

M&A and tie-ups also serves as an effective means to expand the functions for delivering value to the customer. Based on our in-depth knowledge about automotive industry, NRI provides support for collaborations and acquisitions from strategy building to PMI, for improving value addition.

In the strategy phase, it helps in formulating a highly effective and feasible strategy based on the knowledge of automobiles, without assuming acquisition. In collaboration negotiations and dealing phase, the consultants having rich experience in M&A smoothly negotiate with the external experts (Investment banks, lawyers and accountants). In the integration phase, M&A experts as well as functional experts (for human resources system, etc.) become a team and provide on-site support for smooth integration, from strategy building to implementation.

Case: Support for high-value addition and global expansion through overseas M&A

NRI supported a Japanese company in an overseas M&A, as an expert in business strategy/M&A. In the strategy phase, we analyzed the needs, industry structure and success factors of various countries, and formulated a growth strategy. Moreover, we validated the results of collaboration by collecting data regarding customers’ evaluation (VoC*) about the promising companies for collaboration.

In the following phase, NRI supported customers for their negotiation such as anonymous soundings to companies with high possibility of acquisition.

Further, we carried out comparison with strategy and business level of target companies and led to conclusion of acquisition. NRI made careful arrangements at advance-level, and for PMI after acquisition, we teamed up with customers and acquired company to ensure smooth operations.

* Voice of Customers

■ Features of M&A/collaboration services of NRI

Rebuilding strategies for electrification of cars “Creating a new business model”

Battery business that supports electrification requires enhancement of supply chain and improvement of profitability using a business model that brings cost to the users of batteries.

Stringent demand and supply of batteries in the era of rapid electrification

There is a rapid electrification of cars, mainly in Europe and China. The measures adopted to spread electric vehicles are also shifting from assistance type (such as purchase subsidy and tax exemption) to control type (such as ban on sale of internal combustion engine-equipped vehicles and restriction on NEVs).

Further, after the Diesel gate scandal, OEMs have started working on the electrification strategy and are announcing aggressive sales targets, which is expected to expand electrification rapidly.

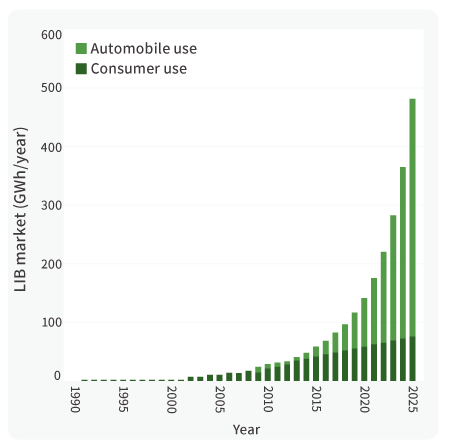

On the other hand, the Lithium-ion battery (LIB) industry is bound to point out the possibility that supply may not be able to meet the over rising demand, comparing the rapid expansion of electric vehicles market with the trends of market expansion until now. Elimination of bottlenecks concerning the supply chain, such as securement of resources and capital investment by battery and material manufacturers, and supply of battery equipment, has become a pressing issue.

Development of a business model that is indispensable for the spread of EV

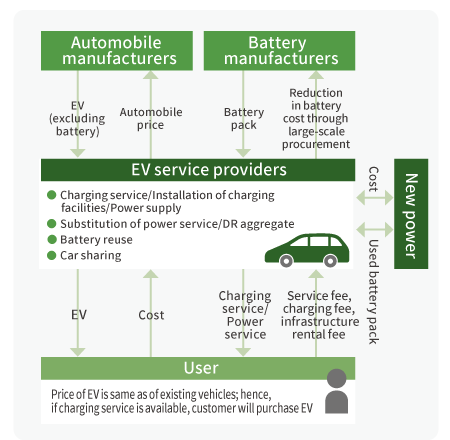

If we generally classify the current roles in automotive industry among manufacturers, dealers and fuel companies, EV society will offer low profits to the fuel companies, due to which an ecosystem will not be established. Hence, it is necessary to divide roles appropriately that can help in securing profits.

Further, due to high cost of batteries, making EV having the same driving range as the gasoline vehicles makes it very expensive and reduces the demand.

Since there is a limit to the cost reduction of batteries through technological development, it is required to make adjustments for substantial cost reduction of batteries through business innovations. Specifically, they can pass on lifecycle cost of battery on the user, by creating a used battery market, promoting reuse of batteries and making adjustments in power systems that are used in-vehicle batteries. Therefore, it is necessary to create a business model that solves these issues and verify and execute such model.

■ LIB market estimation based on optimistic electrification scenario

■ Business model for the EV era

Using our industry knowledge, NRI can propose a strategy using client's strengths and provide execution support for the electric car, battery and materials business.

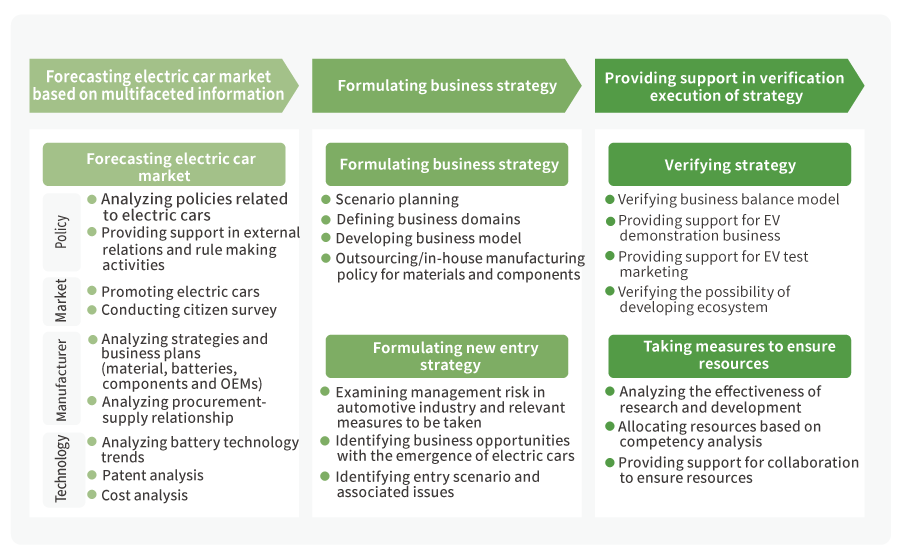

Provides specialized execution support for forecasting, strategy formulation using highlyaccurate information and multifaceted analysis

NRI has over 20 years of accumulated data acquired through industry research and has established itself in the field of electrification of cars and batteries.

Market forecasts are characterized by multi-faceted analyzes such as policies, users, manufacturers, and technologies. NRI visualizes the future from both supply side and demand side, using our powerful industry network, highly-accurate information and user surveys. Further, in addition to research activities for policy-related trends, we provide support for making rules related to decision-making process and identification of key persons.

While making a new entry strategy, it is important to consider differences in industry practices and patents as a risk and include them in the strategy.

We have a collaborative system in place with NRI Cyber Patent for implementing patent analysis.

After the strategy is drawn, most companies face the issue of resource shortage in the execution phase. Therefore, NRI provides support for reliable execution of strategy through optimization, resource allocation, and outsourcing, to eliminate the shortage of man-hours for development.

Case: Provided support in forecasting electric car market and developing a business model

After the Diesel gate scandal in 2015, various governments proposed the policy to ban the sale of internal combustion engine-equipped vehicles, and OEMs in Europe strengthened the strategy related to electric cars. Regarding the feasibility of shifting to electric cars, NRI quickly presented the crises in lithium-ion battery market and bottlenecks in supply chain, and advocated measures for stable procurement. For this, NRI utilized the knowledge of entire value chain, including materials, batteries, automobiles and power.

Following this, when NRI performed incremental cost analysis with an intent to reduce the cost of batteries required to shift to EV and PHEV, it was identified that it is considerably difficult to reach the target cost; hence, companies were suggested to reduce cost by having an effective business model.

For developing the business model, NRI suggested to expand the business domains, mainly in Reuse and V2G, based on advanced overseas trends data we obtained through our industry network. Further, we also helped in identifying the core technologies and usage method using clients' strengths.

■ Characteristics of electric cars and battery related services of NRI

Reducing cost further by utilizing emerging nations “Procurement reforms”

It is very crucial to utilize the strengths of local suppliers and actively include emerging nations in the value chain to respond to the growing demand for cost reduction.

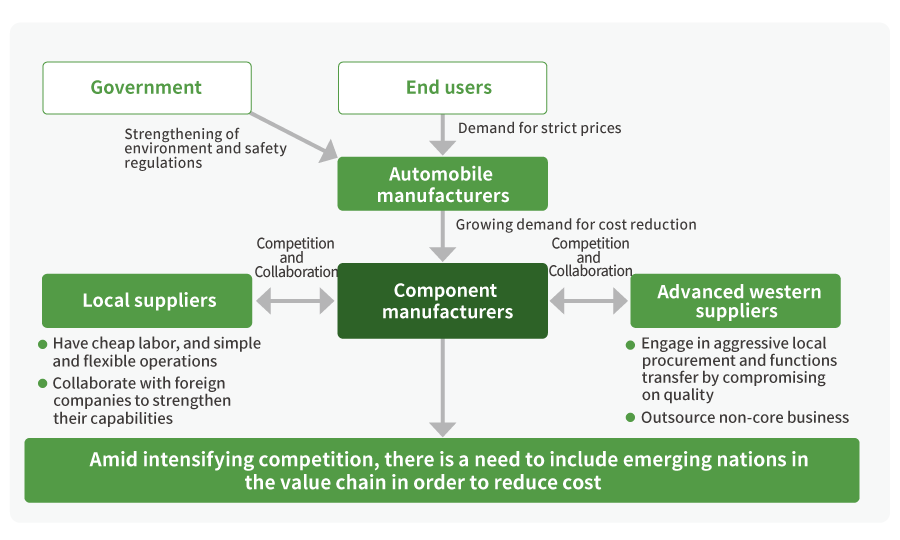

With the growing importance of emerging nations market, demand for cost reduction is becoming very strict

While the new car sales are hitting their peak in developed countries, importance of emerging nation markets including China is increasing. Under these circumstances, "cost reduction" is something that automobile and component manufacturers cannot overlook. With rise of middle class and strengthening of environment and safety regulations, emerging nations require "high-performance cars that can be purchased at affordable prices", and manufacturers are required to offer "low-cost products". With price demands from end users becoming strict, the demands of automobile manufacturers from component manufacturers for cost reduction is also getting severe. The operations centered on developed countries have reached a stage where any increase in fixed cost cannot be afforded. The component manufacturers must stay determined to reduce the cost by utilizing emerging economies.

It is necessary to include emerging nations in the value chain by harnessing the potential of local suppliers

The rise of local suppliers is remarkable in emerging nations. Local suppliers aggressively set low prices by employing cheap labor and compromising on quality, which helps in expanding sales to automobile manufacturers. Especially, in India and China, many local material and mold manufacturers have emerged, who utilize the "wide range of industries" to devise creative measures for cost reduction. Further, if we look at after-market components, China and other countries are supplying such components to the entire world and also offers improved quality, due to which, they are used in the genuine components of OEMs. Under such circumstances, advanced Western suppliers are aggressively progressing towards local procurement and functions transfer activities, and are strengthening their operations in China and India.

They are strengthening their collaboration with local suppliers in order to reduce cost.

■ Structure of demand for cost reduction and tough competition in emerging nations

NRI provides comprehensive support for procurement reforms, from drafting a procurement strategy to exploring suppliers by utilizing the potential of emerging nations.

With a base structure deeply rooted in emerging nations, NRI provides support for partnering with local suppliers

NRI has a well-established base structure in Asia where many promising suppliers are present. The overseas bases of NRI constantly build a strong network with local industry groups and suppliers. In order to search, evaluate and select the promising suppliers, NRI provides support to contact the suppliers and negotiate for the clients.

Further, not only do we search for promising suppliers but also supports procurement strategy planning in the preliminary stage. In "Business Environment Analysis", we analyze country-wise strengths and issues from a macro viewpoint.

Further, we also conduct a concrete market survey to identify the environment where products are used.

In addition, we also "set targets" regarding supplier of products, products that are to be procured and procurement price. In the subsequent "simulation", we analyze the awareness about cost benefits and risks associated with a change in supplier.

Case: Support for searching new suppliers for power train components in India and examining collaboration with them

Using our strong industry network in India, NRI provided support to search new suppliers for power train components and examine the possibilities to collaborate with the identified companies.

In the Company Search phase, we 1) Clearly defined the skills required from new suppliers, based on the management issues faced by clients, and 2) Created a long list of suppliers in a short period of time, using our database and interviewing local industry groups and leading companies.

In order to create a long list, we implemented desktop surveys as well as soft sounding towards promising companies and evaluated them from the perspective of QCDDM to identify the promising companies. In the Evaluation and Selection phase, we connected our client to the local suppliers of the potential region for procurement and provided indirect support for specific negotiations. We also provided support during discussions and negotiations to find any possibility of collaboration.

■ Characteristics of procurement reforms implemented by NRI using emerging nations