Building new business models using vehicle data: Support for Development of Connected Services

With the rapid progress of connected cars, new business opportunities have emerged. Hence, we need to position ourselves and build an ecosystem from a broad perspective.

By 2025, more than 70% of new cars will be connected, and there will be wide range of applications of the collected data

The declining costs of IT such as sensing, communications, and data storage, increasing importance of software in automobiles, and need for their maintenance is driving the development of connected vehicles. As a result, more than 70% of the global automotive market (in terms of sales volume) will be connected by 2025 and a large volume of vehicle data will be collected.

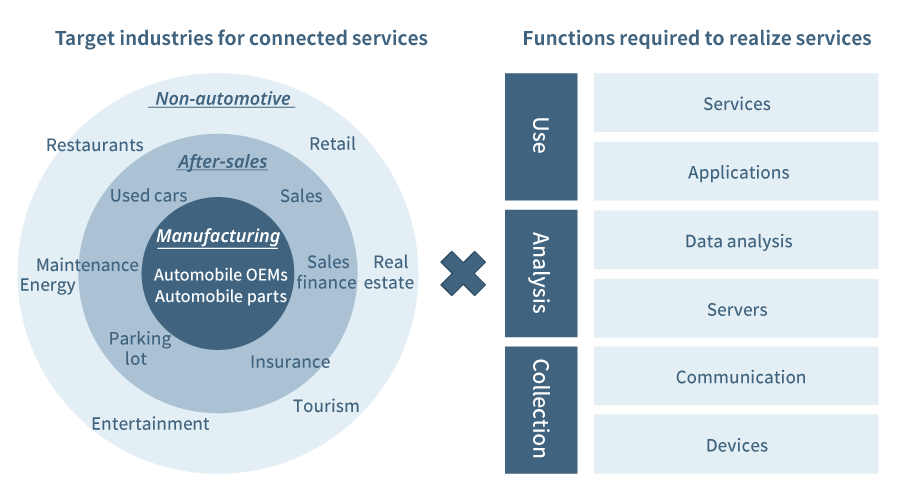

The progress of connected cars will not be limited to areas related to manufacturing (such as autonomous driving and software updates) but will also affect automotive after-sales services (such as automobile insurance and maintenance services) and other non-automotive areas (such as real estate and retail).

A wide variety of capabilities are required, which increases the need to collaborate with other companies

Stakeholders in the field of connected cars range from automobile manufacturers involved in the manufacture and sale of vehicles that generate data, to parts suppliers, telecommunications carriers, insurance and maintenance companies that use them.

From the standpoint of automobile and parts manufacturers, the obstacles to commercialization are cloud data analysis and lack of in-depth knowledge of industries (after-sales) where the generated data will be used. On the other hand, it will become imperative for telecommunications carriers and after-sales service providers to be involved in the automotive industry, which is unfamiliar to them.

In such a case, collaborating with players who have the relevant capabilities and knowledge that we do not have will become indispensable.

■ Scope of consideration of connected services

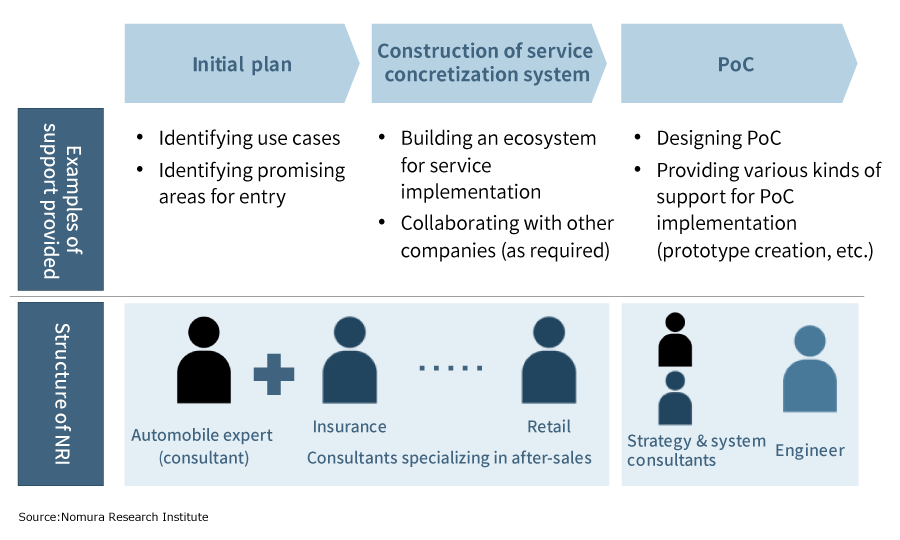

NRI can provide end-to-end support in the field of connected services, from initial planning to service implementation, collaborative negotiations with the related players, and PoC implementation

Experts from various industries provide end-to-end support from planning to PoC*leveraging system capabilities

There are many patchy use cases related to the connected sector because of large number of stakeholders and the great deal of attention that it has recently drawn. Furthermore, there are many nascent use cases; hence, it is often necessary to decide on commercialization based on a more detailed feasibility study (FS) using PoC* in addition to a desktop FS.

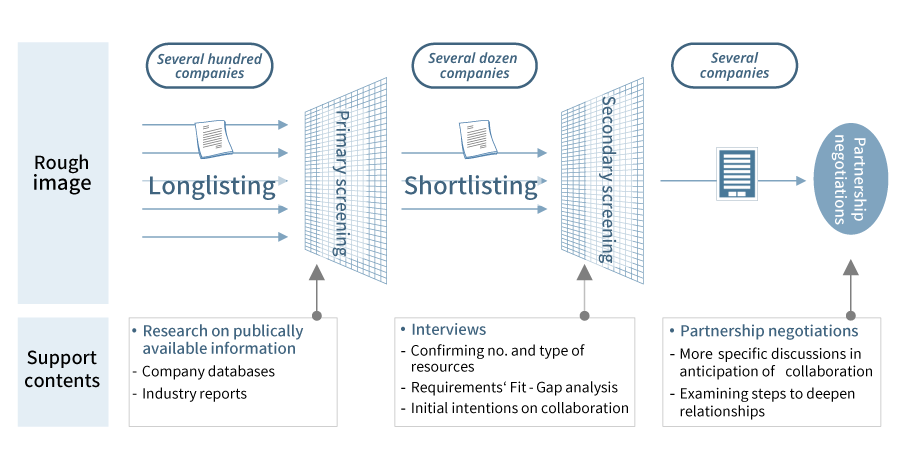

For this, we (1) conduct a detailed desktop examination of numerous use cases to narrow down and define the business scope, and (2) conduct a PoC-based detailed verification involving other companies as necessary.

Regarding (1), our consultants have expertise in their respective industries, i.e., automotive (particularly the connected domain) as well as after-sales (such as insurance and retail) and work together to support the clients. With regards to (2), we provide integrated support with a team specialized in systems and analytics, from PoC design to execution.

* PoC: Proof of Concept

Case: End-to-end support from development of entry strategy for the connected domain to ecosystem construction

NRI provided complete support to the Japanese automobile company A, from its initial plan to enter the connected sector, to the implementation of services and collaboration with partners.

In the initial planning and service implementation phases, NRI identified and narrowed down the areas of entry based on its database of use cases. In doing so, we assigned consultants who are well versed in the relevant industries to conduct detailed feasibility studies and build business models based on the knowledge of the after-sales industry.

In the collaboration support phase with partner companies, we provided the necessary support to deepen the collaborative relationship, including listing up of capabilities of both companies, specification of services to be deployed, and facilitation of review workshops.

■ Intensive support for development of connected services

Strengthening responsiveness to increasing software development: Support for Procurement of Software Development Resources

We provide support for the effective procurement of resources for planning and creation of an appropriate software development system

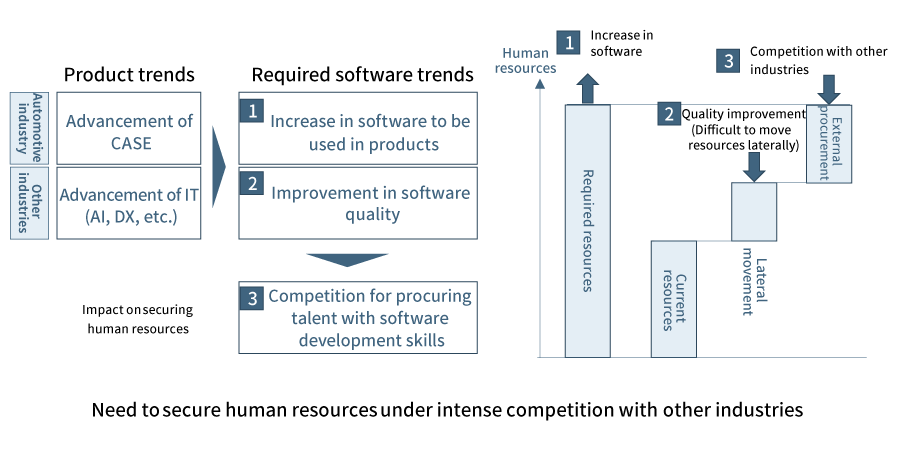

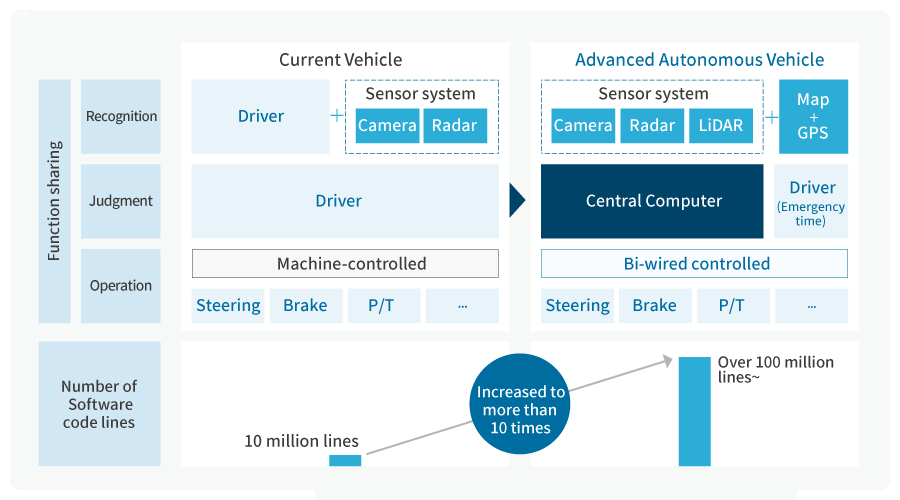

With the advancement of CASE, there has been a dramatic increase in IT software use in vehicles and servers

The advancement of CASE in the automotive industry has dramatically increased our reliance on software.

In order to control automobiles and provide various services, not only does software need to be increased, but its quality also needs to be improved.

To realize CASE, AI (Artificial Intelligence), big data analysis, high-definition maps, precise feedback control, and an easy-to-use user interface are indispensable. Therefore, high-speed processors, special sensor information, and highly technical software that make full use of advanced mathematical models must be developed in a short period of time.

Need to use various approaches to procure resources

Software is becoming advanced not only in the field of automobiles, but in all the areas of society, for example, IT equipment is becoming more advanced and widespread, and home appliances, more intelligent.

As a result, there is a shortage of engineers capable of developing advanced software, which is causing a scramble across industries.

Until now, engineers have been trained internally, but in the field of software, where technological innovation is rapid, there are not many advanced resources to begin with. Moreover, not only do they lack time for training, but there are no leaders to train them.

As a result, domestic procurement (within Japan) has reached its limits, and it is necessary to optimize and establish procurement schemes covering overseas.

■ Software talent shortage caused by product trends

We not only aim to secure human resources in line with the business strategy, but also focus on overall performance by building a system where employees feel comfortable

Securing human resources based on trends in the automotive and software industries

It is relatively easy to determine the required resources for a company from the gap between its current state and future image drawn up in its business strategy. However, in order to secure the necessary resources in the software industry as a whole, where it is becoming more and more difficult to do so, it is important for management to have good judgement skills and to build an environment where people want to stay.

In other words, it is necessary to have a perspective on the kind of companies and human resources that are to be secured and the methods to retain them, including non-monetary aspects as well.

NRI is one of the largest system integrators in Japan, and has accumulated knowledge over many years on the evaluation of software development companies and their personnel and future trends.

We use this knowledge and combine them with multifaceted measures to secure and maintain human resources.

Case study:Maintaining an appropriate distance depending on the situation and deepening relationships while reconciling differences

NRI helped a software developer secure development resources for automobiles.

We analyzed the existing portfolios and future trends to identify human resources that can be internally adjusted, and estimated the number of resources by capacity to be procured externally.

Generally, we follow this approach to identify promising companies and start approaching them individually. However, in order not to end up with mere numbers, we take into consideration their corporate philosophy and culture and thereby create a suitable form of collaboration.

For this project, we not only delineated the current form of collaboration, but also presented the stages from trial ordering to dispatch on site, business tie-ups, and capital tie-ups, making it a pilot project, and established a scheme that allows us to gradually deepen our relationships while also maintaining an appropriate distance from each company.

■ Flow of selection of promising companies and partnership negotiations

Supporting Development of New Businesses in the CASE Era through Industry-Government-Academia Collaboration

We provide support from strategy formulation to execution for early-stage development of new products and services required in the CASE era

Developing new businesses at the early stages of CASE with different business models is the urgent task

The CASE trends in the automotive industry have removed the added value of existing businesses and peripheral businesses and may even potentially destroy them in the long term (due to loss of value / obsolescence of parts with electrification).

As a result, it has become difficult to envision sustainable growth by simply developing new businesses as an extension of existing businesses.

Instead, the need of the hour is for new business development in new markets created by CASE (such as autonomous driving, connected cars, etc.) as well as in other industries (such as medical and energy) using the capabilities cultivated in the automotive industry. As these are new markets, it is necessary to provide products and services at the early stages of development in these areas.

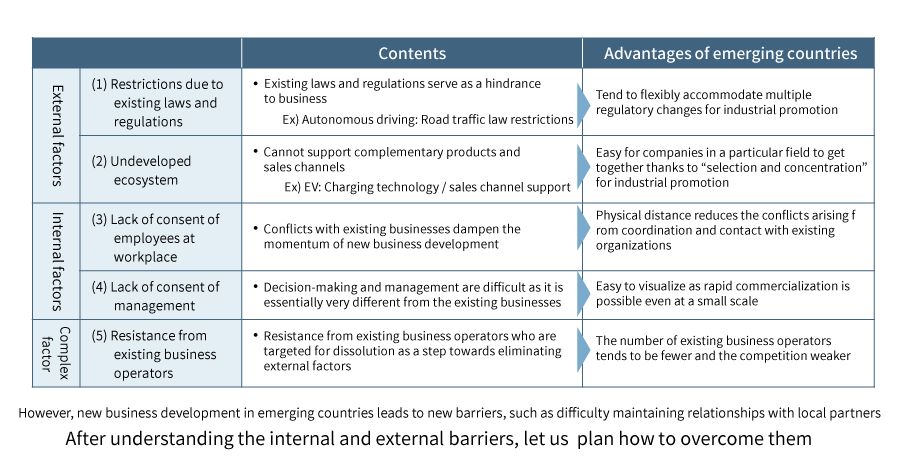

We need to overcome many internal and external barriers at the early stages of new business development

The common barriers in the early stages of new business development are as follows: (1) restrictions due to existing laws and regulations and (2) undeveloped ecosystem as external factors; (3) lack of consent of employees at workplace and (4) lack of consent of management as internal factors; and (5) resistance from existing business operators as a complex factor.

To overcome these barriers, it is important to develop businesses in countries/regions that are suitable for the same. The ideal choices would be emerging countries that focus on the development of specific industries. On the other hand, this will also lead to new obstacles such as a decrease in the supply of people, goods, and capital, and increased difficulties in maintaining relationships with local partners.

■ Barriers to new business development in the early stages / Advantages of emerging countries

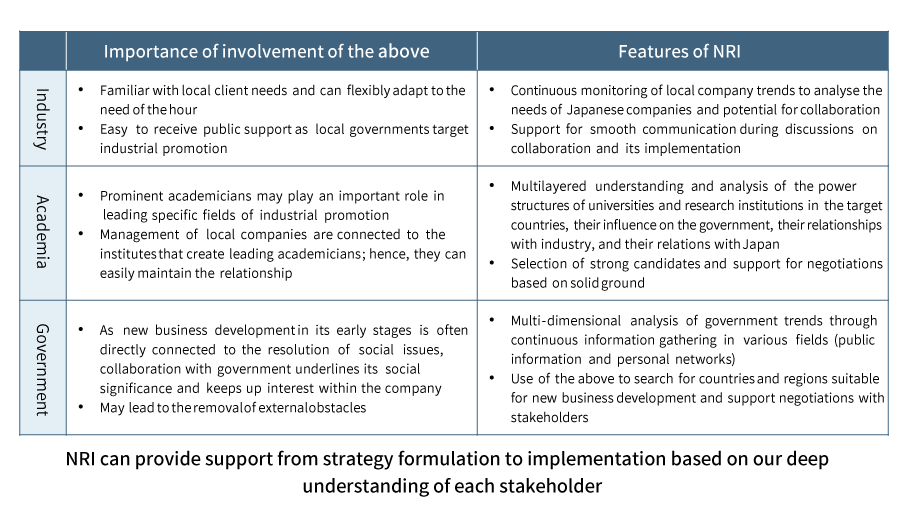

After understanding the barriers to new business development, we will work with the industry, government, and academia to develop our business in suitable countries and regions

Leverage industry, government, and academia to overcome the obstacles to new business in suitable countries/regions

One of the most effective solutions to overcome these obstacles is to collaborate with industry, government, and academia.

By collaborating with local offices in various countries and regions, NRI can provide comprehensive support ranging from overall new business strategy formulation involving the local industries, governments, and academia, to negotiation and execution.

For overall strategy formulation, we will use our network of personal contacts and deep knowledge of the target countries to gain a thorough understanding of the needs of local industry, government, and academia. Based on this, we will create a favorable outline of new business.

For negotiation and execution, we will provide PMO support encouraging a large number of stakeholders to take action. In addition, we will be present at the workplace to ensure smooth communication and suitable responses to everyday problems based on information received from the relevant stakeholders.

Case study:Supporting industry-government-academia collaboration in emerging countries for commercialization of autonomous driving technologies

NRI had supported the launch of a new business related to autonomous driving for an auto parts manufacturer.

To formulate the overall strategy, we identified trends in the governments of emerging countries suitable for the launch of the target business as well as the leading academicians in related fields. This was used to paint a picture of industry-academia-government collaboration.

For negotiation and execution, based on an understanding of the background, culture, and needs of each stakeholder, we prepared negotiation scenarios and materials to be used and facilitated communication during the negotiations itself.

Moreover, in addition to providing negotiation support, we also addressed and reported on everyday irregularities by working together with local partners and preparing POCs. In this way, we maintained our ability to support implementation.

■ Characteristics of NRI’s new business development support through industry-government-academia collaboration

Enhancement of software development capabilities with the emergence of automotive intelligence “Support to outsource development work”

With the emergence of automotive intelligence, large-scale, complex, strategic and effective software development has become imperative.

Development of automobiles go into an uncharted territory to realize advanced autonomous driving

In recent years, new cars, such as autonomous driving and connected cars, that have undergone a discontinuous change from conventional cars, are not only gaining attention from the automotive industry, but also in whole society. The leaders of “Automotive Intelligence” are not the traditional automobile manufacturers, rather the so-called Silicon Valley companies, such as Google and Tesla, that have their main business in IT or software.

Technologies like AI (Artificial Intelligence), image processing and connectivity are very important for developing new cars. Going forward, the focus on value addition in automobiles is likely to shift from hardware to software.

Because of these evolutions, the development of cars has been venturing into an uncharted territory for automobile manufacturers.

Development of large-scale and complex automotive software is on urgent business

In the autonomous driving, the car computer substitutes the function of “Recognition and Judgment”, which has been performed by the driver

up to now. It is expected that the scale of in-vehicle computers for this autonomous driving would be 10 times more than the size of automotive software that is currently being sold in the market, and scale of development will increase further.

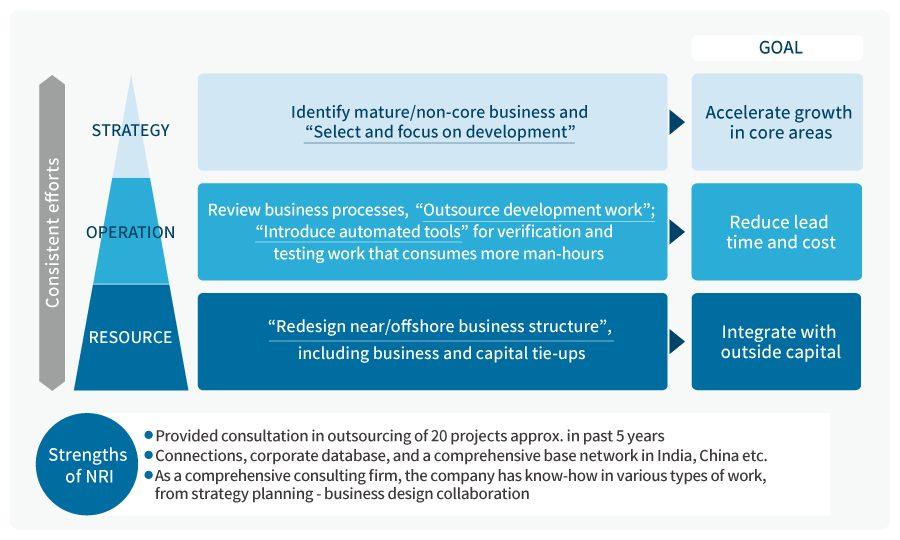

Accordingly, the automobile manufacturers will be required to respond to the challenges, such as (1) Selection and focus of businesses, (2) Development efficiency (standardization/process review) and (3) Development resources optimization (external resource utilization/resource reallocation). Reviewing the current method of development, redefining the direction for business and development, and resource allocation require urgent attention.

■ Software development in accordance with automotive intelligence

NRI can extend support for the formulation of the development strategy, review of business processes, and the utilization of outsourcers.

Drastic strategical changes are required even for the development that was unquestionable before the technological expansion

In expanded and complex software development, a resource strategy is required to assess company’s focus areas and efficiency, to operate the business (including external resources) in a lean manner.

Further, in the autonomous driving that requires coordination between various systems, there is a risk that man-hours pertaining to development and verification will be more due to the complexity of the control architecture. Therefore, it is also important to design an optimized control architecture by introducing model-based development, etc.

Moreover, collaboration with the leading startups is also an important issue. It is also required to divide the roles of development taking advantage of each company’s special skill and redefine the competitive area as an automobile manufacturer. It is difficult for many companies to implement above with the extension of conventional business. It is time to

review the development strategy and system to respond to the technological expansion.

Case: Extensive support such as exploring outsourcing of development to India

Domestic pool of engineering resources is reaching its limit, requiring resources to be ensured on a global scale.

Outsourcing development work to offshore locations, such as India which continues to grow was difficult for many Japanese companies, however this option is now widely used as both the parties (i.e. the outsourcer and the contractor) have been able to accumulate knowhow. NRI has provided support for the development of products and business units, strategic alliances

that are entwined with capital, and the revision of the company's development subsidiaries. It is also important to bridge the language and development culture gap in case of outsourcing development work.

Because of support from NRI for initial trial, companies were able to achieve a smooth resource shift. NRI has numerous project achievements in formulating outsourcing strategies, exploring and evaluating offshore outsourcers such as India, and providing support for trial engineering.

■ Utilization of outsourcing for “Shifting resources to different dimension”

Expanding downstream services for automobile manufacturers “PoC-Proof of Concept”

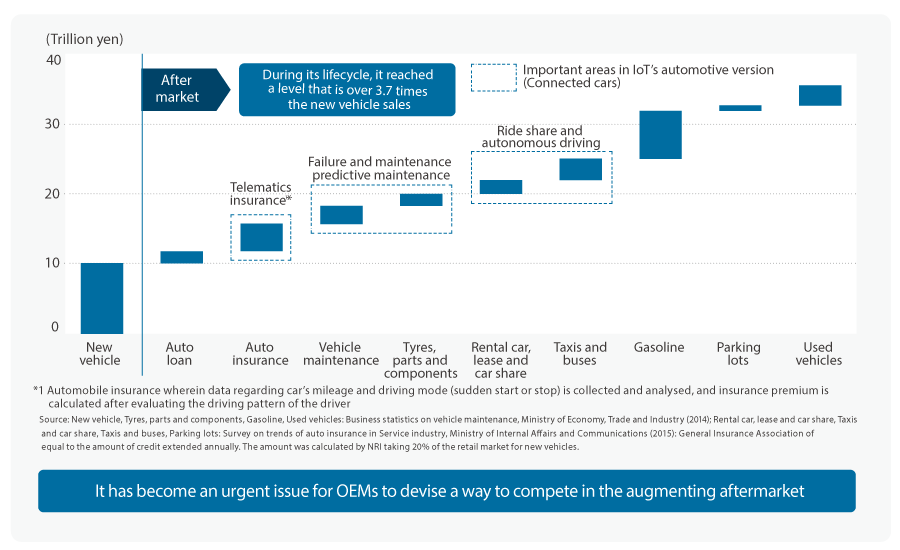

Automotive aftermarket is about 3.7 times larger than new car sales, OEM and service providers are competing beyond the industry barriers.

The advancement of linked technologies, mainly connected cars, has increased the scale of downstream business

The type and quantity of information that can be collected and transmitted to the car is greatly increasing with the advancement of linked technologies, such as the introduction of connected cars and advanced functions of automotive infotainment system. In addition, with a decline in data communication charges, cloud usage charges and unit price of devices, such as sensors, it has become easy to use large volume of data. As a result of these changes, automobile OEMs are shifting their resources from selling hardware, i.e. traditional vehicle sales to downstream business domain that are strong in software, such as autonomous driving, sharing platform, telematics insurance and real-time prediction of failure in components. NRI estimate that the size of aftermarket will be about 3.7 times of the new car sales.

With a tough competition among OEM and service providers, it is necessary to devise a way to succeed in downstream market

On the other hand, service providers, such as Google, Apple, Uber, Grab, have been proactively involved in the development of autonomous driving

or shared platforms in the large-scale downstream business area, and the automobile OEMs and service providers are competing beyond the industry borders.

While the whole industry is accelerating towards establishing a new automotive industry such as autonomous driving and sharing, the existence of service providers with advanced service models and know-how on data utilization poses a threat to OEMs.

Although some OEMs have steered up the road of partnership, it is a challenge for OEMs to consider how to take advantage of their own customer assets and data assets to capture downstream areas.

■ Annual retail market size related to automobiles (Japan)

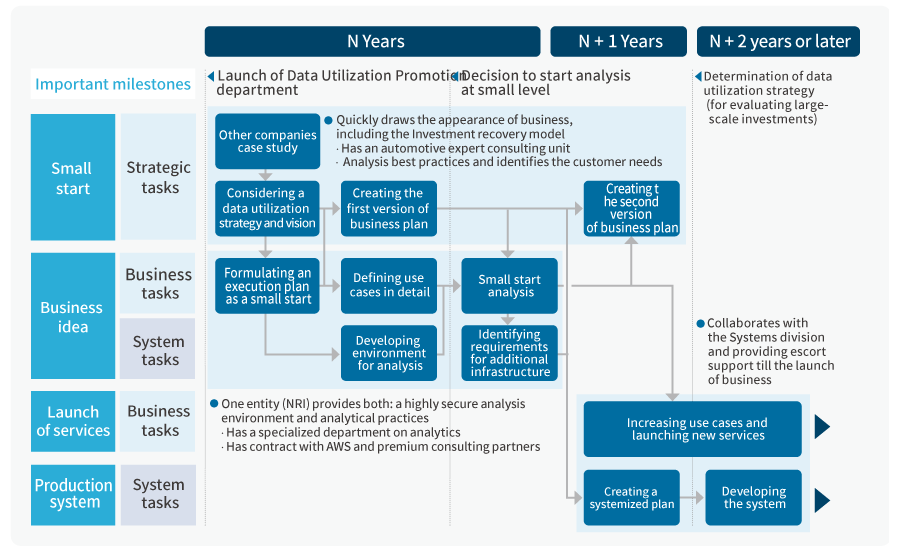

NRI will support from formulation of the data-driven strategy for automobile OEM through PoC due to harmonize consulting and solutions.

Supports PoC with “Con-solutions” that combines consulting and solutions

When deploying services that utilize data such as car sharing and failure prediction in the downstream, know-how and resources are needed to analyze large amount of data owned by the company or partner companies and summarize it in output that can be used within the company. NRI has a system of "con-solution" in which the consulting department and the system solutions division are monolithic, NRI provide support starting from the study of strategy and vision for OEMs in downstream area, creating use cases in detail based on the analysis done within the company, formulation of small start execution plan for PoC, developing analysis environment, implementing analysis using AI or machine learning, to the study of requirements and estimation of the market scale for formulating a business plan for new services.

Case: Creation of new service menu and environment for data analysis

NRI provided support to a division of an automobile

OEM that promotes cross-company data usage.

Taking advantage of the global research network, we conducted a case study on the use of advanced data applications, and we jointly formulated a new service menu with a company, while listening to the After-Sales Services division, the Technical Development department and the production site. Further, to implement PoC, NRI built an analysis environment that ensure security on the cloud, based on the Amazon Web Services (AWS) that NRI has a tie-up.

As a result, the company was able to prepare a mechanism where external data scientist can be

used, without disclosing the highly-confidential data possessed by each division to external parties.

■ Features of NRI's downstream business development "PoC" service

Ecosystem construction in the AI/IoT era “Support to explore and evaluate technology ventures”

In the AI/IoT era, it is important to construct an ecosystem with cross industries and venture companies.

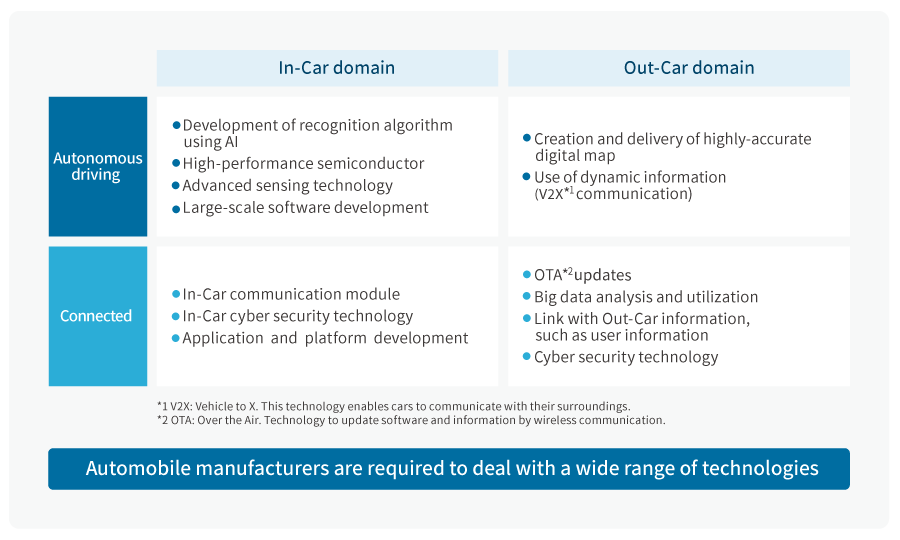

Expanding the technological field which automotive industry should deal with

For automotive operation and connected service, the functions required of the car are expanding significantly. In order to implement these functions, importance of technology is increasing in areas where conventional automobile manufacturers do not possess know-how such as AI (artificial intelligence), large-scale software development, big data analysis, high precision digital maps. Such innovative technologies are not only emerging in the In-Car domain (technologies used within a car), but also in the Out-Car domain (technologies used outside the car); hence, automobile manufacturers are required to effort to these technologies.

Collaboration with different industries and ventures is required in area that can’t be covered independently

The technical areas that needs to be covered is extremely wide and there is hardly any company that can cover all of them all alone. Moreover, speed is also important to secure a competitive advantage in the AI/IoT era. Therefore, regarding the areas that cannot be covered by the company, it is important to leave the principle of self-sufficiency and quickly collaborate with other companies, including different industries and venture companies. By collaborating with different industries and venture companies the automobile manufacturers not only acquires the technology that the company owns, but also leads to speedy management and the opportunity for highrisk development that it is difficult for the company to handle alone.

■ Technologies required in automotive operation and connected domain

NRI quickly explores and evaluates the venture companies that possess the core technologies of AI/IoT to meet customer needs.

Total support, from search to evaluation of venture companies

In the AI/IoT industry, venture companies are likely to grow very quickly. On the other hand, there is a risk that the company gets dissolved or taken over by any other company due to insufficient finance or human resources. Therefore, when selecting a venture company for collaboration, it is necessary to evaluate the target companies from various aspects and make quick decisions.

NRI has established a system to monitor venture companies not only in developed countries but also in the emerging countries, and has built a database to understand the industrial structure and companies working on core technologies. Instead of providing a simple list, NRI can flexibly evaluate the company from various perspectives, such as technology strengths, networks maps, and stakeholders’ evaluation, to meet the needs of clients.

Case: Support for evaluation of partners with AI/IoT technology

NRI has success stories in several fields, such as automotive industry and machine industry. For example: During evaluation of AI-related companies by automobile manufacturer for collaboration purpose, in addition to collecting public information, such as credit information, we also created a network map of stakeholders of the candidate companies, interviewed stakeholders of venture capital or potential companies, and evaluated them from various aspects. In addition, we also presented the return and

risk expected from the collaboration, points to note for inferring risk, and measures to reduce such risk.

Although it was a short-term project of about a month NRI completed it very quickly.

Further, for developing an IoT-related strategy for machine manufacturers, NRI promptly supported the search for IoT venture companies in various countries and regions to support negotiation with partners.

■ NRI's Technology Venture Evaluation

Redefining business values in the era of uncertainty “Creating a steady vision”

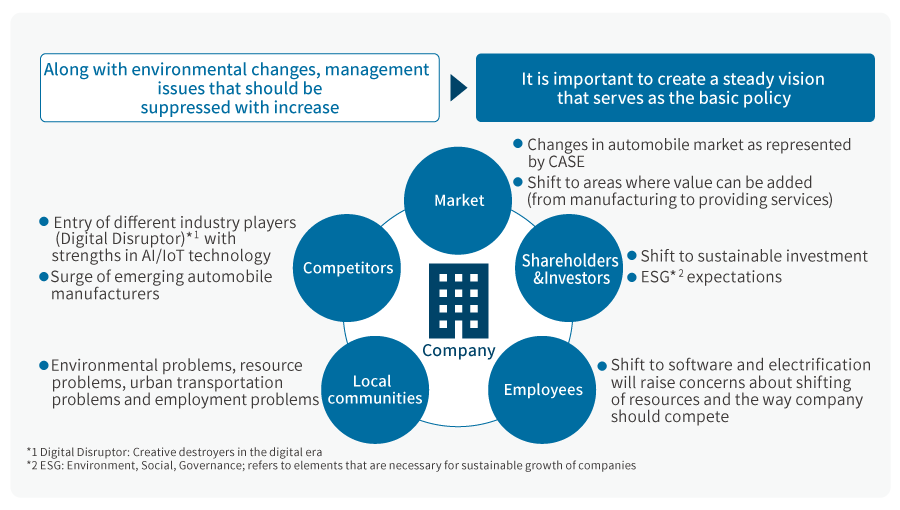

The automotive industry is likely to have a turning point once every 100 years in the 2020s era. A “steady vision” is imperative in this era of uncertainty.

Conventional winning pattern cannot be applied in the next era according to changes in environment represented by “CASE*”.

Over 2020s, we will reach an era where advanced technologies, such as electrification and connected cars, can finally be introduced in the market at full

scale. Besides having a competitive strategy, the automobile manufacturers have to considerably keep pace with the movements in such technologies.

However, when these technologies and products become the mainstream, value addition where especially the Japanese automobile manufacturers have been working on as their specialty, such as engine design or related technology, is likely to relatively decrease. Further, due to the shrinking of new car market because of popularization of sharing and matching, and with the entry of new emerging players that are well versed in ICT, major automobile manufacturers will enter an era where they cannot compete based on the conventional winning pattern.

*CASE: Connected, Autonomous, Shared, Electric

Timing to re-inspection what value the company provides to society

It is extremely difficult to precisely understand the environmental changes. However, if a company chooses to “Wait and not act until the environment becomes predictable”, there is a risk that it may be swayed away by the emerging players entering into the industry.

Therefore, the first step is to “move”. However, the important thing here is to have a steady vision that remains the same regardless of any change in the environment. Communicating vision to people inside and outside the company improves the unifying force, fosters an organizational culture where people can think spontaneously, and also establishes a relationship of trust with investors.

This can also be taken as a great opportunity for management to re-think “what kind of products and services need to be created” and “how the company will contribute to the society”.

■ Environmental changes and request for management in the 2020s

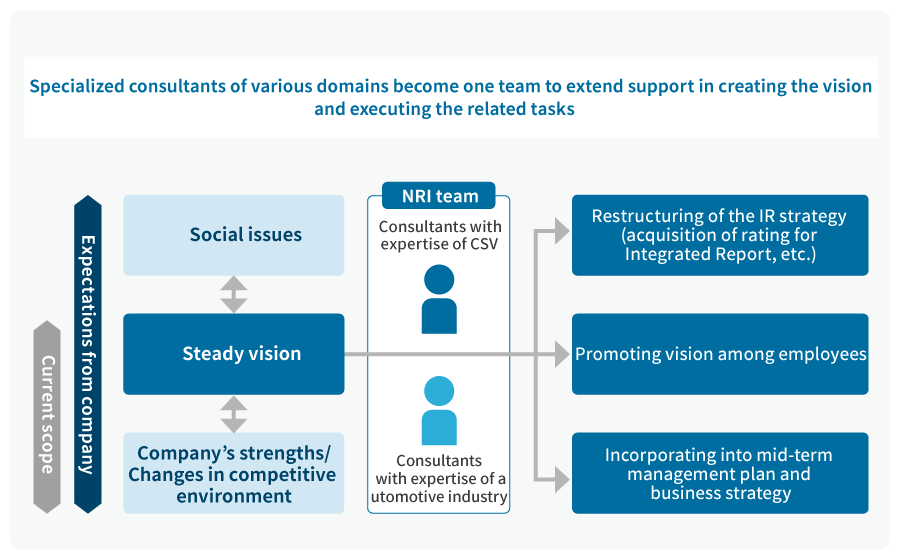

NRI support the formulation of corporate vision that integrates solutions for social problems with the management and business strategy and provides implementation support as well.

Fusion of social problem solution and business strategy/management strategy is important

In order to formulate a “steady vision”, it is better to organize the issues faced by the societies worldwide, integrate company’s strengths with its business strategy, and then move to the next step of identifying social problems that that company wishes to solve.

The importance of this process is that the solutions for social problems are integrated with the business and management strategy. In corporate activities, until now, in most of the cases, CSR and business strategies were classified separately, and the studies and the organizations were considered to be separate entities; however, to realize the integration discussed above, it is necessary to integrate the two and examine the fusion.

NRI has specialized consultants who have expertise of the automotive industry and can support in drafting the business strategy. They work together with the consultants specialized in managing CSR*1/CSV*2 to create a steady vision and extend support in drafting the mid-term management plan and IR strategy.

*1 CSR: Corporate Social Responsibility

*2 CSV: Creating Shared Value

Case: Support for formulation of vision at the time of formulating integrated report and medium-term management plan

Recently, Integrated Reports have become popular, mainly among the major Japanese companies.

Integrated Report is a new tool to interact with the investors wherein the financial reports (e.g., existing Annual Report) are integrated with the non-financial reports (e.g., CSR Report). Nowadays, many global companies have started creating these reports.

To respond to such social demands and management's needs, NRI has accumulated the knowledge required to create a vision for Integrated Report and mid-term management plan over a long

term.

In order to create the vision, NRI provided various kinds of support, such as setting the aspirations and areas for social contribution, as well as, incorporating them into the business strategy and mid-term management plan, communicating the created vision to people inside and outside the company and implementing activities to promote it.

■ Features of NRI's vision development project