Weakness in personal consumption continues in October-December period due to headwinds from high prices

On February 15, the Cabinet Office will release the (first preliminary) GDP statistics for the October-December period of 2023. Based on the average of 37 forecasting agencies’ estimates compiled by the Japan Center for Economic Research’s ESP Forecast Survey up to January 9, real GDP is +1.2% on an annualized quarter-on-quarter basis. The average forecast of 12 agencies released by NHK on February 6 is +0.4% to +2.5% on an annualized quarter-on-quarter basis. The forecast is for an increase from the July-September period, which saw a sharp decline of -2.9% on an annualized quarter-on-quarter basis.

Real GDP in the July-September period declined significantly due to transitory factors such as a decrease in inventory investments and an increase in imports. However, real private-sector domestic demand, including real personal consumption and real capital investment, both declined, exposing the weakness of the economy as well.

According to the ESP Forecast Survey, real exports are expected to have increased by 0.6% from the previous quarter and real capital investment also looks to have risen by 0.6% quarter-on-quarter in the October-December period, boosting the growth rate to some extent, while real personal consumption is still languishing at +0.3% from the previous quarter.

Although the rate of wage increases in the 2023 spring labor negotiations was the highest level in 30 years, real wages continued to decline amid persistently high price inflation, creating a headwind for personal consumption. The weakening of the employment situation presumably was another drag on personal consumption, as the jobs-to-applicants ratio continued to decline throughout 2023, and the year-on-year decline in the number of new job offers accelerated in the October-December period.

Bank of Japan’s consumption activity index shows marked downward shift in October-December period

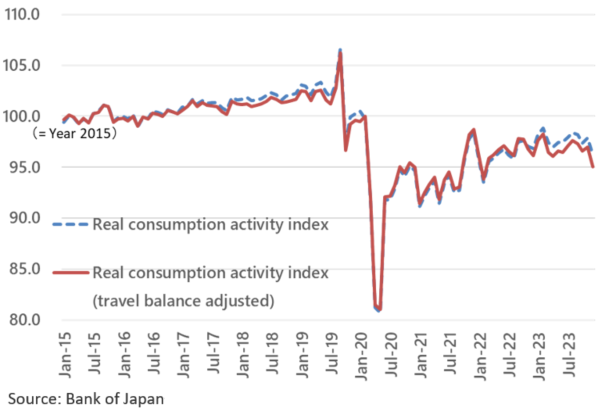

The actual state of consumer spending in October-December 2023 may be even weaker than GDP statistics indicate. According to the consumption activity index estimated by the Bank of Japan (BOJ) based on reliable supply-side data, the real consumption activity index (seasonally adjusted) for October-December 2023 was -1.0% from the previous quarter, and the real consumption activity index (travel balance adjusted, seasonally adjusted), which excludes inbound consumption, was -1.2% quarter-on-quarter, the largest decline since the January-March period of 2022, when the COVID-19 crisis was still serious (Fig. 1).

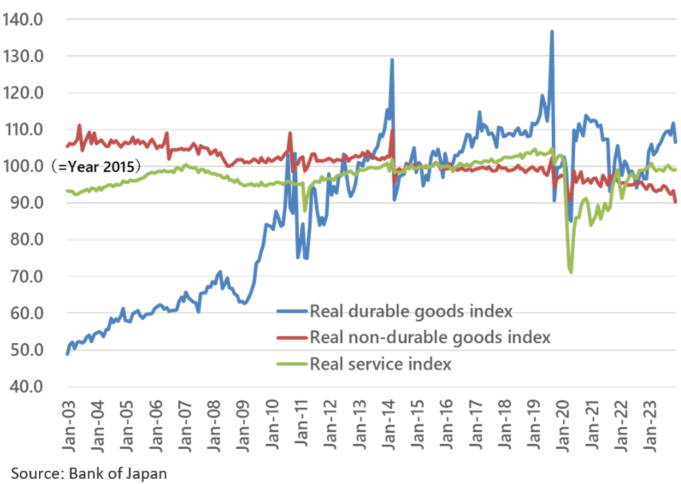

Further, real non-durable goods consumption, real durable goods consumption, and real services consumption in October-December 2023 all declined, by -2.2%, -0.2%, and -0.3% year-on-year, respectively (Fig. 2).

The BOJ expects that a virtuous cycle between wages and prices will be realized as wage increases are passed on to service prices, and that the 2% price target will be achieved. However, with the weak underlying tone of service consumption, firms are unlikely to increase their efforts to pass on higher wages to service prices.

Fig. 1: Real Consumption Activity Index dips markedly in October-December 2023

Fig. 2: Service consumption is also weak, creating headwinds to shifting higher wages to service prices

Real wage growth will come after mid-2025

The Ministry of Health, Labour and Welfare’s monthly labor statistics for December released on February 6 showed that total cash payrolls increased 1.0% year-on-year. The real wage growth rate, which is calculated by subtracting +3.0% year-on-year growth in the Composite Consumer Price Index excluding imputed rent for owner-occupied houses, remained sharply lower at -1.9% year-on-year, continuing to put pressure on personal consumption.

In 2023, total cash payrolls were +1.2% year-on-year, and the year-on-year change in the Composite Consumer Price Index excluding imputed rent for owner-occupied housing was +3.8% year-on-year. The real wage growth rate was -2.5%, a significant decrease following the -1.0% rate of the preceding year.

The government and the Keidanren are aiming to achieve a higher rate of wage increase in this year’s spring labor negotiations than last year’s, which was the largest wage hike in 30 years, but even if the rate is somewhat higher than last year’s, real wage growth is unlikely to turn positive year-on-year within the year.

There is still a long road ahead to real wage growth, and I expect it will not come to fruition until mid-2025 or later.

To put it bluntly, the shortest path to a sustainable increase in real wages is not to force companies to raise wages, but to wait for the price inflation rate, which has risen significantly since 2022, to decline in a natural way. If the government or public opinion demands unreasonable wage hikes from companies, real wages may rise temporarily, but on the other hand, this will put pressure on corporate profits, which will eventually cause companies to curb employment and wages, ultimately preventing a sustained rise in real wages.

What matters to consumers is not that the rate of price increase or rate of wage increase goes up, or that the two increase synergistically. Even if the rate of price increase and the rate of wage increase go up by the same range, real wages will remain the same and livelihoods will not improve. What is important is that the rate of wage increase exceeds the rate of price increase, i.e., that the rate of real wage increase rises sustainably and that living standards steadily improve and the outlook for the future becomes brighter.

To realize this goal, the government needs to promote growth strategies such as measures to combat the declining birthrate, labor market reforms, inbound strategies, correction of the concentration of people in large cities, and utilization of foreign labor. If these efforts bear fruit and the outlook for future growth increases, firms will increase capital investment, which in turn will boost the rate of increase in labor productivity.

Japan’s economy in 2023 started strong but stumbled: growth rate to decline significantly in 2024

Japan’s real GDP for the calendar year 2023 is expected to have been +2.0% year-on-year, a fairly significant increase. However, this is mainly attributable to the high growth seen in the first half of the year, whereas in the second half this growth ran increasingly out of steam. The main reason for this was that the growth boost from inbound demand, which greatly boosted the growth rate in the first half of the year, weakened in the second half of the year. In addition, headwinds to personal consumption due to high prices and falling real wages slowed the pace of growth in the second half of the year.

The Japanese economy thus began 2024 having lost some of its growth momentum, and at the outset also suffered from the negative effects of the Noto Peninsula Earthquake.

The government opted to implement the benefits and fixed-rate tax cuts in the comprehensive economic stimulus package decided last November. The fixed-rate tax cuts are scheduled to be implemented around June of this year. The total amount of tax cuts and benefits is estimated to be around 5.1 trillion yen, with an estimated GDP boost of +0.19%. Temporary benefits and tax cuts have a limited effect on buoying the economy, as a higher percentage of the money goes to savings.

In addition, after the spring labor negotiations, households may not see wage growth as high as expected, and consumer spending may swing further downwards as the decline in real wages is expected to continue for a longer period of time.

Lower real wages, the effects of limited economic stimulus measures, and softer overseas growth will be downside factors for growth in 2024, and real GDP growth in calendar year 2024 is expected to be +0.6%, down sharply from +2.0% in calendar year 2023 to less than one-third of that in 2023.

Profile

-

Takahide KiuchiPortraits of Takahide Kiuchi

Executive Economist

Takahide Kiuchi started his career as an economist in 1987, as he joined Nomura Research Institute. His first assignment was research and forecast of Japanese economy. In 1990, he joined Nomura Research Institute Deutschland as an economist of German and European economy. In 1996, he started covering US economy in New York Office. He transferred to Nomura Securities in 2004, and four years later, he was assigned to Head of Economic Research Department and Chief Economist in 2007. He was in charge of Japanese Economy in Global Research Team. In 2012, He was nominated by Cabinet and approved by Diet as Member of the Policy Board, the committee of the highest decision making in Bank of Japan. He implemented decisions on the Bank’s important policies and operations including monetary policy for five years.

* Organization names and job titles may differ from the current version.